Author: RootData

From Layer1, DeFi to NFT, from BRC20, RWA to social, the hotspots in the crypto market are constantly shifting, dazzling, and the consistent result of all these changes is that the scale of on-chain and off-chain data in the entire industry is expanding rapidly, with the hidden wealth effect also stimulating market participants' systematic exploration demand for potential hotspots.

RootData was born in such a background. The core team of RootData has over five years of experience in Web3 industry data and content production, dedicated to bridging on-chain and off-chain data, presenting a rich project/asset details page, and a comprehensive Web3 transaction data flow change to help users improve the quality of investment decisions.

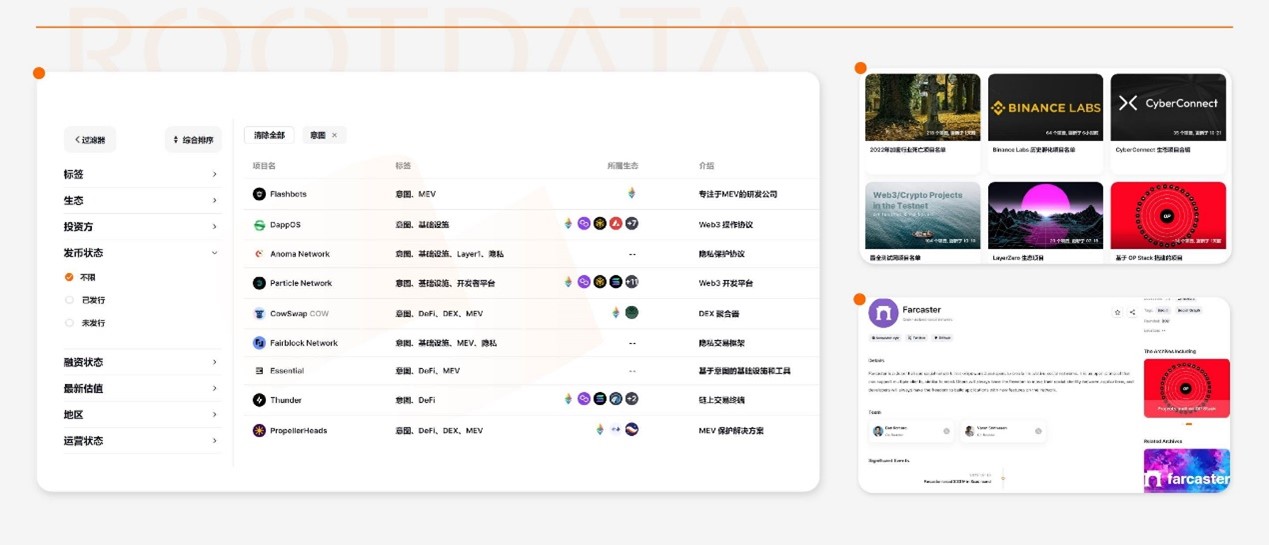

Since the start of internal testing in December 2022, RootData has completed the first phase of exploration, which is the comprehensive integration of early off-chain transaction data for professional institutions. With the project's off-chain information as the core, RootData has comprehensively split the project's fundamental information, including basic introduction, investment and financing, team, tokens, news, tags, ecology, and region, among 22 pieces of information. These data, unlike on-chain data that can be exported for analysis and summarization with just an API, can be described as "dirty and heavy" "hard work," so for many years, there has been no widely recognized off-chain data platform on the market, and even a large number of users have been using traditional data platform Crunchbase to view crypto project information. However, due to the uniqueness of the Web3 industry, traditional data service providers have greatly constrained the efficiency and accuracy of user information processing.However, we have persisted. Off-chain data is complex and scattered, but its importance is self-evident. After refining through the processing of millions of data points, RootData has now established a mature data acquisition, cleaning, summarization, and entry process, and is integrating AI contributions. Ultimately, each data entry will undergo manual review to ensure the authenticity and accuracy of the data, presenting the most important and highly credible data information to readers. In addition, community users are also assisting in the construction of the database, with over a thousand pieces of content feedback information contributed, further enhancing the reliability of the content. As of early October, RootData has already included over 200 tags, 9000 crypto projects, 5000 investors, 6000 personalities, and nearly 6000 pieces of investment/merger and acquisition information, covering almost all projects and investors in the Web3 industry, and updating transaction and project changes in real time. These data are presented to users in a highly combinative UI for viewing and usage, such as "Unreleased projects invested by Binance Labs," "RWA projects that have received funding," "Polygon ecosystem projects with funding exceeding $1 million," and so on. Furthermore, RootData has specifically created a "Collection" function to establish information lists for projects with certain common attributes, such as "List of crypto projects that died in 2022," "Crypto projects founded by Tsinghua University alumni," "Projects funded by the Ethereum Foundation," and "Crypto projects holding a digital payment license in Singapore." Each user can also create their own exclusive Portfolio collection to track projects they are interested in. With these practical functions and a powerful data engine, RootData has received praise from various parties in the industry over the past period and has become the preferred asset query platform for numerous crypto asset investors and enthusiasts, with over 1 million cumulative visitors. It has been cited by mainstream media such as The Wall Street Journal and Decrypt. Just as checking prices on Coinmarketcap or Coingecko, checking comprehensive information such as project funding is now a daily habit for many users on RootData. However, we are well aware that the current product form of RootData still has a long way to go to reach the ideal state. There is still room for further improvement in meeting users' needs for trading and research, so the exploration of the second phase is imperative.Indeed, on-chain data is a more enclosed track, and the competition is more intense. With the explosion of various on-chain application ecosystems, user behavior