Written by: Eric, Foresight News

On January 20, LayerZero announced that it would unveil important events on February 10. Although its token ZRO's price rose from about $1.7 to nearly $2.4, a gain of over 40%, it is clear that the market has already desensitized to such "big event announcements"; no one seemed to be expecting what would actually happen.

Come February 10, it was unexpected for LayerZero to drop several heavy bombs on this predetermined day.

First, on the evening of the 10th, Tether announced its investment in LayerZero to support the development of blockchain interoperability technology. In the early hours of the 11th, LayerZero officially announced that it would launch L1 Zero this fall, aimed at replacing Ethereum as the "next-generation World Computer." Born with a golden key, Zero confirmed Citadel Securities, the U.S. Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange (ICE), and Google Cloud as partners on its first announcement day.

The global top market maker Citadel Securities, which handles over 35% of retail order flow in U.S. stocks, will assess how to integrate Zero into high-performance trading, clearing, and settlement processes; DTCC will optimize tokenization services and collateral application chains through Zero; ICE, the parent company of the New York Stock Exchange, will optimize trading and clearing infrastructure via Zero to support around-the-clock markets and the potential integration of tokenized collateral; Google Cloud aims to integrate its cloud infrastructure and AI capabilities with Zero to create a new economic system.

This is not all; Zero's advisory team includes Cathie Wood, ICE's Vice President of Strategy Michael Blaugrund, and former global head of digital assets at BNY Mellon Caroline Butler. Cathie Wood's ARK Invest even directly invested in LayerZero and stated that this is her "return to serving as an advisor after many years," highlighting the significance of this move.

Cathie Wood and traditional financial institutions in the U.S. hardly need much introduction. The only thing to remind everyone is that Citadel was revealed to plan to become a market maker for cryptocurrencies by the end of February 2025, after which Bitcoin surged from around $75,000 to over $120,000 after hitting a low. This time, Citadel made a direct investment in ZRO, causing ZRO to skyrocket nearly 50%.

LayerZero Never Plays Low-End Games

Before Zero's launch, LayerZero was already the chosen one.

In early 2022, LayerZero launched the cross-chain bridge Stargate, and within less than 10 days, its TVL surpassed $3 billion. By the end of March, LayerZero completed a $135 million Series A+ funding round led by FTX Ventures, Sequoia Capital, and a16z. A year later, LayerZero completed a $120 million Series B funding round at a $3 billion valuation, with participation from a16z Crypto, Sequoia Capital, Circle Ventures, Samsung Next, and others.

It is extremely rare for a Web3 project to achieve a $3 billion valuation before its token issuance.

However, everything seems justifiable with LayerZero. LayerZero's co-founder and CEO Bryan Pellegrino is a young poker genius who, as early as 2018, developed a platform called OpenToken to help ordinary people issue tokens, which was later acquired. In 2020, Bryan, along with partners who later co-founded LayerZero, developed a poker AI that defeated all other "competitors" and some of the world's top professional players. The paper introducing this AI, "Supremus," was later referenced by research in game theory published by Alphabet AI Lab DeepMind.

Bryan Pellegrino is the type that investors love—naturally intelligent and successful in whatever he does. The subsequent development of LayerZero proved this point.

If you still think LayerZero is just a cross-chain bridge, it indicates you may not fully understand this project.

As the first to bring the omnichain concept into Web3, LayerZero's core is not "cross-chain," but "interoperability." If you study LayerZero's mechanism carefully, you will find it has actually built a technical standard for "how to transmit messages between different chains without trust." In the blog introducing LayerZero V2, there is a phrase: "Just as TCP/IP standardized internet development, LayerZero aims to standardize the development of all on-chain applications. This unified cross-chain development concept is summarized as omnichain, which represents LayerZero's vision for the future of cryptocurrency."

A cross-chain bridge only involves the transfer of tokens; omnichain is the capability to call contracts from other chains on any chain. More importantly, LayerZero has only developed the stack to achieve this functionality, allowing token issuers or protocol developers to adjust parameters as needed. Currently, LayerZero V2 uses a decentralized validation network (DVN) combined with executors to achieve message transmission. DVN is a network composed of multiple centralized validators, while the executor is responsible for executing the validated messages. All chains supporting LayerZero have deployed Endpoint contracts to send and receive messages.

