TON's ecosystem is actively developing diverse applications through Telegram while strengthening its foundation, with the potential to become a popular Web3 ecosystem by optimizing user experience and serving vertical industries.

Author: OKX Ventures / Source: https://okxventures.medium.com/navigating-the-evolving-teleg

1. Interaction between Telegram and the TON Ecosystem

1) Current State of the Telegram Ecosystem

Unibot and its outstanding revenue-generating capabilities have sparked strong interest in the low-risk, high-return bot field. Creating and developing Telegram bots is a straightforward process closely integrated with the Telegram platform, offering unparalleled convenience. These bots generate revenue through trading volume and related fees. Even in bear markets, they demonstrate strong profitability, with top projects like Unibot and MEVFree generating monthly revenues exceeding $5 million. Meanwhile, second-tier projects with market values below $10 million can still achieve monthly revenues in the hundreds of thousands of dollars.

Currently, the Telegram ecosystem primarily revolves around the "bot + API + wallet hosting" framework. While WeChat application development is relatively simple, small-scale TON projects have encountered complexity in the application process, making it difficult to integrate smoothly into the official wallet. Due to the high development difficulty, costs, and challenges in obtaining grant support, small projects have faced difficulties. Therefore, mini-games have adopted a pragmatic approach, conducting game bodies + Telegram API + offline computing on the Ethereum layer2 for rapid deployment and improved efficiency.

2) Why Telegram Needs the TON Ecosystem?

While bot data may seem promising, it is important to note that the bot ecosystem lacks actual support from public chains like TON. The bot ecosystem operates independently without utilizing components or token mapping from the TON ecosystem.

On the other hand, TON is an important avenue for Telegram's commercialization efforts. Due to historical sensitivity and limited profitable avenues available to Telegram, the platform must carefully choose the appropriate path for commercialization. Telegram's founder envisioned integrating blockchain technology from the early days of its establishment. Through bot migration, TON has the potential to become a unique application-based public chain. Therefore, TON becomes one of the most promising avenues for Telegram's future success.

3) Why Developers Need to Turn to the TON Ecosystem?

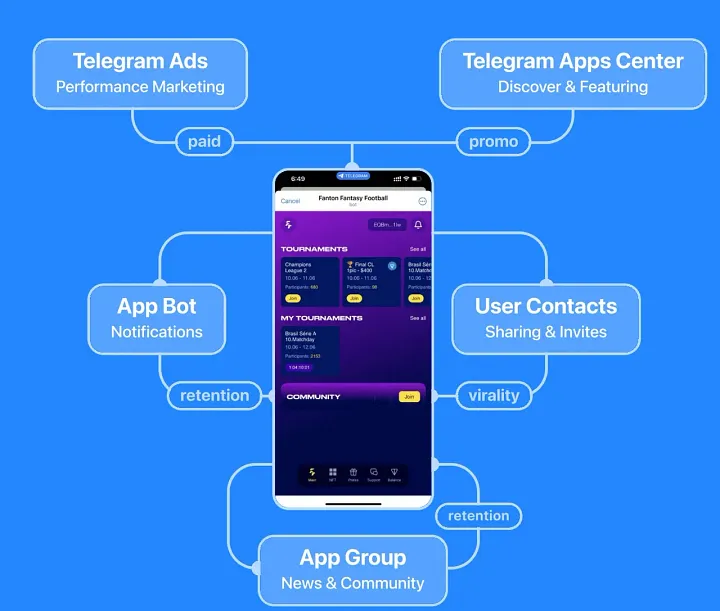

To thrive in the digital domain, developers have strong reasons to turn to the TON ecosystem. The TON Foundation has designed key strategies to promote ecosystem growth, including inflows into the application center, TON native payment integration, Telegram community promotion, foundation grants and investments, and lifting API restrictions. Here are some comparative advantages that may attract developers to turn to the TON ecosystem in the future:

TON's native payments: While the current @Wallet meets KYC requirements, its functionality and scalability are limited, only providing payment invocation functions. To expand product scale and functionality, developers must introduce a native payment component based on the TON public chain. TON Space is a self-hosted wallet for Web3 users, capable of smart contract invocation, assisting project parties, enhancing product imagination, and enabling seamless payments without importing wallets.

