一. The Best Way to Open the BTC Ecosystem

This year, with the popularity of Ordinal, the BTC ecosystem has risen, representing both on-chain data factions such as inscriptions and BRC20, and off-chain data factions represented by the Lightning Network and Stacks. Many teams have begun to explore how to replicate DeFi, NFT, and other infrastructure on BTC. However, due to the lack of support for smart contracts, BTC is naturally unsuitable for complex on-chain applications, and its strongest narrative in the short term remains as an investment product, "digital gold." At the same time, Bitcoin's POW network has higher security and durability, making it a valuable asset class, and we believe it will continue to grow.

Therefore, there are two best paths for BTC + DeFi:

- Find a relatively safe and efficient way to bring BTC into a public chain with smart contracts (such as Ethereum) and directly utilize its well-established DeFi infrastructure.

- Issue off-chain assets through a way that verifies the off-chain client and securely links to UTXO on-chain, such as RGB and Taro.

The DLC.Link we invested in belongs to the first path.

二. The Suffering of WBTC Has Been Long

FTX's collapse at the end of last year dealt a heavy blow to the entire blockchain industry, which was reflected not only in funds and confidence but also had a direct impact on certain critical infrastructure within the industry. For example, Ren Protocol was directly affected by Alameda's collapse, leading to a lack of operating funds and the direct shutdown of the Ren1.0 network. The planned 2.0 was put on "indefinite hold."

renBTC was once one of the most commonly used BTC wrappers on-chain, ranking just behind WBTC. However, with the subsequent shutdowns of Ren and Multichain (which issued multiBTC), the market once again fell into a situation where centralized WBTC dominated, with only Threshold, Badger, and others struggling to support decentralized BTC wrapping. The market share was far behind that of renBTC in the past. BTC wrapping once again found itself in an embarrassing situation similar to the Dex of 17-18, where despite the promotion of decentralized blockchain, 99% of the trading occurred on Cex. The rise of DeFi in 2020, including Uni and Curve, eliminated this problem. However, the important aspect of DeFi, BTC wrapping, still remained dominated by centralized WBTC in the market. The suffering of WBTC has been long.

三. New Technology - Discreet Log Contracts

The Taproot upgrade has brought many new technological expansion possibilities to BTC. The aforementioned Brc20, Inscription, RGB, etc., are all based on the Taproot technology. However, there is another new technology that has not received much attention but has great potential applications, and that is DLC - Discreet Log Contracts.

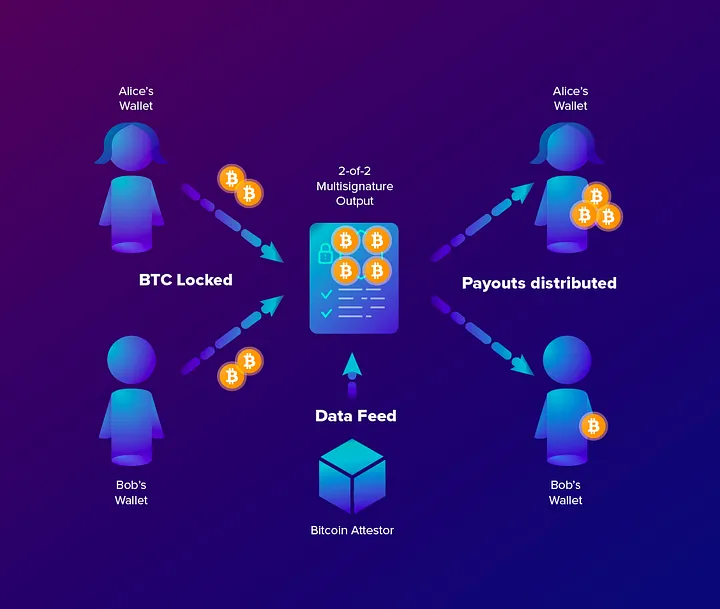

In simple terms, DLC can be seen as a mechanism similar to multi-signature. By combining the Point Time Locked Contracts supported by the Taproot upgrade (an upgraded version of Hash Time Locked Contracts, HTLC) with Schnorr signature technology, DLC can be seen as a low-level primitive. Its initial purpose was to help implement smart contracts on Bitcoin. However, it may be more suitable to be viewed as an "if-then" statement on Bitcoin (Bitcoin itself is not Turing complete), where the condition is determined by off-chain data from another smart contract on the chain. This unlocks various applications such as peer-to-peer lending, derivative contracts, sports betting, prediction markets, and insurance.

