Author: JAKE PAHOR

Translation: Deep Tide TechFlow

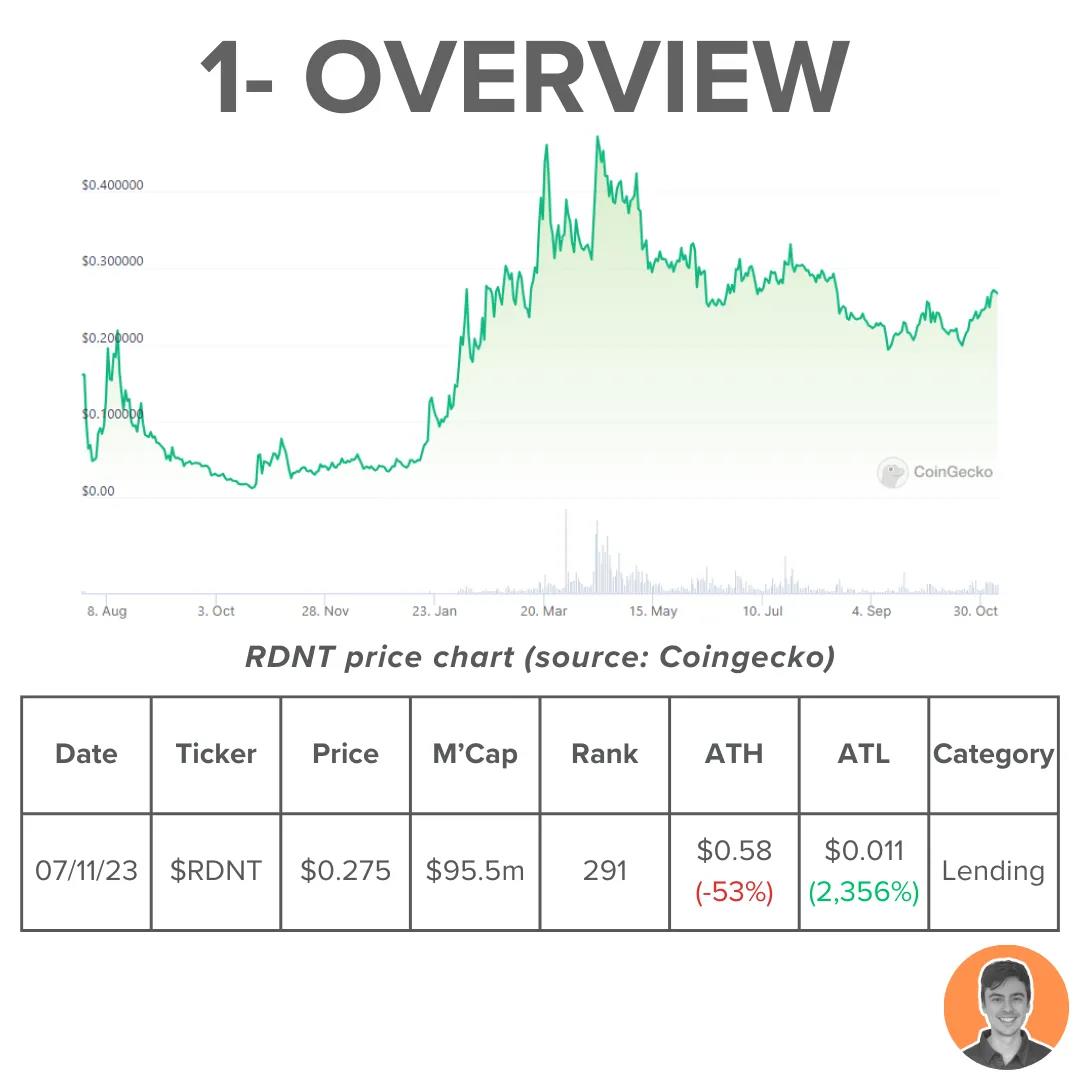

The Arbitrum season is approaching, and Radiant Capital is ready for the upcoming Arbitrum bull market. Here is my research report on RDNT for November 2023.

Overview

Radiant Capital is a full-chain lending protocol. It is built on LayerZero, allowing users to:

- Deposit collateral—such as USDC on Ethereum

- Borrow on other chains, for example, ETH on Arbitrum

Use Cases

A major issue in DeFi is liquidity fragmentation. Borrowers must choose one chain, and the assets they draw must exist on the same chain. Bridging between different chains can be cumbersome and risky. So, Radiant aims to:

- Unify liquidity

- Simplify borrowing experience

- Innovate on top of this

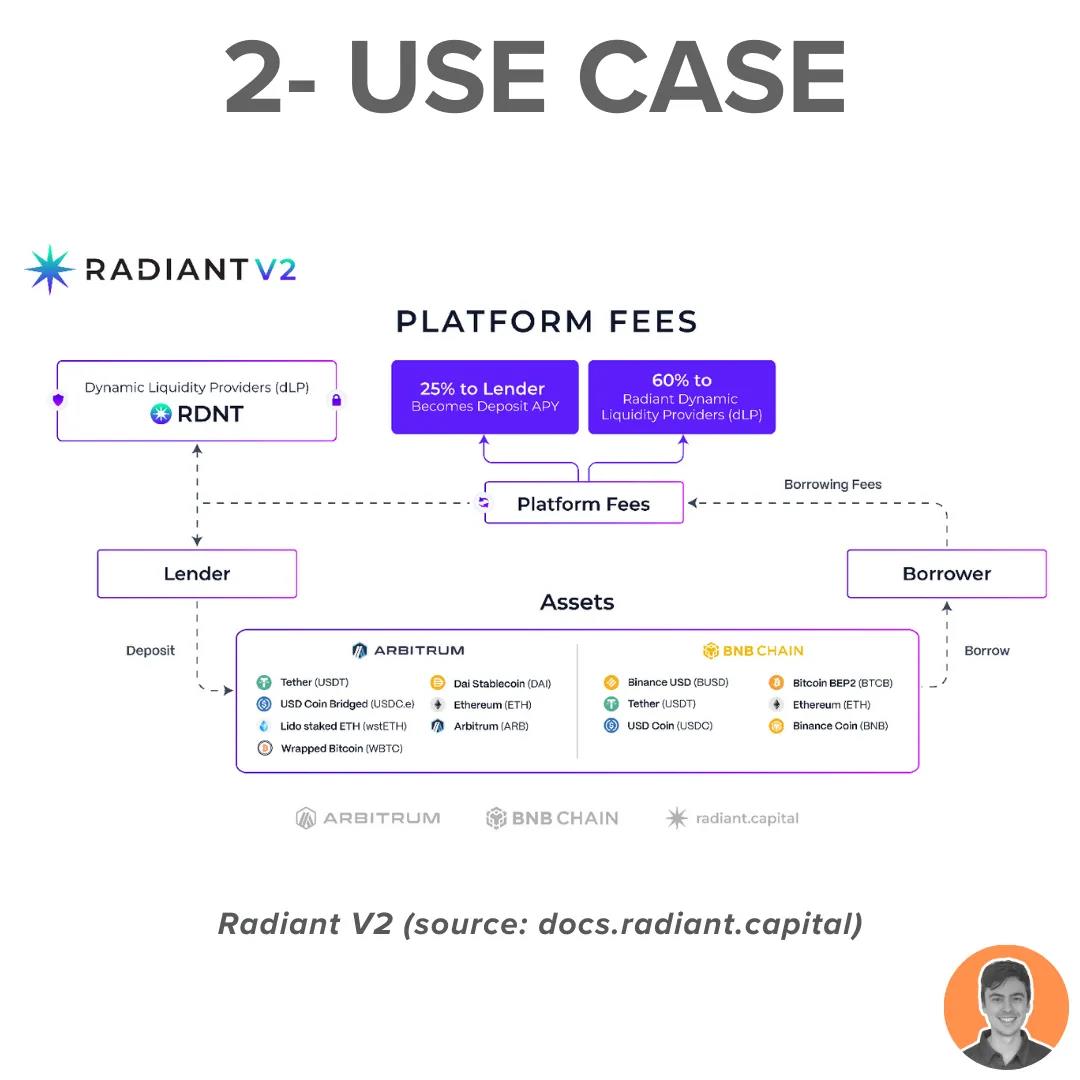

In the March 2023 release of Radiant V2, the project significantly reduced inflation and improved the overall token economics.

- Now, user behavior aligns with the protocol, and rewards are only distributed to RDNT holders

- Increased income to stakers (50% -> 60%) and reduced to borrowers (50% -> 25%)

