Pyth Network is an oracle network that allows users to access the prices of cryptocurrencies, real-world stocks, and more, and helps users understand the latest prices of various assets such as cryptocurrencies and stocks.

Basic Information

Token Name: PYTH

Pyth Network is an oracle network that allows users to access the prices of cryptocurrencies, real-world stocks, and more, and helps users understand the latest prices of various assets such as cryptocurrencies and stocks. The platform provides a special price indication service, which not only tells you the current price of an investment project, but also provides a so-called "confidence interval," which is equivalent to a probability range for the accuracy of the price.

This price and confidence interval are derived from aggregating data from multiple sources, which are various market participants such as exchanges or other financial institutions, providing the latest and real market information. By aggregating data in this way, Pyth Network ensures that even if someone tries to mislead the market by false information or manipulating prices on other platforms, it is difficult to affect the aggregated price it provides. This is how it ensures the reliability of prices.

Figure 1: Pyth AUD/USD Price Source (Pyth, n.d.)

Pyth's native token will be PYTH, which will be used to pay for updating oracles. The price sources on Pyth will remain unchanged until someone pays for this update fee. This token will also be used for governing the following:

- Size of update fees

- Publisher reward distribution

- Approval of on-chain program updates

- How to list new price sources, including any reference data

- How to grant publisher permissions

Competitors

Chainlink | Price: $15.53 | Market Cap: $893,252,853

Chainlink is a data provider oracle that allows smart contracts to access real-world data. Its latest feature, Cross-Chain Interoperability Protocol (CCIP), provides users with a single interface for multiple blockchains. LINK, Chainlink's native token, is used for node collateral.

Band | Price: $1.46 | Market Cap: $199,256,414

Band Protocol is also a data provider oracle. Like Chainlink, it can access real-world data, but it can also directly connect APIs to smart contracts. Its native token BAND is also used for node collateral.

Token Economic Model

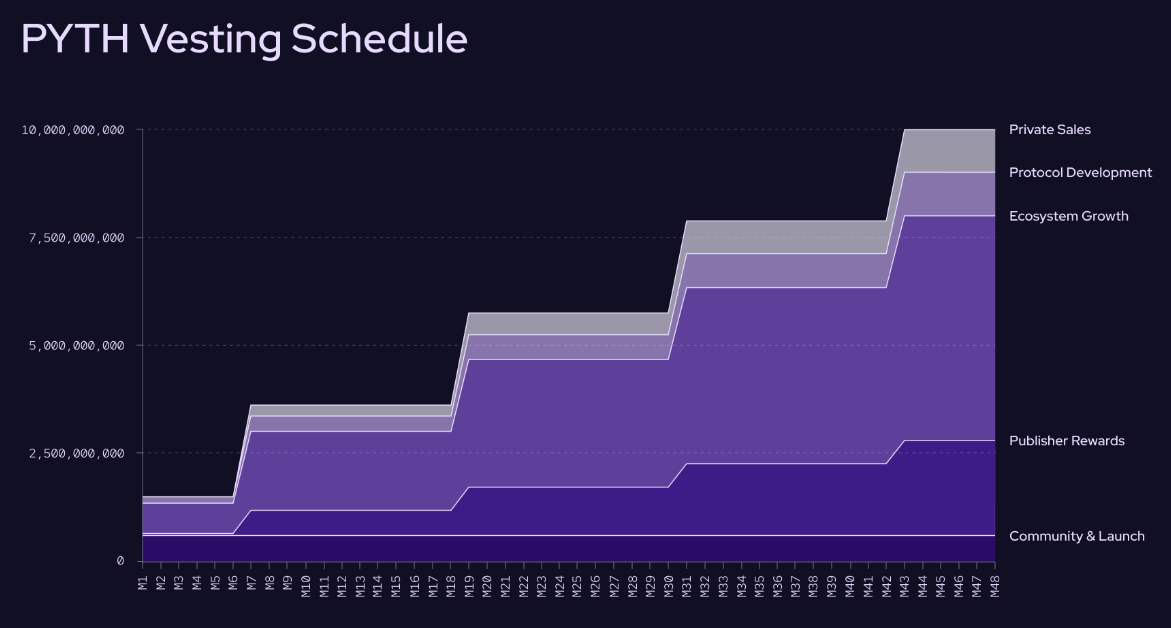

Figure 2: PYTH Release Ratio Process Chart (Pyth Network, 2023)

The total release period will take about 42 months, which is quite a long time. It should also be noted that in May 2024 - around the next Bitcoin halving - a significant portion of the tokens will be released. In addition, except for the community and the launch, all rewards will be released at the same rate and time.

