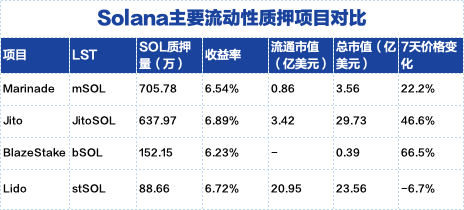

Compare the staking volume, yield, governance token performance, and application in DeFi of Solana's liquidity staking tracks Marinade, Jito, BlazeStake, and Lido.

Author: Jiang Haibo, PANews

With the market rebounding, Solana (SOL) has risen to become the sixth largest cryptocurrency and, among all proof-of-stake (PoS) blockchains, its staking asset scale is second only to Ethereum, ranking second. However, relative to its market position, the concentration of funds in decentralized finance (DeFi) applications in the Solana ecosystem is relatively low, with a total locked value (TVL) of 1.137 billion USD, accounting for only 11.3% of its historical high.

In Solana's TVL, liquidity staking projects are particularly important, as they are key to driving TVL back to its historical high. In this track, Marinade and Jito have occupied significant positions with their highest TVL, highlighting the importance of liquidity staking. This article by PANews will delve into the important participants in the liquidity staking field on Solana and compare and analyze their strategies and market performance.

Overall Situation of Staking and Liquidity Staking

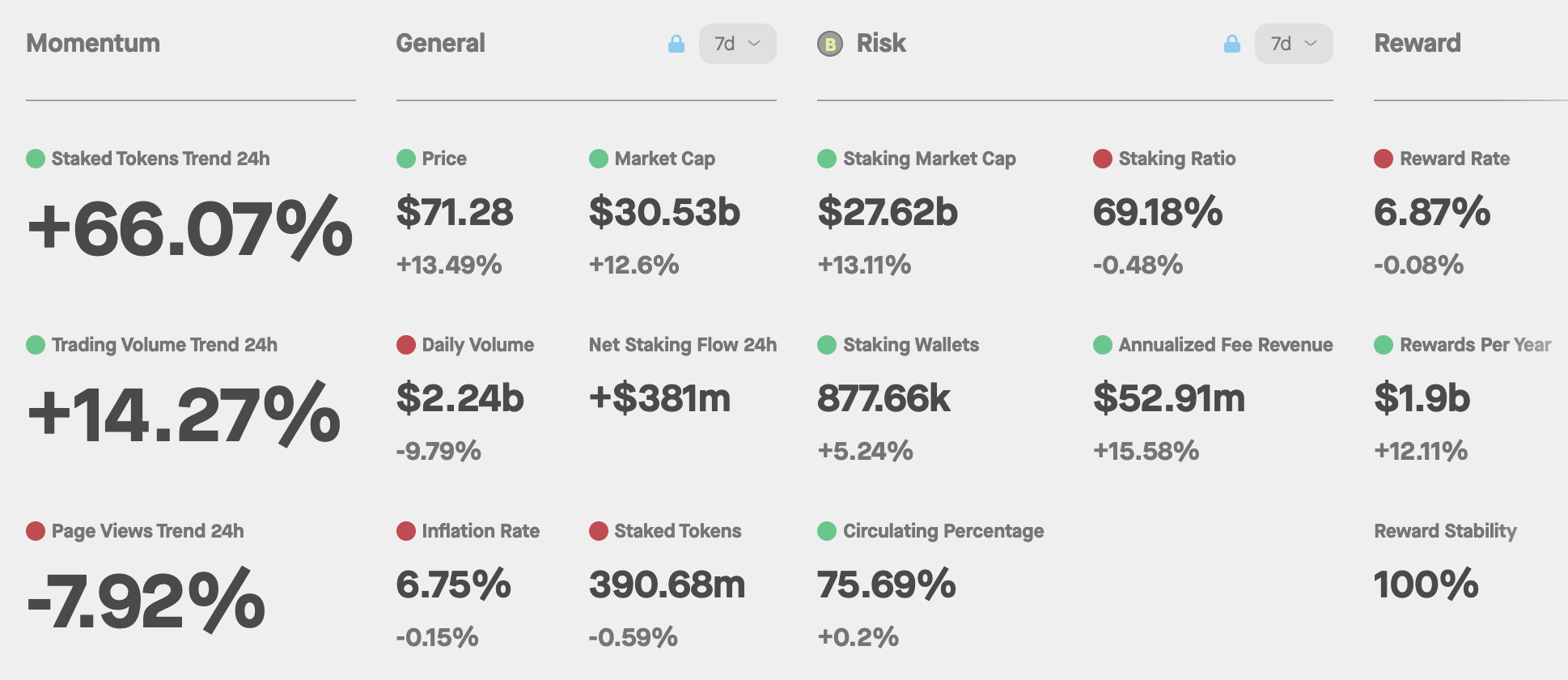

According to Staking Rewards data, as of December 12th, SOL's market value was 305.3 billion USD, staking market value was 276.2 billion USD, staking ratio was 69.18%, staking quantity was 3.91 billion SOL, inflation rate was 6.75%, and reward rate was 6.87%. Among them, SOL's staking market value ranks second among all PoS public chains, second only to ETH; the staking ratio is also relatively high among PoS public chains with high market value.

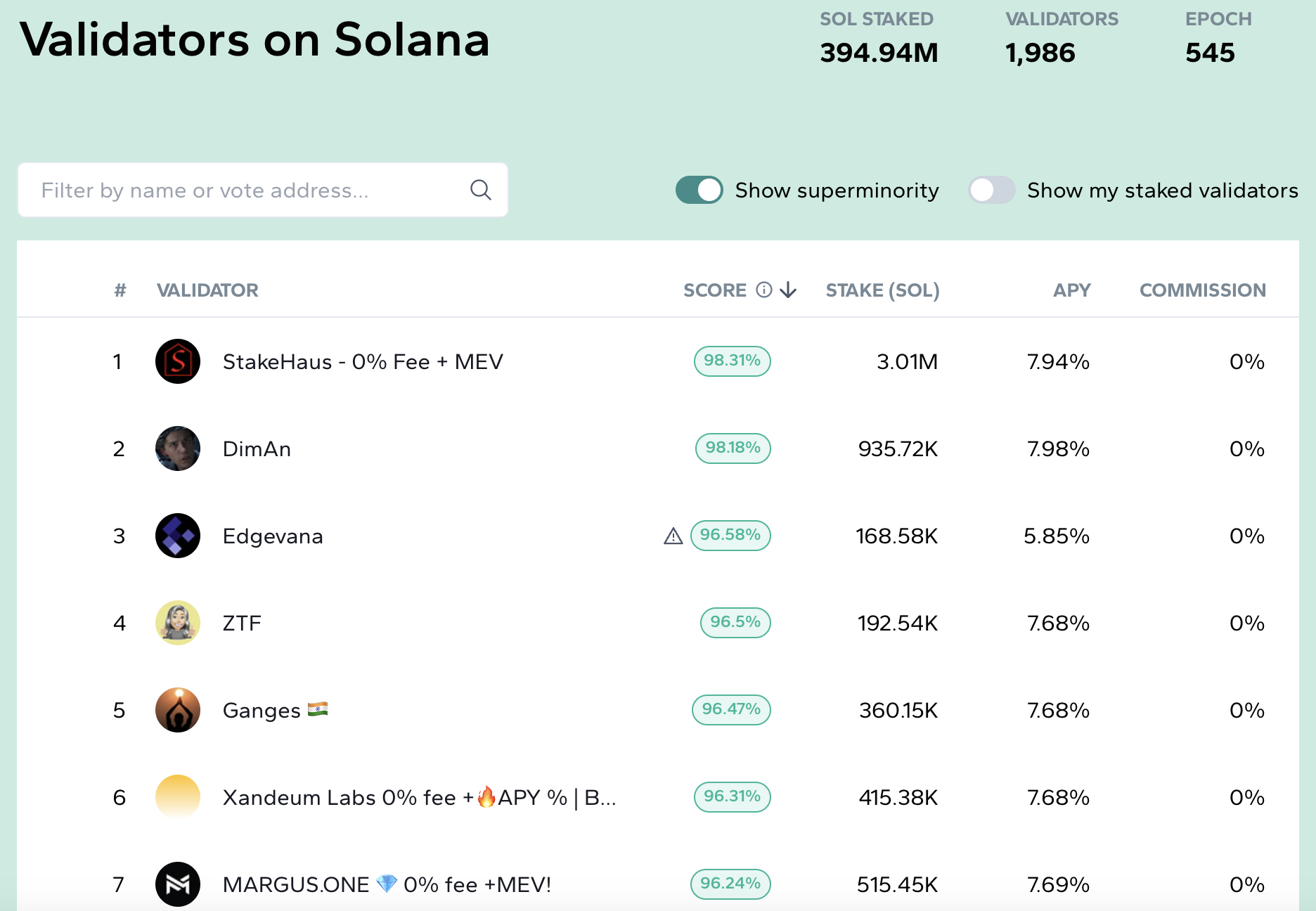

Data from Marinade shows that there are a total of 1986 validators in Solana, with top-ranking validators providing an APY close to 8%, all without commission.

