Gary Wang: The Rise and Fall of a Tech Prodigy

Renowned programmer Gary Wang once enjoyed great fame, but his razor-sharp skills were tragically misused, leading to a hasty and inglorious end.

On October 3rd, the bankruptcy case of FTX, once the world's second-largest exchange, was officially heard in New York. In a courtroom filled with the judge, SBF, and numerous witnesses, explosive revelations and detailed testimonies exposed the mysterious operations of FTX, a cryptocurrency exchange that once boasted a trading volume ranking second globally and a market value of up to $32 billion.

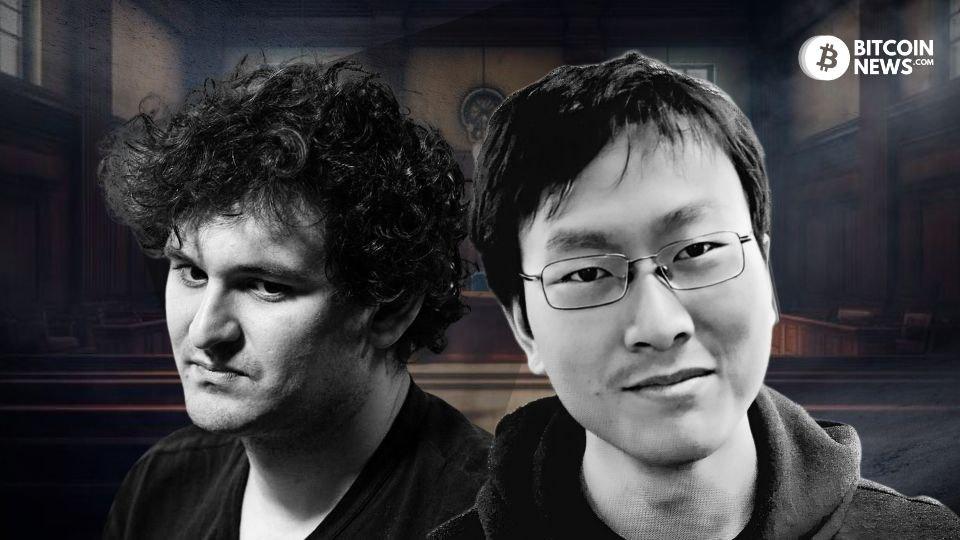

On the day of the trial, key figures within the company, including Gary Wang, Caroline Ellison, and Trabucco, appeared as witnesses. Among them, the attention of all media and the public was drawn to a Chinese face – the mild-mannered, bespectacled witness was none other than Gary Wang, the co-founder and CTO of FTX.

Gary Wang's testimony was explosive, personally revealing the existence of a backdoor relationship between FTX and Alameda:

SBF allowed Alameda to freely withdraw funds from FTX, and in 2019, as the CTO, Gary personally wrote the functionality for Alameda to siphon client funds from the FTX system. Furthermore, Alameda could trade with more funds than were actually in their account, granting them the invisible privilege of misappropriating user assets and unlimited trading.

When FTX collapsed, Alameda increased its credit limit to an exaggerated $650 billion, and even directly withdrew $8 billion from the FTX platform. This $8 billion precisely matched the fund shortfall in FTX's corporate account, sourced from FTX clients.

Additionally, the publicly disclosed balance of the real insurance fund (ensuring the clearing risk of traders' counterparts) at FTX was found to be falsified. It was generated by a random number generator, with the amount not matching the database. The actual figure was lower than the generated number, exposing FTX's deceptive practices in its financial statements and audit responses.

Seeing his once most important "comrade" testify and reveal shocking data and information, SBF trembled uncontrollably, desperately rubbing his eyes in an attempt to calm himself.

Who is Gary Wang?

According to Gary's own account, as a co-founder of FTX, he earned a salary of $200,000 per year, held 17% of FTX's equity, and 10% of Alameda's equity, making him the second most important figure after SBF. In FTX's operations, SBF was responsible for company strategy, public relations, and communication, while Gary focused on coding.

