Looking back at the third quarter of 2023, the cryptocurrency market showed relative stagnation and low-key performance, but emerging trends have emerged.

Author: Ulrik K. Lykke / Source: https://medium.com/@ulriklykke/crypto-market-snapshot-trends

Translation: Plain Language Blockchain

Key Points

Market Overview: The cryptocurrency market saw a significant increase at the beginning of Q4, with Bitcoin prices rising by over 25% and the total market value reaching 13 trillion USD, while Q3 remained stagnant.Decline in Q3 Trading Volume: Trading activity on the top ten cryptocurrency exchanges decreased by 23% in Q3, with a total trading volume of 6.1 trillion USD, lower than the 8.3 trillion USD in Q2. Particularly, Binance's market share plummeted to 44% due to legal challenges.

BTC Dominance and ETF Expectations: By the end of Q3, Bitcoin's dominance increased from 46% in Q2 2023 to 51%, as excitement grew about the possibility of launching Bitcoin spot ETF in the United States as early as 2024.

Layer1 and Layer2 Dynamics: Active users on Layer1 blockchains decreased by 2%, while active users on Layer2 blockchains increased by 18%. Base, an Ethereum Layer2 solution, became a significant participant, processing a peak daily transaction volume of 1.8 million.

Cryptocurrency Venture Capital: The cryptocurrency venture capital market faced resistance in Q3, with investments in the cryptocurrency and blockchain sector totaling only 19.75 billion USD, hitting a new low since Q4 2020.

Cryptocurrency Security Vulnerabilities: Several major security vulnerabilities occurred in Q3 2023; Mixin Network suffered the largest breach, resulting in a loss of approximately 200 million USD. Other notable hacking incidents include Multichain, CoinEx, Curve Finance, and Alphapo.

Emerging Narratives: Two emerging narratives in the cryptocurrency space include the tokenization of real-world assets (RWA) and social DApps (SocialFi), with the successful example of the Friend.tech DApp, which saw a rapid increase in active wallets.

In October, the cryptocurrency market showed a significant upward trend, with Bitcoin prices soaring by over 25% and the total market value reaching an impressive 13 trillion USD. However, looking back at Q3 2023, we found a relatively stagnant and subdued period compared to the current market dynamics.

In this comprehensive market overview, we will delve into the performance of various cryptocurrency indicators and elucidate some emerging narratives and niche innovations in the digital asset space.

1. Market Overview

According to Coingecko's data, the total cryptocurrency market value in Q3 decreased by 9.6%, reaching 11.2 trillion USD, lower than the previous quarter's 12.4 trillion USD. Discussions surrounding the potential approval of Bitcoin spot ETF in the United States have sparked excitement.On the positive side, the market is now pricing in the "when" rather than "if" of the latest developments, with the earliest possible appearance of several Bitcoin spot ETFs in the United States expected next year.

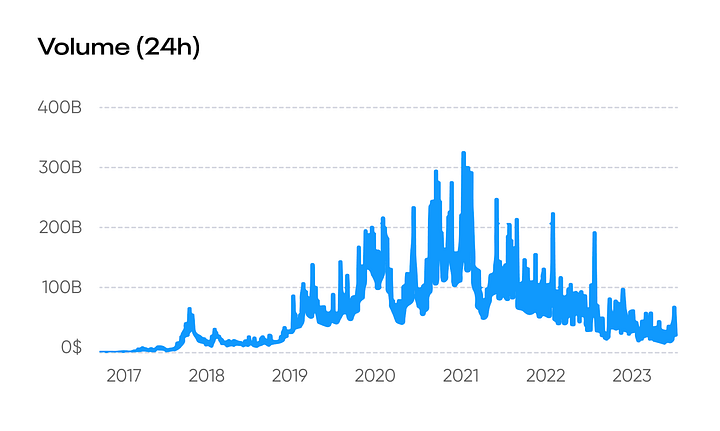

Continued Decline in Exchange Trading Volume

Trading activity on the top 10 cryptocurrency exchanges plummeted by 23%; according to TokenInsight's report, the total trading volume in Q3 was 6.1 trillion USD, compared to 8.3 trillion USD in Q2. It is noteworthy that Binance, due to legal obstacles in multiple jurisdictions including the United States, saw its market share drop to 44%. In context, Binance's market share was over 66% earlier this year, before the disaster began.

