Recently, with the rising price of the SOL token, tokens in the Layer1 public chain sector have also experienced a general uptrend. On December 12th, the AVAX token of Avalanche and the ATOM token of Cosmos both saw intraday gains of over 20%, with AVAX breaking through $40 and entering the top ten in market value; the native token NEAR of Near saw a gain of over 30% in the past 30 days; the FTM token of Fantom saw a gain of 15% in the past 14 days, and so on.

Last week, the wealth effect brought by the Jito airdrop of JTO in the Solana ecosystem completely activated the long-ignored on-chain ecosystem applications. At this time, people discovered that the Solana ecosystem had already made a strong comeback, and a batch of new native applications were trying to emerge, including the trading aggregator Jupiter, the liquidity staking platform Marinade Finance, and so on. Today, the TVL on the Solana chain has exceeded $1 billion (approximately $10.44 billion), and the on-chain 24-hour trading volume is $9.12 billion, making it the second largest Layer1 network after Ethereum ($12.3 billion).

As the Solana ecosystem progresses rapidly, people have noticed that during the same period, challengers in the Layer1 space such as Near, Fantom, Avalanche, and other networks have seen varying degrees of price increases, but their on-chain ecosystem development has not been satisfactory. Their ecosystem growth has not only entered a stagnant state but has also experienced varying degrees of regression, and they have long been left behind by Solana.

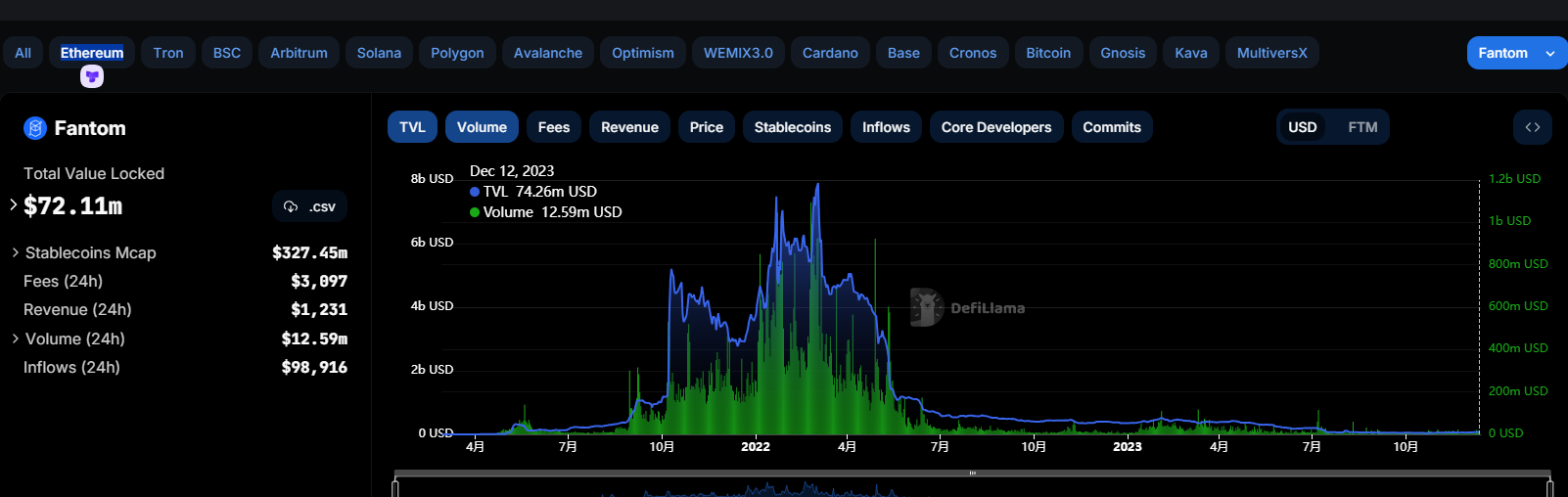

For example, in terms of on-chain trading volume, the 24-hour trading volume of the Avalanche network is $198 million, which is about 5 times less than Solana, while the trading volume of the Fantom network is only $12 million, and the Near network is only a few million dollars. The TVL of the latter two is also more than 10 times less than Solana.

This has left users puzzled as to why Layer1 public chains like Near cannot replicate the growth momentum of the Solana ecosystem. What exactly has led to the differences in ecosystem development among these Layer1 networks?

