Comprehensive interpretation of the development of the Solana ecosystem RWA market, and personal opinions on how the Solana ecosystem RWA can stand out.

Author: Yash Agarwal, Crypto KOL

Translation: Felix, PANews

In 2023, RWA has gained widespread attention and was referred to as the "TradFi killer app" by J.P. Morgan. According to DeFiLlama data, RWA has become the eighth largest track in DeFi, with a TVL of $2.4 billion. This article will delve into the Solana RWA market, explore various RWA categories, top projects in each category, and discuss the future prospects of RWA on Solana.

Why Choose Solana?

Like other public chains, Solana has high transparency, automated payment calculations, self-custody of assets, and provides global 24/7 settlement for tokenized assets. However, Solana also has the following advantages:

- Low gas fees and fast speed: For high-frequency trading of tokenized foreign exchange, stocks, etc., Solana offers lower transaction costs, faster settlement, and higher TPS.

- Standards and ecosystem: A market-proven DEX ecosystem, as well as standards such as cNFT (compressed NFT), pNFT (programmable NFT), Token 2022, provide the fundamental building blocks for RWA to create and launch its products.

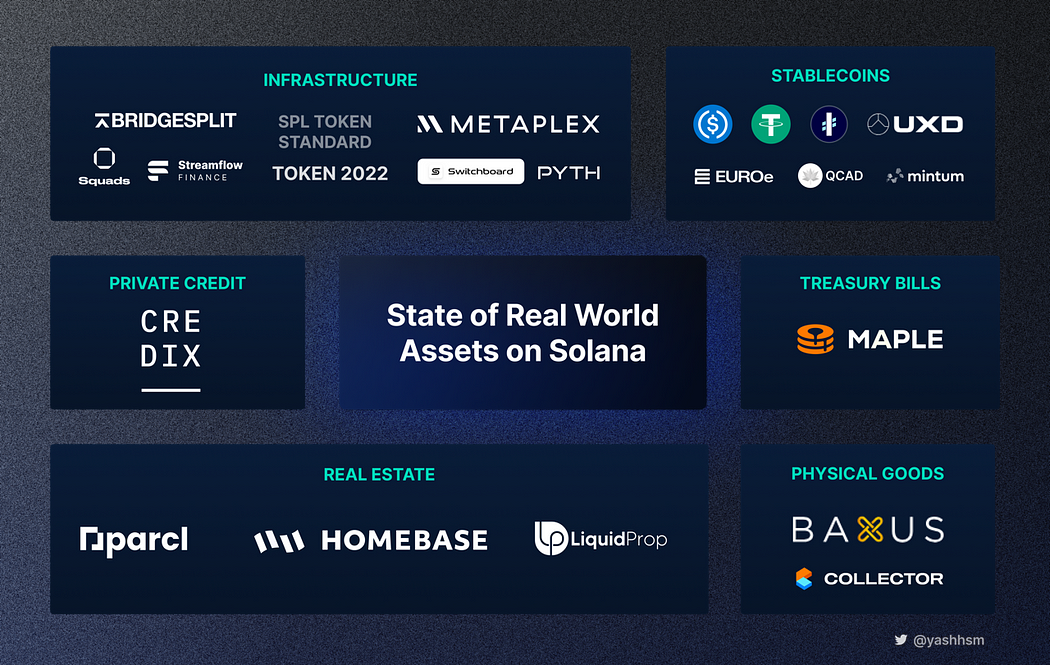

RWA Projects on Solana:

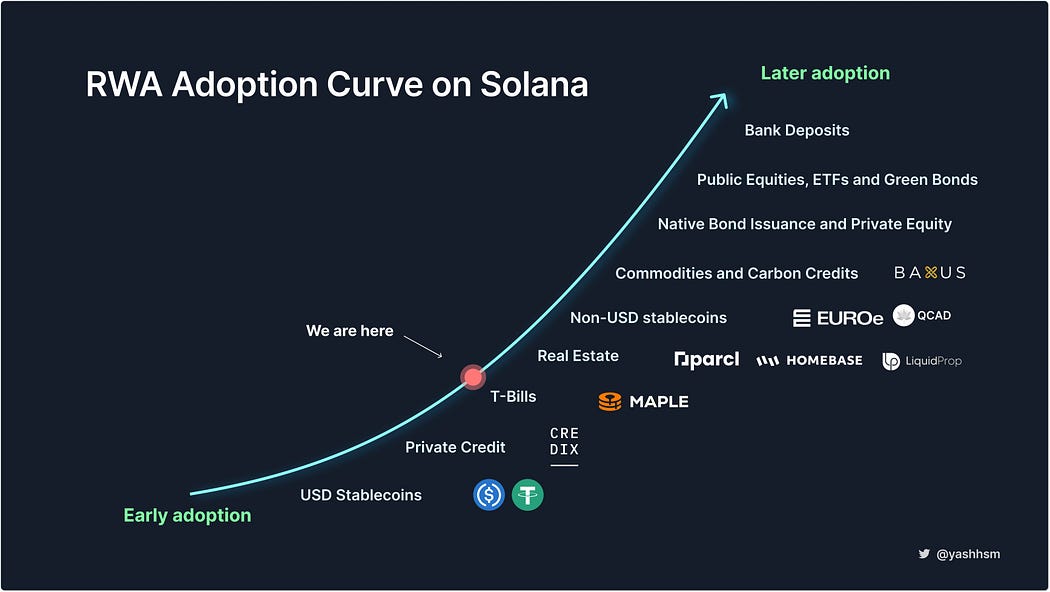

Despite the large market for tokenized assets, Solana's RWA is often overlooked. Unlike other DeFi categories, the adoption of RWA may take 5 to 10 years. However, this is an exponential market, and the TAM (Total Addressable Market) is unlimited.

Stablecoins:

Although stablecoins are not usually classified as RWA, they have the highest market fit, with their underlying reserves being U.S. dollars and treasury bonds. Solana has the following stablecoins:

USD-denominated:

- USDC: Backed by U.S. dollars and U.S. treasury bonds held by U.S. banks, custodied by BlackRock.

- USDT: Allegedly backed by U.S. dollars, treasury bonds, and other assets.

- UXD: Partially backed by RWA (such as Private Credit).

- Bridged Wormhole DAI, backed by DAI, which is in turn partially backed by RWA.

Non-USD-denominated:

- QCAD: A CAD stablecoin backed by Canadian dollars.

- EUROE: A euro stablecoin backed by euros.

- ISC: Backed by a basket of RWA.

Real Estate:

The two major real estate companies on Solana—Parcl and Homebase—have already launched and performed well. Although they may appear similar, they are fundamentally different. Homebase represents tokenized real estate in the U.S., while Parcl focuses on tokenizing real estate price indices.

Homebase: Tokenization of U.S. Real Estate

Homebase allows anyone to invest in real estate for as low as $100 and is currently tokenizing real estate in the U.S. It has already sold two tokenized properties worth over $400,000, but is still in its early stages. Homebase is fully compliant, with its tokens registered with the U.S. SEC, and has established a process to recover tokens in the event of a user wallet being hacked. However, it is currently only available to U.S. residents.

Parcl: Long/Short Real Estate Index

Parcl allows users to invest in real estate for as low as $1, creating risk exposure for real estate markets in cities worldwide through index-like REITs. Parcl can be seen as a company that creates real estate indices and provides price feedback services. Parcl has also developed a perpetual AMM platform to assist users in trading these indices, whether they want to go long or short. The TVL has already exceeded $1 million. The service has been launched in cities such as Brooklyn, Las Vegas, and Paris, with cities like London, Jakarta, and Hong Kong set to follow.

Liquidprop is another emerging participant in the real estate sector following the Homebase model, but has not yet launched.

The real estate market is not a winner-takes-all situation. There can be over 100 tokenized real estate markets on Solana, serving different regions and sharing a massive market worth over $33 trillion.

Private Credit:

In the TradFi field, loans issued by non-bank entities are referred to as "private credit." These loans are typically short-term (30-90 days), have floating interest rates, and involve direct lending between investment funds and corporate borrowers (usually small and medium-sized enterprises). Private credit has evolved into a significant industry, managing over $800 billion in traditional financial assets.

