Author: Zen, PANews

In recent years, the banking industry has been closely following the cryptocurrency sector with the aim of improving efficiency, reducing costs, meeting digitalization needs, and exploring new business opportunities. According to the blockchain analysis company Blockdata, as of June last year, 61 out of the top 100 banks in terms of managed assets had invested in the cryptocurrency field.

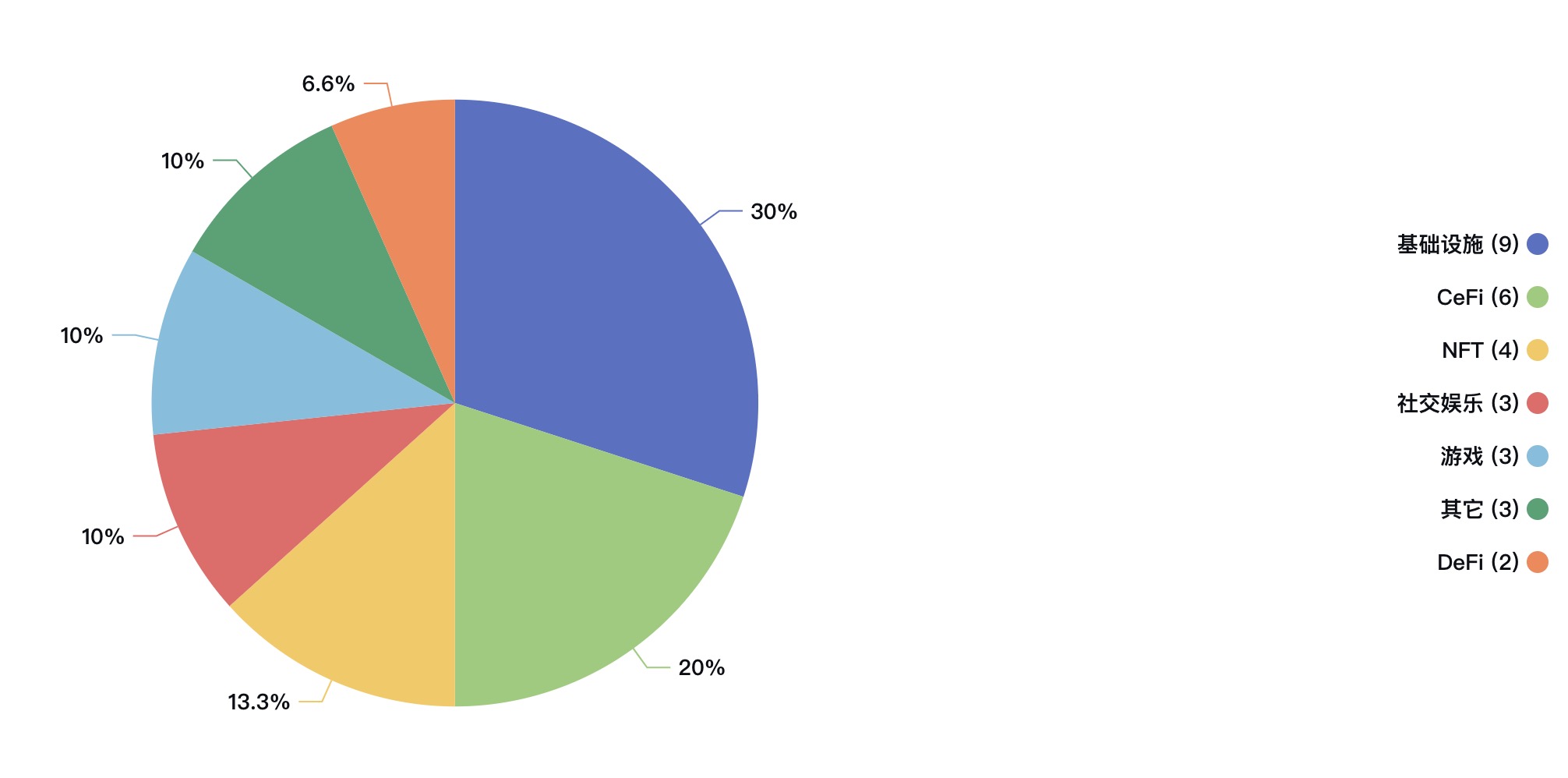

Among them, United Overseas Bank (UOB), headquartered in Singapore, has become one of the most active cryptocurrency investors among the top banks in recent years. It has currently invested in 31 cryptocurrency companies, covering various verticals such as infrastructure, CeFi, DeFi, NFT, blockchain games, and social media.

Top Three Banks in Singapore, Focused on Southeast Asia

UOB is one of the top three banks in Singapore, established in 1935. Its global network consists of 500 branches and offices across the Asia-Pacific region, Europe, and 19 countries in North America. In Asia, UOB conducts extensive financial operations through its headquarters in Singapore, subsidiary banks in China, Indonesia, Malaysia, Thailand, and Vietnam, as well as various branches and offices. According to the bank's 2022 annual report, its core net profit reached 4.8 billion Singapore dollars (approximately 24.9 billion RMB), a year-on-year increase of 18%, reaching a historical high. With its extensive operational network and robust balance sheet, UOB is one of the few banks rated "Aa1" by Moody's, "AA-" by S&P Global Ratings, and "AA-" by Fitch Ratings.

UOB has a significant presence in the Southeast Asian region, with branches spread across Southeast Asian countries, making it the third-largest bank in terms of total assets. On November 20, 2023, according to Citigroup's official website, the sale of Citigroup's personal consumer banking business in Indonesia to UOB has been completed, including retail banking, credit cards, unsecured loans, and employee transfers. With this, UOB has completed the acquisition of Citigroup's retail business in the ASEAN's four major markets (Malaysia, Thailand, Vietnam, and Indonesia).

