Written by: Zack Pokorny

Compiled by: DeepTech TechFlow

There are several different types of RWAs on the blockchain, each with its own characteristics, serving different use cases. While certain types of RWAs, such as stablecoins and tokenized gold, have been in existence for many years, other types of RWAs, such as US Treasury bonds, have recently emerged in the context of rising interest rates. This article will briefly outline the following types of income-type RWAs:

- Real estate

- Private credit

- Government bonds

Note: The following analysis focuses on these tokenized assets and their market value. This report does not include information about the underlying protocols for building RWAs (such as Ethereum, Polygon, Stellar, etc.) or auxiliary blockchain-native services that support RWA transactions and financial management. Additionally, the report does not involve stablecoins (which have the largest market share at $125 billion in value and the longest history of RWAs) in the charts and RWA TVL calculations, in order to avoid overshadowing the growth of smaller market value RWAs or underestimating the driving force of RWAs.

Integrating the Real World with the Digital World

RWAs are created by the issuer who completes one or more of the following activities:

- Acquiring assets in the real world

- Tokenizing these assets on the chain

- Distributing RWA tokens to on-chain users

Without issuers, whether they are centralized companies, decentralized protocols, or a combination of both, RWAs would not exist on the chain.

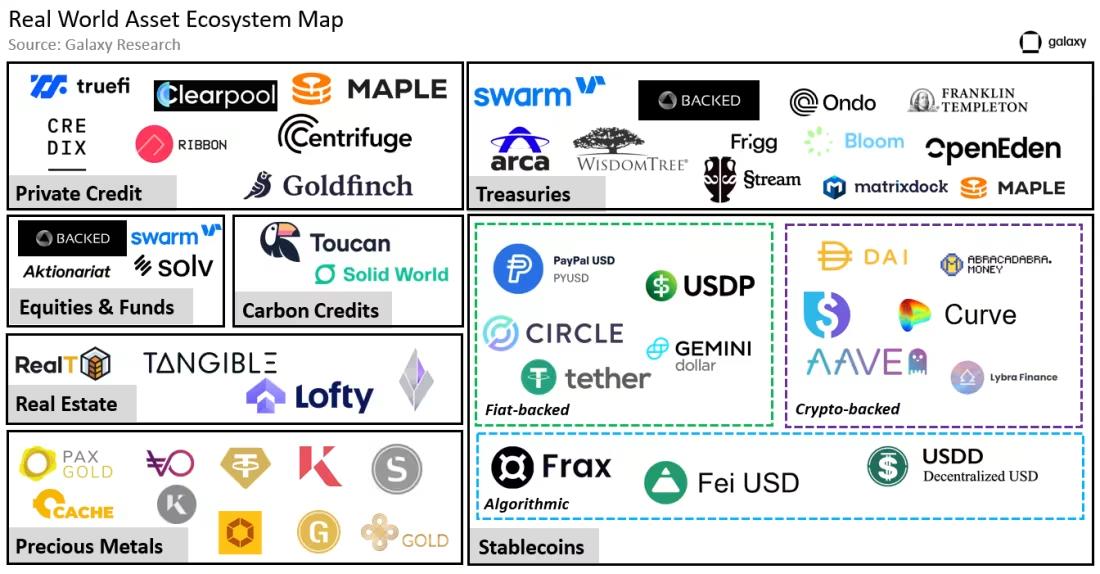

Some notable RWA issuers include:

- Centrifuge (active RWA value of $238 million) — the largest on-chain private credit issuer.

- Franklin Templeton (active RWA value of $310 million) — a traditional financial institution issuing tokenized government bonds.

- Wisdom Tree (active RWA value of $11 million) — an institutional capital market issuing treasury tracking funds.

This brief list, along with other issuers shown in the above image, highlights the situation of off-chain entities endorsing on-chain RWAs. Franklin Templeton and WisdomTree are two seasoned traditional financial companies whose primary businesses are unrelated to cryptocurrencies and blockchain technology. Franklin Templeton is a global investment firm with a 76-year history, providing mutual funds, ETFs, and other fund products to individuals and institutions. As a company, Franklin Templeton manages over 100 ETFs and mutual fund products with total assets under management of $1.5 trillion. WisdomTree is a global financial innovation company founded in 1985, offering diversified exchange-traded products (ETPs), models, and solutions. WisdomTree manages assets under management of $95.948 billion.

