L2 network Mantle announced the launch of the ETH liquidity staking protocol Mantle LSP, which is a core product deployed on Ethereum L1 and managed by Mantle.

Author: defioasis

Editor: Colin Wu

On December 4th, L2 network Mantle announced the launch of the ETH liquidity staking protocol Mantle LSP, a core product deployed on Ethereum L1 and managed by Mantle. As of December 14th, 10 days after its launch, Mantle LSP TVL exceeded 120,000 ETH, worth approximately $2.74 billion; with over 3,700 validators, the APY reached 3.92%. (All data in this article is as of 18:00 on December 14th, UTC+8)

Development of Mantle LSP

On June 14, 2023, Mantle Builder, core contributors, and advisor Cateatpeanut announced the first discussion of Mantle LSD (predecessor of Mantle LSP) at the Mantle governance forum, proposing the introduction of the liquidity staking protocol Mantle LSD deployed on the Ethereum mainnet, including the ability for users, including Mantle Treasury, to deposit ETH and receive the tokenized staking rewards in the form of mntETH (predecessor of mETH).

On July 29, 2023, Cateatpeanut and the Mantle core team officially initiated MIP-25: Mantle Economic Committee and ETH Staking Strategy proposal to the community, which received 100% approval from the community.

On October 6, 2023, the Mantle LSP mainnet contract was deployed, but it required selection for the whitelist of core contributors, with a limit of 1,000 mETH.

On December 4, 2023, the ETH liquidity staking protocol Mantle LSP was officially launched to all users.

Despite Mantle LSP achieving a staking volume of billions of dollars within a week, it took nearly half a year from community discussion to proposal to official launch, following the governance process established by the Mantle community. Mantle LSP adopts a simple and user-friendly design after the Ethereum Shanghai upgrade, emphasizing the integrity of mETH running on L1 without adding complexity to other PoS tokens and chains.

Distribution of mETH

As the staked ETH token of Mantle LSP, the distribution of mETH can identify the composition of staking entities and user preferences, as well as the adoption of the protocol.

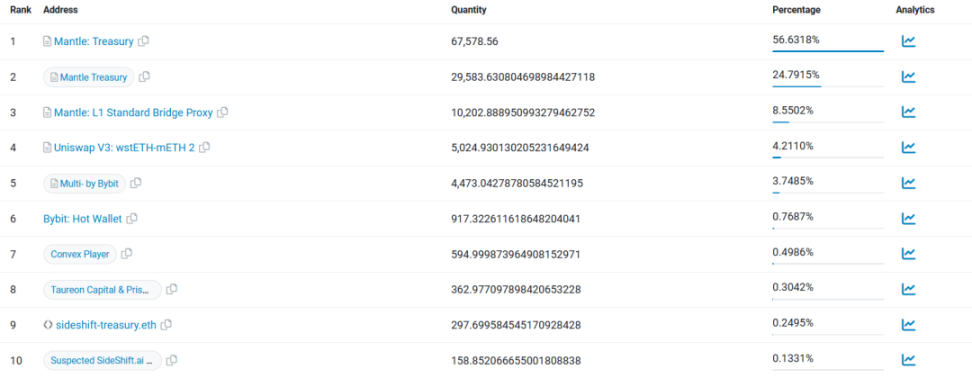

Data source: https://etherscan.io/token/0xd5f7838f5c461feff7fe49ea5ebaf7728bb0adfa#balances, as of 18:00 on December 14th

The largest holder of mETH comes from Mantle Treasury, totaling approximately 97,200 mETH, accounting for about 81.4%. In the initial June proposal discussion stage, Mantle Treasury was allowed to participate as part of the users in Mantle LSP. Unlike most LSD protocols with no staking limit, Mantle LSP ultimately established a limit of 250,000 mETH, meaning it ultimately serves and benefits important partners of the Mantle ecosystem, including Mantle Treasury, institutional partners, and ecosystem supporters. Mantle Treasury can also use its mETH to support the liquidity of on-chain DeFi protocols, expanding its use cases.

The second largest holder of mETH comes from Mantle Network. Mantle LSP collaborates with L2 Mantle Network to expand the adoption of mETH on L2 and establish partnerships with DeFi protocols. In the coming weeks, mETH will begin to act as ETH in various Mantle DeFi protocols. In the future, it will also explore mETH as gas fees for L2 Mantle Network.

mETH can be bought and sold on the secondary markets of Uniswap and Bybit, but the price of mETH on the secondary market is determined by price discovery, and large transactions may face higher slippage. It is worth mentioning that mETH is also listed by the account-free on-chain exchange SideShift ai.