Solana's Ecosystem Makes a Full Recovery, While Near and Fantom's Ecosystem Development Stagnates and TVL Drops to Tens of Millions of Dollars

While the Solana ecosystem has been creating stories of wealth through airdrops, new applications are emerging one after another, and TVL and on-chain trading volume are skyrocketing, its counterparts in the same race, Near and Fantom, have seen a huge contrast. The TVL of the two has dropped to the tens of millions of dollars, and the daily trading volume has even fallen to less than tens of millions of dollars.

As of December 15th, Fantom's TVL is $84 million, with an on-chain daily trading volume of $14 million; Near's TVL is $59 million, with an on-chain daily trading volume of only $8.4 million. During the same period, the TVL on the Solana chain has exceeded $1 billion, and the on-chain daily trading volume is close to $920 million. The TVL and on-chain daily trading volume of the two are more than ten times less than Solana, and there is no upward trend in the on-chain data trends.

Why is it that, despite being in the same Layer1 network category and having experienced major crises and challenges, the Solana ecosystem has fully recovered, while Fantom and Near are still stagnant?

It is well known that Solana was once severely affected by the collapse of FTX, causing its development to stagnate. FTX and Alameda, as important supporters of the Solana ecosystem, not only invested in Solana but also in many projects built on Solana. In addition, FTX is the largest holder of SOL, holding over 71.8 million tokens, accounting for approximately 13% of the total supply, with a value close to $1.2 billion; and the Solana Foundation also holds FTX shares and FTT tokens worth millions of dollars.

Therefore, when FTX collapsed, Solana suffered losses on three fronts: a shrinking treasury asset size, outflow of funds from ecosystem applications, and a large outflow of liquidity, and the SOL held by FTX was transferred to liquidators, leading to market selling pressure on SOL.

The collapse of FTX plunged the Solana network into a year-long crisis, with the SOL token plummeting to around $10 at its lowest, and the price fluctuating around $20 for a long time, with on-chain TVL dropping to around $200 million, and remaining in that range. During this period, on-chain applications on Solana not only suffered a large outflow of funds but also experienced a series of hacking incidents, such as the clearing of over 8,000 Phantom wallet assets, and the decentralized trading platform Mango being attacked by hackers, resulting in losses of up to $116 million.

However, with the recent surge in the price of SOL and the wealth creation stories of Solana ecosystem projects, it seems that Solana has already made a full recovery.

Since October, positive actions from Solana's ecosystem projects have been frequent. According to ChainCatcher, the oracle project Pyth Network first announced the economic model of the PYTH token, and then announced a 6 billion PYTH token airdrop to over 75,000 wallets, and on December 5th, Pyth developer Pyth Data Association completed a strategic financing round led by Multicoin Capital, Wintermute Ventures, and others. In November, the official cross-chain bridge Wormhole in the Solana ecosystem completed a new round of financing of $225 million at a valuation of $2.5 billion, with participation from Coinbase Ventures, Multicoin Capital, Jump Trading, ParaFi, and other institutions. Following this, the Solana ecosystem liquidity staking protocol Jito announced the launch of the governance token JTO, and a total of 10% (approximately 100 million tokens) were airdropped to community users, and subsequently, JTO was rushed to be listed on top exchanges such as Binance and Coinbase.

The continuous airdrops of ecosystem application tokens and the series of funding support from well-known crypto capital have completely ignited the enthusiasm of the community users and their loyalty to the Solana ecosystem. Many members of the crypto community have expressed that it is only on Solana that it is most likely to make the poor rich, as the Solana ecosystem applications are very generous to users, rarely fleece users, and instead give real airdrop rewards to benefit users.

Fantom Sinks into Mire Due to Multichain's Collapse, Near Faces Controversy with Wintermute and is Criticized for Management Chaos

In contrast to the increasingly prosperous Solana, the on-chain ecosystems represented by Layer1 public chains such as Fantom and Near are much quieter. Fantom has fallen into chaos due to the collapse of Multichain, and Near has been criticized for management team chaos and lack of credibility in the controversy over the USN exchange with Wintermute.

Fantom suffered a major setback in July when the founder of the cross-chain bridge Multichain was arrested, resulting in a loss of up to $200 million. This led to a collapse of the on-chain ecosystem, with stablecoins issued within the ecosystem significantly deviating from their pegs. The largest DEX, SpiritSwap, stated that the Multichain incident led to the depletion of project funds and threatened to shut down if no new team took over. Additionally, the largest lending protocol, Geist Finance, announced permanent closure. In October, the Fantom Foundation's wallets were reportedly attacked, resulting in a loss of $657,000. These series of black swan events caused Fantom's on-chain TVL to shrink to less than $50 million, and the FTM token price dropped to a low of $0.17.

