Author: dt, DODO Research

As one of the few hot tracks of the year, how is the once popular TG Trading BOT track performing now? Today, Dr. DODO will take everyone to explore, let's use the publication date of the Binance Research report on August 17 as a reference point, and compare the changes in the TG Trading Bot track over the past two and a half months. How have Maestro, Unibot, and Banana Gun, which used to be in the leading position, developed?

Data Comparison

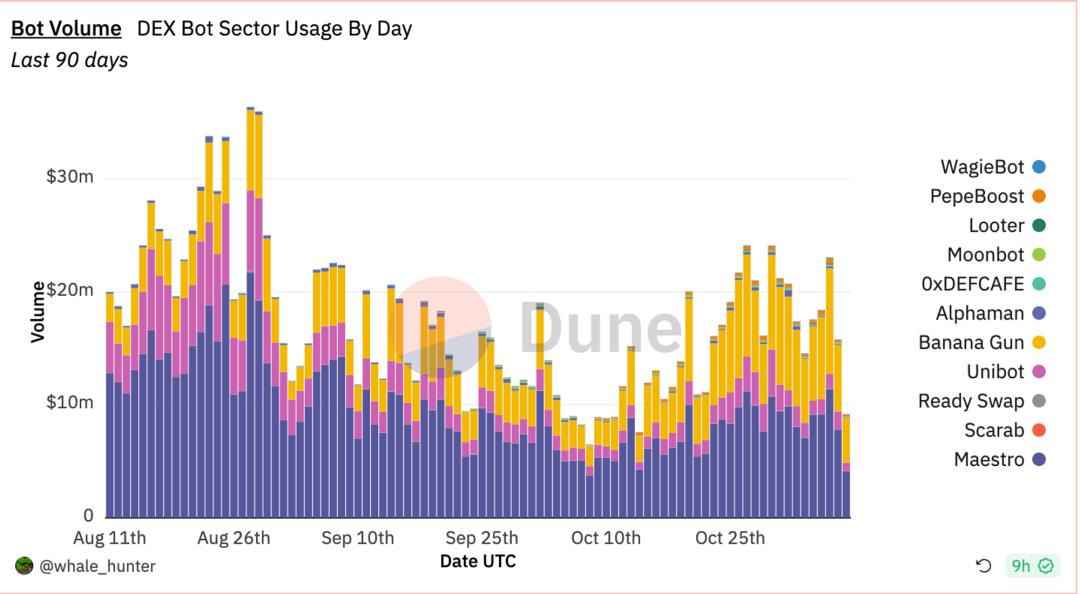

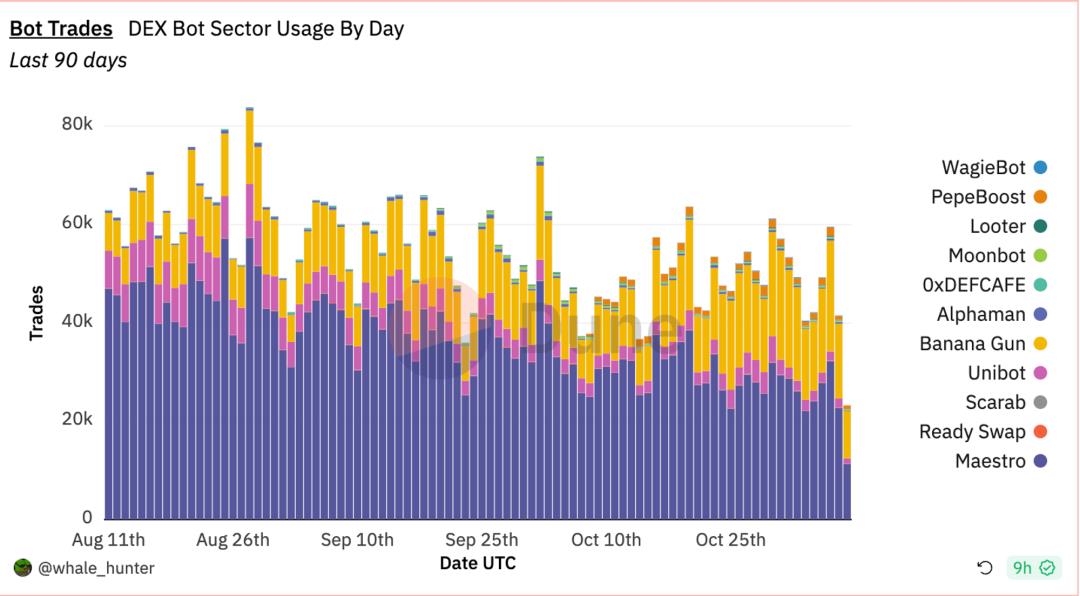

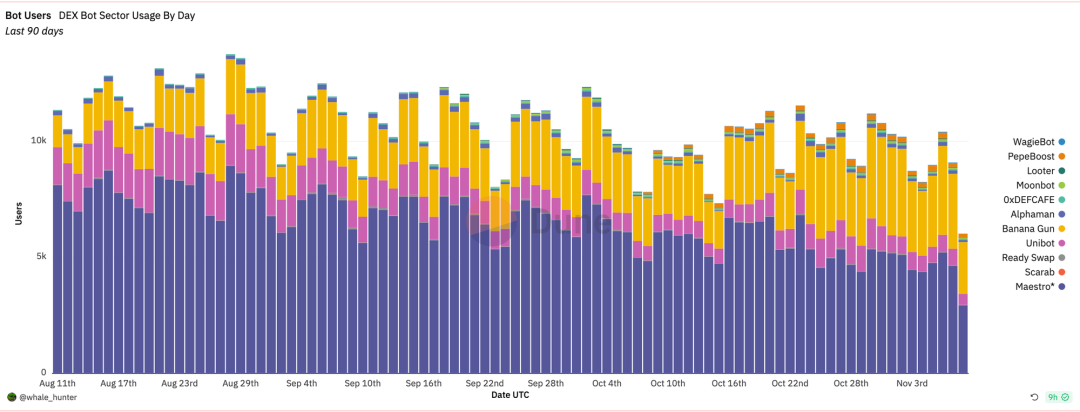

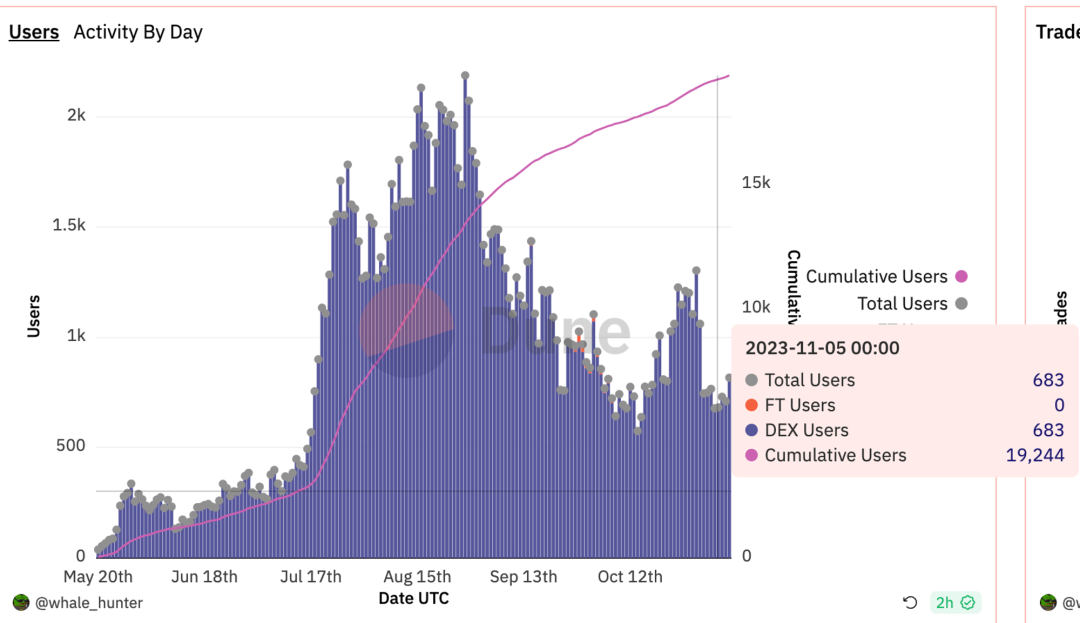

In terms of the overall data of the track, compared to the summer data, the TG Trading Bot track has shown a significant decline in trading volume, Tx number, and user base. The trading