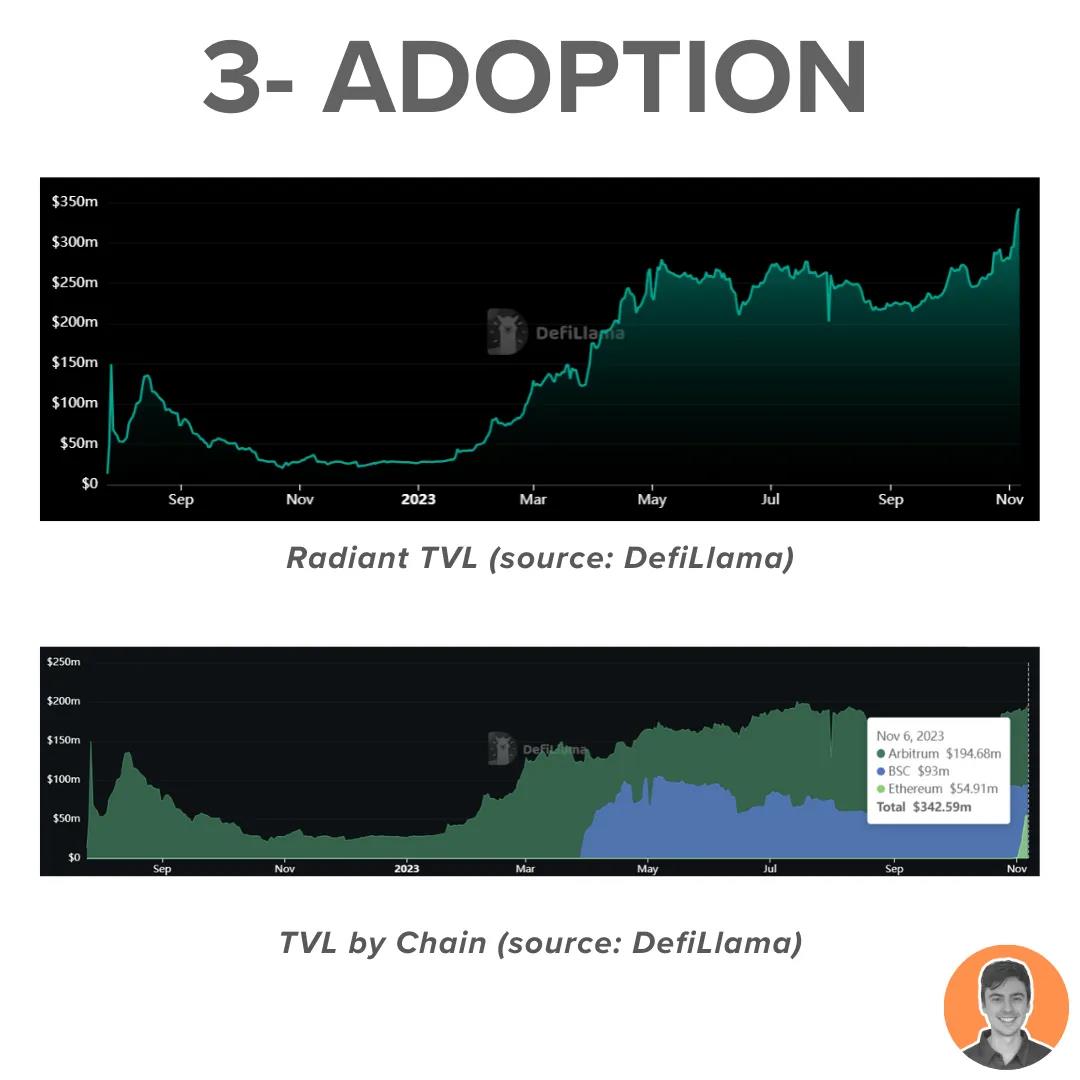

Adoption

Radiant's Total Value Locked (TVL) continues to grow, reaching a historical high of $342 million. In just the past month, its TVL has grown by 26%, mainly due to its launch on Ethereum in October.

This places Radiant at 7th in lending protocols and 32nd among all protocols on DefiLlama.

