Author: Nan Zhi

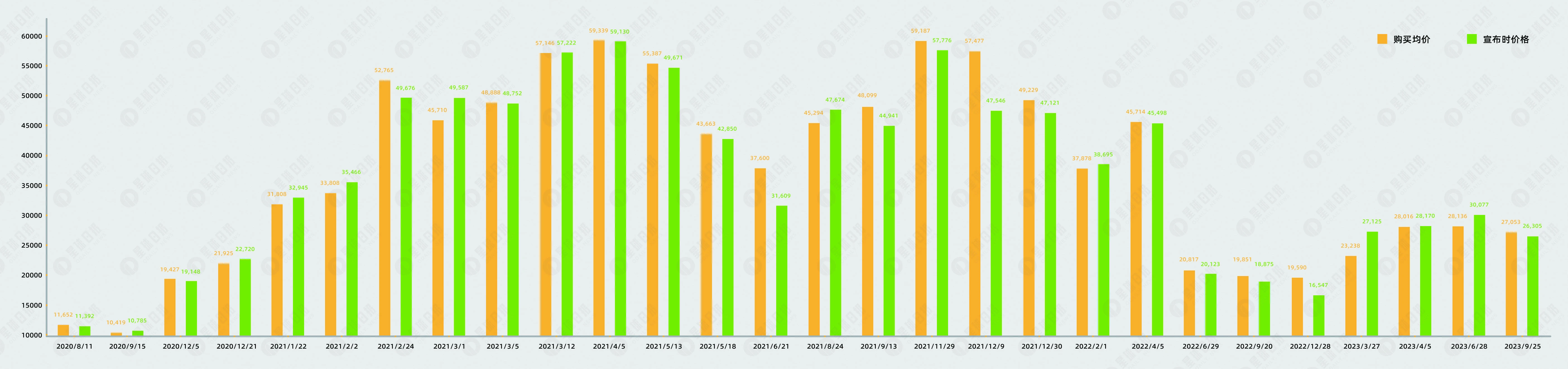

From August 2020 to the present, MicroStrategy has announced 28 BTC purchases, accumulating a total of 158,245 bitcoins with an average holding price of 29,582 USDT.

Every time a purchase is announced, the following voices often appear on social media:

① The average purchase price of MicroStrategy is higher than the market price at the time of announcement (multiple sets of rescue); ② Once MicroStrategy announces the purchase of BTC, the market is about to start falling.

This article reviews the 28 BTC purchases by MicroStrategy to explore whether there is a certain connection between MicroStrategy's announcement of purchasing BTC and the market price.

MicroStrategy Official Announcement Price Difference Analysis

The price situation of MicroStrategy's 28 BTC purchases is as follows, showing a significant price difference between the "market price at the time of announcement" and the "purchase price."

The proportion of "market price at the time of announcement" being higher than the "purchase price" is 60.7%, with a mean price difference of -1.43%, indicating that there is a certain tendency for MicroStrategy to announce a purchase after an average 1.43% decline.

The specific situation of price difference (absolute value) is as follows:

- 50% of the price difference is within 1000 USDT;

- 39% of the price difference is between 1000 USDT and 5000 USDT;

- There are also three instances of price differences exceeding 5000 USDT, which are -5716 USDT, -5991 USDT, and -9931 USDT, respectively.

When measured by price difference rate, the conclusion is even more significant:

- 25% of the price difference rate falls within the 0%-2% range;

- 39% of the price difference rate falls within the 2%-5% range;

- 21% of the price difference rate falls within the 5%-15% range;

- There are 4 instances of price difference rate exceeding 15%, which are -15.53%, -15.93%, 16.73%, and -17.28%.