You may wonder, what is the difference between this and the common 2/3 multi-signature in the ETH ecosystem? The most important difference is the Bitcoin Attestor, also known as the oracle. It does not know the specific contract using its own data, so it cannot determine the specific contract result, fundamentally eliminating the possibility of collusion between one party and the oracle, and providing security almost equivalent to BTC itself. In addition, the groundbreaking innovation of DLC.link is to further split the "oracle" mentioned in the original DLC whitepaper into three parts: the oracle layer (such as Chainlink or Pyth), the smart contract running on the blockchain (such as the Defi contract running on Ethereum), and the component provided by DLC.link called "Attestor," which can obtain data from the smart contract and convert it into instructions for settling DLC.

It is important to note that at the time, renBTC, as a decentralized BTC wrapper, mainly relied on the MPC nodes of the Ren network for generation. In other words, the security of renBTC or the vast majority of wrapped BTC has no relationship with the original BTC chain. The security of renBTC is linked to the Ren network, while WBTC relies on endorsements from centralized institutions. This is also the reason why wrapped BTC has always been tepid. Imagine if you were a large holder with 100 BTC in your hands, would you be willing to send all your BTC to an address that does not belong to you for a 5-6% return, and then choose to "trust" the institution or network behind that address?

"Not your keys, not your coins" - the obsession of the vast majority of Bitcoin holders.

The method of DLC, which is a combination of multi-signature and oracle, is more likely to win the favor of Bitcoin holders, both from a rational technological perspective and an emotional cognitive perspective.

四. Application Scenarios Unlocked by DLC.Link

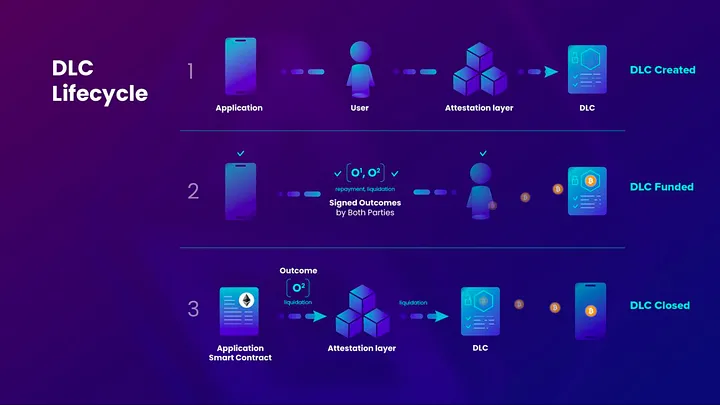

Overall, DLC.Link's roadmap will be divided into three major milestones, with each step advancing further after market validation of the previous step. It takes a steady and cautious approach to avoid various security or other risks brought about by seeking quick success.

- First Step: Proof of Collateral (POC) stablecoin with native Bitcoin as collateral.

