Author: Nancy, PANews

The long-awaited Perps V3 is about to be released. On November 20th, the well-established DeFi protocol Synthetix announced that Perps V3 will be released on Base through the Andromeda version.

According to Synthetix, Perps V3 plans to introduce several new features, including support for various types of collateral such as sUSD, sETH, and sBTC; simplifying the trading experience by using cross-margin with different positions; better control and flexibility based on account access; liquidation upgrades including smarter liquidation processes for large positions and configurable partial liquidation delays; and allowing developers to choose any on-chain oracle, among others.

It is reported that V3 is designed specifically for derivative protocol and liquidity providers, aiming to provide infrastructure and liquidity for rapidly creating on-chain derivatives and to provide LPs with derivative liquidity and rewards. Synthetix announced the launch of V3 in the fourth quarter of this year several months ago and initiated a proposal to "deploy V3 to Base," which received 100% support.

It is worth mentioning that the decentralized perpetual trading platform Infinex will also debut alongside Perps V3. Infinex addresses major friction points of DEX such as high slippage/low liquidity, high fees, and high LP market risks, and can be traded on Optimism and use Synthetix's SNX token for governance, bringing more users to participate in the "missing components" of DeFi. Synthetix founder Kain Warwick once stated, "From a trading perspective, DeFi's functionality is quite similar to CeFi. We have liquidity, markets, depth, and execution time. But we still lack a key component."

Synthetix stated that the launch of V3 is based on the huge success of V2, which brought a paradigm shift to on-chain perpetuals and, with features such as a focus on risk management and the introduction of dynamic funding rates and price impact, has driven Synthetix's trading volume to over $30 billion and generated tens of millions of dollars in fees for liquidity providers.