Since the Multichain incident, the on-chain ecosystem of Fantom has not shown signs of improvement. Despite the launch of the upgraded Fantom Sonic network on October 25th to enhance network scalability and performance, the on-chain ecosystem has not seen significant improvement. On December 4th, the Fantom Foundation announced the launch of the Sonic Labs startup accelerator program to incentivize developers to build projects on Fantom Sonic, with technical support and marketing guidance, and with "DeFi father" Andre Cronje as a mentor.

Some users view these actions as Fantom's self-rescue efforts. However, despite the release of a series of positive news by the official team and the foundation, it has not attracted much attention from users.

Currently, there are few native applications left on the Fantom chain, with even the largest DEX platform, SpookySwap, having only $23 million locked in funds, and most other application TVLs being only a few million dollars. As of now, the TVL of the Fantom network is $84 million, with a daily average on-chain trading volume of only a few million dollars, and the FTM token has risen to around $0.40.

In comparison to the black swan events experienced by Solana and Fantom, the Near network has been much luckier and has not experienced similar unexpected shocks. However, its on-chain development has remained stagnant. This includes its EVM network, Aurora, which has maintained a TVL between $10-30 million, with a 24-hour trading volume of only a few hundred or a few thousand dollars.

Although Near has not experienced catastrophic unexpected events, the team's management chaos has been criticized, and there have been ongoing controversies with external parties. On November 8th, Wintermute founder Evgeny Gaevoy criticized the Near Foundation and Aurora Labs, accusing them of breaching trust and failing to fulfill their promise to redeem stablecoin USN, worth $11.2 million, from the sale of FTX assets. He stated that if the Near Foundation continues in this manner, legal action will be taken.

Despite these controversies not directly impacting the on-chain ecosystem development of Near, users have expressed dissatisfaction with the Near Foundation's lack of credibility and chaotic management. Although the NEAR token has been rising in the recent bullish market for public chain projects, the Near ecosystem has remained stagnant, with almost no new applications being developed.

During these controversies, Near has released a series of positive news, including the appointment of Near Protocol co-founder Illia Polosukhin as the CEO of the Near Foundation, a strategic partnership with Polygon Labs to develop zero-knowledge (ZK) proof zkWASM, and the launch of the new Near DA data availability layer project aimed at providing efficient data availability services for Ethereum and its L2 networks.

However, based on current on-chain data, these positive actions have not brought about any turnaround in the development of the Near ecosystem. Currently, the main activity on the Near chain is focused on staking.

Whether due to external factors or internal team management issues, the on-chain ecosystem development of Fantom and Near, which were once on the same front line, has been left far behind by Solana, and they are no longer on the same level.

The Prosperity of On-Chain Ecosystems Benefits from an Active Developer Community. Why Do Developers Prefer Solana?

In the Layer1 sector, apart from the continuous emergence of new applications in the Solana ecosystem, the development of ecosystems in other networks such as Fantom, Near, as well as established networks like Avalanche, Harmony (One), and new high-performance representatives like Aptos and Sui, has remained stagnant, with no popular new projects or user attention. The underlying cause of this disparity is the activity of developers, which determines the prosperity of on-chain applications.

According to data from the Developer website, in October, Solana had 268 full-time active developers and a total of 946 active developers, ranking fifth among many blockchain networks. The top four were Ethereum, Polkadot, Cosmos, and Bitcoin.

During the same period, the number of full-time active developers on Avalanche, Near, Aptos, Fantom, and Harmony networks was 133, 103, 55, 32, and 22, respectively, with total active developers of 472, 441, 174, 119, and 85.

In fact, the collapse of FTX last year did not lead to a mass exodus of Solana developers. The number of monthly active developers has consistently remained above 2,000, reaching 2,732 in March this year, and the number of code submissions has also reached a new high.

Developers have always been considered the most valuable asset in the blockchain network, and the blockchain industry is often referred to as "the one who gets the developers gets the world." A prerequisite for a widely adopted L1 ecosystem is a strong developer community, and the growth of the ecosystem is directly related to the level of developer activity, which refers to the launch of new and unique projects on various chains. The general expectation is that the more active the developers are, the more projects there will be, and the higher the usage will be. If developers do not develop products, users will have nothing to use. The activity of developers also demonstrates the quality of blockchain, native code, and virtual machine construction and development.

Solana's current level of developer activity is representative of the top networks, and its developer community vitality has been praised by leaders in the crypto industry. Shortly after the FTX collapse, Ethereum founder Vitalik Buterin tweeted that someone smart told him that Solana is a serious and smart development community, and he hopes it has a bright future. Placeholder VC partner Chris Burniske later explained that the Solana community has a group of hardcore developers and technical wizards, as well as many exciting builders, and compared to Ethereum and Cosmos, Solana's on-chain innovation is more independent and advantageous.