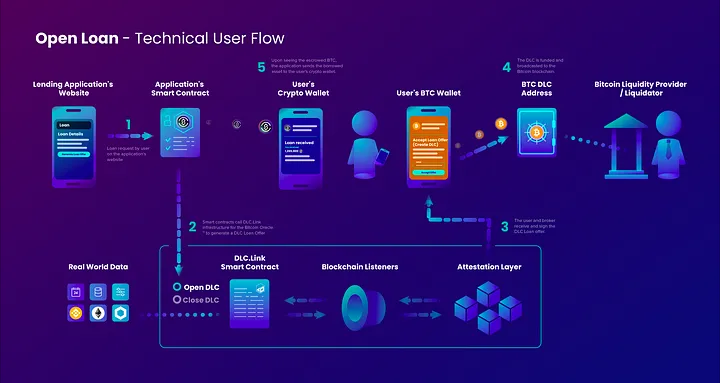

The first step can be seen as a "semi-decentralized" method of using BTC to mint stablecoins. In this case, the counterparties in the DLC are well-known CeFi institutions or DeFi organizations (using MakerDAO as an example) and BTC holders. Maker and BTC holders sign a contract through DLC, setting parameters such as liquidation standards. BTC is locked after signing, and Maker mints DAI to the holder on the ETH side. When the holder burns DAI within the specified parameters, the BTC is automatically unlocked and returned to the holder's address. During liquidation, the BTC is automatically unlocked and returned to Maker's BTC address.

DLC.Link recently made a technological breakthrough, allowing the official DLC.Link to act as the counterpart of BTC holders as an administrator to sign DLC contracts, but when liquidation occurs, the BTC flows directly to the liquidator's BTC address (such as Maker). This simplifies the participation of institutions in the entire lending process and ensures that BTC will only flow to the holder or the lending institution, with no contact with the official DLC.Link under any circumstances.

This step mainly involves the participation of BTC holders and CeFi institutions, representing a style of decentralized lending with centralized clearing.

- Second Step: Participating in the Defi Ecosystem in the Form of dlcBTC (erc20) Tokens

In the first step, the POC plays more of a "voucher" for repayment or centralized clearing, and this voucher is non-transferable.

The second step will further expand the use cases of DLC, turning the POC from the first step into a more universal and transferable Erc20 token similar to WBTC.

In this mode, DLC acts as the counterparty for all Bitcoin holders who come to "deposit" their coins, and also serves as the issuer of dlcBTC. Similar to renBTC, dlcBTC is not very concerned about the risk of being detached, because if it happens, buying dlcBTC at a low price to redeem the original BTC at the original price becomes an arbitrage opportunity. The difference is that unlike renBTC, which can be redeemed by anyone, dlcBTC can only be redeemed by the original Bitcoin holders who deposited the coins initially. The team plans to later design the addition of the Merchant role (served by multiple reputable institutions and market makers), expanding the "redeemability" of dlcBTC by allowing only "qualified retailers" and large institutions to mint and burn dlcBTC.

At that time, dlcBTC can directly participate in the Defi ecosystem, such as Uniswap, AAVE, Curve, etc., just like WBTC, while still maintaining security similar to the original BTC chain, which no other solution on the market can provide.

- Third Step: Completely Decentralized, Multi-form dlcBTC

The third step will be an extension and further decentralization of the second step.

On the extension level, after the ERC20 version of dlcBTC is validated, dlcBTC will continue to expand into ecosystems such as Cosmos, Solana, Move, etc., and there have already been inquiries from some ecosystems for cooperation.

On the decentralization level, the dlcBTC used in the second step is based on a somewhat centralized Attestor, and the third step will completely decentralize the Attestor. Of course, this does not mean that users' funds in the second step are at risk. Similar to the scenario faced by Layer2 Sequencers, centralization is more for security and efficiency during the cold start, and the ability of the centralized Sequencer and Attestor to act maliciously is very limited (mainly in being able to "reject" legitimate transactions) and they have no motivation to do so. However, in the long run, decentralization is still a way that aligns with the core and spirit of Web3.

In addition to the "mainline tasks" of the three steps, due to the recent popularity of Brc20, the native lending demand based on Ordinal, and the "BTC Layer2" that many teams are currently exploring, DLC.Link can also play a key infrastructure role in BTC Layer1 peer-to-peer lending and bringing BRC20 into the "BTC Layer2" cross-chain bridge.

DLC.Link has received grants from ChainLink and Stacks, and is actively discussing with multiple CeFi institutions and multiple smart contract chains on how to bring native BTC into their business/ecosystems. DLC.Link is currently the best technical solution we see on the market to bring BTC into other public chain ecosystems. We have reason to believe that in the next bull market, DLC.Link will become an important infrastructure in the BTC ecosystem, and more BTC will enter various ecosystems through DLC.Link, creating higher value for holders and unlocking more possibilities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。