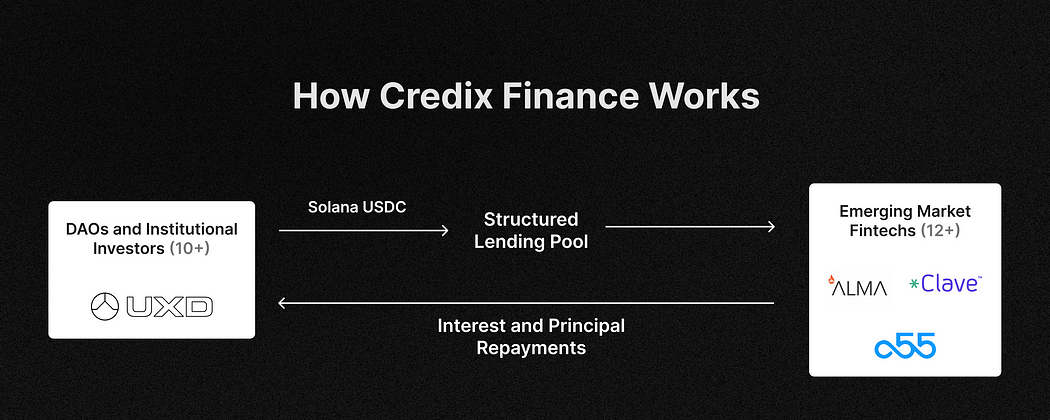

On-chain private credit is very similar to its TradFi counterpart. However, the difference lies in allowing anyone to invest using stablecoins. To illustrate the concept of on-chain private credit, let's take Credix Finance as an example:

Credix Finance: Major Participant in On-Chain Private Credit on Solana

Credix connects investors with fintech borrowers in emerging markets. Here's how it works:

Investors: Invest stablecoins such as USDC in liquidity pools or specific portions of the market.

Borrowers: Credix primarily collaborates with fintech borrowers in emerging markets, who borrow USDC and convert it into local currency. They then lend the local currency (e.g., Brazilian real) to various types of enterprises. The types of credit provided by fintech are highly diverse:

- Trade receivables (through Clave).

- Asset-backed car loans (through Atria).

- Income-based financing (through Brazil and Mexico).

Credix Finance has been growing rapidly, issuing over $40 million in private credit, generating over $4.9 million in interest. The tracked APY within 90 days is approximately 12.9%. To enhance attractiveness to investors, a portion of its investment portfolio has also been insured and reinsured.

Challenges and Opportunities of Private Credit:

While tokenizing private credit presents a huge market opportunity, addressing some loan issues, and reducing operational and capital costs, it also faces challenges:

- Non-performing loans: Recently, a platform similar to Credix on Ethereum, Goldfinch, has a funding pool from a fintech company called "Tugende," which provides loans to motorcycle taxi operators in Kenya. They borrowed funds under the name "Tugende Kenya" and transferred the funds to their subsidiary "Tugende Uganda" to address business issues. This violation of the loan agreement was discovered through quarterly reports, exposing the problems in private credit, which RWA cannot yet solve. Additionally, enforcement in jurisdictions such as Kenya and other emerging markets presents some obstacles, making it difficult to recover non-performing loans.

- Tracking off-chain data: In emerging markets, the lack of on-chain credit risk data or means to verify off-chain data, as well as the absence of robust credit underwriting infrastructure, forces RWA protocols to rely entirely on data provided by borrowers, which can be easily manipulated. After loans are disbursed, it becomes impossible to track the financial status of the loans and borrowers.

Addressing these issues requires innovation in credit structures, including:

- More proactive risk tracking, such as more diversified underwriting involving multiple specialized stakeholders in risk assessment. Coordination can also be done on-chain.

- Post-loan tracking through integrations such as open banking APIs. Insurance/reinsurance (similar to Credix).

U.S. Treasury Bonds:

U.S. Treasury Bonds are the most popular RWA on-chain, with over $660 million issued on all chains, and many participants are still actively developing. This is primarily due to the high interest rate environment, as USD-denominated treasury bonds offer a risk-free yield of 4-5%.