volume has dropped from nearly $30 million per day at its peak to about $10 million currently, the Tx number has decreased from a peak of 80,000 per day to 40,000, and the user base has experienced the least decline, with the daily average users still maintained at around 10,000.

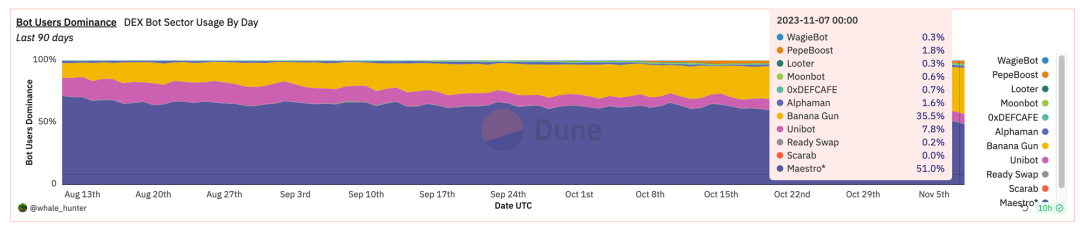

Next, looking at the market landscape of the TG Trading Bot, Maestro still maintains the top position, occupying over half of the user base. Banana Gun continues to grow steadily, with a significant increase in data after the token launch, successfully surpassing Unibot to take the second place in early September, with the user base currently accounting for about 35%. Meanwhile, Unibot has been experiencing continuous decline in data after the coin price ATH, with the user base dropping below 10%.