So, why do developers prefer Solana? This is probably due to the fact that Solana provides developers with high-quality technology, infrastructure, and a friendly development environment that other chains cannot provide.

In September of this year, Rune, the founder of MakeDao, stated that the reason for favoring Solana when exploring the creation of a new application chain, NewChain, based on the Solana codebase, is mainly due to the high quality of Solana's code, its flexible ecosystem, and the thriving developer community. While Cosmos also has a large number of high-quality developers, its efficiency and maintenance costs are higher compared to Solana.

Solana also understands the importance of developers and has always placed them at its core. When asked in a recent AMA about Solana's target users, Solana founder Anatoly Yakovenko replied, "It's developers. Solana is an operating system. My parents should never care about what operating system they are using, but they should like the applications built on it. Therefore, our goal is to maximize the efficiency of developers as much as possible."

It is reported that Solana's code only requires two engineers to run its applications, while the dydx application chain normally requires over 30 engineers and researchers to operate.

Solana is committed to creating a friendly development environment for developers with mature technology, continuously optimizing and improving network conditions, and striving to maximize the reduction of the barriers for developers. It is reported that programmers can develop a DApp on Solana in just a few minutes, and with the help of some developer platforms, developers can create custom DApp source code with just a few clicks of the mouse, including smart contracts, web UI, and server-side APIs.

This year, Solana has been working hard to address the risk of network downtime. After a series of upgrades and improvements, it has been online since February 25th. In November, the new generation node verification client Firedancer testnet launched by Solana announced its launch, which can improve network speed, reliability, and validator diversity. It is reported that during internal testing, Firedancer can achieve a TPS of 1 million, enough to meet the needs of high-frequency trading applications, making Solana another blockchain with multiple completely independent validator clients outside of Ethereum.

In July, Solana's EVM-compatible solution Neon went live, and two days later, the Solang compiler was released, allowing developers to write Solana programs in Solidity. This compatibility reduces the cost of development, deployment, and migration for developers.

In April of this year, for NFT project developers, Solana introduced state compression technology for storing data, greatly reducing the cost of minting NFTs. For example, minting 1 million NFTs costs only $921. This not only reduces costs but also expands the space for innovation, allowing NFTs to be used for more use cases.

In addition to continuous technical advancements and providing stable network performance and comprehensive infrastructure, Solana also collaborates with the developer community to explore new markets, host hackathons, provide technical and financial support, and expand its influence.

Lily Liu, the chair of the Solana Foundation, stated in an interview in July that they began to increase their investment in the Chinese-speaking and Asia-Pacific regions in February and March of this year, and developed a separate growth strategy focused on developers for the Indian market. On November 4th, the Solana Foundation also announced an exclusive ecological funding plan for the Chinese-speaking region, with a total of $1 million to support the development of the Solana ecosystem in the Chinese-speaking region.

To further attract and incentivize developers, Solana regularly holds various developer events and competitions. This year, two large-scale hackathon events have been held. The Solana Grizzlython hackathon held in February had a prize pool of up to $5 million and attracted over 10,000 participants who submitted 813 final projects to the judges. In November, the Solana Hyperdrive hackathon with a prize pool of $1 million attracted over 7,000 participants who submitted 907 final projects to the judges.

Solana's hackathon events have become a model in the crypto industry. Lily Liu stated that the Solana hackathons not only provide rewards but also provide an opportunity to bring developers together to innovate and compete, which not only promotes innovation but also community building. The hackathon event is divided into two parts, with half dedicated to the development and training of projects, and the other half dedicated to community activation and developer collaboration. This encourages creative collisions among independent developers and provides them with a beneficial environment to explore interesting ideas together, promoting broader community interaction and collaboration.

In terms of financial support, Solana has not stopped. In April of this year, the Solana Foundation introduced a new financing method called Convertible Grants to support projects in the Solana ecosystem. The mechanism of convertible grants means that these grants will only be converted into investments when the project reaches certain milestones. In May, the Solana Foundation launched a $10 million donation fund to explore the combination of the Solana blockchain and artificial intelligence.

It can be seen that Solana's ecosystem strategy is to first strengthen its technology, consolidate its infrastructure, form an industry reputation through excellent data performance, successfully attract the first wave of developers, and then hold online hackathon competitions to discover and reward high-quality projects, attracting developers to stay in the ecosystem, forming a positive growth flywheel of developers, ecosystem, and users.