In recent years, Franklin Templeton and WisdomTree have begun to explore RWAs by tokenizing various traditional financial instruments such as tokenized equity funds and government bonds to meet the needs of institutional clients. Although this work is still in its early stages, the move by traditional financial companies to issue RWAs has the potential to catalyze a large number of new users who have never been exposed to on-chain cryptocurrencies.

Growth of Income-type RWAs

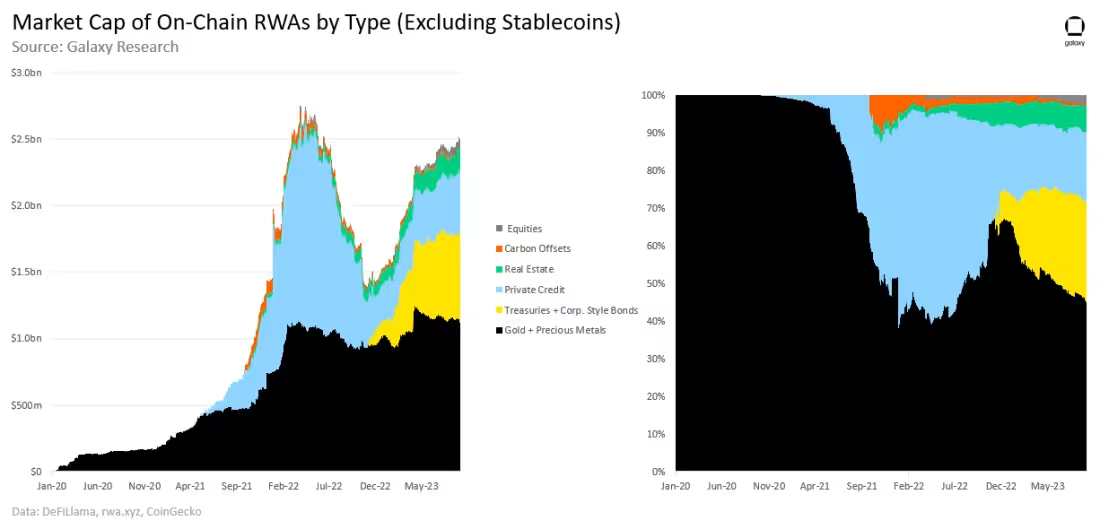

As of September 30, the market value of RWAs reached $2.49 billion, a 9.6% decrease from the peak value of $2.75 billion set on April 19. Despite strong growth in RWA related to government bonds, the active loans of private credit issuers have decreased significantly over the past 18 months, resulting in RWA market value falling below its all-time high.

From January 31 to September 30, the value of non-stablecoin RWAs increased by $1.05 billion. The additional growth of $855.7 million in the past three quarters came from government bonds and other bonds, real estate, and private credit.

Private Credit

Private credit is a form of lending provided by non-bank institutions. Since the 2008 financial crisis, banks have faced increasing regulations, leading to significant growth in the private credit market as borrowers seek alternative sources of capital. In the current interest rate cycle, this trend has further expanded, especially as bank balance sheets are constrained (as evidenced by bank failures earlier this year). Private credit solutions benefit both borrowers and lenders. It provides borrowers with the flexibility lacking in bank loans, and its floating interest rates offer lenders rate protection not available with fixed-rate alternatives. As of August 2023, the global private credit loan market is valued at $15 trillion.

