Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

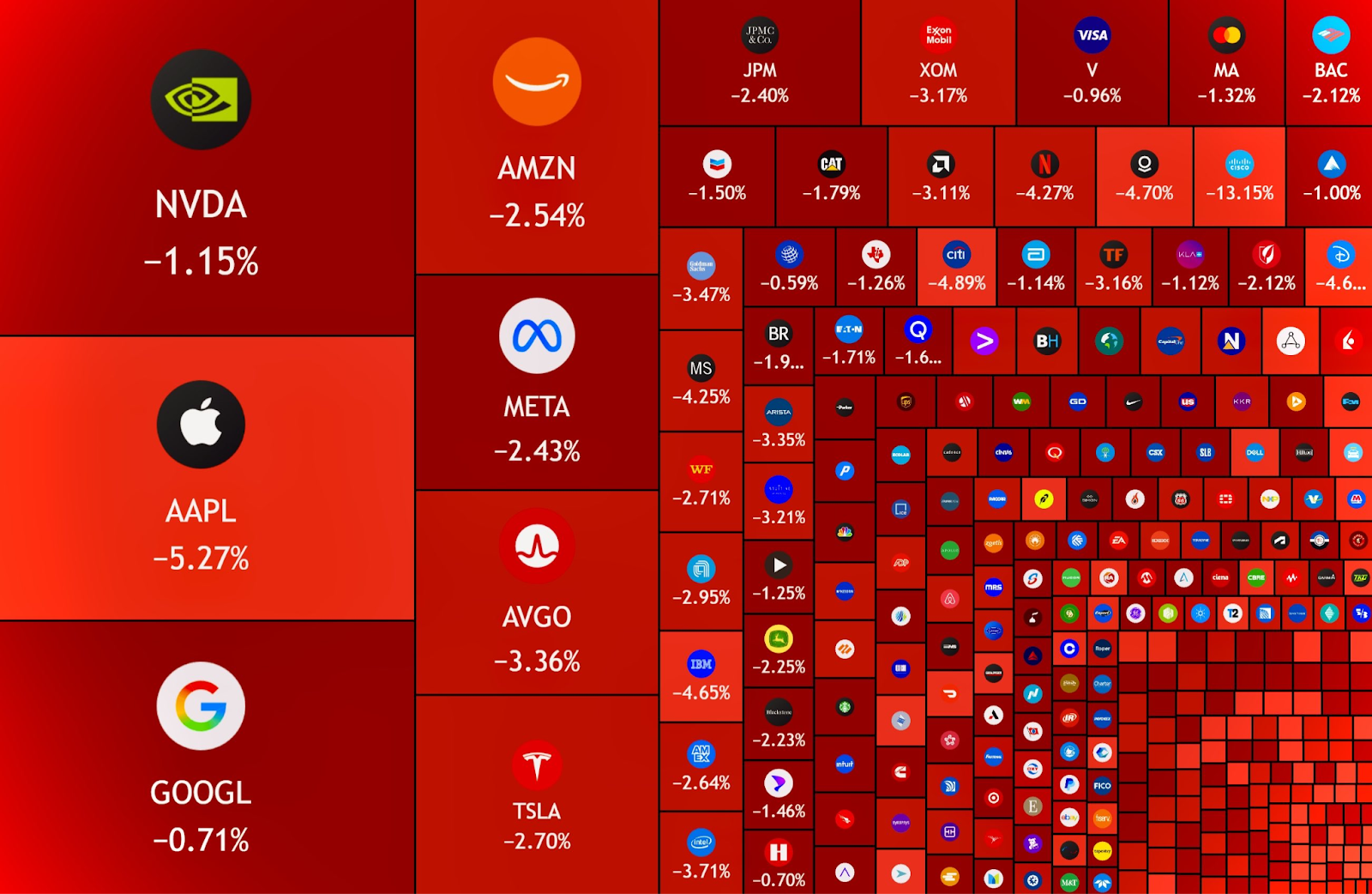

The current macro market is experiencing a profound crisis of confidence triggered by AI, the narrative has shifted from "AI enthusiasm" to "AI panic," with investors no longer focusing on who will benefit, but rather panicking over which industries will be disrupted and replaced. On Thursday, financial markets faced widespread sell-offs, with U.S. stock market capitalization evaporating by $1 trillion, Cisco plunging 12% after offering a weak profit margin guidance. The Nasdaq fell more than 2%, the S&P 500 dropped 1.57%, falling below the 50-day moving average, and the Dow Jones index dropped below the 50,000 mark. The tech giants all fell, with Apple dropping over 5%, losing about $20.2 billion in market value in a single day, and Amazon's stock price officially entered a technical bear market on Thursday after falling for eight consecutive days, down 21.4% from its peak. Industry experts expect Nvidia's earnings report on February 25 to become an important catalyst in the AI sector.