Telegram community promotion: The TON ecosystem has an official website, mobile promotion bots, and dedicated promotion Telegram channels.

GitHub: Developers who complete bounty tasks will be listed in the "Hall of Fame" on TON GitHub, covering 106 projects including code extensions, NFTs, and development tutorials.

Advertising: Telegram sponsorship messages can be displayed on large public channels, providing extensive exposure for projects. The TON Foundation has the right to publish project advertisements, including banner ads, category ads, and search ads.

Foundation support: The TON Foundation has allocated over $1.2 million in funding, supporting over 100 projects, averaging $10,000 per project. In 2023, funded projects covered TON wallet integration with KaiOS, the EVAA Protocol for borrowing, application platforms, development components, prediction markets, issuance platforms, and AI integration, among others.

Lifting API restrictions: Unlike Telegram's limitations on bot message capacity, TON provides unrestricted anonymous RPC access API, promoting data indexing and retrieval, significantly enhancing development flexibility.

Stable platform: While bots have issues with payments and cashing out, applications in the TON ecosystem can seamlessly connect to the corresponding infrastructure. Bots charge fees for DeFi transactions, while TON DeFi applications offer lower fees, providing a more cost-effective solution.

Enhanced user experience: Bots often encounter limitations in response speed, interaction mode, and multitasking capabilities. In contrast, TON applications offer a superior user experience with stronger functionality, interactivity, and composability. Projects showcased in the app center can all be connected through @Wallet, highlighting the substantial differences between TON and Telegram bot projects.

By turning to the TON ecosystem, developers can unlock a range of new opportunities, such as adopting native payments, gaining community support, enjoying enhanced development flexibility, accessing stable infrastructure, and providing improved user experience. With TON's solid foundation and these significant advantages, developers have ample reason to consider turning to the TON ecosystem.

- In-Depth Understanding of the Thriving TON Ecosystem

The official TON ecosystem showcases an impressive 551 applications covering diverse fields. From staking platforms to wallets, browsers, cross-chain bridges, public facilities, NFT markets, social platforms, games, decentralized exchange platforms, and more, the ecosystem offers a wide range of project choices.

Wallets: In the TON ecosystem, most wallets are embedded components, with only three of the top ten wallets having their own official websites. While these wallets provide convenience through integration with Telegram, concerns about Telegram's security and excessive spam messages have led to uncertainty in user transactions.

DEX (Decentralized Exchange Platforms): The ecosystem currently has six native platform DEXs, all offering basic exchange and liquidity pool functions. The total locked value (TVL) of these DEXs averages between $200 million and $500 million. Non-native DEX platforms like DODO, Uniswap, Pancake Swap, and Nomiswap also play a role. However, development in this area is slow, with most products supporting only a few cryptocurrencies. The only DEX aggregator, OPTUS, is currently unable to aggregate. (Note: The main issue is the lack of stablecoins. There are indications that Telegram may issue stablecoins in Dubai, or issue its own stablecoin, or initially issue USDT.)

Staking Platforms: Currently, there are only two available staking platforms in the TON ecosystem (TonStake and Whales Pool). Other products like liquidity staking hipo finance are still in the testnet stage. The user interface is basic, providing only basic functionality similar to the early stages of the BTC ecosystem.

CEX (Centralized Exchange Platforms): TON currently hosts 44 CEXs, including well-known trading platforms such as OKX, Huobi, Bit, CoinEX, Gate, BiTelegramet, and Moonpay. The remaining trading platforms are smaller in scale or are local trading platforms, such as Spain's Bit2me and Iran's اوکی اکسچنج.

Cross-Chain Bridges: The official bridges in the TON ecosystem currently support interoperability of assets between BSC, ETH, and TON networks, with asset transfers limited to TON. The third-party bridge Orbit Bridge announced support for the TON network starting from December 1, 2022. Orbit Bridge also supports Ethereum, BNB, Klaytn, Polygon, and other chains, enabling cross-chain transfers of assets between these networks and the TON blockchain.