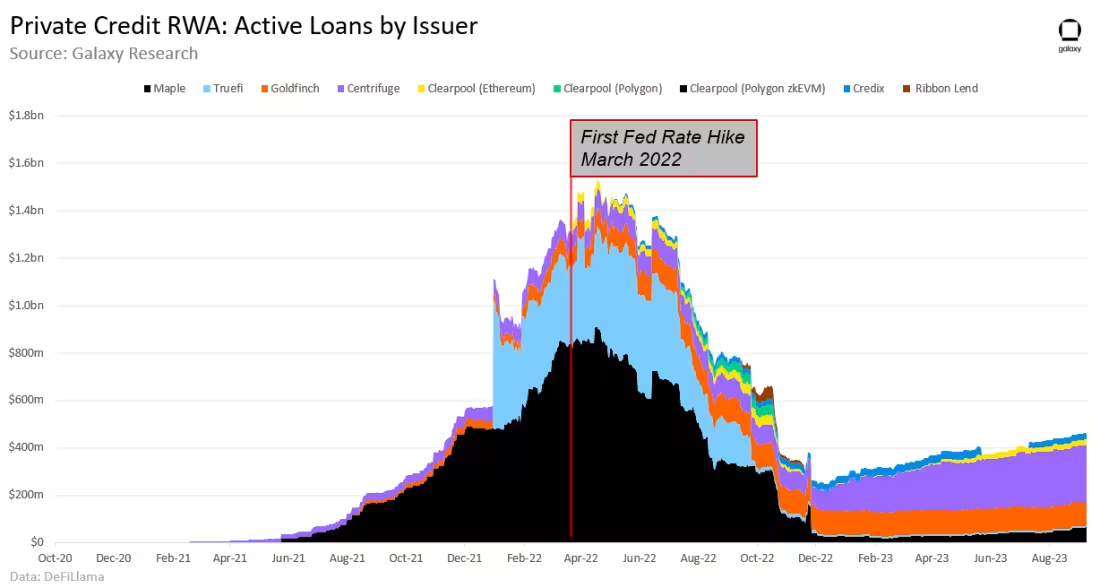

From January 1 to September 30, the active value of on-chain private credit loans increased by $210.5 million (84% growth). The majority of the growth (74%) came from Centrifuge, with its outstanding loan balance increasing by $155.7 million. Clearpool, a decentralized credit market, experienced the largest relative change over the past three quarters. From January 1 to September 30, the platform's loan balance increased by 966%, reaching $23.96 million by September 30. Clearpool has issued over $400 million in private credit loans on three chains (Polygon, Polygon zkEVM, and Ethereum) over its lifetime.

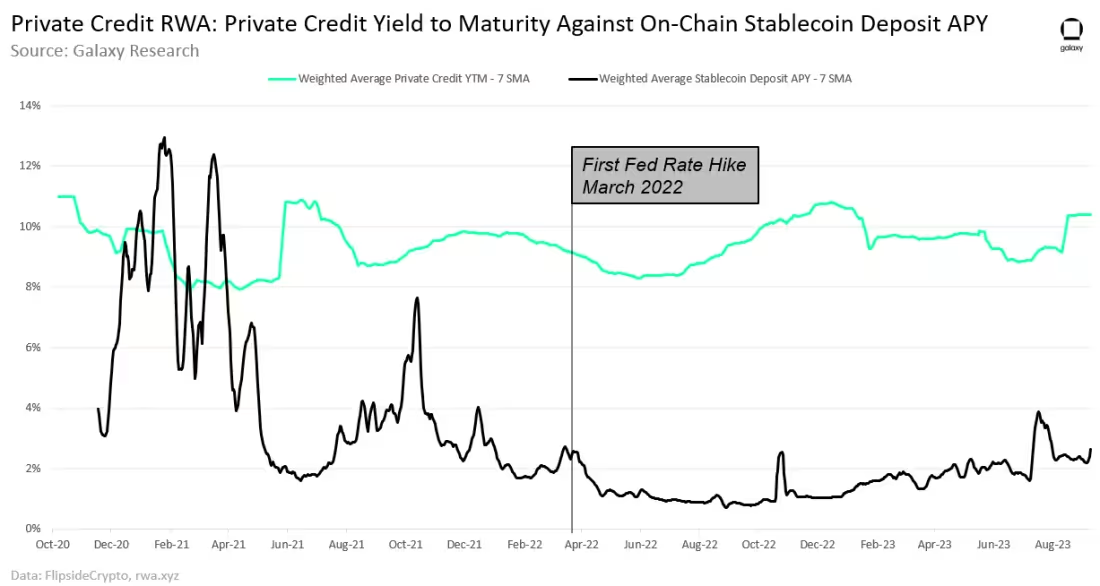

Despite the growth in 2023, the total value of on-chain private credit loans represented is still 70% lower than the historical peak of $1.54 billion reached in May 2022. As the Federal Reserve significantly raised interest rates, active loans decreased significantly, and the yield to maturity increased in the nine months following the first rate hike in March 2022.