Data: Coinmarketcap

2. Improvement in Bitcoin Fundamentals

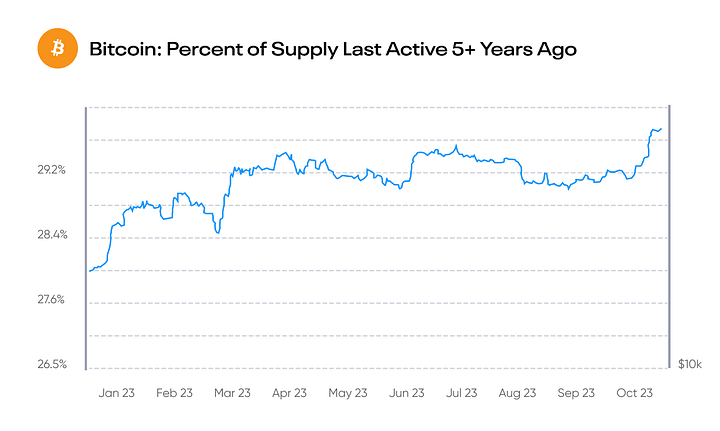

Although Bitcoin's price remained stagnant for most of Q3 2023, it has risen by over 28% this quarter, with little indication that this could be the start of a long-term bull market. I will focus on four main driving factors below:1) Stagnant BTC Supply

The proportion of inactive BTC supply in circulation is currently 29.6%, the highest level since the inception of Bitcoin. This indicates that long-term BTC holders have strong conviction and may be preparing for the expected halving in 2024, when the block reward will decrease from the current 6.25 BTC to 3.125 BTC.2) Miners' Commitment and Continued Investment

Bitcoin's computing power (hash rate) has been consistently increasing, indicating a more secure network. Currently, the hash rate is 445 EH/s, higher than the 393 EH/s at the beginning of Q2 2023.

Data: Glassnode

3) Rising Bitcoin Dominance

Bitcoin's dominance is also on the rise, currently at 51%, compared to 46% at the beginning of Q2 2023. Historically, the rise in Bitcoin dominance often precedes a bull market. Equally interesting is the depletion of altcoin liquidity, which is evident in the BTC/ETH chart.4) Excitement over Future ETF Approvals

This excitement surrounds the approval of Bitcoin spot ETFs, applications submitted by prominent fund managers including Blackrock, and Grayscale's legal victory against the SEC. Blackrock CEO Larry Fink recently publicly stated that given the current geopolitical tensions and macro uncertainty, Bitcoin's recent rebound is a trend "leaping towards quality assets."

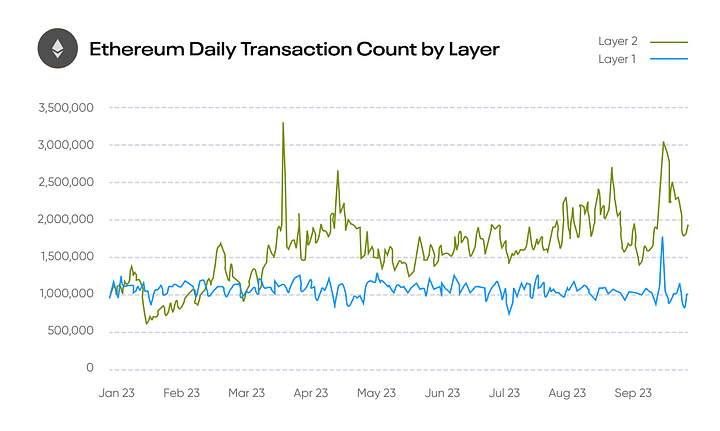

3. Layer1 Stagnation, Layer2 Rise

In Q3 2023, the number of active users on Layer1 smart contract blockchains decreased, with Near being the only ecosystem to see increased on-chain activity after launching the USDC stablecoin in its ecosystem.The share of active users, daily transaction volume, and fees generated on Layer1 and Layer2 also underwent significant changes, with more native cryptocurrency users opting for the latter due to high fees associated with the Ethereum network.

