Celestia airdrop coverage is relatively widespread; the debate over whether the Mixin theft incident is a black rhinoceros or a black swan event is also heated.

Author: Frank, Foresight News

Graphics: Kiet, Foresight News

Note: "Weekly Hot Search" statistics are based on user search results from Foresight News from last Friday to this Friday (September 22 to September 28), and the capitalization of the same concept has been merged.

The modular blockchain "Celestia" made it to the top of the list this week, mainly due to the launch of the Genesis Drop airdrop (recommended reading: "Quick Read: Celestia Token Economics and Airdrop Rules"), making it one of the few star projects with an airdrop in recent times.

The native token TIA of Celestia has a total supply of 1 billion, with 7.4% allocated for the Genesis airdrop and incentive testnet distribution. The Genesis airdrop targets 7579 developers and 576,653 on-chain addresses on Ethereum Rollups, Cosmos Hub, and Osmosis. The airdrop covers developers, ecosystem project contributors, regular users, and stakers.

Especially for developers and Ethereum Rollups users, as a heavyweight project in the Cosmos universe, Celestia's airdrop rules' coverage (not to mention the quantity) seems to be quite widespread.

Following closely, "Mixin" experienced a rather bizarre theft incident this week. Mixin Network's cloud service provider database was hacked, resulting in the loss of some assets on the mainnet. The initially reported amount involved was as high as $200 million, and most of the damaged assets were primarily in Bitcoin, making it one of the most serious security incidents in recent times (recommended timeline reading: "Stolen $200 million, Mixin's ongoing turmoil").

The concept of "cloud service provider data," which is somewhat counterintuitive to blockchain, coupled with the intricate connections between Mixin Network and individuals such as Li Xiaolai, has led to various speculations and debates about whether this theft incident is a black rhinoceros or a black swan event.

Regardless of the truth, the profile of the victims of this security incident is almost exclusively long-term Bitcoin investors, which is quite tragic. Furthermore, with no specific progress in the recovery of the stolen assets by Mixin, the swift announcement of "compensating up to 50% of the losses, with the remaining portion compensated in the form of bond tokens and using profits for repurchase" has intensified various market doubts (recommended reading: "Stolen $200 million, digging deep into the Mixin saga").

As of the time of writing, Mixin has stated that it has completed most of the asset inventory work, and the situation is much more optimistic than expected. The proportion of compensation that users can receive is: Bitcoin (90%), Ethereum (30%), ERC-20 format USDT (10%), with the highest compensation ratio for Bitcoin, which suffered the most severe losses.

Overall, the feeling about this incident is "sudden" — it happened quickly, and it seems eager to conclude as soon as possible. The subsequent developments are worth continuous monitoring.

In addition, "Maverick" in the top three did not have any particularly significant project developments this week; the LSD derivative track projects "LBR" and "Raft" continued to be on the list, once again indicating the continuous rise in the popularity of this track.

The migration deadline for Lybra V1 is also approaching — 8:00 on October 1st, Beijing time. Any V1 LBR that is not migrated before the deadline will be permanently destroyed from the circulating supply. Currently, the TVL of Lybra Finance V2 has rapidly surged to $180 million, with a total TVL of $220 million. As long as the secondary market price is not considered, everything seems to be thriving.

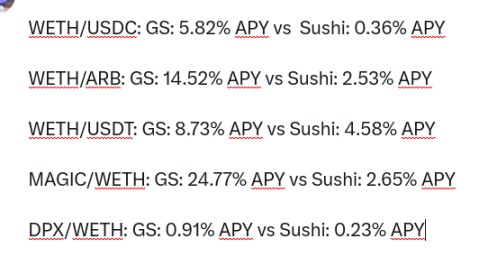

Interestingly, the performance of the familiar face "Gamma Swap" in recent weeks has been decent. Sushi LP obtained through GammaSwap earns more than direct Sushi LP without incentive measures. In the past 24 hours, the income from Sushi LP obtained through GammaSwap has exceeded that of direct Sushi LP.

"Gamma.io", "Pulse Chain", and "Raiser" did not have any particularly significant project developments this week.

The discussion heat of the Telegram bot track, represented by "Unibot", remains high, and Unibot has quickly launched the FriendTech Snipers bot for "friend.tech", supporting two modes: user sniping and automatic sniping. In this competitive field, being fast means everything — understanding user needs quickly and launching products even faster.

With the news of a possible delay in the Cancun upgrade, "ARB"'s performance in the secondary market continues to be lackluster. However, Arbitrum's Short-Term Incentive Plan (STIP) has attracted a lot of attention from both inside and outside the community, and the application just ended at noon today, with approximately 100 projects having submitted related community proposals, with a total application amount of around 100 million ARB.

Furthermore, the Odyssey event has been restarted, with the first task launched on GMX, with the task period from early morning on September 27 to early morning on October 2, Beijing time. These measures are particularly worth paying attention to for the continuous impact on the Arbitrum ecosystem.

"Arkham" continues to be on the list, with not much news on project developments; "MKR" has been a leading project for RWA in the past few months, with a quite impressive performance in the secondary market prices and inflow of funds. It remains to be seen whether RWA and MakerDAO can become important channels for the continuous integration of DeFi and TradFi.

This week's Mirror hot search list, in addition to "Doubler" and "Starknet," also saw newcomers such as "ARC20" and "Dmail," and the author list was completely updated. Overall, the proportion of airdrop tutorial-related categories in the author category continues to decline:

- Luma Xiao Assistant (Airdrop Tutorial)

- billysauce.eth (Market Observation)

- Little Diamond Luma Ji.eth (Airdrop Tutorial)

- 0xA8dE (Project Introduction)

- DigiCN (Project Introduction)

- Avilas (Project Introduction)

- 0x1b5B (Industry Observation)

- Hokake (Project Introduction)

- valioxyz.eth (Project Introduction)

- 0xDE90 (Airdrop Tutorial)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。