data on the chain is becoming increasingly rich. Coupled with the increasing number of open modular components, various on-chain data platforms have emerged this year, such as NFT data platforms, investment portfolio tracking platforms, and whale address monitoring and tracking platforms. These platforms are all vying for user attention. According to RootData, in the context of the overall decline in industry financing, the financing amount in the tool and information service track has continued to increase rapidly by 90% since the first quarter of this year, leading all other main tracks. Most of the projects that have received large amounts of funding are on-chain data platforms, including Cymbal, CoinScan, and Web3Go. This phenomenon indicates that the commercial value of on-chain data has been recognized and favored by various parties in the industry, entering a period of prosperity and rapid development. An obvious sign is the sharp increase in the dissemination of address labels. In addition to the common exchange addresses, on-chain addresses of many market makers, project treasuries, and well-known figures have been discovered. Their every move is closely watched by the market and has even become the subject of real-time tracking and reporting by various media outlets. Ultimately, the crypto secondary market is still mainly driven by the dynamics of large holders and market sentiment. Token distribution is relatively concentrated, and the dynamics of these representative addresses are highly correlated with token prices, making them the focus of the market. With the improvement in address information transparency, the complexity of the market's various games is also rapidly increasing. In the past, most of this information was hidden under the market's unpredictability, but now these addresses have become semi-public information, and the channels and efficiency of information processing have become the key to the game. However, many current on-chain address intelligence platforms still have a high reading threshold and low readability, and many users can only learn relevant information from the dissemination by media or KOLs. RootData believes that the combination of on-chain and off-chain data will elevate the user experience of reading on-chain data to a new level. Effective data tracking is based on an understanding of asset fundamentals, rather than just changes in inflows and outflows. Furthermore, RootData believes that as the entire Web3 market continues to improve in compliance and robustness, more users will return to focusing on structured asset fundamental data and key trading data dimensions.RootData's core goal in the new phase is to create a one-stop product for users to track their asset portfolio data and data of large holders, presenting the multi-party fund game trends behind assets, including institutions, projects, Smart Money, and more. This means that in addition to seeing the fundamental information of projects, users on RootData can also understand the dynamic of whale addresses for their tokens, changes in the number of holders, and real-time tracking of on-chain and off-chain data dynamics for any token of interest, as well as the asset portfolio changes of any address (individuals, investment institutions, project parties, Smart Money, etc.) on the dashboard. By combining on-chain address information with existing project databases, users will be able to simultaneously access introductions, news updates, whale changes, and other information related to the assets of any address, significantly improving the reading experience and efficiency of on-chain data. This will be more conducive for users to capture more trading signals and make investment decisions, especially for trading-oriented users, representing a revolutionary improvement in user experience and interaction processes. The vast amount of on-chain and off-chain data contains significant treasures, but the crypto market currently lacks sufficiently user-friendly "shovels" for excavation, which is the solution provided by RootData. Next, RootData will mainly focus on the design and development of this product, providing efficient, accurate, and comprehensive asset information to more users inside and outside the Web3 community with institutional-level product standards, and offering corresponding tools for users to discover market dynamic signals, becoming a productivity-level product for active Web3 users to trade and track assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。