UOB's investment business is mainly managed by its wholly-owned subsidiary, UOB Venture Management (UOBVM), which has been providing funding support to numerous private enterprises through direct equity investments in the Southeast Asia and Greater China regions since 1992.

The core members of UOBVM have collaborated for over 15 years, with diverse experience and expertise in various fields including business, engineering, life sciences, accounting, mergers and acquisitions, corporate consulting, and auditing. This diverse experience and expertise, combined with local talent from Singapore, Indonesia, Vietnam, and China, have enabled UOBVM to establish a strong network in the region, with an annual evaluation of over 700 companies in the ASEAN and China regions. During due diligence, UOBVM typically assesses companies and projects for risks in six areas: management risk, market risk, financial risk, entry barrier risk, execution risk, and compliance risk. Companies with two or more high-risk factors are not considered for investment.

Unlocking Asset Value through Blockchain Technology and Tokenization

Due to the significant risks, uncertain valuations, and high volatility associated with cryptocurrencies and related assets, UOB will not engage in the cryptocurrency field or provide cryptocurrency services to clients until relevant investment protection regulations are in place. However, UOB believes that innovations around the underlying blockchain technology can improve the operation of capital markets, enhance efficiency for lenders, simplify operations, improve transaction efficiency, and enable banks to offer innovative products. UOB recognizes the potential of blockchain technology and has been actively promoting the application of blockchain technology and asset tokenization in recent years.

In 2021, UOB collaborated with the Infocomm Media Development Authority (IMDA) of Singapore to pilot cross-border digital trade finance transactions using blockchain technology powered electronic bills of lading provided by TradeTrust. The pilot results showed reduced processing time (from several days to less than an hour) and demonstrated the interoperability of TradeTrust in paperless workflows within the trade ecosystem. By adopting this blockchain-based trade document exchange, UOB can more easily complement the digital trade ecosystem with tokenized trade finance assets.