Solana's support for developers is not only in terms of technology and resources but also provides an environment for growth and learning. The "1v1 communication between new Solana developers and advanced developers" culture has become an unwritten rule in the Solana community. Solana founder Toly once stated in an interview that this is a very good product development process because developers will receive a lot of questions or feedback, which can lead to immediate changes. We need to know what developers want, what is missing from the documentation, and where developers are stuck. The communication process may change the product roadmap and plans, which is beneficial for building projects better.

In summary, Solana's ecosystem strategy is to first strengthen its technology, consolidate its infrastructure, form an industry reputation through excellent data performance, successfully attract developers, and then hold online hackathon competitions to discover and reward high-quality projects, attracting developers to stay in the ecosystem, forming a positive growth flywheel of developers, ecosystem, and users.

Why Can't Layer1 Networks Like Near Replicate Solana's Ecosystem Growth Flywheel?

Solana's achievements are not only due to its attractive technical foundation but also to the support it provides, which not only benefits the development of the ecosystem but also benefits from the applications developed by developers in various fields. So, why can't Layer1 public chains like Near, as representatives, replicate Solana's ecosystem growth flywheel?

This is mainly because many current Layer1 networks lack even the most basic infrastructure. If developers want to deploy applications, they not only need to focus on developing their own applications but also need to develop related supporting infrastructure, which undoubtedly increases the workload for developers. For example, in terms of user and fund access, Fantom currently does not even have a reliable cross-chain bridge to support funds from other chains to enter; the Near ecosystem does not have a user-friendly wallet, making it very complex for users accustomed to EVM wallet interactions.

The same issue was mentioned by Manta in an interview about "Why leave the Polkadot ecosystem?" They stated that there is not even a mature cross-chain bridge from the Polkadot native chain to EVM on the Polkadot chain, and there is no well-designed native wallet with a good user experience. Their team not only needs to develop ZK-related products but also needs to develop the underlying infrastructure products that Polkadot should provide, such as spending 4 months developing a wallet during their time in the Polkadot development.

Regarding "how to determine which blockchain network is the best solution," Solana development tool provider Helius has stated that as a developer or project CEO, the first consideration when choosing which infrastructure to adopt or integrate is the least amount of time spent on maintaining the application on the blockchain infrastructure. Time should be spent on iterating their own products to create the best user experience.

The dimensions that developers consider mainly include: 1. The activity of on-chain users; 2. On-chain interaction usage, execution time, such as the need for a low-cost environment for transaction and gaming products, as well as understanding the technical trade-offs and limitations such as shorter block times and larger block sizes; 3. On-chain liquidity, such as whether there is enough liquidity support for token issuance; 4. Community activity, for example, NFTs need artists, and transactional products need traders; 5. Grants and later-stage risk funding support, for example, new ecosystems may have more grant support for projects, and mature ecosystems may have more risk fund investment support; 6. Management of technical complexity and expenses; 7. Programmability and sovereignty of chain rules, such as some chains not supporting native tokens as gas fees; 8. The prosperity of the on-chain ecosystem and the composability of applications with other ecosystems, such as DeFi applications that can combine to provide returns, etc.

In summary, the main dimensions that developers consider include the performance and technical stability of the chain, entry barriers, operating costs, and whether the environment can provide resource and funding support.

Compared to the above-mentioned developer requirements, the vast majority of current Layer1 networks cannot even meet the most basic technical stability and developer entry barriers, and they continue to chase after the prosperity of the on-chain ecosystem.

In response to this, crypto user Li explained that for users, it seems that they do not care whether the technology is decentralized, as long as it is easy to use, cheap, and has on-chain wealth effects, there will be an ecosystem. But for developers, when building an application, the first consideration is whether the underlying infrastructure meets the basic requirements and whether the supporting facilities are sound.

In a sense, developers are like real estate developers in a certain area, needing to consider popularity (users) and surrounding supporting facilities. Similarly, there is a "Matthew effect" in blockchain networks, where the more active the developer community, the more mature and complete the corresponding network's basic supporting facilities will be, making it easier and smoother for developers to build applications, leading to a more prosperous ecosystem. This will then attract more and more developers to build, forming a positive and virtuous cycle.

Whether it is Solana or Layer2 representatives like Polygon, Optimism, etc., the reason they can attract more and more developers is because they have been continuously breaking through and innovating in terms of technology. They have a complete set of docking standards and processes for the underlying network infrastructure, as well as their own strategies for operating the developer community and ecosystem development, making the development of their ecosystem sustainable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。