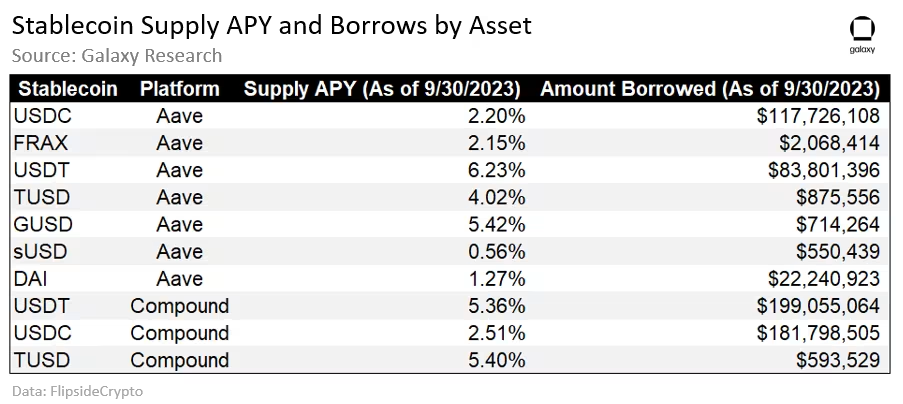

Users can earn significantly higher returns on on-chain private credit loans by depositing stablecoins compared to using stablecoins on DeFi lending protocols such as Aave and Compound. From January 1 to September 30, the average daily interest rate differential between tokenized returns on on-chain private credit loans and the weighted average supply rate of stablecoins on Aave and Compound was 7.7%. The stablecoin deposit rate is calculated based on the weighted average amount borrowed on Aave and Compound.

It is worth noting that there are different risk profiles when depositing stablecoins into decentralized lending protocols like Aave and Compound compared to depositing into platforms like Centrifuge and Clearpool that offer tokenized real-world private credit loans. Most loans on decentralized lending protocols are overcollateralized, while tokens for private credit loans may not be.

Real Estate

Real estate is a tangible asset class that includes properties such as residential, commercial buildings, and land. Real estate is particularly attractive to investors because of its potential for positive cash flow through passive income streams such as rent. In 2023, real estate is the largest asset class in the world, valued at approximately $613 trillion.

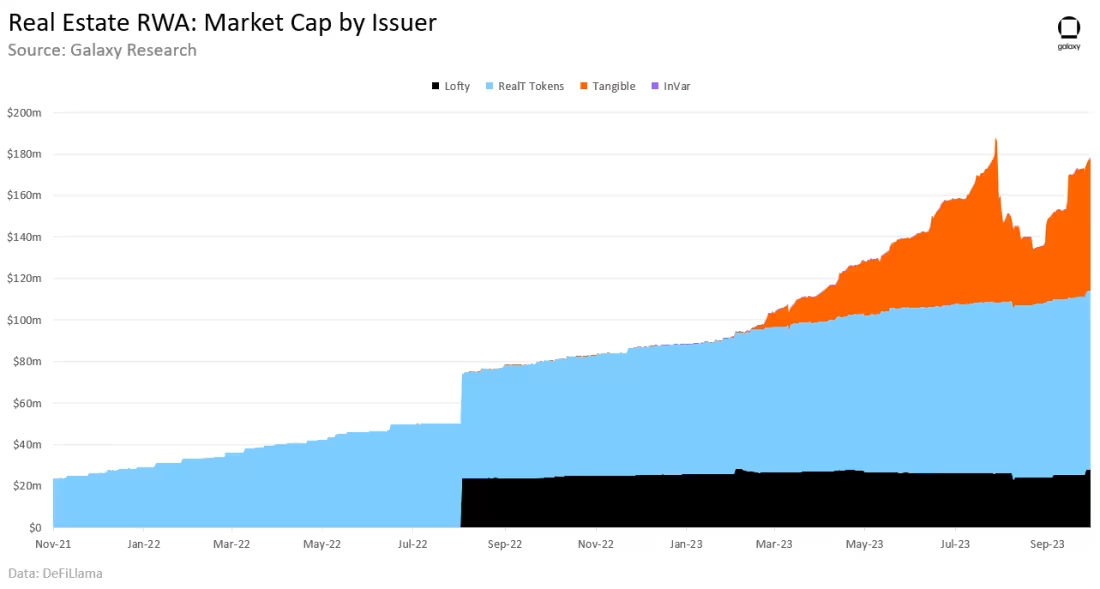

Among all income-generating RWA categories covered in this report, tokenized real estate saw the least growth in value in USD. From January 1 to September 30, the total value of these tokenized assets was $178 million, representing ownership shares in real estate in some cases. RealT tokens are the largest issuer of tokenized real estate, holding a 49% market share. Tangible is another key RWA issuer focused on real estate, showing the strongest growth this year. The total locked value of Tangible tokens increased from $100,000 to $64 million in the first three quarters of 2023.

Government Bonds and Other Bonds

US Treasury bonds are debt securities guaranteed by the government. They are widely considered the safest and most reliable income asset type, known as "risk-free" (with the caveat that the risk is the US government defaulting). In contrast, corporate bonds are debt securities issued by companies, offering potentially higher returns but also greater risks than government bonds. In 2022, the global bond market was valued at $133 trillion, with US companies alone issuing $10.2 trillion in corporate bonds in the first three quarters of 2023.