In June of the same year, UOB piloted the issuance of digital bonds on Marketnode's digital asset issuance and custody platform, making it the first financial institution in Singapore to tokenize capital securities. Marketnode is a joint venture between the Singapore Exchange and Temasek, utilizing blockchain, smart contracts, and tokenization to digitize capital markets.

Leong Yung Chee, the Executive Director of Blockchain and Digital Assets at UOB, believes that digital assets will become an important asset class and will eventually be widely applied across the banking industry. He categorizes digital assets into four main types: central bank digital currencies (CBDCs), tokenized securities, stablecoins, and cryptocurrencies. Currently, UOB is focused on developing use cases around CBDCs and tokenized securities, while closely monitoring stablecoins.

Leong stated, "Given their unique ability to maintain stable value and redeem at face value, stablecoins have the potential to provide reliability in value transfer and serve as a potential bridge between fiat and cryptocurrencies." However, he pointed out that there have been fraud incidents in algorithmic stablecoins, and regulations governing the use and trading of stablecoins supported by collateral have not been established.

UOB believes that robust regulation is key for the financial industry to adopt blockchain technology. Regulatory authorities must act prudently to promote innovation while ensuring accountability, transparency, and financial stability in the operation of blockchain companies. In addition, achieving the value of tokenization requires more than just a regulatory framework. The ecosystem must establish institutional-grade networks, assess the applicability of tokenization for various use cases, set participant eligibility criteria, identify infrastructure vulnerabilities, and ensure secure storage and custody of tokens. Therefore, industry-wide collaboration is crucial for unlocking asset value through tokenization.