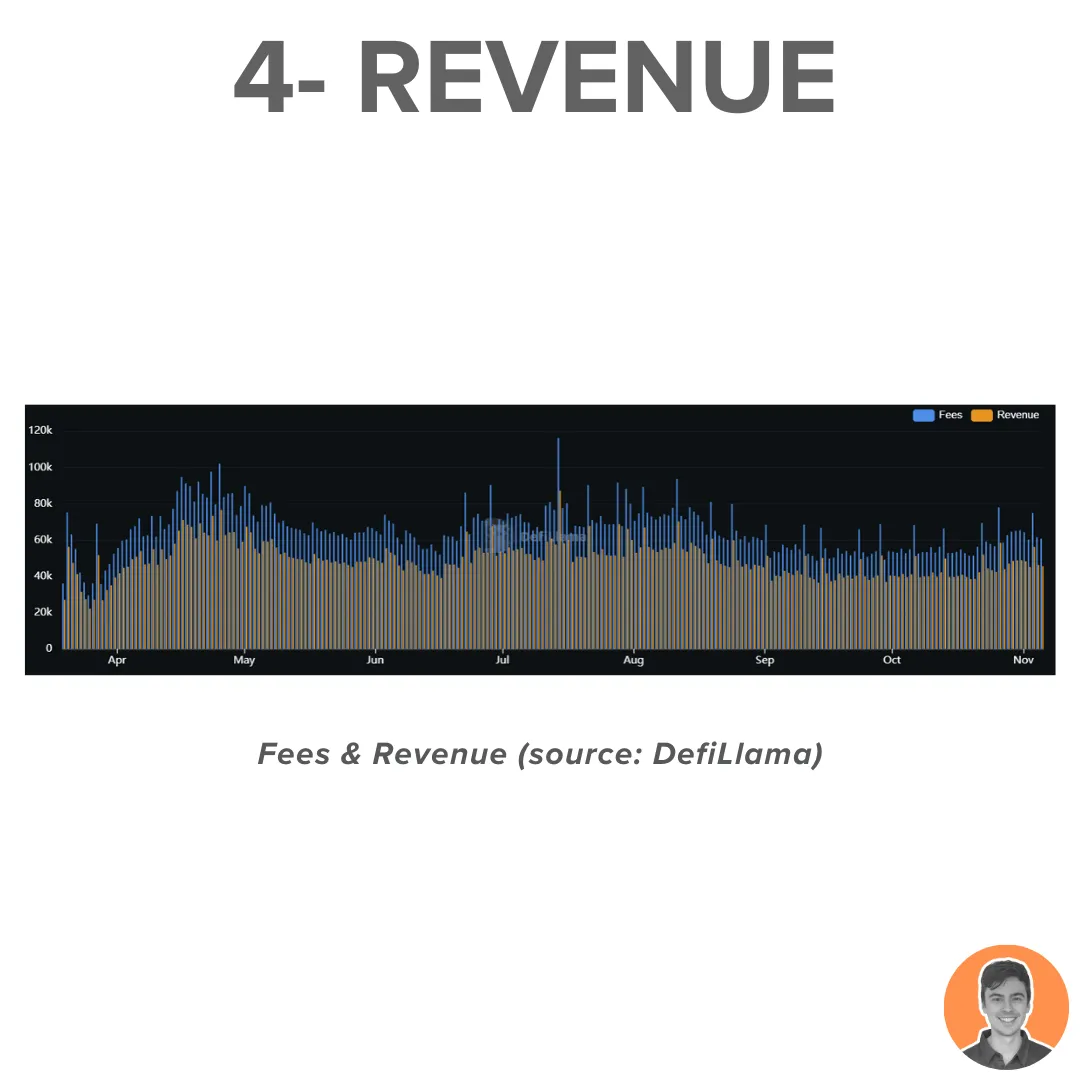

Revenue

The protocol's revenue distribution is as follows:

- 60% - Locked RDNT dLPs

- 25% - Borrowers

- 15% - Operational expenses

Over the past 30 days, the protocol has generated:

- $1.78 million in fees

- $1.33 million in revenue

Ranking it 2nd in lending protocols and 15th overall.