The "survival anxiety" brought by AI is spreading from software stocks to broader industries. Following sectors like SaaS, insurance, and wealth management, the commercial real estate and logistics industries are the latest victims, with commercial real estate companies like CBRE and JLL seeing stock prices plummet over 25% cumulatively in two days, and logistics giant CH Robinson falling 14.5%, as investors worry that AI automation will compress commissions and replace some businesses.

This panic is triggering a liquidity squeeze, leading safe-haven assets like gold and silver to also suffer, with spot gold at one point plummeting over $200, closing down more than 3% below the $5,000 mark, and silver crashing roughly 11% to around $75. Funds are flowing into U.S. Treasuries seeking safety, with the 10-year U.S. Treasury yield retreating to around 4.100%. Furthermore, today is the last day for U.S. stocks before the Spring Festival, with market focus eagerly anticipating tonight's upcoming CPI data, expected to be 2.5%, in hopes of finding clues about the Federal Reserve's rate path amid the turmoil, with the market generally expecting rate cuts will start in July.

Bitcoin is currently struggling within the range of $60,000 to $72,000, constrained by heavy supply pressure above $82,000 to $97,000. On-chain analysis firm Glassnode pointed out that the market is squeezed between the "real market average" of around $79,200 and the "realized price" of about $55,000, and could undergo a lengthy consolidation without extreme catalysts. A report from FLAME LABS further analyzed that the shutdown price for S19 series miners is set between $75,000 and $85,000, for S21 series between $69,000 and $74,000, while the range of $52,000 to $58,000 accumulates the 200-week moving average and the miner shutdown price defense line, forming a structurally high-confidence bottom, even though the extreme physical bottom for S23 models drops to as low as $44,000. Analysts from Tony Research and Titan of Crypto believe the bottom may appear in the fourth quarter of 2026 or in October, with target prices looking to $40,000 to $50,000; Rekt Capital warns that failure to reclaim the 200-week EMA (approximately $68,300) could lead to accelerated bearish momentum, while William Clemente and Frank A. Fetter suggest that the Mayer Multiple indicator indicates we are currently in a historically bullish buying zone. Astronomer and Altcoin Sherpa are focusing on the effectiveness of support around $60,000 to $65,000.

Ethereum is showing relatively weak performance, unable to maintain prices above $2,000, hitting a low of $1,745. Bloomberg analyst James Seyffart noted that ETH ETF holders are in a worse position than Bitcoin holders, with the current price far below the average cost basis of around $3,500. In terms of technical analysis, Man of Bitcoin believes ETH is in a downward B wave, with crucial support at $1,832; if it breaks below this level, it could see a drop to $1,600. Lennaert Snyder also holds a bearish view, targeting $1,866; StefanB is even more pessimistic, predicting that this round of declines is too steep to form a V-shaped recovery, suggesting that the bottom may arrive in April next year, with prices potentially dropping to the range of $1,006 to $1,333. However, not all viewpoints are so pessimistic; analyst Rod pointed out that prices are forming a bullish falling wedge pattern, with a short-term target pointing to $2,250. Cointelegraph analysis suggests that institutional demand and the resilience of on-chain metrics may support a price rebound to $2,400.

Solana is also under immense pressure, with analysts like Fade and Altcoin Sherpa warning that it is in the correction phase at the late stage of the cycle; should it break below the crucial support of $60, it could further retreat to $50 or even lower. For the entire altcoin market, analyst Inmortal believes that due to extreme capital dispersion, 99% of altcoins may never reach historical highs again. Regarding the Mene coin, GEM DETECTER data shows that among the 180,000 traders on the PumpFun platform last month, 99% made profits of less than $500, and 42% were at a loss. Additionally, as a market bellwether, Coinbase's fourth-quarter earnings report shows that despite a 156% increase in total trading volume for the year, due to high operating expenditures and investment losses, the company's net loss reached $667 million, putting pressure on its stock price. Meanwhile, its CEO Brian Armstrong has sold over $550 million worth of company stock in the past nine months, further hurting market confidence.

2. Key Data (As of February 13, 13:00 HKT)

(Data Source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $66,256 (Year-to-date -24.33%), Daily spot trading volume $4.681 billion

Ethereum: $1,933 (Year-to-date -34.83%), Daily spot trading volume $1.909 billion

Fear and Greed Index: 9 (Extreme Fear)

Average GAS: BTC: 10.06 sat/vB, ETH: 0.35 Gwei

Market share: BTC 58.9%, ETH 10.5%

Upbit 24-hour trading volume ranking: XRP, BTC, BERA, ME, ETH

24-hour BTC long-short ratio: 48.95% / 51.05%

Sector gains and losses: The crypto market is generally down, with GameFi, Meme, and AI sectors all down over 2%