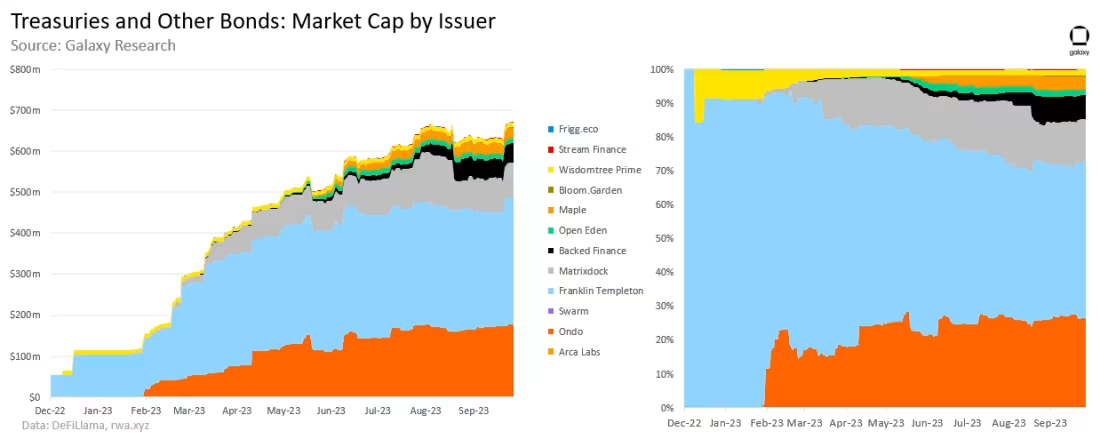

The value of tokenized government bonds and other bonds increased by $557.05 million from January 1 to September 30. Ondo Finance, Franklin Templeton, and Matrixdock are the top 3 government bond RWA issuers. Together, they issued $572.05 million in assets (accounting for 85% of the tokenized government bonds and other bonds category) and issued $468.5 million in government bond RWAs this year.

Frigg.eco, unlike other issuers in this category, issues bonds related to sustainable infrastructure development. These instruments are more like corporate bonds rather than government bond RWAs issued by other parties. The bonds issued by Frigg.eco allow token holders to earn returns by providing funding for development and allow developers to issue debt to fund their initiatives.

Another tokenized government bond asset with a market value of approximately $1.8 billion is stUSDT. stUSDT is the first RWA project launched on the Tron network. Recently, this asset has been criticized for its lack of transparency in support and revenue sources.