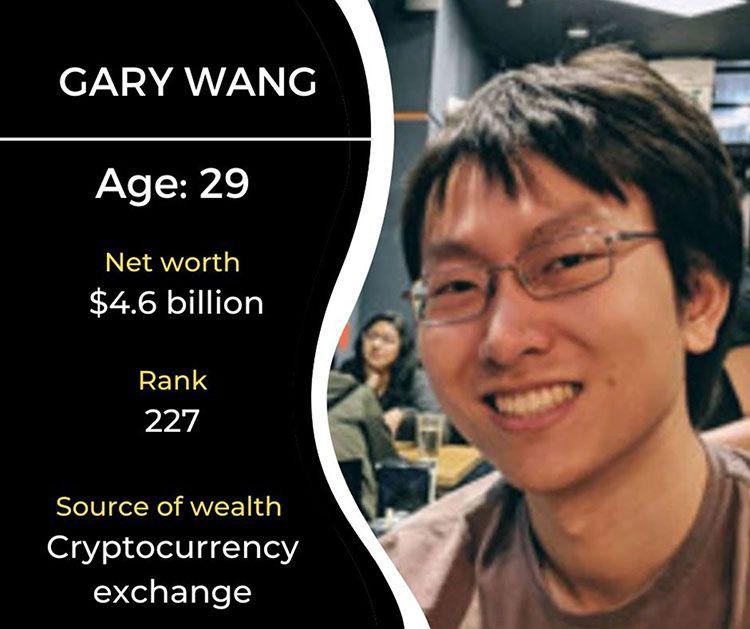

Based on the equity value of FTX and Alameda, in April 2022, the 28-year-old Gary became the wealthiest individual under 30, with a net worth of $5.9 billion, as listed in the latest Forbes billionaire rankings.

As the most enigmatic billionaire executive, Gary was known for his mysterious personality, rarely making public appearances. There were few online photos of him, and even his colleagues often went long periods without seeing him. His LinkedIn profile only featured a silhouette.

The Relationship Between Gary and SBF

According to online sources, Gary was born in China and immigrated to New Jersey, USA, with his parents at the age of 8. He excelled in his studies from a young age, particularly demonstrating exceptional talent and interest in mathematics and programming.

In 2010, he met SBF and Trabucco (another executive at FTX) while participating in a high school math competition. The three of them attended a mathematics summer camp at the Massachusetts Institute of Technology (MIT) and all successfully entered the mathematics program at MIT. Trabucco and Gary pursued bachelor's degrees in mathematics and computer science, while SBF pursued a bachelor's degree in physics.

SBF and Gary gradually built trust during their university years, becoming roommates for three years. Aside from their studies, they often played games and solved puzzles together. In their free time, they also joined the Epsilon Theta fraternity. While many found Gary reserved and difficult to communicate with, SBF, after years of observation, deeply understood Gary's character and abilities, especially recognizing his talent in programming and mathematics (Gary had won the MIT programming competition).

"Many people found it hard to get along with Gary and kept their distance, but I didn't. I believe Gary doesn't want to deliberately distance himself from the world. He's very intelligent, and he can take the time to think about very difficult problems," SBF recalled.

Their years of academic experience forged a deep bond of friendship. After graduation, SBF went to work in trading at the Jane Street hedge fund on Wall Street, while Gary joined Google to work on the Google Flights integrated ticket pricing engine.

In November 2017, SBF founded the quantitative trading company Alameda Research in San Francisco, focusing on quantitative trading in the cryptocurrency market. Immediately, SBF thought of Gary, who was working at Google, and flew to Boston to persuade Gary to join Alameda: "Your talent in trading will surely be successful. The cryptocurrency market is filled with countless new opportunities. Let's create them together!" SBF vividly described his ambitions and aspirations to Gary.