Maestro, with the long-standing community support, still leads the track, but its market dominance has gradually declined from nearly 70% to almost falling below 50%.

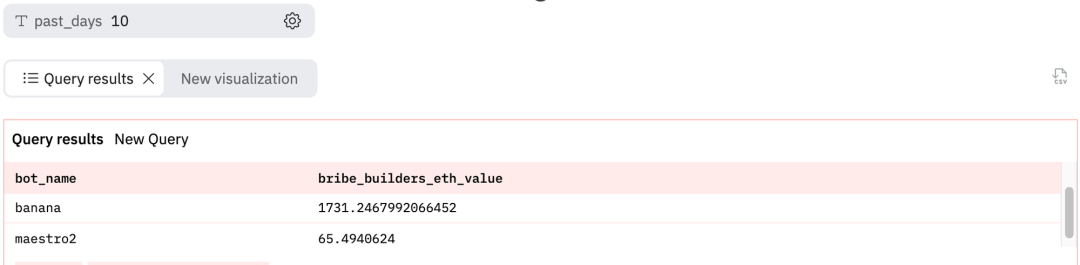

Banana Gun initially attracted many new users with the expectation of airdrops and consolidated its user base with the high-quality MEV Bribe Snipe token sniping feature and a lower 0.4% service fee compared to other competitors. The product continues to innovate, and the recently launched limit order with Bribe feature has brought substantial profits to many users, receiving high praise. Banana Gun holds a leading position in the MEV Bribe sniping feature for new coins, with the data of Banana Gun users bribing MEV Builder exceeding 1700E in the past ten days, far surpassing Maestro's 65E, while Unibot has yet to introduce this feature.

Compared to the first two, Unibot has made few improvements to its product. With the decline in token value, the advertising effect has diminished, and venturing into the FriendTech Bot has been a major failure, with daily average user numbers of less than 10. Introducing new business lines while the main business technology lags behind gives the impression that the project is more focused on coin speculation than its products.

Security

Although the projects in the TG Trading Bot track have never boasted about security, their target users are the high-risk Degen community. However, two recent hacking incidents have also brought a lot of setbacks.

On October 24th, Maestro updated its routing contract, but due to a smart contract code vulnerability, the contract was hacked, resulting in user losses of over 280 ETH. However, Maestro's team showed a high level of sincerity by reimbursing nearly 610 ETH after fixing the vulnerability, earning high praise from the community. Less than a week later, on October 31st, Unibot also suffered a code vulnerability in its updated routing contract, leading to a hacker attack and user losses of approximately 355 ETH. Its token, $Unibot, also plummeted by 50%. Unibot claims to have fully compensated user losses, and the token price has since recovered to pre-incident levels. TG Trading Bot has always been an alternative solution that prioritizes convenience over security. Users should be aware of the risks when using such applications, as the principle "Not Your Key, Not Your Money" applies. **Rising Stars** While the top three projects currently occupy nearly 90% of the TG Trading Bot track market, there are still many up-and-coming projects actively challenging them, some of which have well-known backgrounds. **PepeBoost**: Pepeboost primarily targets the Chinese community and has attracted many users through community-led coin speculation. It currently ranks fourth in market share, and the project claims that its copy trading feature surpasses Maestro. **Shuriken**: Shuriken's feature lies in its Dapp on the web, which provides users with convenient dashboard features beyond the TG Bot, allowing users to monitor smart addresses or popular tokens. It has also introduced a point badge system to attract a significant number of airdrop hunters. **Alfred**: Alfred is currently the most talked-about TG Bot project, not because of any particularly outstanding product features, but because of its remarkable background. The Alfred team is founded by Stephane Gosselin, a co-founder of Flashbots. The recent series of hacker attacks on TG Bot projects has raised significant doubts about security. Alfred, with its real-name and highly regarded background, has gained many supporters. It has also introduced a point mechanism, attracting many airdrop hunters to participate. **Author's Viewpoint** The TG BOT field has always been a track that the author has paid close attention to and is very interested in. **In the author's view, the widespread use of blockchain applications is an inevitable process.** Despite the considerable decline in data compared to the peak, the overall situation remains quite healthy. The data decline is likely related to market trends, with the overall market recovery leading to higher on-chain gas fees. Additionally, the meme coin craze on-chain has diminished, and a significant number of on-chain Degen users have shifted to BTC derivatives applications. **Returning to the TG BOT track, not only are the leading projects continuously updating, but there are also several new projects joining, some of which involve the participation of Flashbot founders. This indicates that not only Degen users but also legitimate developers with backgrounds are actively paying attention.**免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。