For example, if I issue token A and want this token to transfer between Ethereum, Arbitrum, and Base, I can deploy corresponding token contracts on each chain, integrate LayerZero's stack, and agree that in all DVNs, as long as more than 5 DVNs have validated the authenticity of the message, the cross-chain operation of the token can proceed.

LayerZero provides a unified standard for such tokens: OFT (Omnichain Fungible Token), which includes tokens such as USDT, USDC, USDe, WETH, and PENGU that have already become OFT. For token issuers, there is a plug-and-play standardized format that supports nearly 200 blockchains, and once integrated, it can be automatically supported by all cross-chain bridges and DEXs that support LayerZero, without the need to establish liquidity on each chain—what's not to love?

From supporting USDT to Tether making a direct investment, from a 10-day $3 billion TVL to over 165 blockchains and over $200 billion in cross-chain transaction volume, the recently launched tokens Aztec and Stable coin blockchain both quickly integrated LayerZero—which shows the power of standards.

Zero is More Like L 0.5

According to LayerZero's own description, the concept of Zero was actually conceived over two and a half years ago, around mid-2023, shortly after completing the Series B financing. If they had envisioned the integration with traditional power in Wall Street back then, it may have been overly optimistic. However, the underlying idea that has not changed in these two and a half years has always been: to replace Ethereum's position as the World Computer.

As a decentralized infrastructure for transmitting messages between L1 and L2, LayerZero can rightly be called "L0," but the team may have some fixation on infrastructure; Zero, which boasts "the speed of Solana and the decentralization of Ethereum," is actually more like "L 0.5," an L1 that carries multiple L1 operations.

In summary, Zero's distinct feature is simple: network transactions do not need to compete for limited resources.