MicroStrategy Official Announcement Market Analysis

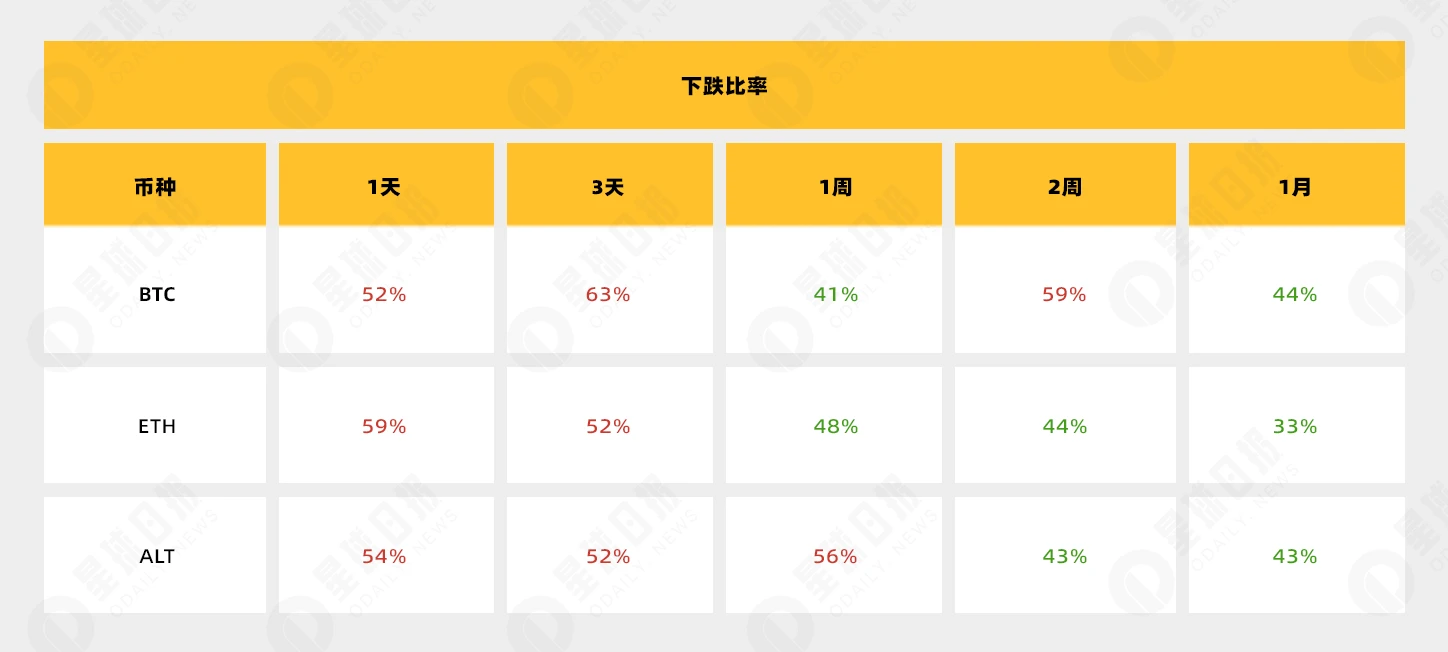

An analysis of the market situation in various time periods after MicroStrategy's official announcement, excluding the purchase on September 25, is as follows:

- Time: Comparisons are made over different time frames such as 1 day, 3 days, 1 week, 2 weeks, and 1 month;

- Market: The average values of BTC, ETH, and mainstream altcoins (the top 20 non-stablecoins by CoinGecko market value, including BNB, XRP, ADA, DOGE, SOL, TRX, DOT, MATIC, LTC, BCH, LINK);

- Price: Based on the closing price of each time period.

The comprehensive results are shown in the table below:

It can be seen that the statement "Once MicroStrategy announces the purchase of BTC, the market is about to start falling" is not groundless. In the short term, all three types of markets tend to decline, but the probability of an uptrend begins to rise one week later, with the pattern being most pronounced in the ETH market.