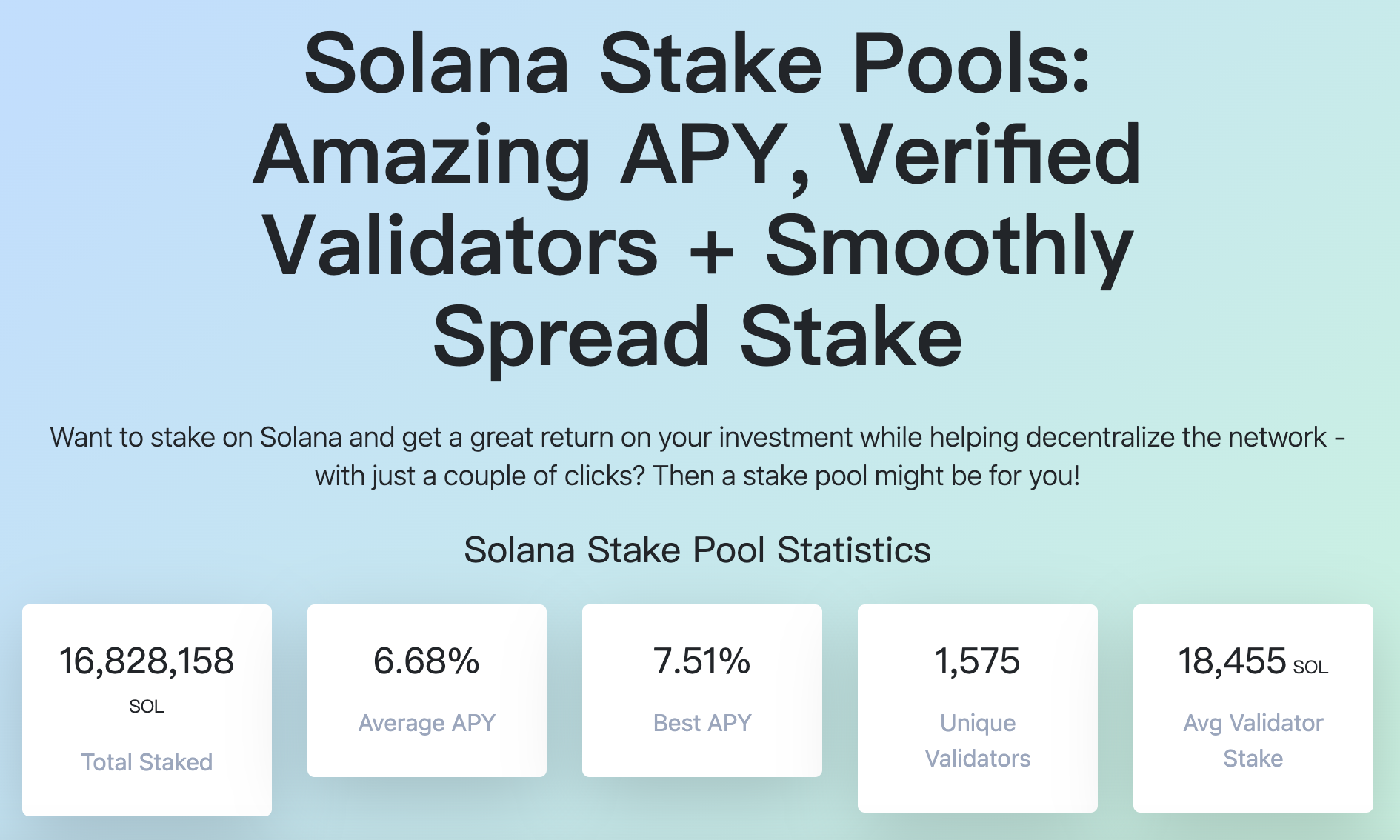

To reward SOL holders, increase network security, and censorship resistance, the Solana Foundation launched the "Staking Pool Program," allowing users to deposit SOL into the staking pool and receive SPL tokens representing their share in the staking pool, which are the liquidity staking tokens (LST) that can freely circulate. Solana Compass data shows that a total of 16.82 million SOL is locked in the staking pool, providing an average APY of 6.68%. Therefore, SOL in the staking pool accounts for approximately 4.3% of the total staking volume. The top 4 staking pools are Marinade, Jito, BlazeStake, and Lido, the 4 largest liquidity staking projects in the Solana ecosystem.

