Informed sources indicate that any unilateral demands from the U.S. that undermine the EU's autonomy in regulatory and tax matters will remain a "red line."

Written by: Zhu Xueying, Wall Street Insights

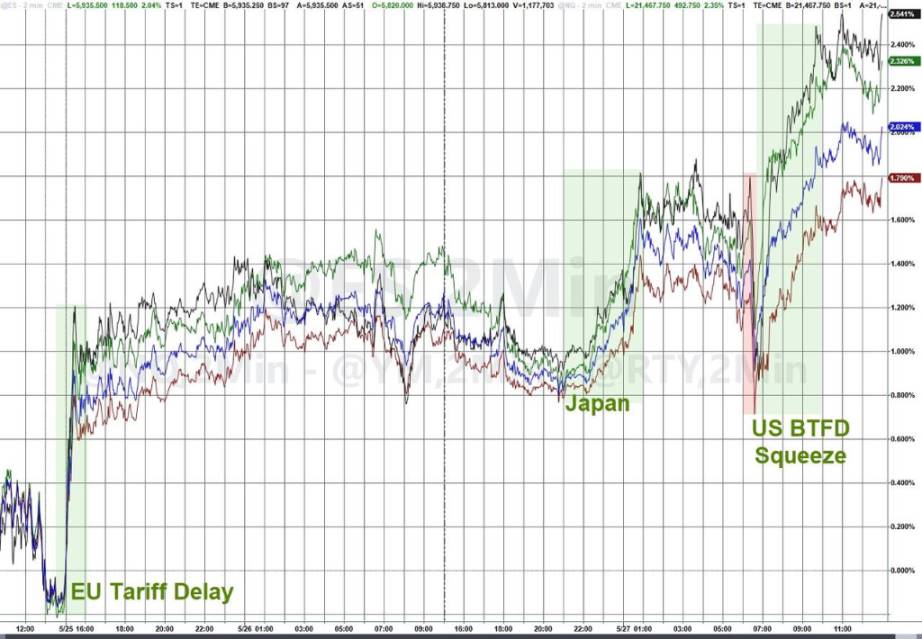

When Trump began to praise the EU, which he had previously referred to as "taking advantage of the U.S.," investors sensed a dramatic shift in direction—from a 50% threat of devastating tariffs to a deadline of July 9. This trade game is being pulled back from the brink at an astonishing speed. As a result, U.S. stocks surged, with the S&P 500, Nasdaq, and Russell small-cap stocks soaring over 2% at one point, as the market seemed to bet that Trump would once again concede under pressure from the financial markets.

However, reports indicate that many EU officials and member states still believe that some of Trump's tariffs will persist in the long term, and the likelihood of reaching an ideal agreement remains slim. Informed sources state that any unilateral demands from the U.S. that undermine the EU's autonomy in regulatory and tax matters will remain a "red line."

German Finance Minister Lars Klingbeil stated in Berlin on Monday, "We now need quick solutions." He added that he was "cautiously optimistic" about reaching an agreement but emphasized that the EU must respond to U.S. tariff threats in a united, coordinated, and consistent manner.

Dramatic Reversal in Five Days

This thaw in trade relations occurred in just five days.

According to CCTV News, on Friday, May 23, local time, U.S. President Trump stated on social media that he proposed imposing a 50% tariff on the EU starting June 1. According to Xinhua News Agency, on the 25th, Trump said that after a phone call with European Commission President Ursula von der Leyen, he agreed to delay the start date for the 50% tariff on the EU from June 1 to July 9. Von der Leyen had earlier posted on social media X that she had a "good call" with Trump but noted, "To reach a good agreement, we need time, until July 9." She stated that the EU is ready to "swiftly and decisively" advance negotiations with the U.S.

In response to Trump's latest remarks, the EU has developed a "new approach" and quickly adjusted its strategic focus. According to informed sources, the European Commission will concentrate its new trade strategy on key sectors such as metals, automobiles, pharmaceuticals, semiconductors, and civilian aircraft—industries that have already suffered or are facing U.S. tariff threats. Additionally, the EU will continue to work on addressing tariff and non-tariff barrier issues.

The Real Dilemma Behind the Negotiations

Despite the apparent easing, the prospects for negotiations remain full of uncertainties. According to media reports, U.S. trade deficit data shows that the trade deficit between the U.S. and EU has doubled this year, primarily driven by a pre-import effect—companies stockpiling goods before tariffs take effect.

The proposal put forward by the EU last week was rejected by the U.S., which included mutual reductions in tariffs on various goods and cooperation on global challenges and joint investments, after which Trump threatened to further increase tariffs.

Countermeasures Ready to Go

The EU is not unprepared. According to media reports, the EU has approved retaliatory tariffs on U.S. goods worth €21 billion ($23.8 billion), which can be implemented immediately, and these tariffs specifically target politically sensitive states.

In addition, the EU is preparing an additional tariff list covering €95 billion worth of U.S. products, targeting industrial goods such as Boeing aircraft, U.S.-made cars, and bourbon whiskey.

The market may be pleased with the temporary easing, but the core logic of Trump's trade game remains unchanged: threats, concessions, and further threats. Whether the six-week window can resolve this transatlantic trade crisis may not be answered until July 9.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。