Source: Tide Capital

Summary

The overall market has entered a period of oscillation and consolidation. Large-cap altcoins are completing the process of de-bubbling, with funds flowing from altcoins to BTC and ETH, and the market is approaching the bottom. We are optimistic about BTC's short-term oscillation between $25,000 and $30,000. The current market sentiment is overly pessimistic, and a natural rebound may occur. The Fed's interest rate hike is nearing its end, and the prospect of future rate cuts is expected to trigger a major market rally, making the remaining time of this year a good opportunity for positioning.

Macro: Interest rate hike nearing its end, rate cut still pending

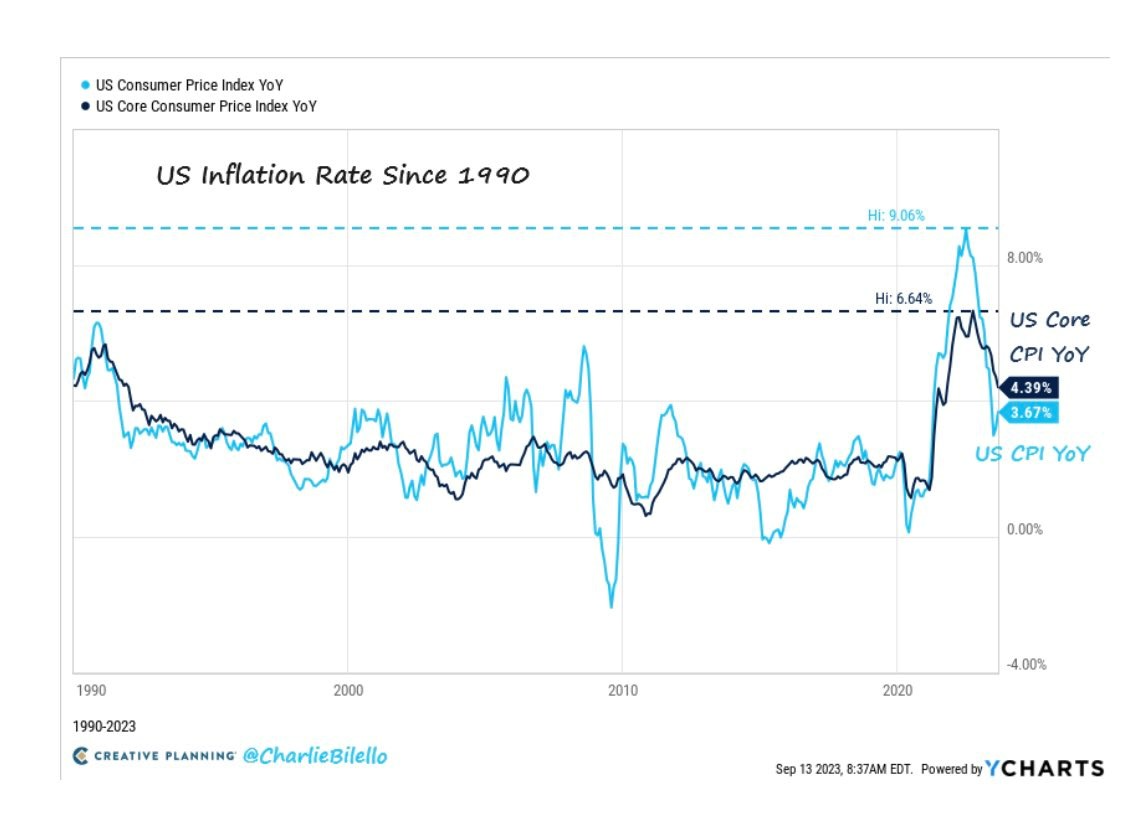

Over the past month, overall U.S. inflation has been on a downward trend, and the heat in the labor market is easing. The U.S. macroeconomy is heading towards a soft landing, and the adjustment in the U.S. stock market is relatively manageable, with no apparent unexpected factors. The Fed's interest rate hike is nearing its end, and while there may be one more, its impact is no longer significant and is no longer the main focus of the market.

Figure: U.S. CPI data is on a downward trend

However, the key issue for the crypto market is the current high interest rate environment. Recently, both the 10-year U.S. Treasury bond yield and the U.S. dollar index have risen, putting significant pressure on risk assets. In a high-interest-rate, continued balance sheet reduction monetary environment, risk assets are unlikely to perform well. Due to the strong performance of the U.S. economy, the Fed's determination to resist inflation remains firm, and a rate cut is still pending. The Fed may not start cutting rates until the third quarter of next year, and investors need to remain cautious and patient.

Figure: 10-year U.S. bond yield at a new high

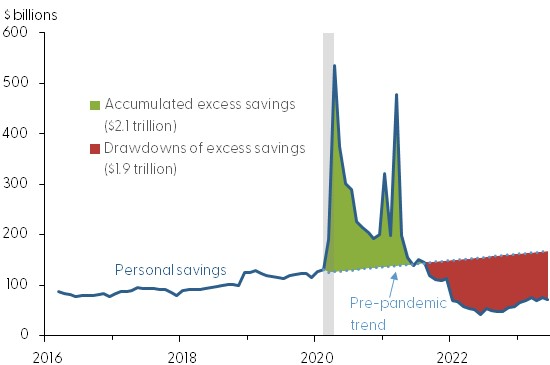

Retail investors are running out of ammunition. During the pandemic, the U.S. government provided a large amount of fiscal subsidies to residents, which not only boosted the economy but also led to a significant flow of funds into the financial markets, driving up small-cap stocks and cryptocurrencies. However, as time has passed, the excess savings of U.S. residents have gradually declined, and the Federal Reserve Bank of San Francisco predicts that excess savings will be depleted by the third quarter of 2023, which will also have an impact on the economy, inflation, and employment. As one of the world's most powerful economies, the U.S. is close to depleting its residents' excess savings, indicating that retail investors are running out of ammunition, making it difficult for the capital market to reproduce a bull market performance.