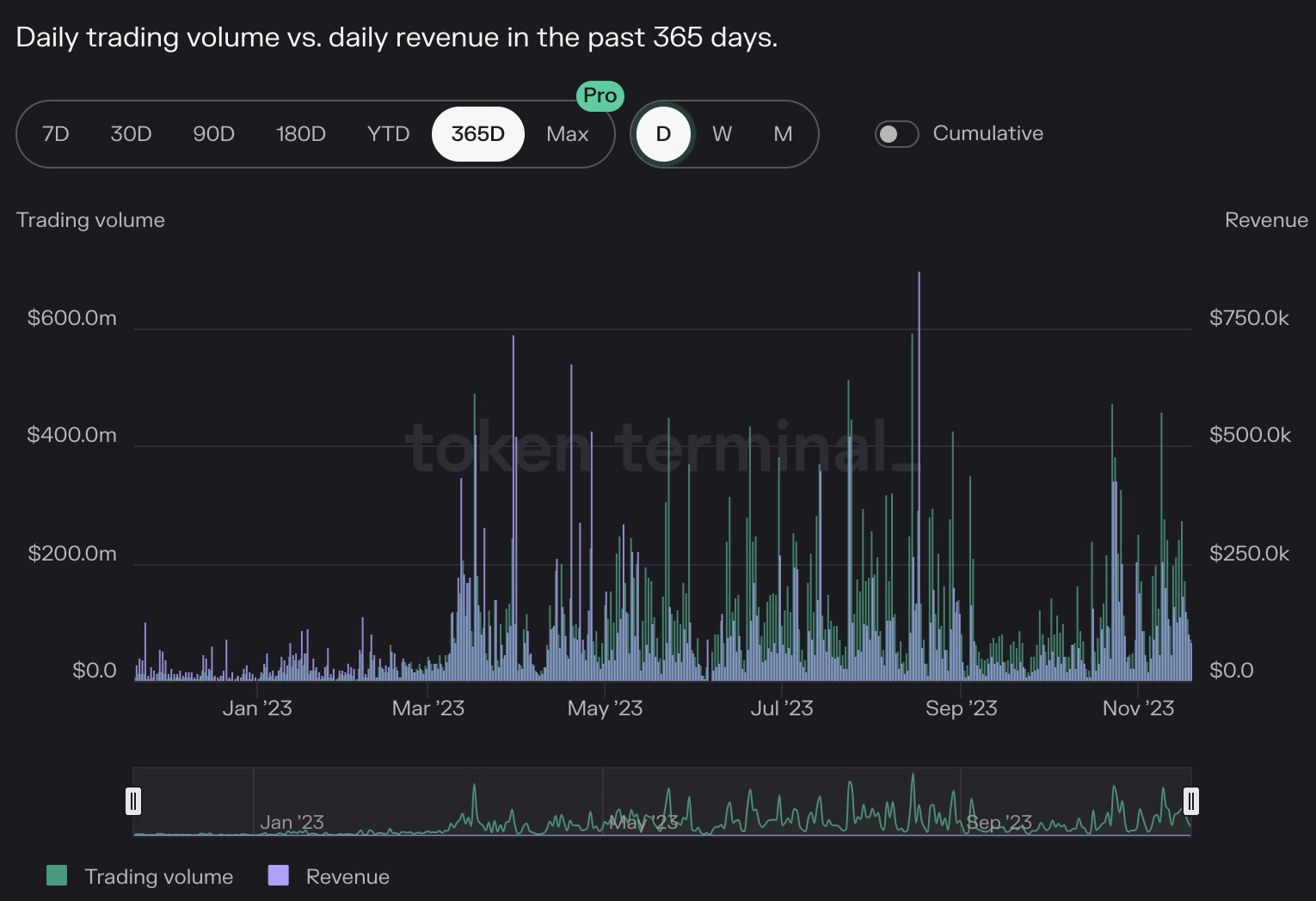

According to Token Terminal data, as of November 20th, Synthetix's trading volume reached $36.94 billion, an increase of about 209.9% over the past year. Not only that, Synthetix's current annual revenue is approximately $51.29 million, with a growth of 202% in just the past 30 days, all of which goes to SNX stakers. According to Dune data, as of November 20th, the number of Synthetix stakers is approximately 60,600, with a total staking amount of SNX exceeding $680 million.

Source: Token Terminal

The significant increase in Synthetix's trading volume and revenue is inseparable from the launch of the Synthetix Perps Optimism trading incentive program. In April of this year, Synthetix Perps announced the launch of the Optimism incentive program, distributing 200,000 OP tokens weekly based on traders' scores and SNX staking for a period of 20 weeks. In September, Synthetix announced an extension of the program by five weeks, distributing 100,000 OP tokens weekly, totaling 500,000 OP tokens, with rewards capped at the total generated fees. Thanks to most of the fees being covered, the subsidy incentive program greatly stimulated the growth of Synthetix Perps trading volume.