UOB's Cryptocurrency Investment Portfolio

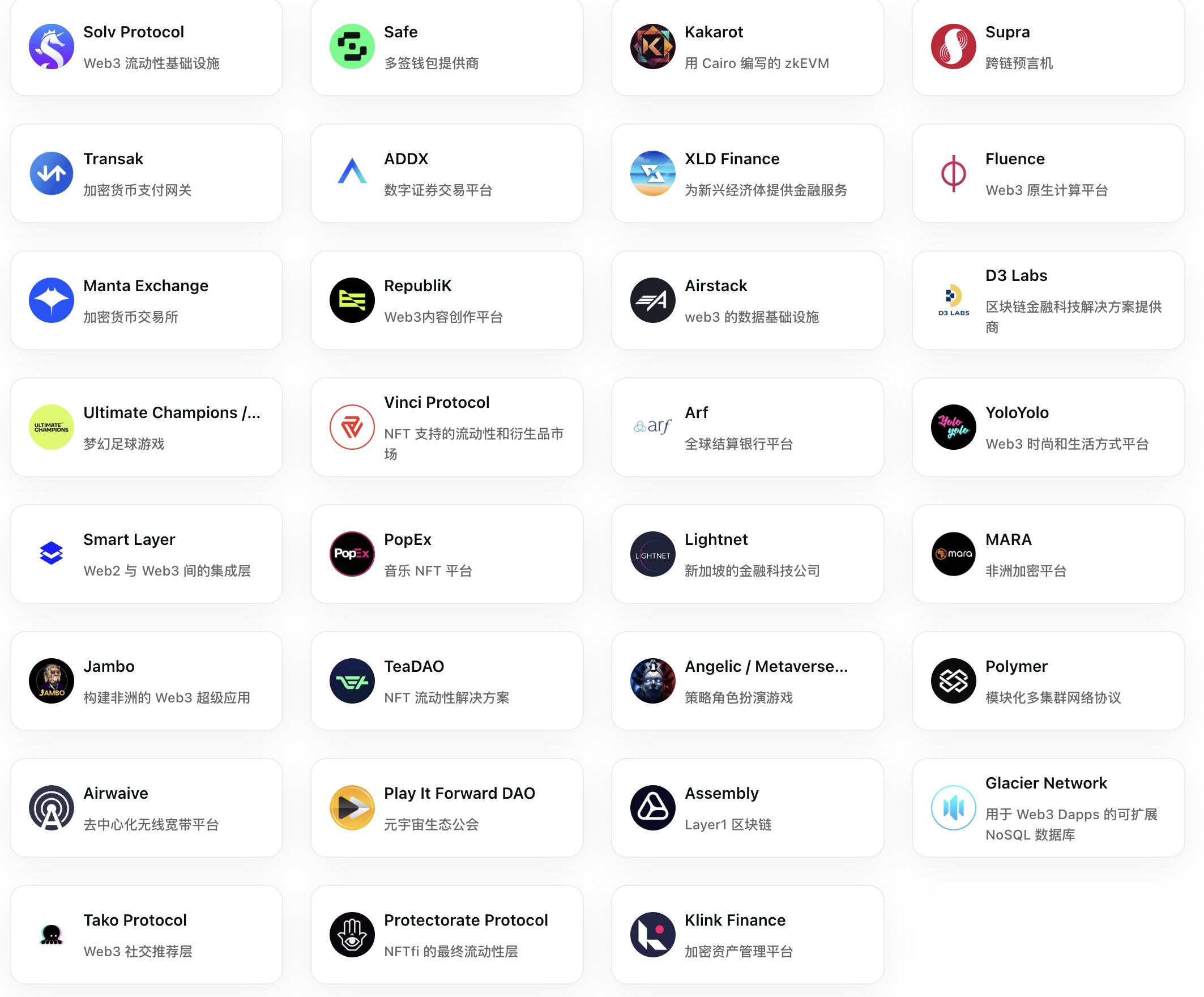

According to the cryptocurrency data provider RootData, UOBVM has currently invested in 31 cryptocurrency projects and companies.

PANews has previously reported on some of the financing information related to these projects. Based on available information, brief introductions to some of the projects are as follows:

- Manta Exchange: Cryptocurrency exchange, announced the completion of a new round of financing in November 2023, with participation from ABCDE Labs, and the financing amount has not been disclosed.

- Glacier Network: Decentralized data composability protocol, aimed at creating a composable, modular, and scalable Layer2 data-driven network for large-scale decentralized applications, and promoting DApp creation of trustless data primitives based on decentralized databases (DDB). Announced the completion of a $2.9 million seed round financing in November 2023, with participation from Gate Labs.

- Supra: Oracle and VRF service provider, developing an innovative cross-chain oracle and "bridgeless" communication network, aiming to achieve sub-2 second finality, with security guarantees expected to be more than 10 times higher than existing bridges using its custom consensus algorithm "Moonshot Consensus." Announced the completion of a $24 million financing in September 2023, with participation from Animoca Brands, Coinbase Ventures, and others.

- Transak: Fiat aggregator, allowing users to switch funds between traditional finance and crypto assets, currently available in over 150 countries/regions. Announced the completion of a $20 million Series A financing in May 2023, led by CE Innovation Capital.

- Vinci Protocol: NFT infrastructure protocol, developing NFT data services and development toolkits, including NFTFi, NFT oracles, NFT governance, etc. Announced the completion of a $2.1 million seed round financing in November 2022, with UOBVM, Signum Capital, and TGE Capital leading the investment.

- Arf: Stablecoin cross-border payment network, announced the completion of a $13 million financing in October 2022, with participation from Circle Ventures.

- XLD Finance: DeFi service company, with its main service xSpend acting as an "exporter of cryptocurrency to fiat currency," allowing users to pay utility bills with cryptocurrency. Announced the completion of a $13 million Series A financing in July 2022, led by Dragonfly Capital and Infinity Ventures Crypto.

- TeaDAO: Metaverse algorithmic stablecoin project, aiming to build an ecosystem combining DeFi 2.0, GameFi, and the metaverse. Announced the completion of a $4.6 million seed round financing in March 2022, with investment from Shima Capital, among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。