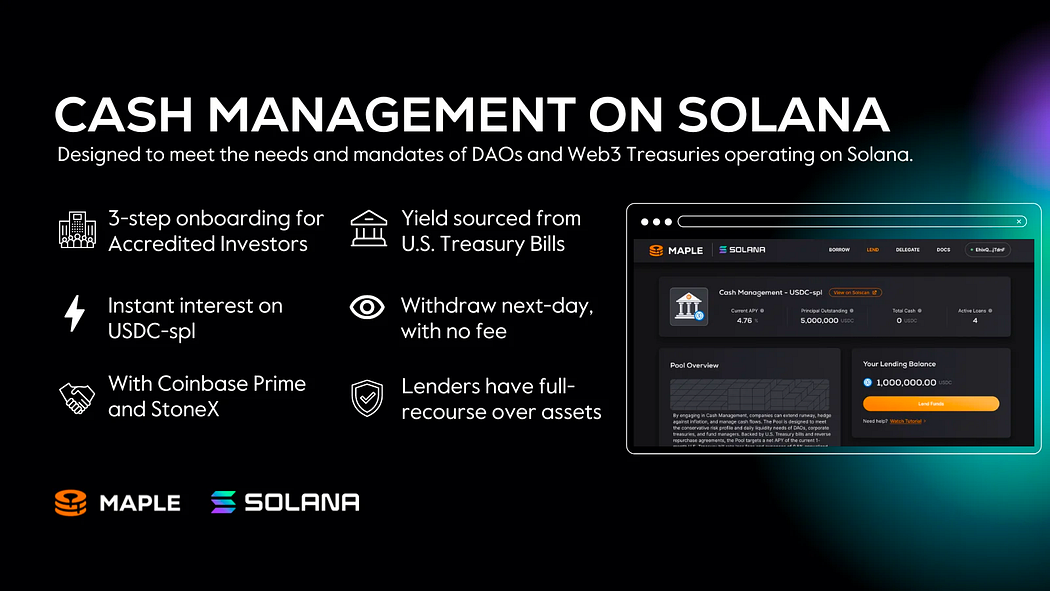

Solana is still in the early stages of tokenizing treasury bonds, with only one participant, Maple.

Maple Finance: First Tokenized Treasury Bonds on Solana

One of the crypto institutional capital markets, Maple Finance, announced its return to Solana with a cash management product. Within a few days of launching the cash management product on Solana, it attracted over $4.2 million and is expected to continue growing.

Here's how Maple's cash management product works:

- Lenders provide USDC-SPL to the pool and receive LP tokens.

- The pool disburses USDC-SPL loans to Room40 Capital's Solana wallet, and the USDC is converted to USD through Circle.

- Room40 is the borrower responsible for managing the treasury bonds.

Therefore, Maple Finance acts as a bridge between lenders on Solana and borrowers like Room40 Capital.

With explosive growth of participants like Ondo, Open Eden, and MatrixDock on Ethereum, it is expected that many participants will expand to Solana in the coming months.

Physical Commodities:

Any physical commodity, from artwork, trading cards, to sneakers, can be tokenized and put on-chain. The process of tokenizing physical commodities includes:

- Custody: Physical commodities are verified and securely stored in custody and represented on-chain as NFTs or tokens.

- Marketplace: Users can buy, sell, and transfer tokens on the marketplace.

- DeFi: These on-chain assets can also be used as collateral for loans.

In addition, similar to stablecoins, physical commodities can be tokenized by depositing them, or tokenized physical commodities can be redeemed for the physical items. However, unlike stablecoins, tokenizing physical commodities requires physical delivery.

There are two participants on Solana:

- BAXUS: Founded by a whiskey trader and a software engineer, BAXUS is a secure marketplace for identifying, storing, buying, and selling wines and spirits. These spirits are tokenized and securely stored in a U.S. custody.

- CollectorCrypt: Collector is a unique tokenization service that brings real-world collectibles to Solana, similar to Courtyard but for Solana. Users can also deposit physical cards and tokenize them.

Another participant on Solana, Blockride, is tokenizing bus fleets but is still in the early stages. It allows users to purchase a revenue-generating portion of a bus fleet for as low as $50 and directly receive a share of the daily revenue in their wallet.

