From the emergence of use cases for "artificial intelligence + blockchain," to the increasingly important role of stablecoins in the financial market, to the maturity of zero-knowledge proofs, I believe that despite market volatility, these areas still maintain resilience.

Author: Paul Veraditakit, Managing Partner at Pantera Capital

Translation: Luffy, Foresight News

I will explore some areas that Pantera is focusing on.

1. Social and Consumer Use Cases

Web2 has shifted from social to financial, while Web3 is shifting from financial to social. From Friend.tech to on-chain loyalty, the social elements of Web3 have recently received increasing attention, seeking to use tokenization to change social behavior. As consumer transactions on-chain may become more frequent, we believe stablecoins will play an increasingly important role as settlement solutions between DeFi and TradFi.

In addition, the latest advances in generative artificial intelligence may bring about a more abstract, personalized, and simplified user experience. With the widespread adoption of AI abstraction, we hope it can reduce the barriers to entry and education in Web3, making blockchain data more accessible to non-technical backgrounds.

2. ZK-Supported Modularity and Composability

We believe that zero-knowledge proofs (ZKP) will continue to mature, whether through new theoretical advances in recursive proofs or the gradual specialization of specific vertical companies, such as collaborative processing, proof execution, zkDevOps, privacy layers, etc. We are now beginning to use ZKP as a way to establish a common interface between different layers in the modular technology stack.

Modularity refers to different layers of the blockchain stack (consensus, execution, data availability, etc.) being handled by different providers. This concept allows for increased composability in the form of a "plug-and-play" blockchain architecture similar to Lego. This means that projects can customize their blockchain technology stack based on the specific needs of consumer-facing applications. Furthermore, enhancing the composability of smart contracts using general-purpose languages like Rust can increase developers' familiarity, thereby lowering the barriers to entry for Web3 developers.

3. Bitcoin Ecosystem

We believe that the third area worth paying attention to in the next year or so is the entire Bitcoin ecosystem, which has regained interest ahead of the expected halving in 2024. This includes the potential approval by the SEC of ETFs for major traditional financial funds, as well as the modular Bitcoin blockchain allowing more composable smart contracts.

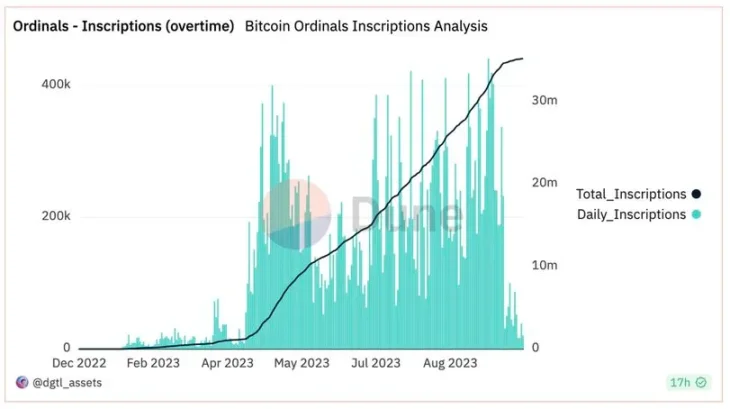

The rise of Ordinals inscriptions, Source: Dune Analytics, October 6

Perhaps one of the most interesting innovations is the rise of Bitcoin digital assets supported by technologies similar to Ordinals. As a result, we may see a divergence in the use of NFTs, with Ethereum NFTs possibly focusing on transactional utility, while Bitcoin NFTs, due to the cultural significance of the chain, may evolve into a form of "digital jewelry" and art and fashion collectibles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。