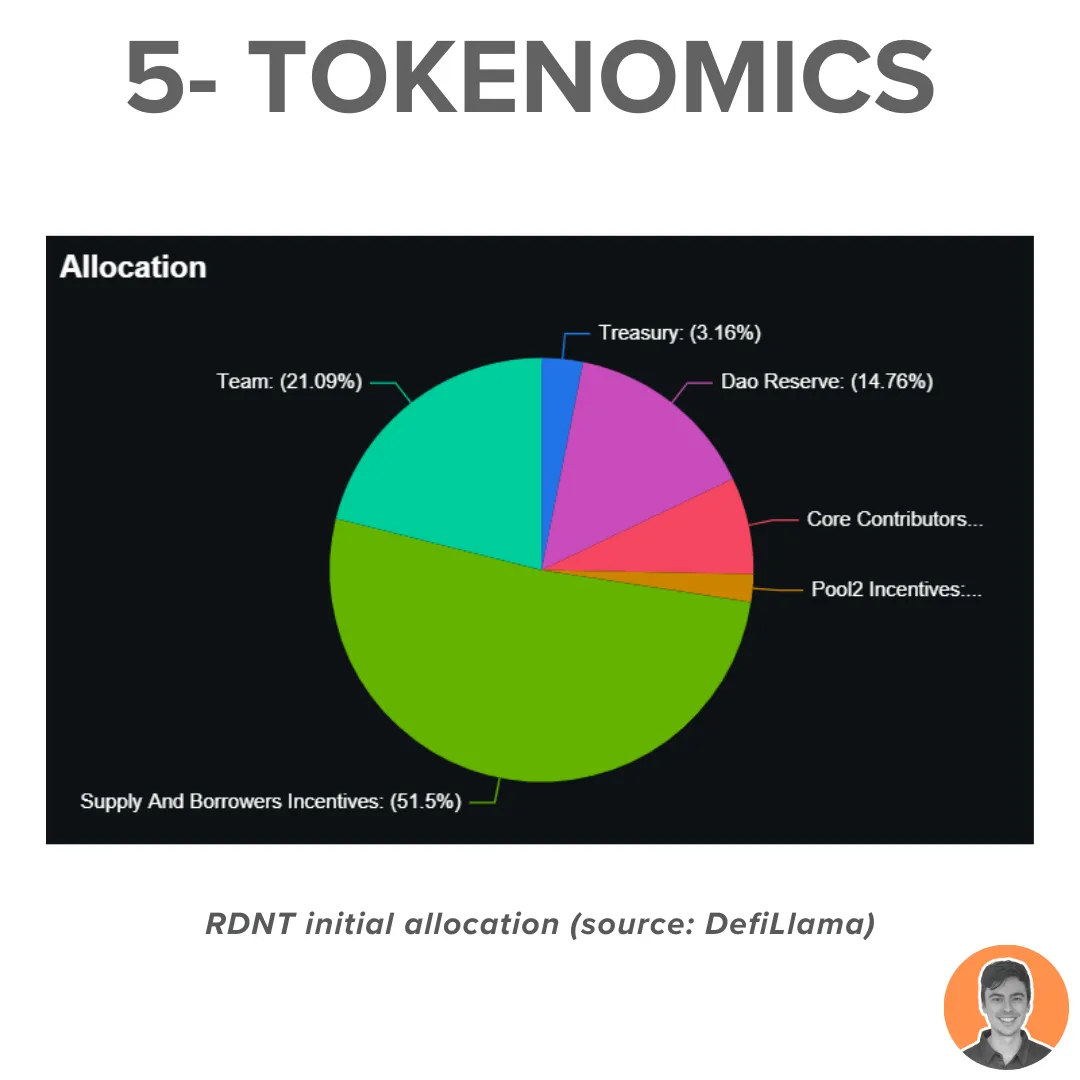

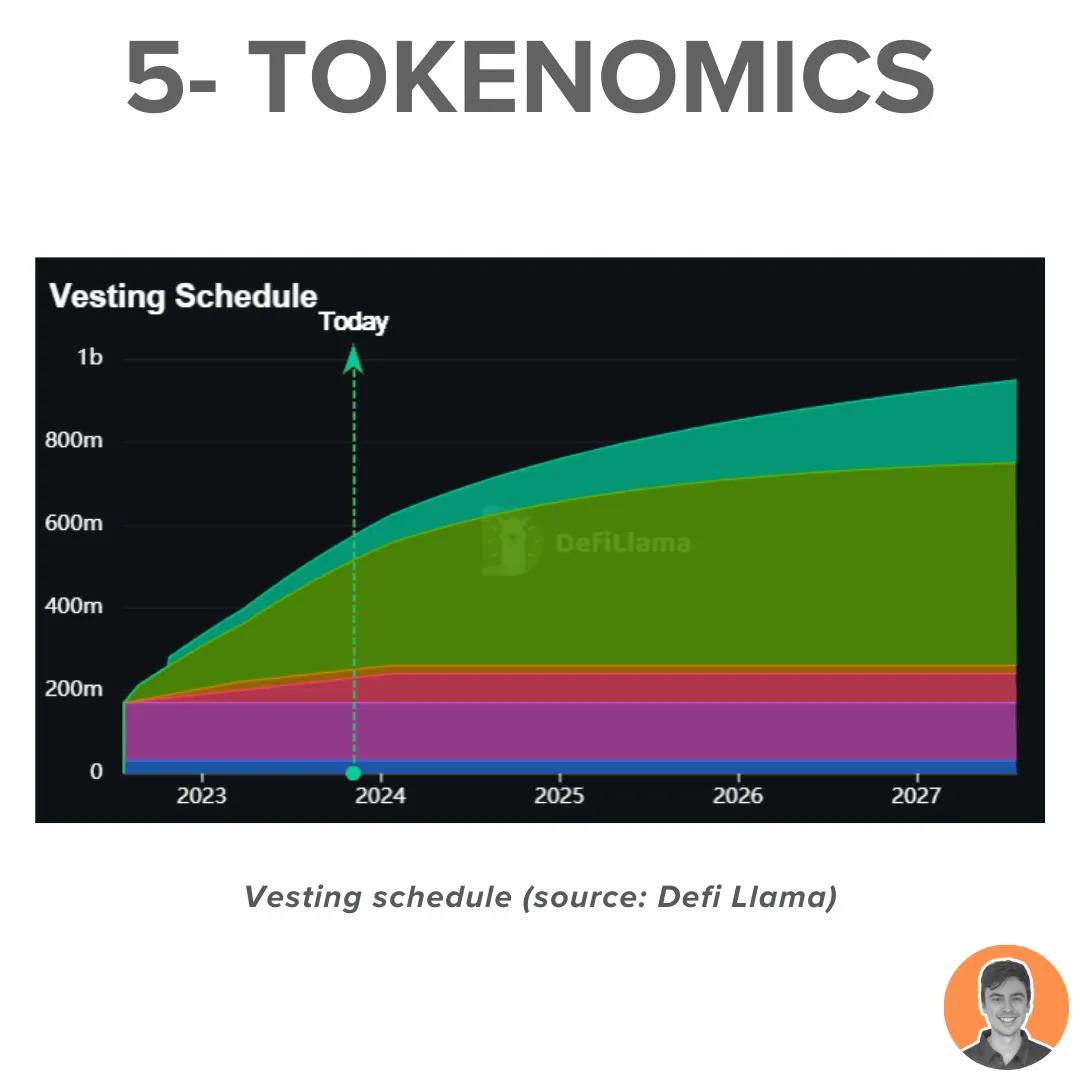

Token Economics

$RDNT is Radiant's native utility token (OFT-20). LayerZero's full-chain solution enables seamless on-chain token transfers. $RDNT supports protocol fee sharing and provides governance through locked dLPs.

The protocol is now live on Arbitrum, BNB Chain, and Ethereum. All vesting will be completed by 2027.

Current supply statistics:

- Circulating supply = 347 million

- Max supply = 10 billion

- Market cap = $95.5 million

- FDV = $275.2 million

- Market cap/FDV = 0.35

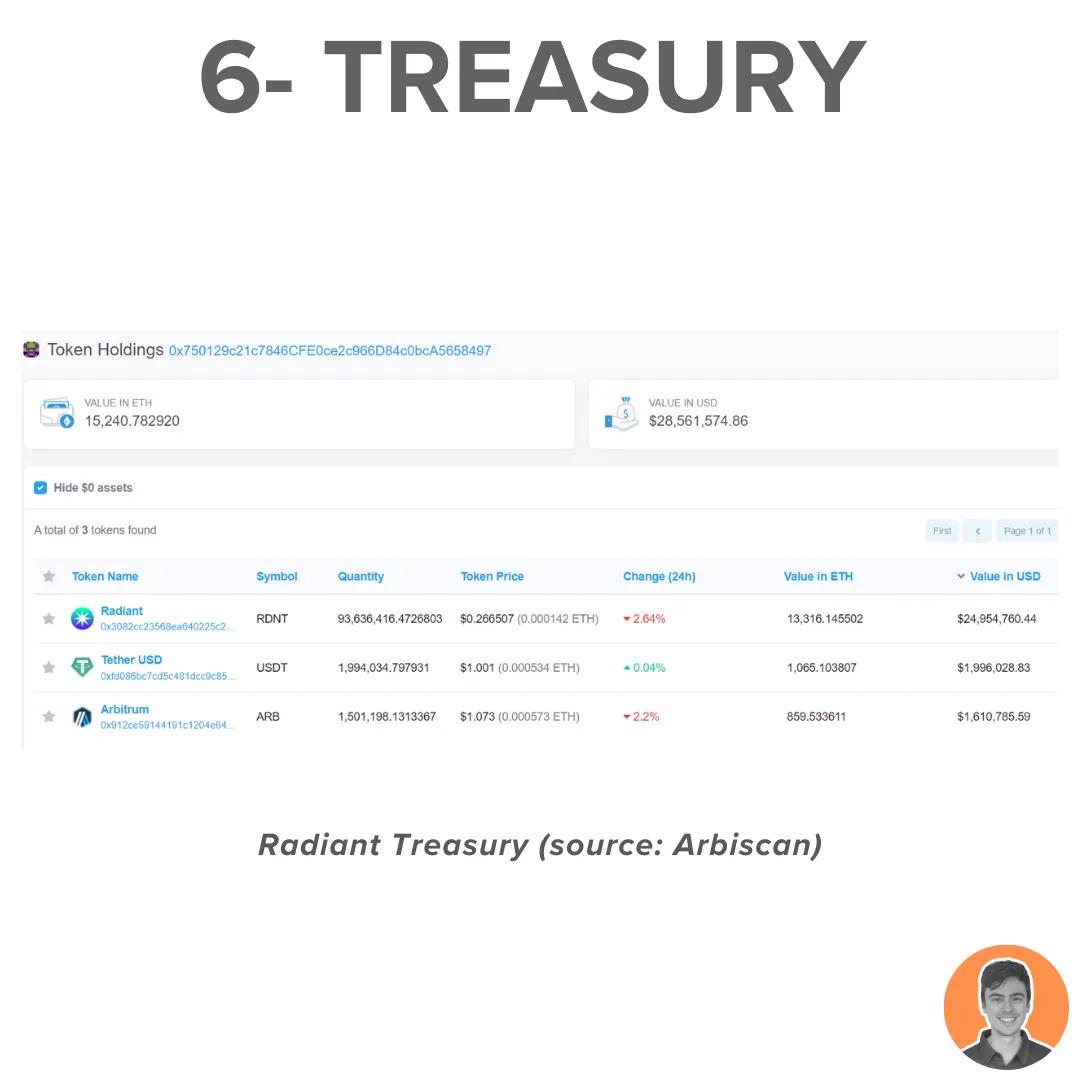

Treasury

Radiant DAO has two main treasury wallets:

- Radiant Reserve - $44 million

- Radiant DAO Treasury - $28.5 million (RDNT, USDT, ARB)

The DAO reserves funds and has the authority to decide the distribution scheme for RDNT issuance. The treasury funds are used for daily operational expenses (such as salaries, listings, marketing, etc.).