Marinade Finance

Marinade Finance is the earliest liquidity staking protocol in the Solana ecosystem, established with funding from the Solana ecosystem during the 2021 Spring Solana x Serum Hackathon, and launched the liquidity staking protocol on the Solana mainnet in August 2021. Staking SOL on Marinade yields mSOL, with staking rewards accumulating directly into mSOL.

Unlike other projects, Marinade also provides native staking services, allowing users to earn staking rewards without using any smart contracts (and thus no LST).

Marinade has 7.058 million SOL staked, the highest staking volume among liquidity staking projects on Solana; it also has the highest TVL on Solana, valued at 7.77 billion USD; staking yield is 6.543%; staking volume has increased by 31.22% in the past 30 days.

Marinade's governance token is MNDE, with a circulating market value of 85.99 million USD and a total market value of 356 million USD, up 22.2% in the past 7 days.

Jito

Jito completed a Series A financing led by Multicoin Capital and Framework Ventures in August 2022, and launched its liquidity staking platform at the end of 2022. Staking SOL on Jito yields JitoSOL, with staking rewards accumulating directly into JitoSOL.

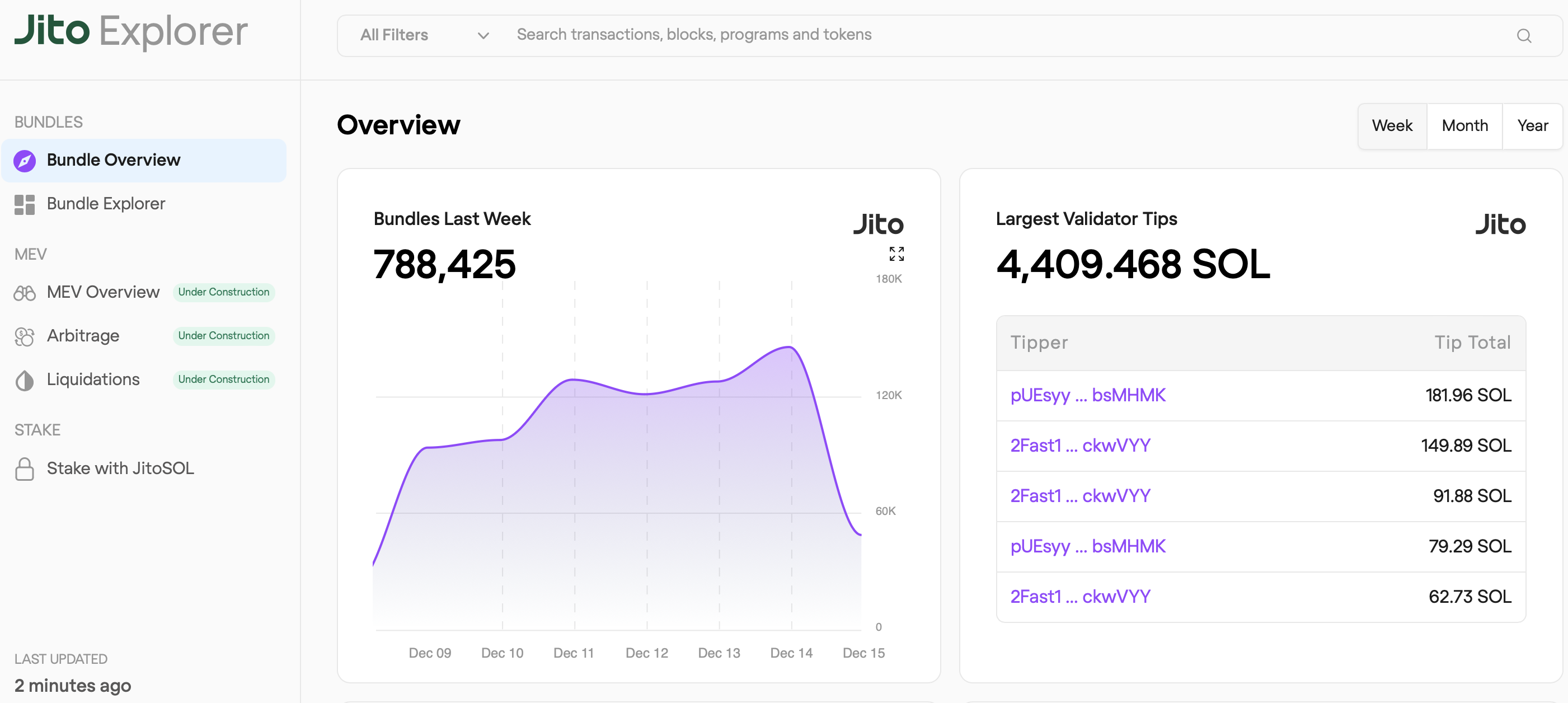

Unlike other liquidity staking projects, Jito has developed the largest maximum extractable value (MEV) infrastructure for the Solana network, including: the Jito Solana client, Jito Bundles that allow searchers to send transaction bundles to validators, the Jito Block Engine blockchain builder, and the MEV allocation system. Due to its own MEV business, a portion of the MEV revenue is allocated to JisoSOL, resulting in relatively higher earnings for users staking through Jito.

Jito has 6.38 million SOL staked; staking volume has increased by 17.77% in the past 30 days; TVL is 4.55 billion USD; staking yield is 6.892%.

Jito's governance token is JTO, with a circulating market value of 342 million USD and a total market value of 2.973 billion USD, up 46.6% in the past 7 days.

BlazeStake

BlazeStake was originally a niche staking pool launched in May 2022, but due to the collective outbreak in the Solana ecosystem, the governance token has increased by tens of times from its low point, making BlazeStake surpass Lido to become the third largest liquidity staking project on Solana. Staking SOL on BlazeStake yields bSOL, with staking rewards accumulating directly into bSOL.

BlazeStake mainly uses Solana Labs' official staking pool smart contract, which has the largest validator set, allowing users to stake liquidity to specific validators.

BlazeStake has 1.52 million SOL staked; staking volume has grown by 177% in the past 30 days; TVL is 1.08 billion USD; staking yield is 6.232%.

Blaze's governance token is BLZE, with an undisclosed circulating market value and a total market value of 38.84 million USD, up 66.5% in the past 7 days.

Lido