RWA Infrastructure on Solana:

While most DeFi infrastructure may not be RWA-focused, infrastructure is currently being built, as follows:

- RWA-specific Bridgesplit: Bridgesplit is an infrastructure platform on Solana that allows asset custodians and markets to provide financing products to businesses and individuals. It was initially designed as a platform to tokenize off-chain assets into NFTs, but later shifted its focus to RWA. However, the Bridgesplit team has not released any significant updates or versions recently.

- Another key infrastructure related to RWA financial management is multi-signature solutions like Squads, which help protect their on-chain collateral assets.

- DEX (AMM and order book): While it may not be immediately apparent, the ultimate goal for RWA is to trade on DEX. DEX is not only designed for trading meme coins but is undergoing rigorous testing to facilitate the trading of tokenized assets in the near future.

- AMM: The main obstacle hindering free trading of RWA is the lack of "permissioned pools." For example, individuals should be able to convert their tokenized credit positions into stablecoins through AMM pools.

- Order book: Order books are particularly suitable for frequent trading of RWA, such as tokenized stocks and forex markets, as these assets already exist in traditional financial systems that use order books. Additionally, in markets with strong liquidity, order books can significantly narrow spreads. Order books are the preferred choice for most market makers, as they provide flexibility to LPs and more precise control over the prices at which traders buy and sell.

- Oracle: Oracles are crucial sources of off-chain asset data and ensure proof of reserves for real-world assets. The Solana ecosystem has two major oracles: Pyth (permissioned) and Switchboard (permissionless), which can be used to transmit off-chain data to the Solana blockchain.

- Fiat Onramps: Exchanging fiat currency with cryptocurrencies, especially specific fiat-to-stablecoin exchanges (e.g., USD to USDC), is crucial for reducing payment costs associated with RWA operations. Most providers support Solana; a complete list can be found here.

- Bridging: Looking ahead, bridges will play a crucial role in RWA, as most RWAs will be multi-chain (executed natively on multiple chains), and some may even be cross-chain (deposited on multiple chains and executed on a single chain). While Solana has various bridges supported by Wormhole and DeBridge, having more bridges and cross-chain token standards is crucial.

Token Standards:

Token standards play a crucial role as they enable "tokenization" in a secure and standardized manner:

SPL Tokens: The primary token standard on Solana, representing fungible tokens. Like any stablecoin, any RWA player can issue their assets as SPL tokens, with features such as dynamic supply, minting, freezing, burning, etc.

Token 2022: Expanding on the original standard, Token 2022 enables additional functionalities related to RWA:

Encrypted transfers: Allowing private transfers of tokens; relevant for institutions seeking private transactions.

Transfer fees: Issuers can configure transfer fees or taxes for transactions.

Interest-bearing tokens: Tokens that accumulate interest over time, such as bonds.

Non-transferable tokens: Tokens that cannot be transferred once issued.

Metaplex NFT Standards: Metaplex has a set of NFT standards, such as compressed NFTs and programmable NFTs, which also allow RWA players to represent unique assets.

While the current standards cover a wide range of scenarios, the lack of RWA standards hinders the adoption of RWA on Solana.

Solana Needs RWA Standards:

The Solana ecosystem lacks a unified, widely accepted standard for tokenizing RWAs. Standardizing RWA can help improve RWA on Solana, and standardized RWA tokens can simplify the process of creating tokenized RWAs.

Some considerations for creating RWA standards:

- Asset-level tokenization rather than fund-level tokenization: For example, each loan from an Argentine merchant would be tokenized as individual assets, rather than tokenizing the loan pool issued by the fintech company, with each token representing a portion of that fund. Asset-level tokenization can transparently represent ownership, allowing real-time tracking of the performance of all assets on-chain.

- Other on-chain RWA standards: Existing standards such as ERC-3643 (used by Tokeny), ERC-1400 (used by Matrixport), ERC-6065 (real estate), and ERC-4626 (used by TrueFi) should also be considered and borrowed from.

- BD push: It is worth noting that RWA token standards need initial BD push and reiteration based on institutional requirements to achieve initial adoption.