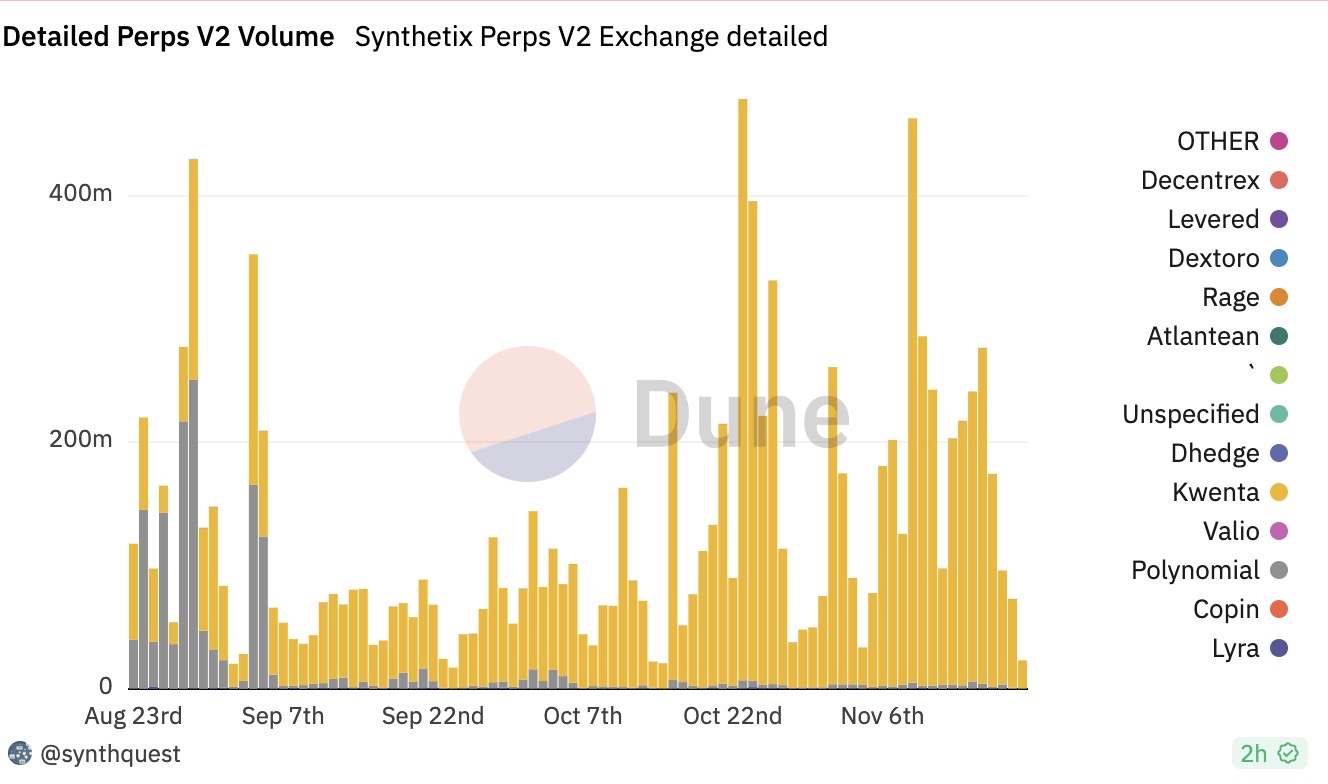

According to Dune data, in the past month, the daily trading volume of Synthetix Perps V2 reached nearly $480 million, but the vast majority of it was contributed by the derivatives trading platform Kwenta. However, as the incentive program ended, the trading volume of Perps V2 also experienced a significant decline. As of November 20th, its daily trading volume is approximately $23 million.

From the perspective of indicators such as trading volume and revenue, Synthetix is on par with competitors like GMX, but it lags far behind in terms of active user numbers compared to GMX and dydx.

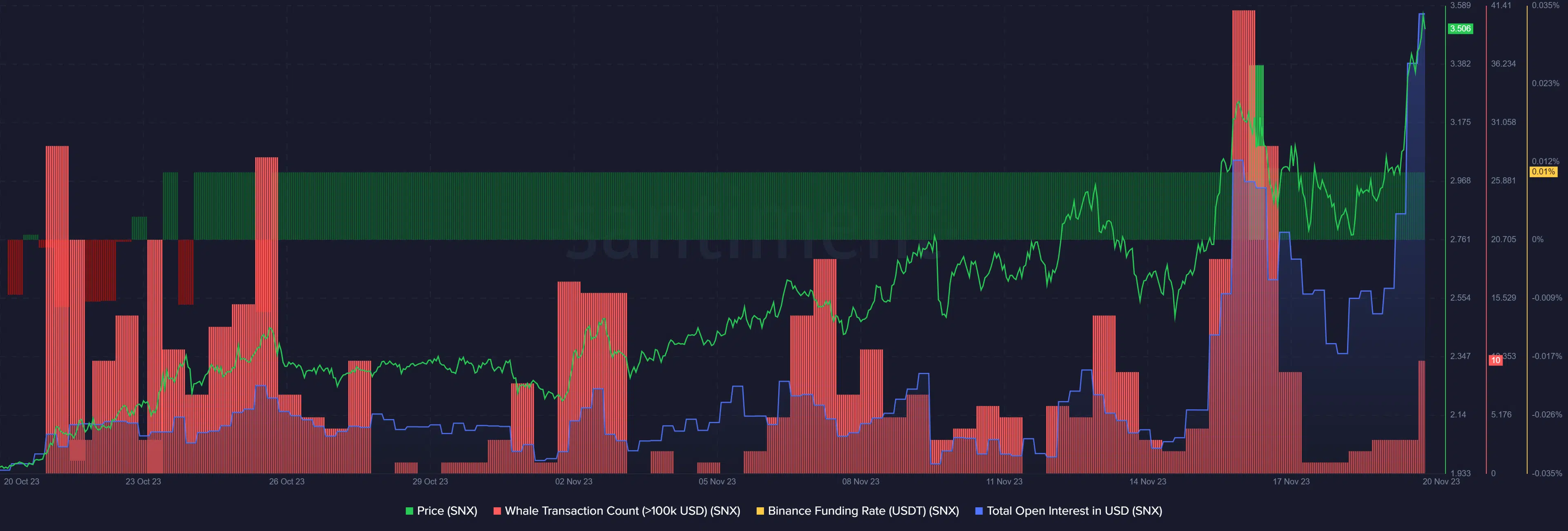

In addition, Token Terminal data shows that the token SNX has performed well in the secondary market, with its price and trading volume increasing by about 83% and 152.4% respectively in the past 30 days. In just the past 24 hours, the trading volume of SNX reached as high as $180 million, and the price reached a new high since September last year.

However, according to on-chain analysis platform Santiment, as of November 20th, Synthetix's DAA price is -24.08%. Generally, when the DAA deviates to below zero, it indicates a "sell" signal, suggesting that the asset may be manipulated by whales. In the past 24 hours, the number of whale transactions holding at least $100,000 worth of SNX has increased from 3 to 10.

Source: Santiment

Overall, the upcoming launch of V3, incentive programs, and staking rewards are stimulating the rise in the price of SNX.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。