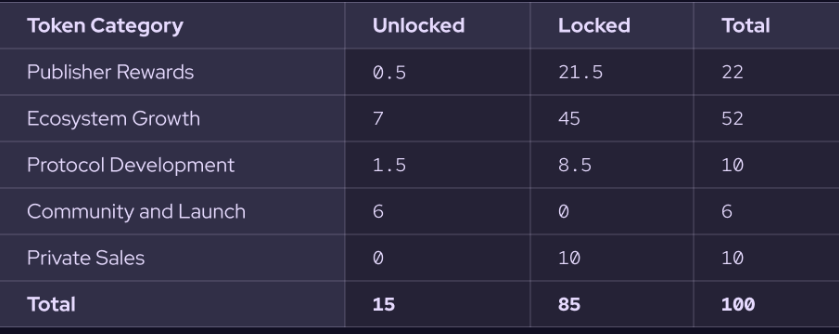

From the information they have released, a significant portion of the tokens will be allocated to the ecosystem, with specific examples as follows:

Figure 3: PYTH Token Allocation Table (Pyth Network, 2023)

Investors

Top five investors (out of 13 investors):

- CMT Digital

- Everstake Capital

- IMC Trading

- Jump Crypto

- Kucoin Labs

It is worth noting that PYTH also received a grant of 40,000 OP from the OP Foundation.

Bullish Fundamentals

Advantages of data aggregation:

Pyth Network provides price information by integrating data from multiple sources, making it particularly powerful in competition. Other platforms' data providers may have differences in the price information they provide due to data transmission delays or inaccuracies. Pyth effectively reduces this inaccuracy by integrating this data.

Increased market transparency:

Pyth Network could be a very valuable tool for the cryptocurrency market as it increases market transparency. With increased market transparency, it can attract investors who may have been unfamiliar with or difficult to access cryptocurrencies.

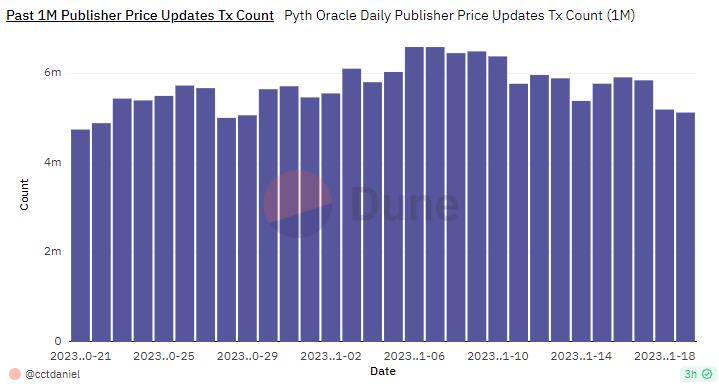

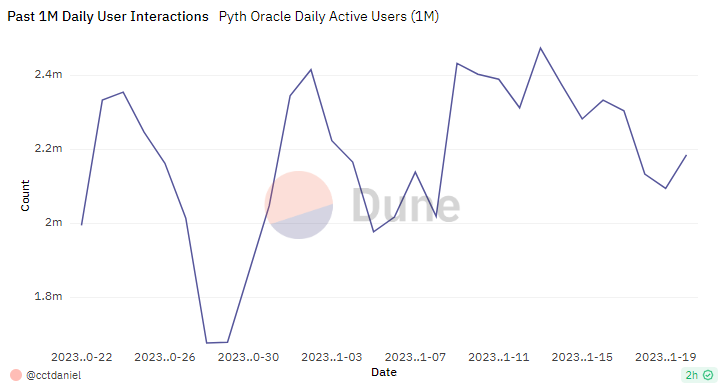

User willingness to pay:

Currently, users are clearly willing to pay for higher quality updated data. This indicates that the services provided by Pyth Network are valuable to users. However, there is also some uncertainty about whether users are willing to pay (as mentioned in the bearish fundamental factors).

Figure 4: Number of data updates in the last month (@cctdaniel, n.d.)

Figure 5: Number of user interactions in the last month (@cctdaniel, n.d.)

Platforms collaborating with Pyth Network:

- Vela Exchange

- Unidex

- HMX

- Synthetix

These are all data providers for the Pyth Network. Each platform provides data in its specific area, which the Pyth protocol uses to create more comprehensive and accurate market price information. By collaborating with these platforms, the Pyth protocol can capture market dynamics from multiple perspectives, providing users with richer data and information.