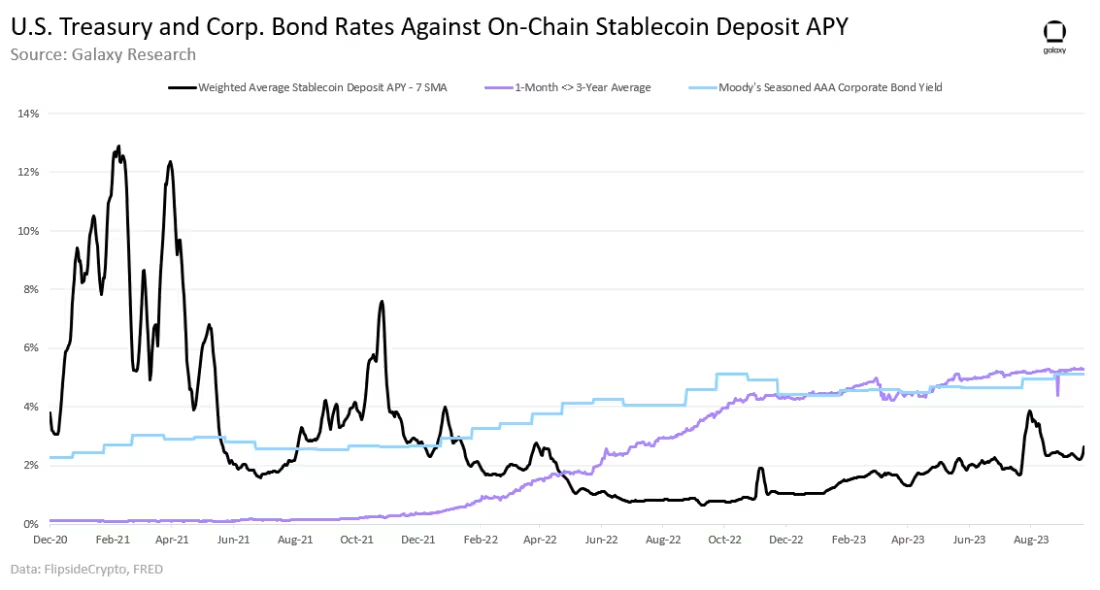

Over the past 18 months, the average yield to maturity of US Treasury bonds (the most widely used maturity on-chain) with a term of less than 3 years has consistently been higher than the average yield on stablecoin deposits. In 2023, the average interest rate differential between these bonds and the weighted average stablecoin interest rates on Aave and Compound was approximately 3% (bond rate - on-chain rate). In comparison, the average spread between the yield on Moody's AAA-rated corporate bonds and on-chain stablecoin rates was 2.7% (bond rate - on-chain rate).

Outlook

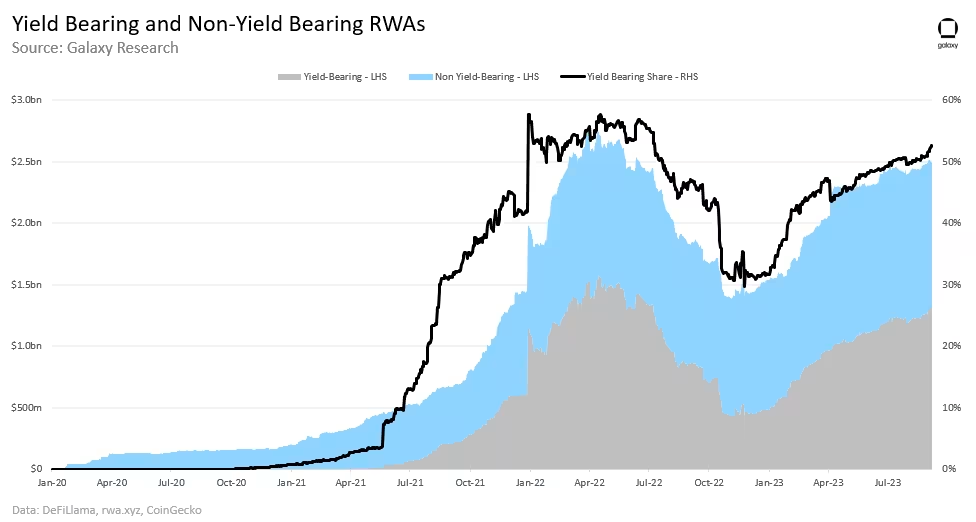

The demand for income from native cryptocurrency users has driven the growth of on-chain RWAs. Approximately 82% of the new value created in the RWA space this year comes from income-generating RWAs such as tokenized private credit, real estate, and government bonds. The share of income-type RWAs in the total RWA market value nearly doubled from 31% on January 1 to 53% on September 30 (4% away from the historical high of 57%).

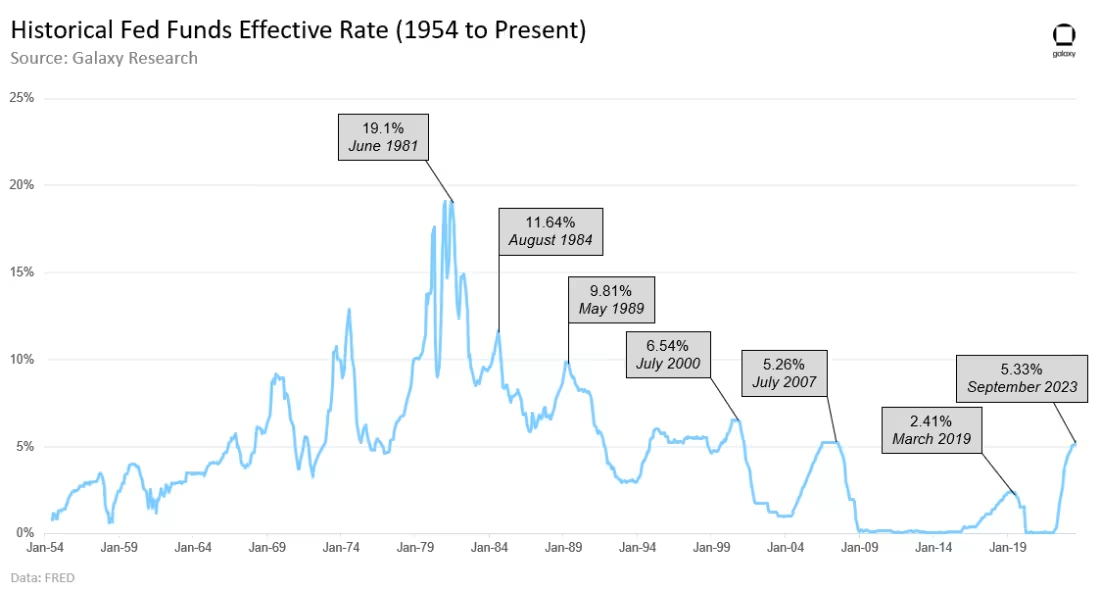

The proactive shift in monetary policy by the Federal Reserve has raised benchmark interest rates to levels not seen since 2007. This has created new demand for RWAs from native decentralized finance users seeking higher returns.