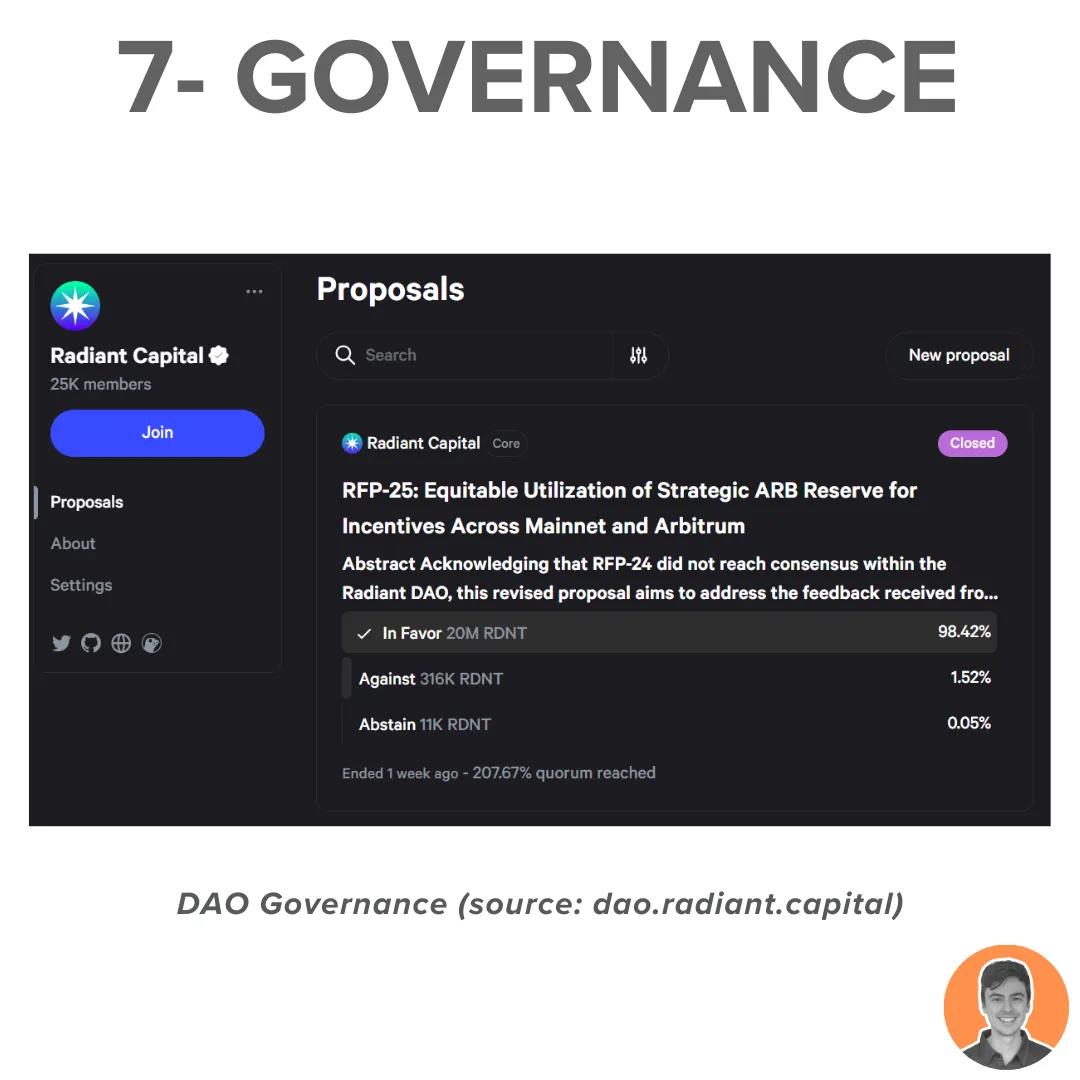

Governance

Radiant Capital operates as a DAO and has 25,000 members on its governance forum, with 25 proposals voted on to date. To participate in the voting process for these proposals, locking your RDNT tokens is required.

Currently, over 44 million dLP tokens are locked.

Team / Investors

Radiant was launched in 2022, with the founding team self-funding the development work (approximately $1.5 million). There were no venture capital, private sales, or ICOs to raise capital.

Main partners:

- LayerZero

- Chainlink

- Lido

- Arbitrum

- Balancer Labs

- Binance Labs

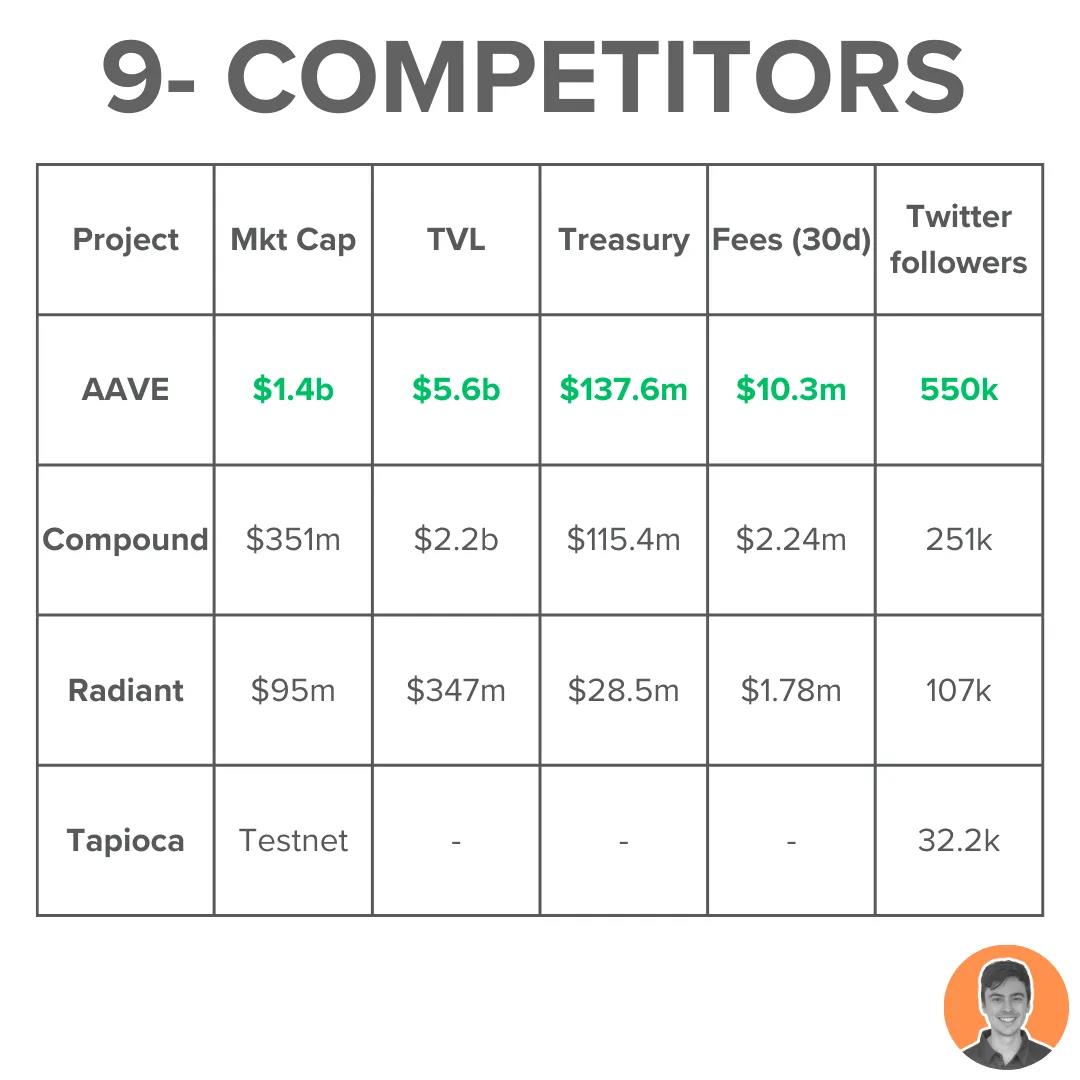

Competitors

Aave is a leader in the DeFi lending space. Radiant, a branch of Aave, is emerging as a powerful competitor with full-chain capabilities.