The largest non-exchange EOA user of mETH comes from two DeFi players. One user participated in Convex USDT+crvUSD staking, and the other player may have a close relationship with the venture capital firm Taureon Capital, which has invested in the important LSD trading protocol Maverick. (Arkham data shows that the address transferred over 150 wstETH to a suspected Taureon Capital address.) Regardless of institutional identity, this user is also a seasoned DeFi Degen player, who injected 375.4 stETH into the stablecoin protocol Prisma Finance, borrowed 383,000 mkUSD, and used the mkUSD for farming, earning a cumulative reward of approximately $7,000; and participated in Ethena USDe staking. The more comprehensive the Degen player is, the more they can utilize the composability of mETH to penetrate various major DeFi protocols and applications in the Mantle Network, earning profits while providing efficient liquidity between protocols.

Dual-Drive of Ecosystem Stablecoins and Mantle LSP

One month before the launch of Mantle LSP, in early November, Mantle and Ondo Finance announced the launch of the RWA-backed USD stablecoin USDY, as well as the rebase version mUSD on Mantle Network. Currently, Ondo Finance's USDY TVL exceeds $35 million, with an APY of 5.2%, with an issuance of over $3.7 million on Ethereum and over $29 million on Mantle. The stablecoins USDY and mUSD provide another stable income channel for the Mantle ecosystem.

USDY adopts over-collateralization and is essentially a tokenized note secured by short-term US Treasury bonds and bank demand deposits, significantly different from stablecoins issued by centralized entities:

(1) Bankruptcy-isolated entity. Most stablecoins have specific issuers, such as Tether and USDT, Circle and USDC. If the issuer goes bankrupt, stablecoin holders may not be able to redeem them. USDY adopts a financial design structure with bankruptcy-isolated entities, allowing assets to be protected from being involved in bankruptcy proceedings in the event of the bankruptcy of the initiator or related party. This means that even if Ondo USDY LLC operating company goes bankrupt, its financial structure protects the assets of USDY holders from direct impact.

(2) Stablecoin holder benefits. Most stablecoins are non-interest-bearing assets, meaning holders do not earn interest. However, holders of RWA-backed USDY receive income generated from underlying assets such as short-term US Treasury bonds (minus management fees). USDY has a variable interest rate, adjusted in advance by Ondo each month; the yield automatically compounds, meaning the dollar value of USDY that can be minted and redeemed grows slowly every day.

(3) Holder-beneficiary priority redemption mechanism. When stablecoin issuers are unable to meet redemption requests within a specific timeframe, they often employ a delayed withdrawal strategy to address runs, and most stablecoin holders do not have the right to passive default or automatic liquidation. USDY holders have the right to active liquidation, and if Ondo USDY LLC fails to meet redemption requests in a timely manner, they can request a third party, Ankura Trust Company, to act as a verification agent and collateral agent to liquidate the investment portfolio and repay.

(4) Private stablecoins often operate in a regulatory gray area, while USDY complies with US federal securities laws and anti-money laundering regulations.

RWA-backed USDY has been widely adopted in the Mantle Network ecosystem.

In Agni Finance, the largest DEX with a TVL of $53 million, USDY has a TVL of $2.2 million, making it the fifth-largest asset in the protocol. Additionally, the USDC/USDY 0.01% LP Pool is the third-largest LP Pool in the protocol, with over $4.5 million in liquidity.

In FusionX Finance, the second-largest DEX with a TVL of over $27 million, the USDC/USDY 0.01% LP Pool has the highest liquidity for stablecoin trading pairs across the entire platform, reaching $5.2 million.

Mantle's first liquidity management tool, Range Protocol, launched a USDC-USDY pegged strategy on November 14th, offering a 5.1% Vault APY (including trading fee APY and incentives), with a current TVL of approximately $63,000. Although the protocol's scale is still relatively limited, the potential for income enhancement with USDY is evident. USDY itself has a 5.1% automatically compounded income supported by RWA. If the adoption rate of USDY in on-chain trading can be expanded, it will significantly increase LP trading fee income, combined with other incentive measures, unlocking even greater income potential.

Based on the stablecoins USDY/mUSD and Mantle LSP mETH, Mantle Network has effectively formed a dual-channel income aggregator supported by RWA and ETH PoS.

In addition, the Mantle Economic Committee will continue to seek high-quality sustainable income products and ecosystem deployments to serve the Mantle ecosystem. A recent example is the approval of a $10 million investment in Ethena-USDe by the Mantle Economic Committee. Ethena has built a stablecoin USDe collateralized by Ethereum derivatives, eliminating the price volatility of underlying collateral assets by holding staked ETH long positions and ETH perpetual contract short positions to construct a stablecoin. In July of this year, Ethena completed a $6 million seed funding round led by Dragonfly, and in September, it was selected for the sixth season of the Binance Labs incubation program. Once USDe is launched on Mantle in the first quarter of 2024, the Mantle Economic Committee will inject $10 million in liquidity support into major DEX liquidity pools, making USDe as advantageous as mUSD in the Mantle ecosystem compared to other general stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。