Written by: Loopy, Odaily Planet Daily

Yesterday, the disclosure of a court document allowed us to catch a glimpse of the internal chat of a multi-billion-dollar financial empire.

SEC court documents revealed a Slack chat process that took place in 2019, with the conversation between Terraform Labs founder Do Kwon and another co-founder, Daniel Chin, the founder of the payment application Chai.

The content shows that Do Kwon almost bluntly admitted that they falsified trading volume. In addition to this, there are more explosive "revelations," including criticisms of peers and disdain for retail investors. The most shocking revelation is the admission of pre-mining 1 billion stablecoins. Odaily Planet Daily takes you into the moment, quickly reviewing what Do Kwon said.

"We can create seemingly real trades"

In the court document, the most striking statement is Do Kwon's description of falsifying trades.

Do Kwon told Chin, "I can create seemingly real fake trades… this will incur costs." Chin asked, "What if people find out it's fake?" to which Do Kwon replied, "You don't say, and I won't say."

In 2019, Terra announced a partnership with Chai, aimed at simplifying payment systems through blockchain and providing transaction fees to merchants at a discounted rate. According to the official statement, this partnership was expected to help the Terra network process "hundreds of millions or even billions of transactions."

However, the SEC wrote in the document that Chai did not use the Terra chain to process and settle payments. Instead, they continued to make payments through traditional means and replicated fake transactions on the Terra chain to create the appearance of a large volume of Terra payments.

Daniel Shin expressed some doubts about this, asking, "Won't people find out it's fake?"

Do Kwon replied, "So I will try to make it difficult to distinguish."

Daniel Shin agreed, saying, "Okay, let's conduct a small-scale test. See what happens."

Interestingly, in addition to falsifying trades, their chat also included more interesting content, involving both the Terra project itself and gossip about other industry players.

"The gem on the crown"

In the chat, Do Kwon made a seemingly not very positive side comment about Terra (without explicitly stating it).

Regarding the staking rate, he commented, "Only those who believe Terra is the gem on the crown (Hashed, 1kx) and those managing staking businesses (polychain) would stake."

Diluting financing?

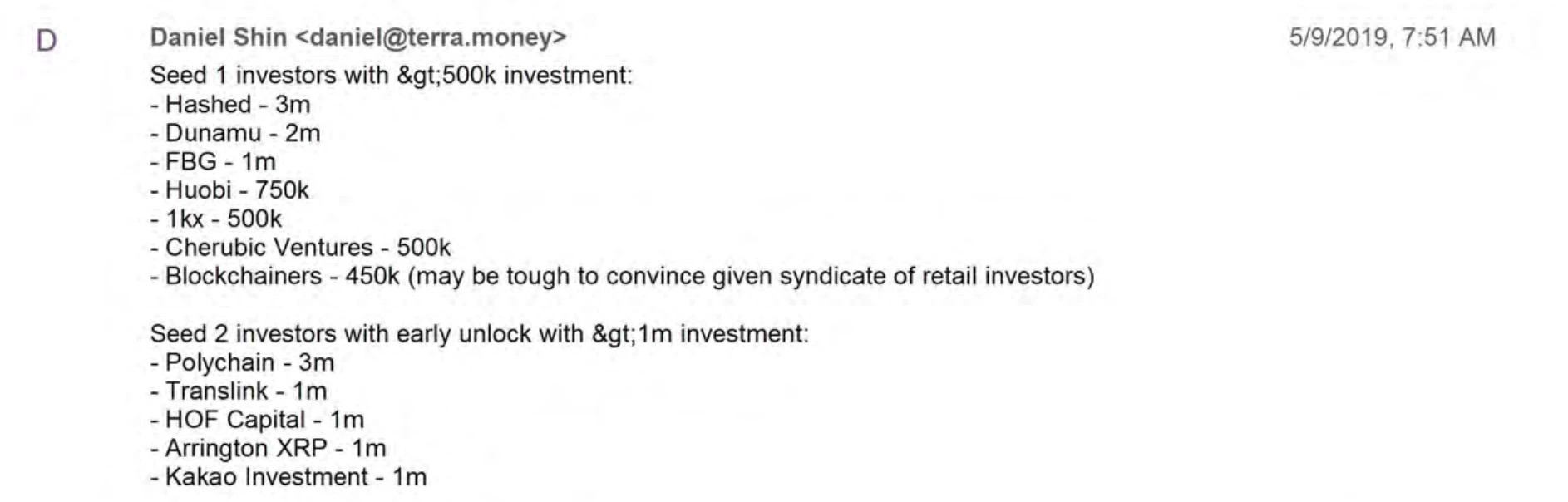

In the chat, Daniel Shin listed the large investors in Terra's Seed1 and Seed2 financing rounds.