- Flexibility and upgradability: All contracts must be inherently upgradable to adapt to the evolving compliance requirements of asset issuers.

It would be best for the Solana Foundation to have an RFP (Request for Proposals) to apply for funding (up to $250,000) to build an RWA standards program.

What Solana Lacks Compared to Other Ecosystems:

While the RWA field on Solana is thriving, there are still shortcomings compared to other ecosystems. Here is a comparison with other ecosystems:

- Ethereum: Setting aside the technology, RWA protocols crave one thing: capital. Ethereum has the largest capital leverage to date, which is why almost every RWA protocol considers Ethereum as one of its main chains. Attracting funds from Ethereum while retaining Solana as the execution layer may be a viable option for Solana RWA.

- Avalanche: The core mission of Ava Labs, the company behind the Avalanche blockchain, is to "digitize all assets in the world," with a focus on RWA. They have launched a $50 million Vista Fund for purchasing tokenized assets and have introduced giants like KKR. The RWA fund established by the Solana Foundation (similar to the $10 million AI fund) can play a crucial role in attracting RWA to Solana.

Opportunities and Trends Forecast for Solana RWA:

Explosive growth of tokenized treasury bonds: While Solana lags behind in the trend of tokenizing treasury bonds, a large amount of Solana capital may be locked in due to high treasury bond yields. If the tokenization of treasury bonds truly explodes, considering the relatively small lending market on Solana, it may also lead to an increase in DeFi rates, which the author believes would be a healthy signal - the fusion of TradFi and DeFi. Projects from other ecosystems are worth watching, as they "may" expand to Solana in the near future, such as Ondo, Matrixport, Backed.Fi, OpenEden, and others.

Stablecoins supported by tokenized treasury bonds: Although the total market value of stablecoins on all chains has reached $125 billion, stablecoins within the Solana ecosystem alone exceed $1.6 billion, but currently in this high-yield environment, their return rate is 0%. One way to enhance stablecoins to better serve users is to use RWA to generate stable returns. Emerging popular participants in this category on Ethereum, such as Mountain Protocol, are building stablecoins that can generate returns.

Tokenized US stocks and synthetic stocks: While tokenizing US stocks may pose legal challenges, projects like Swarm are tokenizing stocks on Polygon.

DEX specifically for RWA: Considering the demand for licensed DEX, a DEX specifically for RWA can allow licensed assets to interact in a compliant manner. For example, Muave, a EVM-based DEX, is a branch of Uniswap v3 that requires KYC through VioletID to use the DEX. One of the Solana DEX, Meteora, is also launching DLMM, focusing on forex and RWA use cases.

DeFi composability: The next step for RWA will involve DeFi composability to increase the yield of underlying assets. For example, holders may have the opportunity to generate higher yields by tokenizing US treasury bonds, using them as collateral in the DeFi lending market, borrowing stablecoins, purchasing more treasury bonds, and repeating this cycle.

Fusion between DePIN and RWA: Thanks to projects like Helium and Hivemapper, Solana is undoubtedly the leading chain for DePIN. These DePIN networks have assets such as sensors, drones, and wearable devices, which will provide real-time, reliable data when RWA solves their financing issues.

Credit protocols: Circle Research recently released the Perimeter Protocol. The protocol allows developers and builders to access audited open-source protocols, and visitors can use USDC freely to build credit applications suitable for RWA, but it is only applicable to EVM. This presents a huge opportunity for Solana.

More assets and more markets: The market needs more on-chain assets, such as solar power plants (e.g., Plural Energy), precious metals (e.g., xMetals), carbon credits, corporate bonds, and possibly even uranium (Uranium308). Additionally, tokenization-friendly jurisdictions such as Switzerland, the UAE, Singapore, Germany, and Hong Kong may be new windows for RWA participants.

Tokenization is the Endgame

Tokenization of all assets will eventually occur, the question is, what the catalyzing event is and when it happens? Market shifts often happen slowly, but falling behind by ignoring these signs is a risk. The standards and infrastructure of tomorrow are being built today. Additionally, the market needs a better term to describe "RWA," as TradFi refers to "RWA" as "risk-weighted assets," which may be confusing if TradFi is expected to enter the tokenization field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。