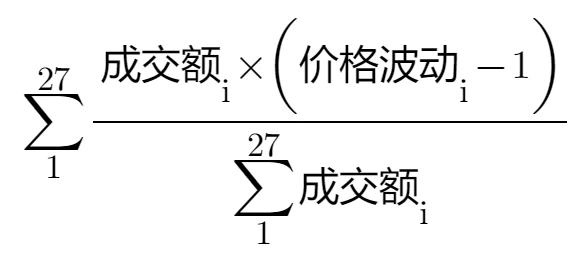

On the other hand, the amount (or value) of MicroStrategy's purchases varies each time. Calculating with the amount as a weight can better highlight MicroStrategy's judgment, with the calculation formula as follows:

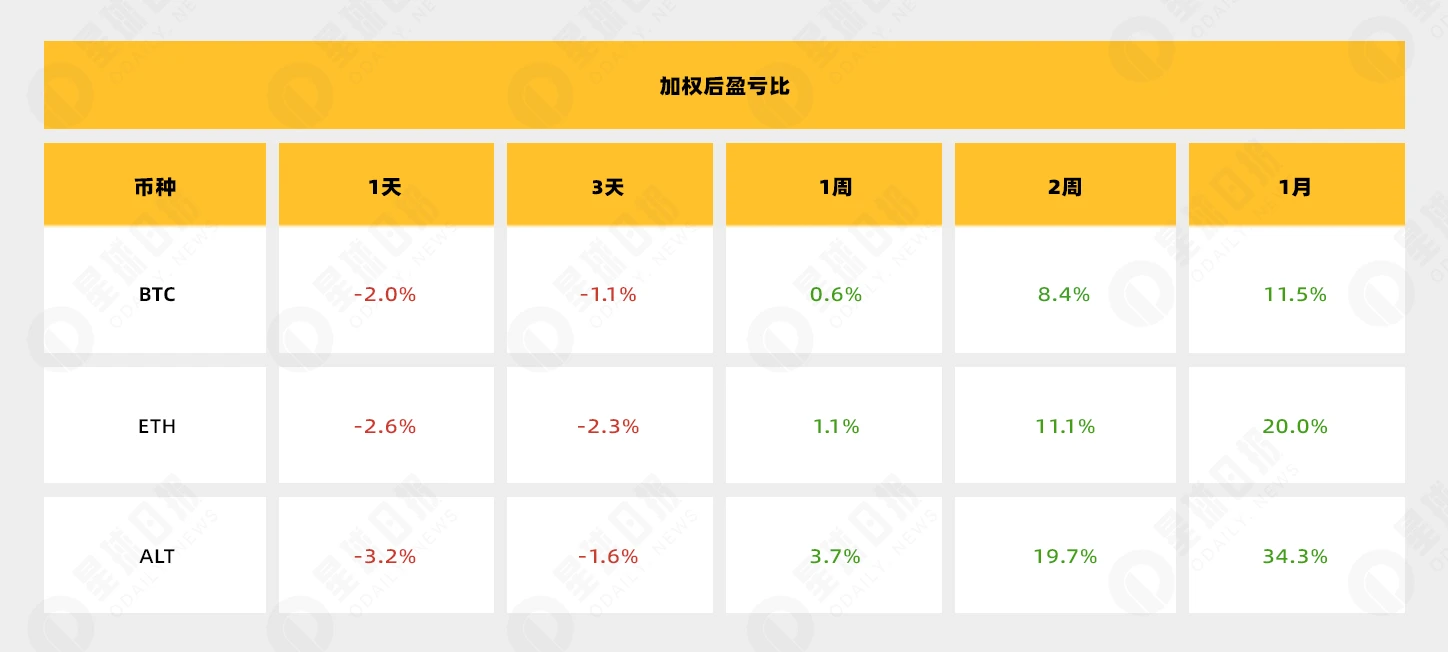

The weighted calculation results are as follows. The situation of decline in the first three days remains unchanged, but the magnitude has decreased, and the profit-loss ratio thereafter has increased significantly, indicating that when MicroStrategy doubles down, the probability of a long-term uptrend is higher.

Conclusion

The two rules about MicroStrategy in the market summarized by the statistics do indeed match the results. As the first Nasdaq-listed company to purchase Bitcoin, MicroStrategy had established most of its positions in BTC by the end of 2020, with considerable unrealized gains. Although it has only sold Bitcoin once to date, it has proven its confidence in the bull market through its positions, despite its short-term contrarian nature.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。