Gary felt that his work at Google lacked challenge, so he accepted SBF's invitation to move to San Francisco.

They often fought side by side, with Gary coding day and night, and SBF often sleeping in the office. They only slept 4-5 hours a day.

Gary Wang's Quantitative Programs

Initially, SBF operated Alameda with his own funds, trading mainstream and alternative coins, but the performance was poor, with daily losses reaching as high as $500,000.

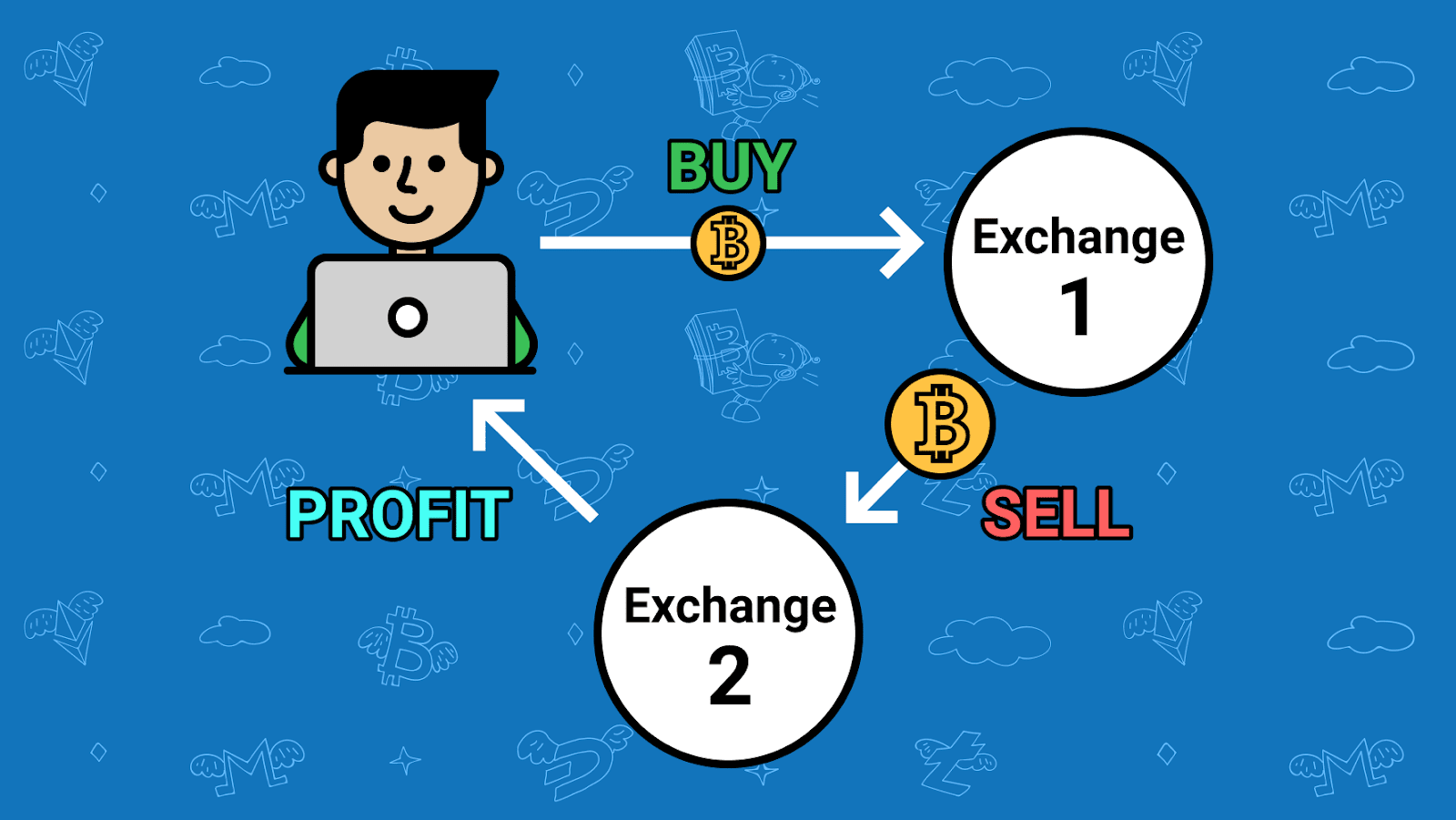

However, after Gary joined Alameda, the team, after a long period of trial and error, settled on a trading strategy that involved arbitrage between Bitcoin prices in Japan, the United States, and South Korea. In a crucial step, Gary wrote an entire quantitative program for Alameda, enabling rapid arbitrage across different trading markets. This program could execute risk-free arbitrage operations by quickly capturing price differences between exchanges. With this method, SBF secured $170 million in funding from investors, and Alameda's daily trading volume exceeded billions of dollars, with daily earnings reaching an astonishing $25 million.

Gary Wang's Liquidation Engine

However, this was not the beginning of everything. As early as 2018, SBF asked Gary to write a program for a Bitcoin exchange, and Gary completed a CryptonBTC exchange in just one month. Although it did not become a product, SBF knew that if he asked Gary to write a contract exchange program, he could complete it within a month and produce a higher-quality product than any exchange on the market. Gary was a true programming genius.

At the time, a common problem with contract exchanges was that when a client's position experienced losses and required additional margin, the exchange would first ask the client to add margin. If the market changed too quickly, the exchange would bear the loss of these funds.

In the code for later contract exchanges, Gary invented a new liquidation engine mechanism that could monitor client positions down to the second and immediately execute liquidation when the client's margin was insufficient, thereby protecting the exchange's funds. Although this feature annoyed traders, it solved a key problem that had long plagued many exchanges. After Gary added the liquidation mechanism to FTX, Binance, Kraken, and other exchanges followed suit in developing this feature.

Gary's Cross-Margin