Tapioca DAO is another emerging protocol operating as a full-chain money market on LayerZero.

In short, there is fierce competition in this space.

Risks and Audits

The V2 codebase has been audited by Open Zeppelin, Peckshield, and Zokyo, with no unresolved critical or high-risk issues.

In addition, there is a bug bounty program operated by Immunifi.

However, as with any DeFi investment, there is always potential contract risk.

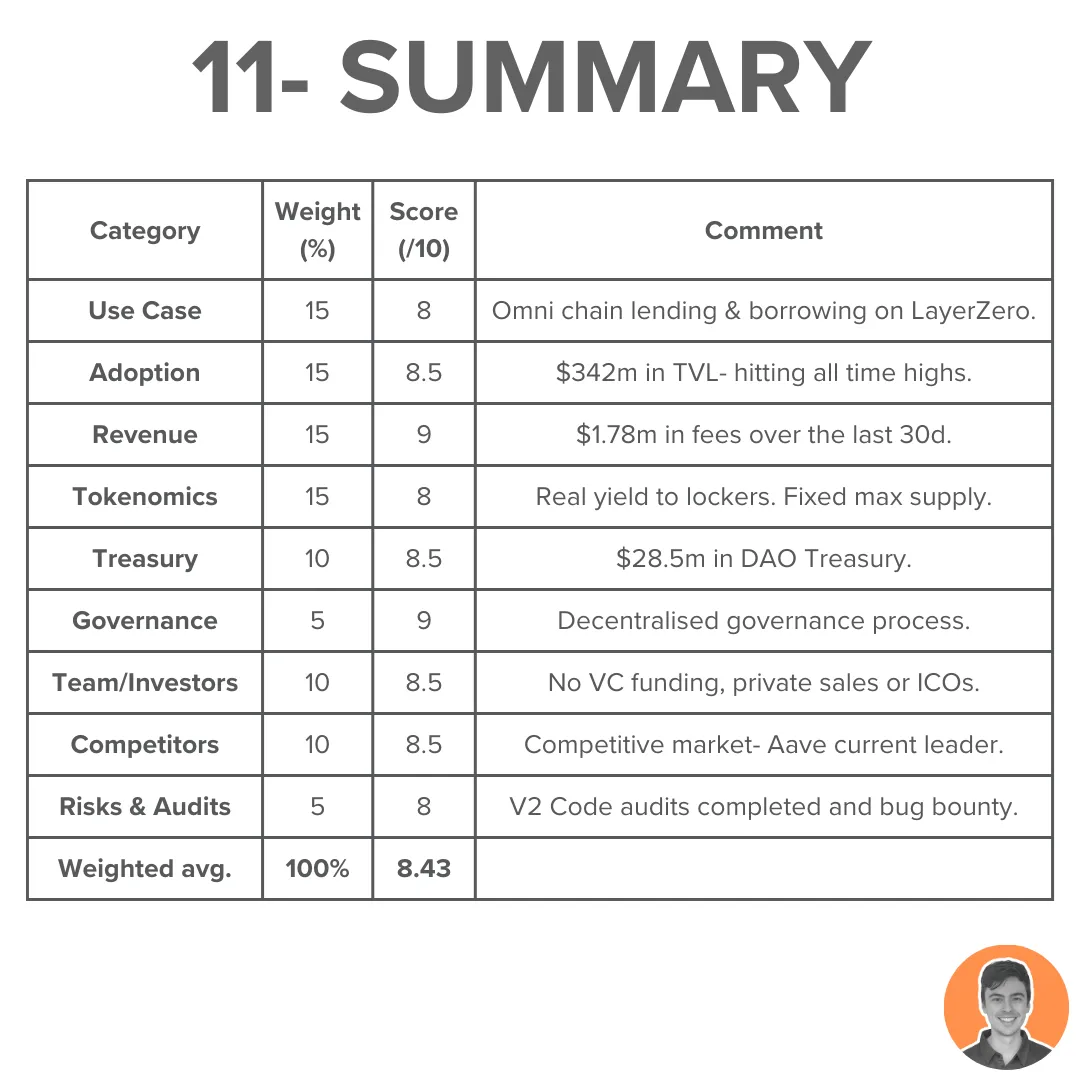

Summary

Overall, I am optimistic about $RDNT and the Radiant protocol, with a score of 8.43. There are also some upcoming bullish factors:

- Launch on Ethereum

- ARB season

- STIP grants—ARB directed to new dLP lockers

- LayerZero narrative

- Radpie integration

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。