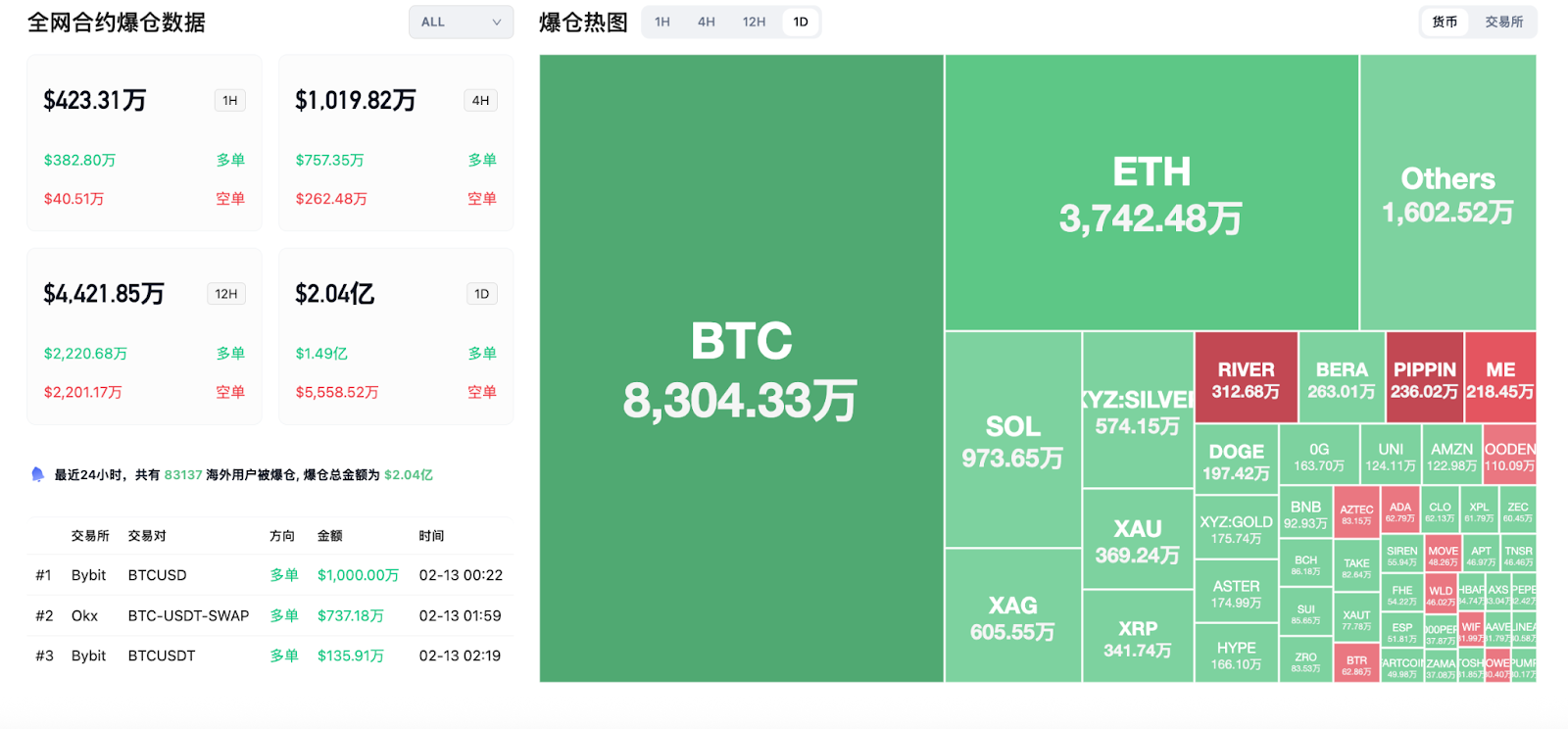

24-hour liquidation data: A total of 83,137 people globally were liquidated, with a total liquidation amount of $204 million, with $83 million in BTC liquidations, $37.42 million in ETH liquidations, and $9.73 million in SOL liquidations.

3. ETF Flows (As of February 12)

Bitcoin ETF: -$410 million

Ethereum ETF: -$113 million

SOL ETF: +$2.7041 million

4. Today's Outlook

Binance will delist ACA, CHESS, DATA, DF, GHST, NKN spot trading pairs on February 13

U.S. January CPI year-on-year: Previous value 2.7%, expected value 2.5% (February 13, 21:30)

Hong Kong Stock Exchange, South Korea, the United States, Vietnam and other exchanges will be closed during the Spring Festival (February 16)

The largest gainers among the top 100 cryptocurrencies today: River up 17.2%, Pi Network up 4%, POL (formerly MATIC) up 3.8%, Toncoin up 3.7%, Sei up 3.5%.

5. Hot News

Coinbase announces an increase of $39 million in Bitcoin holdings

Aave Labs proposal to hand over 100% of protocol income to DAO in exchange for operating funds

Coinbase releases Q4 earnings report: Net loss of $667 million, revenue down 20%

Lighter reaches USDC deposit yield sharing agreement with Circle

The Bhutan government sends 100 BTC to QCP Capital, valued at $6.77 million

Coinbase CEO sells approximately $550 million worth of Coinbase stock over the past year

Binance confirms the purchase of the last batch of 4,545 BTC for the SAFU fund, totaling 15,000 BTC

Alameda bankruptcy management allocates over $15 million of SOL to creditors

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。