Data Source: Fidelity Digital Assets

1) Base Emerges as Leading Layer2 Chain

Base, a Layer2 solution for Ethereum developed by Coinbase and built on the Optimism OP stack, has become a strong competitor in the Layer2 space. The chain went live on August 9, with a peak daily transaction volume of 1.8 million, attributed to popular projects such as Friend.tech, a social DApp built on Base.2) Decentralized Finance (DeFi)

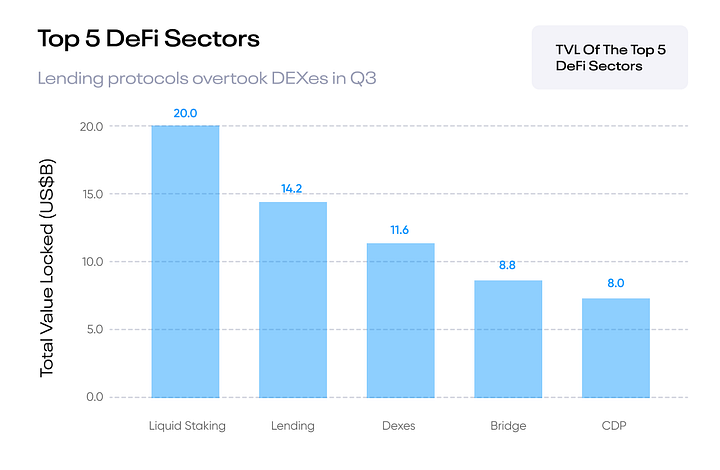

According to DeFi Llama's data, similar to the broader crypto market, the total value locked (TVL) of Q3 DeFi protocols plummeted from 450 billion USD to 380 billion USD.3) Liquid Stake Leads TVL in DeFi

Since Ethereum's transition to a proof-of-stake (PoS) blockchain and the eventual allowance of withdrawals through the merge, the total ETH staked through Liquid Stake Derivatives (LSD) has been on the rise, constituting on-chain activity in DeFi.

Data: Binance Research

According to Coingecko's data, the amount of staked ETH in Q3 exceeded 27.3 million, an increase of 3.5 million compared to the previous period. At the time of writing, Lido Finance held the largest share, exceeding 77%, sparking debate about whether it poses centralization risks to the Ethereum network.

4. NFTs and Blockchain Games

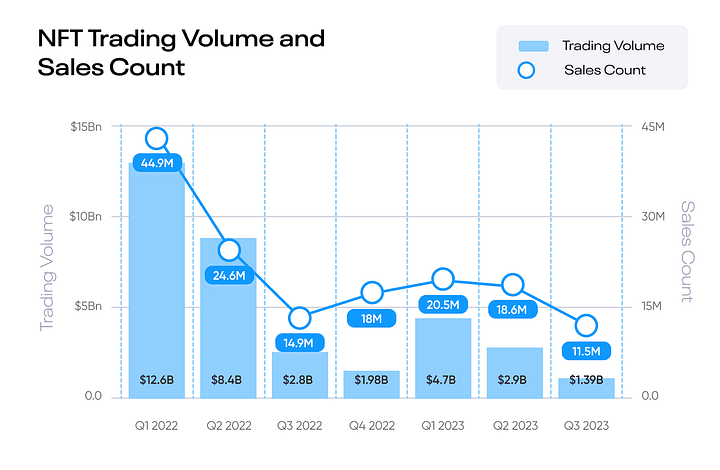

Since February, the NFT market, a subsector of the cryptocurrency market, has been experiencing a decline in trading volume and sales. DappRadar's latest report shows a Q3 trading volume of 1.39 billion USD, lower than the previous quarter's 2.9 billion USD.

Data: DappRadar

However, interestingly, in Q3 2023, while blockchain games maintained their position as the most significant category in the NFT space, interaction with NFT social DApps increased.

5. Cryptocurrency Venture Capital in Q3 2023

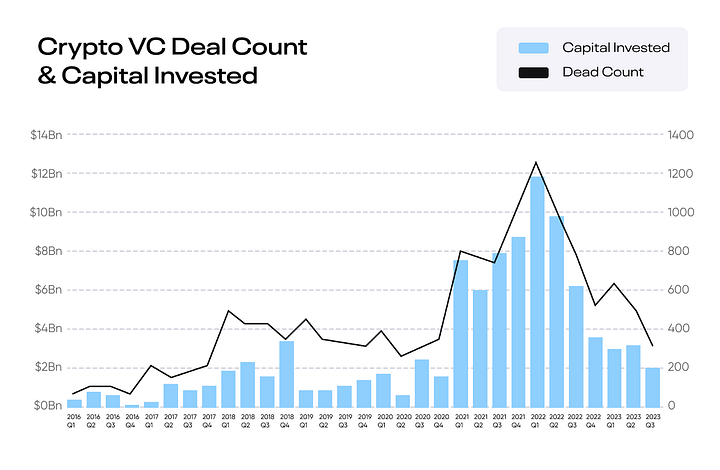

The cryptocurrency venture capital market continued to face resistance, with investors remaining cautious in Q3 2023. According to a report by Galaxy, investments in the cryptocurrency and blockchain sector totaled only 19.75 billion USD during this period, hitting a new low since Q4 2020.