In traditional contract trading, users needed to provide collateral in the corresponding assets for borrowing, lacking flexibility in funds. Addressing this, Gary developed the "cross-margin" feature for FTX, allowing users to use multiple digital assets as collateral for a single trade. This feature was subsequently adopted by other contract exchanges.

SBF's Ruthless Tactics

In fact, as the "right-hand man" to SBF in achieving great success, Gary was not just an excellent programmer; he was also a top-notch product manager! Gary could even develop products that outperformed competitors based solely on market demand. Nishad Singh was the engineering manager at FTX, but the core products were often developed solely by Gary, with Singh mainly coordinating engineers.

At the same time, Gary would handle special program requests from SBF, and only Gary and SBF had permission to use and view these programs. This included the "allow negative balance" feature that allowed Alameda to transfer assets from FTX, a program that allowed Alameda to use FTX client funds without restrictions.

The Fall of FTX's Core Team

Under the leadership of SBF and Gary, FTX rose to become the world's second-largest exchange by trading volume, with a market value of $32 billion. However, in November 2022, FTX collapsed within a week, leaving debts of over $100 billion to more than a million creditors, marking a Lehman moment in the virtual currency world.

The core team of FTX all lived in a top-floor apartment in the Bahamas. When the incident occurred, the police raided the apartment and detained all the core members of FTX, including Gary.

The once invincible SBF said, "I have a 5% chance of being elected President of the United States in the future," but has now become a universally reviled "fraudster."

At the same time, the brilliant programmer Gary also suffered internally. In December 2022, he admitted to all charges, including wire fraud, commodity fraud, and securities fraud, and is facing 50 years in prison. Currently, Gary is seeking to cooperate as a witness in court to mitigate his sentence.

One-time tech prodigy Gary Wang once enjoyed great fame, but his razor-sharp skills were tragically misused, leading to a hasty and inglorious end.

Meanwhile, the trial of FTX is ongoing, and the final outcome for SBF and Gary remains to be seen. Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。