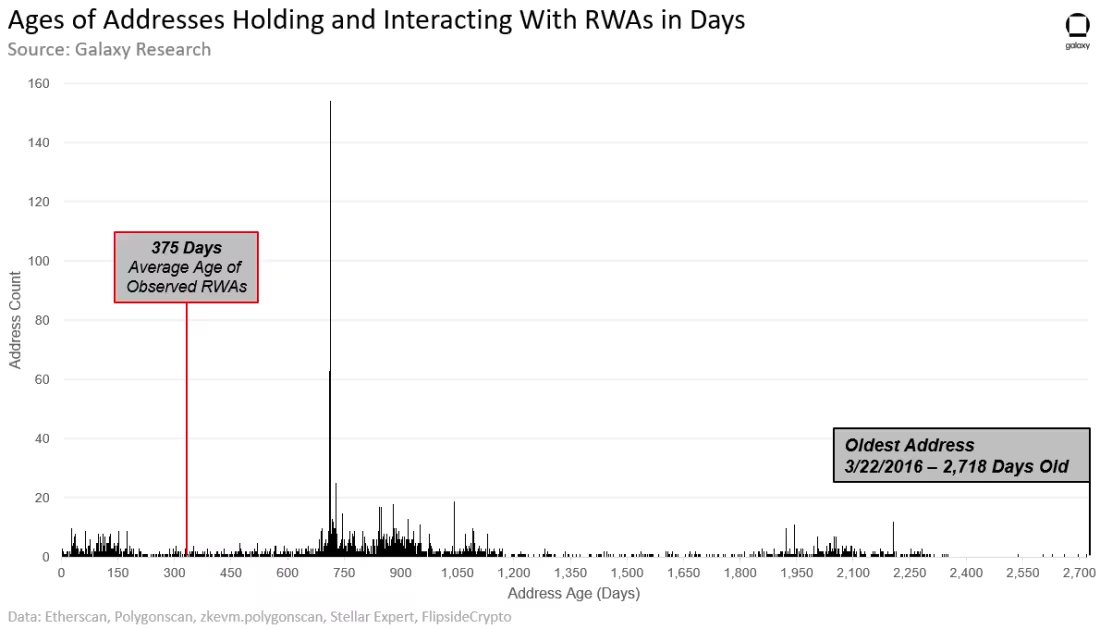

Most RWA Users are Native Cryptocurrency Users

The majority of on-chain RWA demand comes from a small number of native cryptocurrency users, rather than new cryptocurrency adopters or traditional investors. The average age of the user address interacting with RWA tokens is older than the creation time of these assets on-chain, highlighting that the average RWA holder has been transacting on-chain for some time.

The chart below shows the age of unique user addresses holding RWA tokens issued by the following companies and protocols. These assets collectively represent nearly 70% of the income RWA TVL:

- Ondo (OUSG)

- Matrixdock (STBT)

- Maple (MPLcashUSDT and MPLcashUSDC)

- Open Eden (TBILL)

- Backed (bIB01 and bIBTA)

- Arca Labs (RCOIN)

- WisdomTree (WSTY)

- Swarm (TBONDS13 and TBONDS01)

- Stream Finance (US4W)

- Bloom (TBY-Feb1924, TBY-mar24(a), and TBY-mar24(b))

- Franklin Templeton (FOBXX).

Note: The snapshot of these asset holders was taken on August 31, 2023. Therefore, the age of the address is calculated as the number of days between the first on-chain transaction of the address and August 31, 2023. User addresses holding multiple RWAs are counted once. Multiple addresses identified as controlled by a single user are also counted once, using their earliest transaction. The data tracks the age of all on-chain addresses where these assets were issued, including Ethereum, Stellar, and Polygon. The following data also shows the age of user addresses representing tokenized private credit issued by the following three protocols:

- Clearpool on Ethereum and Polygon zkEVM

- Maple on Ethereum

- Goldfinch.