数据:Galaxy

6. Binance Labs and Ethereum Foundation Among Largest Investors in Q3 2023

Despite record-low financing activity in Q3, notable investors including Binance Labs, Ethereum Foundation, HashKey Capital, and Coinbase Ventures allocated significant funds to blockchain and crypto projects. It is noteworthy that blockchain infrastructure and service projects attracted the most funding in the previous quarter.

7. Major Cryptocurrency Security Vulnerabilities in Q3 2023

Mixin Network — $200,000,000Mixin Network suffered a hack in September 2023. Hackers breached the database of Mixin cloud service provider, resulting in the loss of digital assets worth 200 million USD.

Multichain — $126,000,000

On July 7th, the multichain cross-chain protocol experienced an abnormal loss of 126 million USD due to the exploitation of digital assets on the MPC bridge. According to on-chain data, over 102 million USD was stolen from Multichain's Fantom bridge, although post-analysis indicated that this hack may have been a conspiracy by the Multichain team.

CoinEx — $70,000,000

CoinEx encountered a network attack in September, resulting in approximately 70 million USD in losses. The exchange pointed out that the attack was detected by its risk control system, which "detected abnormal withdrawals from multiple hot wallets."

Curve Finance — $61,700,000

Multiple pools using Vyper on Curve Finance were compromised in July 2023 due to a reentrancy bug, resulting in over 61 million USD in losses. However, surprisingly, the hackers later posted a message on the Ethereum network, stating that they would return the funds to avoid damaging the affected protocol. So far, they have returned 8.9 million USD worth of Alchemix ETH (alETH).

Alphapo — $60,000,000

Alphapo also fell victim to a hack in July, with traces pointing to the notorious Lazarus Group, a cybercrime group from North Korea. Initially, the loss was estimated at around 21 million USD, but later when on-chain detectives discovered that the hackers also compromised Alphapo's old addresses, the loss was raised to 60 million USD.

Stake.com — $41,300,000

Stake.com experienced a security vulnerability in September 2023, resulting in a loss of 41.3 million USD. The attackers initially transferred 16 million USD worth of DAI, USDT, USDC, and ETH from Stake.com's ETH address to their personal address, then converted the funds to ETH.

CoinsPaid — $37,300,000

CoinsPaid became a victim of a North Korean hacker attack in September 2023, resulting in a loss of 37.3 million USD.

8. Major Regulatory Developments in Cryptocurrency in Q3 2023

July 13th—Federal District Judge Analisa Torres ruled that the sale of XRP to the public and distribution of XRP to Ripple Labs employees through programmatic means did not violate securities laws regarding unregistered securities.August 11th—A judge's decision to support federal prosecutors' motion to revoke FTX founder Sam Bankman-Fried's bail on charges of witness tampering resulted in Sam Bankman-Fried being jailed.

August 29th—Cryptocurrency asset management firm Grayscale Investments made significant progress in seeking to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) to a publicly listed Bitcoin ETF with the U.S. Securities and Exchange Commission.

9. Emerging Narratives

Tokenization of Real-World Assets: This new DeFi subsector is currently a hot topic both within and outside the crypto community. According to Coingecko's statistical data, tokenized U.S. Treasuries are the most significant on-chain driver in the RWA space this year, growing from 114 million USD in January to over 665 million USD by the end of September.Social DApps (SocialFi): This is another emerging innovation area that is gaining significant attention. The Friend.tech DApp is a standout performer in the third quarter; over the past month, the number of unique active wallets (UAW) has grown by over 200%, reaching 576,000.

10. Conclusion

Clearly, Q3 2023 has been a rollercoaster for the cryptocurrency market. On one hand, there has been some optimism in the market due to the news of the impending approval of Bitcoin ETFs in the United States; on the other hand, the broader market outside of Bitcoin has not reacted significantly to this news. However, looking ahead, momentum is gradually building. With the halving approaching in 2024, Bitcoin's recent rise may signal the beginning of a new price trend.免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Share To