Tools: The TON ecosystem primarily offers utility bots, similar to widgets. These include faucets, notification bots, trading tracking tools, community management tools, and quizzes with prizes.

NFTs (Non-Fungible Tokens): The TON ecosystem has around 50 NFT series. Notable series include Annihilation (base price 198 TON, volume 177.2K TON), CALLIGRAFUTURISM (base price 650 TON, volume 21.6K TON), OCTOPUS BOYZ (base price 87 TON, volume 75.8K TON), and METAMORPHOSES (base price 99.5 TON, volume 38.9K TON). However, no well-known artists have entered the TON NFT space, and overall trading volume remains at a general level.

Games: The TON ecosystem offers over 30 games, with two popular gambling projects integrated into Telegram as bots. Other game projects may be relatively simple, usually launched as direct mini-programs without official websites.

Development Components: Currently, the ecosystem has seven development components, including the TON development plugin for the IntelliJ platform (an open-source platform for developer tools), Tonana cross-chain bridge, contract-to-QR code conversion, and TON contract verification. However, apart from these components, there are no other significantly useful components, and the overall development component ecosystem is at a general level. Occasionally, the official website may also be inaccessible.

1) Optimistic Outlook for Official Support Infrastructure

TON Network: The TON network has a great opportunity to transform Telegram into a TON service, as Telegram's MTProto protocol is easily embeddable with the RLDP protocol. This transformation is not only beneficial for Telegram but also paves the way for similar messaging and social network services to leverage the advantages of the TON network.

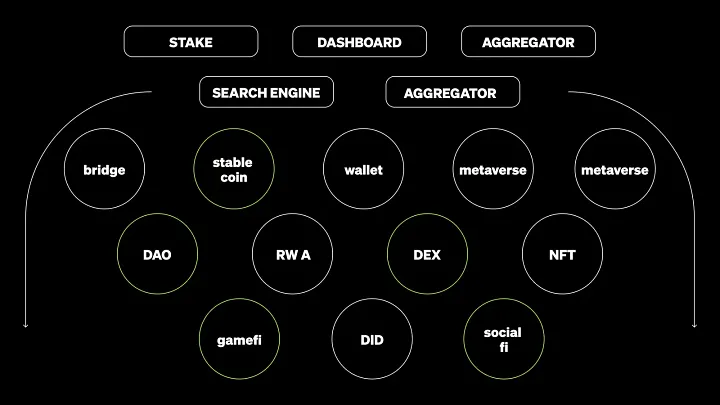

TON's Core Components/Middleware: These include basic network components (such as P2P and proxies), social components (such as DNS and storage), and payment components (such as wallets and TON Space). Looking ahead, these components can be combined and expanded to enhance infrastructure. This may include developing a one-stop network deployment infrastructure, dynamic site search engines, and market data dashboards. In the DeFi field, there is an opportunity to create DEXs and aggregators. Additionally, considering the richness of gaming projects on TON, an ERC-721-based NFT market has significant growth and development potential.

2) Exploring the Potential of Mini-Program Applications

Main Points: When comparing the ecosystems of TON and Ethereum, it is evident that they have different focuses. Ethereum emphasizes decentralized finance (DeFi) and embraces a strong cryptocurrency narrative. In contrast, TON values the diversity and breadth of mini-program applications, leaning towards a Web2.5 narrative. In TON, the focus is on user experience and achieving mass adoption, catering more towards existing Web2 developers, especially those who favor C language. TON's approach prioritizes inclusivity and user-friendly experiences, differing from the traditional cryptocurrency-centric views observed in Ethereum. These different focuses and developer communities contribute to the uniqueness and goals of each ecosystem.

Analysis: TON provides rich opportunities in applications, with a clear focus on supporting mini-programs. Breaking through the purely cryptographic application layer is challenging, so mini-programs have become the primary choice before venturing into the DeFi space. While technological innovation in the crypto field is not the main focus, stability and security are paramount. It is important to note that the habits of Telegram users currently differ from WeChat users. The ecosystem structure, user stickiness, and user psychological expectations are closer to platforms like QQ that provide multifunctional features. These factors shape the direction and development of the TON ecosystem, emphasizing the importance of catering to user preferences and providing diverse functionalities.