Lido launched its liquidity staking service on Solana in September 2021 and dominates the liquidity staking on ETH. However, its development on other chains has not been ideal, and it failed to capitalize on the first-mover advantage and brand advantage. In October, it announced the cessation of accepting new staking on Solana. Staking SOL in Lido yields stSOL, with staking rewards also accumulating into stSOL.

In Lido, there are 887,000 SOL staked; staking volume has decreased by 41.43% in the past 30 days; TVL on Solana is 63.4 million USD; staking yield is 6.717%.

Lido's governance token is LDO, with a circulating market value of 2.095 billion USD and a total market value of 2.356 billion USD, down 6.7% in the past 7 days.

Applications of Various LST in DeFi

Marinade's mSOL, Jito's JitoSOL, Blaze's bSOL, and Lido's stSOL have received good support in Solana's DeFi applications.

The two largest lending protocols on Solana, marginfi and Solend, both support mSOL, JitoSOL, bSOL, and stSOL as collateral for borrowing. However, after Lido's announcement, stSOL has been delisted from these two projects.

In the leading DEX on Solana, Orca, mSOL/SOL and bSOL/SOL both have liquidity of over tens of millions of USD, and there are also trading pairs between mSOL and bSOL; however, the liquidity of Jito/SOL and stSOL/SOL is relatively lower.

The growth in staking volume and liquidity in DEX may be related to the project's incentive measures. Blaze provides the highest incentives, offering an APR 15.37% subsidy in BLZE governance tokens for deposits in Solend, and an APR 1.98% subsidy in MNDE governance tokens for mSOL deposits. Jito has not yet provided incentives for the adoption of JitoSOL in DeFi, and Lido's tokens have been mostly distributed, making it unable to provide further incentives and choosing to exit the market.

Conclusion

The Solana ecosystem contains several representative liquidity staking solutions, all of which have received support from DeFi projects in the ecosystem. Marinade was the earliest to launch and offers native staking services; Jito provides higher returns through MEV infrastructure; BlazeStake allows users to stake SOL to specific validators; and Lido is a representative provider of multi-chain liquidity staking services. However, the total liquidity staking volume is relatively low, with SOL staked in staking pools accounting for only 4.3% of all staked SOL. The abundance of liquidity solutions has also led to liquidity dispersion, and there may be some competitive solutions emerging in the future, such as LST from marginfi.

Incentive measures still seem crucial for increasing staking volume and liquidity of LST in DEX. Blaze has the smallest reputation, but it has provided the highest APR subsidies in DEX and lending protocols, leading to a 177% increase in staking volume in the past 30 days. Despite having the largest reputation in the liquidity staking field, Lido, which was launched early on Solana, has almost distributed all its tokens and is unable to participate in the subsidy battle, choosing to shut down.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。