From the data, the total investment by large investors in the two rounds was about $15 million. Although the number of small investors was not disclosed, publicly available information shows that there were not many small investors, only about a dozen. Therefore, it is speculated that Terra's seed round financing should be slightly over $15 million but far from significantly exceeding that level.

However, Terra's disclosed public relations statement shows that the project's seed round financing reached $32 million. At present, this data may be significantly diluted.

"Upbit lists all the junk coins"

In their discussion, Do Kwon mentioned a project called Thunder that was launching on Upbit. Daniel was not familiar with this project and directly asked, "What is Thunder?"

Do Kwon succinctly replied to him—Berkeley professor Elaine Shi's shitcoin.

He continued to complain, "What's wrong with Upbit?… All the junk coins in the world are listed on Upbit, but not ours."

"I pre-mined 1 billion stablecoins"

Although Terra's most famous stablecoin is the well-known U.S. dollar stablecoin UST, it is not the only one. The Terra ecosystem hosts a wide variety of stablecoins, including U.S. dollar stablecoins, Korean won stablecoins, Mongolian tugrik stablecoins, and more.

The most special among them is TerraSDT, where SDT is a stablecoin pegged to the IMF's Special Drawing Rights (SDR), with 1SDT being stable at 1SDR in value.

Even more astonishing, Do Kwon stated, "I pre-mined 1 billion SDT for ourselves."

In the chat, Do Kwon candidly admitted that Terra's value was somewhat inflated. "As you said, it's now difficult to prove that a $3 billion valuation is reasonable, no matter how much of this story (referring to Terra's narrative) is accepted."

Conclusion

Chai is a company closely related to Terra. The company was founded in mid-2019 and shared offices and employees with Terraform until the two companies split in 2020.

Currently, Do Kwon's legal team has refuted the Slack chat records being used as evidence. His legal team claims, "The U.S. SEC has distorted evidence in a procedural motion, attempting to harm Mr. Do Kwon's interests, and this motion has nothing to do with the truth of the U.S. SEC." "This relies on false statements of irrelevant evidence to support its false claims that it cannot obtain evidence from Mr. Do Kwon."

At the same time, Do Kwon is being detained in Montenegro, and his lawyers are pushing the U.S. federal court to reject the SEC's request to extradite him to the United States.

Currently, this case is still in a lengthy judicial process, and the final outcome is still unknown.

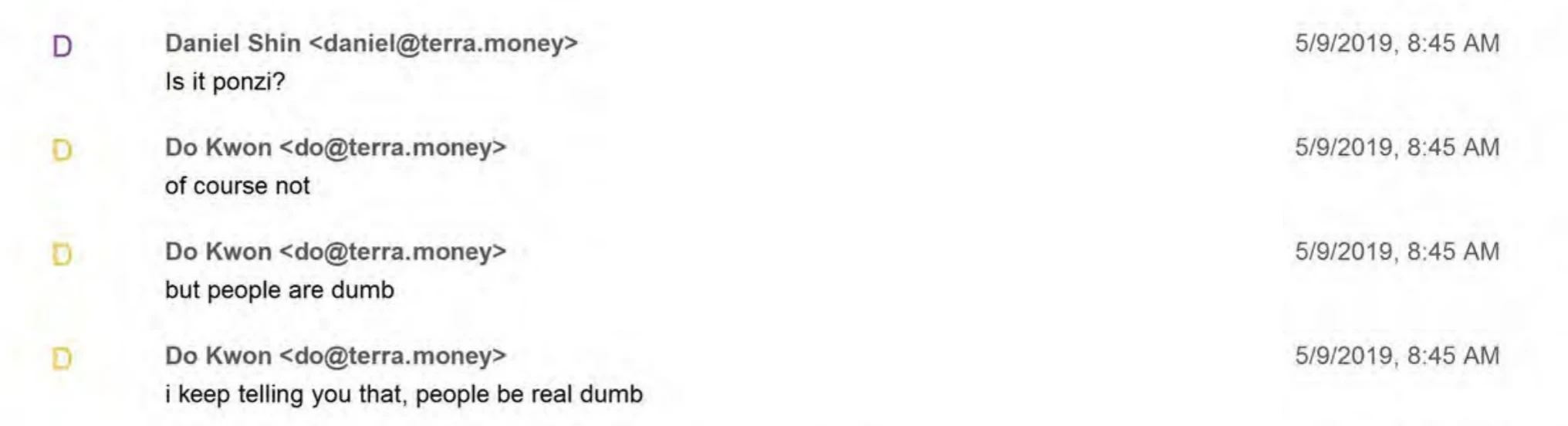

Daniel once asked Do Kwon a soul-searching question, "Is this a Ponzi scheme?"

Kwon replied, "Of course not, but the public is stupid, I've been telling you, the public is really stupid."

Kwon replied, "Of course not, but the public is stupid, I've been telling you, the public is really stupid."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。