Conclusion: The integration of Ton Space and Telegram has the potential to attract a large amount of Web2 traffic to the TON ecosystem. This extensive ecosystem includes a range of key elements, such as traffic sources, application scenarios, social relationships, payment gateways, and functionalities that meet user needs. In the early stages, developers can draw inspiration from the development format of WeChat mini-programs, especially in specific verticals. By leveraging the advantages of Ton Space and Telegram, the TON ecosystem can create an engaging environment that attracts diverse user needs. This approach positions TON to become a thriving ecosystem, capable of attracting and meeting the needs of Web2 traffic, while strategically targeting specific verticals.

Verticals: Traffic Sources: The TON ecosystem can utilize various sources to attract developers and users, such as DApp task distribution platforms and targeted commercial releases. Application Scenarios: TON offers diverse application scenarios, including App Bots, Web App options, and integration with Web 2 content, such as the card game Card Ahoy in collaboration with NetEase. Social Relationships: The TNS-based social graph protocol can enhance interaction, creating an engaging social/trading market environment combining social and transactional elements in games. Payment Gateway: TON can provide various payment methods, including credit cards and cryptocurrencies, integrating real-world assets to expand payment options, similar to the introduction of stablecoin mining platforms. User Coverage: Utilizing Telegram channels and TON Space in conjunction with @wallet to attract more Web 2 users towards Web 3, expanding the user base.

3) Cautious Outlook on DeFi, MEV, and ZK

DeFi: DeFi applications may not require large-scale cryptographic innovation, but they demand reliable collateral, exchange, and trading functionalities. Security and stable usage are crucial, providing opportunities for trading platforms and products with a good track record in the crypto field to adapt to DeFi needs.

Regarding the MEV issue, addressing large-scale transactions is not urgently needed at the moment. It is more important to expand asset availability and stimulate trading demand. By prioritizing asset creation and promoting market activity, the ecosystem can lay a solid foundation for addressing the MEV issue later on.

As for ZK technology and bridge solutions, the time for large-scale deployment in the TON ecosystem has not yet arrived, requiring further infrastructure development.

TON's development relies not only on bridge strategies but also on attracting new traffic, particularly emphasizing fiat stablecoins. Therefore, we maintain a cautious stance on Layer 2 and ZK directions in the short term, expecting further progress and market readiness.

Exploring Alternative Opportunities - Development Tools/Community: While deploying and developing on TON may pose challenges, it theoretically offers a higher TPS advantage. However, limited official technical resources make it difficult for small teams to grow. Therefore, the focus is on building a strong developer ecosystem and enhancing the development experience. Examples include TWA connecting RPC, development toolkits, and a no-code deployment platform. These projects require high-level technical expertise and a solid background.

Social Payments and Parallel Payment Infrastructure: Exploring creator economy solutions, similar to platforms like OnlyFans, can address interaction challenges between creators and users. Additionally, there are opportunities for social media operators in monetizing private traffic.

Integration of Games and Social Graph: Platforms that promote social media traffic distribution and integrate mini-games, combined with social graphs and NFT markets, have potential. Porting traditional games, such as casual games like "Temple Run," "Landlord," and social games like "Happy Farm," seamlessly into the token economic model.

New Value Creation and Circulation: Exploring connections with traditional social media platforms can unleash the potential for new value creation and circulation. By leveraging existing user groups and engagement on social media, innovative methods can be developed to drive value and promote ecosystem growth.

3. Conclusion

The TON ecosystem has experienced significant growth, integrating 551 applications, and this number continues to grow rapidly. This expansion highlights TON's efforts in building a diverse and robust ecosystem. In the future, by focusing on optimizing infrastructure, providing comprehensive deployment services, and enhancing various functional experiences, TON has the potential to attract more developers.

Overall, TON demonstrates a positive development trajectory. Its integration with the Telegram user base and strong technical framework provide significant opportunities for substantial growth. The infrastructure and mini-program applications within TON are particularly noteworthy. However, for investors and developers, it is crucial to carefully evaluate participation decisions based on a deep understanding of the TON ecosystem and related technologies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。