As of August 31, 2023, a total of 3232 unique addresses hold RWA assets issued by the mentioned companies and protocols. The average age of addresses holding and interacting with RWAs is 882 days, or 2.42 years. This means that the average address has been transacting on-chain since April 2021. In comparison, the average age of RWA assets is 375 days. For tokenized government bond assets, the age of these RWAs is calculated as the number of days between the first token minting date and August 31, 2023. For assets issued by private credit platforms such as Clearpool, Maple, and Goldfinch, the age is calculated based on the number of days from the protocol launch date to August 31, 2023. Using the protocol launch as the starting date for the age of private credit RWA assets compensates for the rolling nature of on-chain private credit (i.e., loan maturity/pool closure, new loans opening).

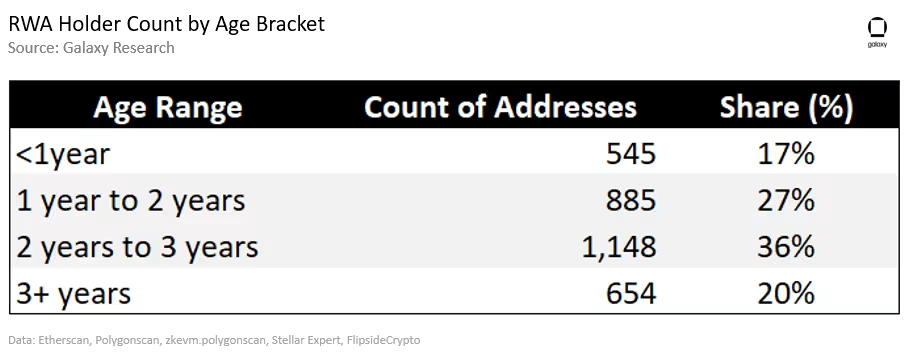

20% of the addresses interacting with or holding the mentioned RWAs have been transacting on-chain since 2023 and over three years before the rise of RWA assets on-chain. The table below summarizes the age range of user addresses holding RWAs as of August 31, 2023:

Many of the RWA holders who executed their first transaction less than a year ago, as highlighted above, are holders of assets issued by Franklin Templeton and WisdomTree (34%, 188 addresses). This indicates that RWA products created by established financial firms may be successfully attracting new user groups into the crypto space, although the majority of RWA users still appear to be native crypto users.

RWAs Signify Real-World Risks and Limitations

While many RWAs are issued on public blockchains, they do not provide users with unrestricted access to financial products and services. In most cases, users interacting with RWAs on-chain need to undergo KYC/AML or whitelist verification, credit checks, and may need to meet minimum balance requirements to mint, purchase, deposit, and/or redeem RWAs. RWAs are subject to similar or, in some cases, more restrictions than their traditional financial counterparts. This means that RWAs are not expanding access to financial instruments by enabling individuals to participate in financial activities they would not otherwise have access to.

Additionally, RWAs carry unique risks beyond the technical risks associated with all on-chain applications and services. For example, since private credit lending is unsecured in some cases in traditional finance, the tokenized representation of private credit loans must also reflect this reality. If an off-chain borrower defaults on their loan, on-chain depositors may lose funds. To mitigate such risks on-chain, RWA private credit issuers must find ways to transfer within the risk/reward range of loans and review new loans through transparent governance processes of decentralized autonomous organizations (DAOs).

Critical Importance of Federal Reserve Policy

The actions of the Federal Reserve have significantly driven the prevalence of RWAs this year. As interest rates rise, off-chain yields become more attractive to on-chain users. Additionally, with rising interest rates, the most valuable types of RWAs have also changed. For example, in the second quarter of 2022, private credit-backed RWAs accounted for 56% of the total RWA TVL, while US Treasury bond-backed RWAs accounted for 0%. In the third quarter of 2023, the share of private credit-backed RWAs in the total RWA TVL decreased to 18%, while the share of US Treasury bond-backed RWAs increased to 27%. Federal Reserve policy is a driving force in influencing the expansion and positioning of RWA DeFi in the field.

Conclusion

The growth of RWAs and the introduction of new types of RWAs on-chain are primarily driven by the demand of native crypto users, rather than new crypto adopters. However, the adoption of RWAs by major traditional financial firms such as Franklin Templeton and WisdomTree demonstrates the potential of this emerging DeFi sector to attract future new users. RWAs are gaining strong momentum in 2023, with the market value of many such assets trending towards new historical highs. The evolving macro environment will continue to impact the development of this sector, and the sustained demand for these assets from both native and non-native crypto users will also do so.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。