Bearish Fundamental Factors

Saturation of data provider market:

The data provider market is already very saturated, and Pyth Network can only provide price information, which may result in a much lower volume of data it can provide compared to its competitors. Although Pyth also provides the feature of a confidence interval, which may make it slightly prominent, other data providers are fully capable of adding this feature.

Risk of providing malicious data:

Pyth mainly avoids publishers providing malicious data by using data aggregators. (Licensed publishers can upload data for free.) However, to make its price oracle run smoothly, the following conditions need to be met:

- There needs to be a considerable number of publishers.

- Multiple attacks cannot occur simultaneously (if they do, more publishers are needed to mitigate their impact).

- There are currently only 39 active publishers in the past week.

It appears that this mechanism needs more participants to join for greater assurance.

Pyth's fee structure:

Pyth's payment structure follows the "volunteer's dilemma" model in game theory:

Player/Other

Cooperate

Defect

Cooperate

Cooperate

Defect

Note:

- i describes the situation where an individual benefits from having information

- l describes the losses incurred by an individual due to having information

- p describes the cost associated with updating information

It appears that only when nodes cooperate with each other and collectively publish accurate data, can each data updating node receive the maximum token reward.

Treating the above table as a matrix, if users need to individually pay to update information and can only access the information after payment, they may actually be more inclined to pay (leaving only the (2,1) and (2,2) cases). However, due to the potential for free-riding (obtaining information without paying), users may actually be very unwilling to pay, or at least wait for the information to be updated. For example, if David wants to invest in Ethereum (ETH), he may choose to wait a day to see if there are any updates, rather than updating immediately. This not only leads to reduced income, but also delays in website updates, and prices will not be updated regularly. Research has found that models like this require a large number of decentralized application (dApp) integrations, or any type of smart contract integration, where smart contracts regularly request prices. This means that there is no thought process involved in waiting/free access to price information.

This section emphasizes the potential issues that Pyth Network may face in its payment and incentive mechanisms. Since users may wait for others to pay the update fee to obtain free information, this may lead to insufficiently timely website updates, affecting the efficiency and profitability of the Pyth Network. This also suggests that Pyth may need to consider more effective incentive and integration strategies to promote more frequent and timely data updates.

References

Band Protocol. (n.d.). Band Protocol - Company. Band Protocol. Retrieved November 20, 2023, from https://www.bandprotocol.com/company

@cctdaniel. (n.d.). Pyth Oracle. Dune dashboards. Retrieved November 20, 2023, from https://dune.com/cctdaniel/pyth-oracle

Chainlink. (n.d.). Chainlink CCIP. Chainlink Documentation. Retrieved November 21, 2023, from https://docs.chain.link/ccip

CoinMarketCap. (n.d.). Band Protocol price today, BAND to USD live price, marketcap and chart. CoinMarketCap. Retrieved November 20, 2023, from https://coinmarketcap.com/currencies/band-protocol/

CoinMarketCap. (n.d.). Chainlink price today, LINK to USD live price, marketcap and chart. CoinMarketCap. Retrieved November 20, 2023, from https://coinmarketcap.com/currencies/chainlink/

Cryptopedia Staff. (2022, February 8). Band Protocol: Decentralized Finance (DeFi) Oracles. Gemini. Retrieved November 21, 2023, from https://www.gemini.com/cryptopedia/band-protocol-oracle-blockchain-defi-band-coin

PitchBook. (n.d.). Pyth Network Company Profile: Valuation, Funding & Investors. PitchBook. Retrieved November 21, 2023, from https://pitchbook.com/profiles/company/470505-07#signals

Pyth. (n.d.). AUD/USD Oracle Price. Pyth. Retrieved November 16, 2023, from https://pyth.network/price-feeds/fx-aud-usd?range=1W

PYTH Data Association. (2023, September 28). PYTH NETWORK: A FIRST-PARTY FINANCIAL ORACLE. Pyth Network. Retrieved November 16, 2023, from https://pyth.network/whitepaper_v2.pdf?ref=pyth-network.ghost.io

Pyth Network. (n.d.). Optimism Agora. Retrieved November 21, 2023, from https://vote.optimism.io/retropgf/3/application/0xfeba07d541bf93651d4278ab2fb91f89b147e6c5d743ea29fe797958997644cf

Pyth Network. (2023, October 17). Understanding the PYTH Tokenomics. Pyth Network. Retrieved November 21, 2023, from https://pyth.network/blog/understanding-the-pyth-tokenomics

Raza, A. (2023, August 14). Chainlink Vs. Band Protocol (2023 Edition). Securities.io. Retrieved November 20, 2023, from https://www.securities.io/chainlink-vs-band-protocol/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。