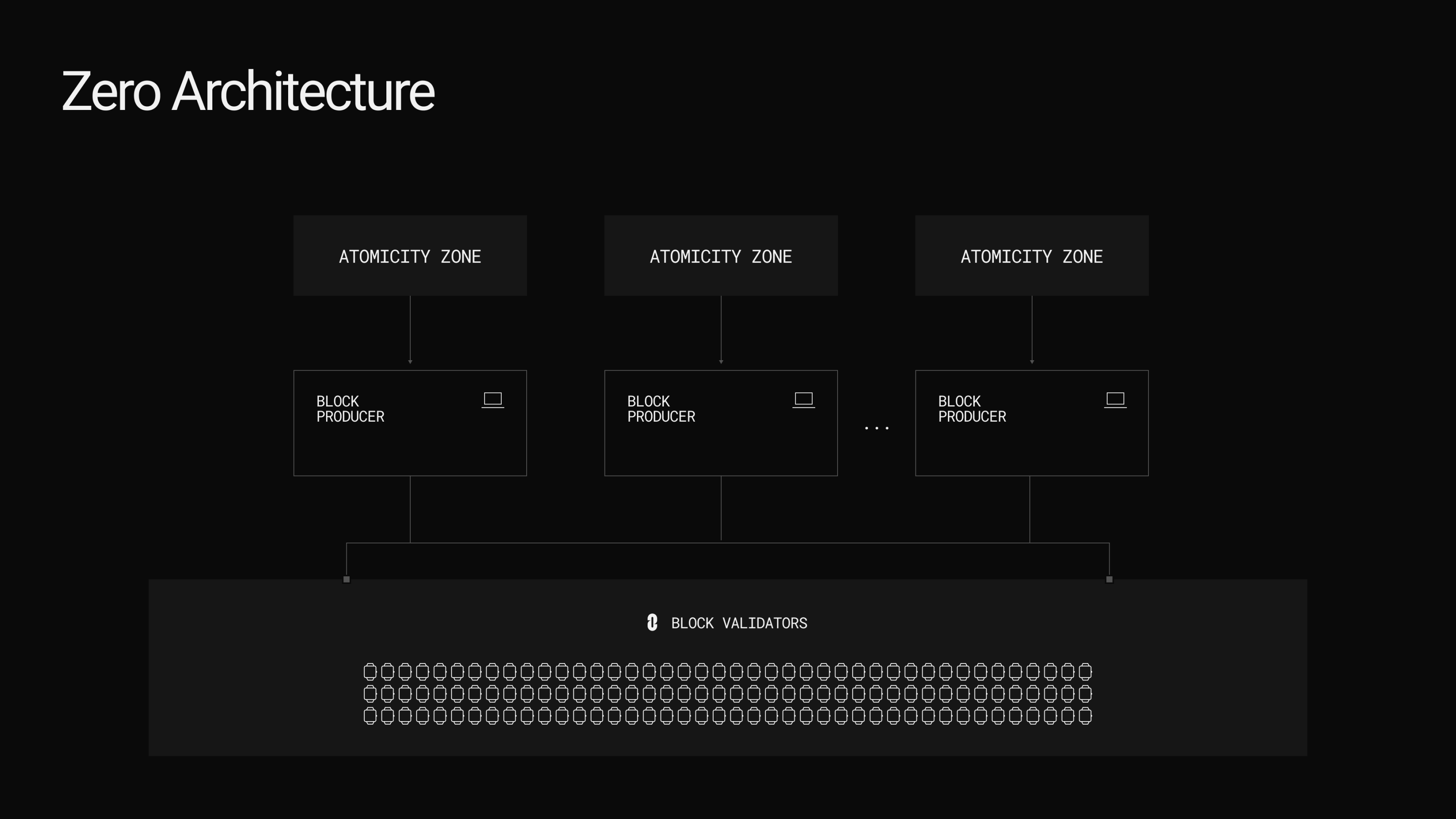

According to official descriptions, every validator in the current L1 needs to traverse each transaction. It is exactly this security-oriented design that limits the efficiency ceiling to that of all validators traversing transactions. Under these premises, if L1 wants to increase TPS, it needs to centralize validators, sacrificing decentralization. However, aided by the development of zero-knowledge proofs (ZKP), Zero separates the construction of blocks from the verification of blocks; builders directly create a complete block and generate a ZKP, while validators only need to verify the proof itself.

According to LayerZero, this design could reduce the cost of running a blockchain with the same capacity as Ethereum from $50 million a year to $1 million while increasing TPS to 2 million.

Based on this design, Zero introduced the concept of the "Atomicity Zone." Each Zone can have its own characteristics, whether it's high-frequency trading, payments, or RWA tokenization; each Zone is equipped with independent block producers, and all blocks will eventually achieve finality on the same chain, yet not all transactions need to compete for limited network resources.

To some extent, this design has some similarity with L2, which is also the reason I believe it is more like L 0.5. In LayerZero's view, such design achieves both high TPS like Solana, and doesn’t require waiting for confirmation on L1 to secure transaction validity like L2 does. With ZKP, Zero has taken a lead in realizing the parallelism of decentralization and efficiency.

It is easy to overlook that once Zero is launched, ZRO is no longer seen as a ticket for cross-chain fees but rather becomes the native token of L1; the imagination for these two concepts does not exist within the same atmosphere.

What Does Wall Street Want?

Imagine a scenario where thousands of financial institutions are using different chains—some are using Ethereum, some Solana, some Base, some private chains—with varying token standards, on-chain settlement speeds, and cross-chain standards. While financial institutions using the same chain can still enjoy the benefits of blockchain, when the chains differ, blockchain may be no better than centralized settlement institutions.

In an ideal situation, all of Wall Street uses the same blockchain, and all troubles would be resolved effortlessly.

So the answer is actually simple: what Wall Street seeks is "standardization." All assets—stocks, bonds, real estate—should be traded under the same tokenization standard, preferably with stablecoins under the same standard as well, eliminating the need for a transaction to cross multiple different chains. Zero is born for this purpose; each Zone may have different features, but they will all settle on the same chain, meaning that everyone adheres to the same standard.

Remember how Citadel handles over 35% of order flow? If Citadel designates Zero, Zero is likely to become the leader in stock tokenization. Moreover, Zero would not exclude other chains; after all, they still have LayerZero to standardize cross-chain formats.

For Wall Street, centralized chains lack an appealing narrative for issuing tokens, while overly decentralized chains are unmanageable. Zero, which adopts DPoS, finds a balance on decentralization; the chain itself is relatively decentralized but is collectively managed by multiple companies or individuals. This environment allows for control while still requiring negotiation, making it an acceptable option for all parties.

There are countless people wanting to develop blockchain for financial giants, but only LayerZero has found a standard answer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。