Figure: U.S. residents' excess savings are about to be depleted

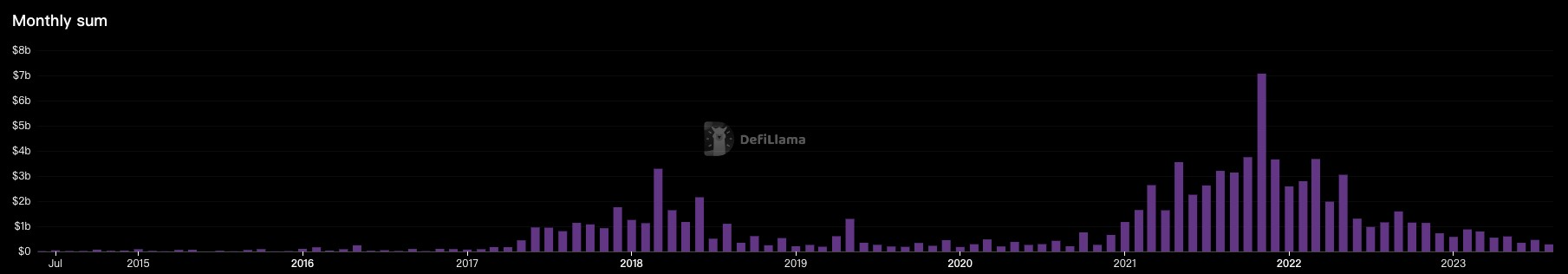

Institutional investors are also becoming more cautious. Since the beginning of this year, institutional investors have been reducing their investments in the crypto market, with primary financing amounts significantly decreasing compared to the previous two years. The financing amount in August was only $283 million, basically returning to the levels of 2019-2020. Even in 2022, when the market experienced a significant decline, the average monthly financing amount was over $1 billion, indicating the current market's lackluster nature. From a positive perspective, the market is completing the de-bubbling process, which is very similar to the characteristics of the bottom of the previous cycle.

Figure: Primary financing amount in the crypto market has significantly decreased this year

Overall, there is a temporary lack of favorable changes at the macro level, and the Fed still maintains a relatively hawkish stance, with a rate cut possibly not happening until the third quarter of next year. Retail investors are running out of ammunition, institutional investors are becoming more cautious, and the market is unlikely to experience a major rally, more likely to pass through this period in a range-bound manner. Investors need to remain patient. Specifically, when the market falls to a low point, it is not advisable to be overly pessimistic; when the market rises to a high point, it is not advisable to be overly optimistic.

On-chain: Lack of liquidity, de-bubbling of altcoins

The ETF narrative is ebbing, and the market is in a stalemate. The news of the Bitcoin spot ETF at the end of June stimulated the market's rise, but the SEC's decision to delay in August led to a comprehensive retreat of the bulls. According to Bloomberg analysts, the first final deadline is Ark's January 10th, and the SEC may postpone the final decision until the end of the year, making it difficult to be a factor driving the market up for the next 3-4 months. Although the news of Grayscale's victory boosted the market in the short term, BTC failed to reclaim the 120-day moving average, and the gains were completely wiped out just 2 days later, leading the market into a stalemate once again.

Figure: BTC is oscillating and consolidating below the 120-day moving average

Declining trading volume, tepid trading interest. Since mid to late July, after BTC and ETH began to oscillate, trading volume has significantly decreased, and market trading interest is quite tepid. Currently, BTC's total trading volume is close to the level after the FTX crash, with both buyers and sellers in a wait-and-see mode.

Figure: Tepid trading in BTC, with trading volume close to the level after the FTX crash

Insufficient on-chain funds, de-bubbling of altcoins. Apart from BTC and ETH, the total market value of cryptocurrencies has approached the bottom range of June, and altcoins as a whole continue to decline, showing a downward trend. XRP completely erased the gains from the SEC lawsuit victory, while ARB fell below the low point of June, with only a few small-cap altcoins experiencing Pump & Dump activities with the participation of market makers. Former on-chain star projects UNIBOT, BITCOIN, and OX experienced even greater declines, indicating a lack of funds and confidence in the market.

Figure: Total market value of cryptocurrencies excluding BTC and ETH has approached the bottom range of June

Overall, funds are flowing from altcoins to BTC, and altcoins are completing the de-bubbling process. Compared to the low point at the beginning of the year, BTC still has an increase of around 60%, while the returns of many altcoins have turned negative. The market is gradually digesting the overvaluation of many altcoins through a low-volatility decline, completing the final consolidation turnover at the end of the bear market. The market has adjusted to a relatively low position, with limited downside, and in the absence of major bearish news, the decline brings opportunities rather than risks.

What We Are Optimistic About

Short-term: BTC to oscillate between $25,000 and $30,000. From the current situation, there are no significant changes at the macro level, and there are no apparent positive or negative factors in the market. BTC is highly likely to oscillate widely between $25,000 and $30,000. Currently, the market sentiment is overly pessimistic, and investors lacking patience have already exited their positions. The de-bubbling of altcoins is also largely complete, and an increase does not require a significant amount of funds. Even a spontaneously occurring confidence-repair rally in the market could potentially push BTC to rebound to around $30,000.

Figure: The current market sentiment is overly pessimistic, and a natural rebound may occur

Medium-term: The Fed's interest rate hike is nearing its end, waiting for rate cut trades. Looking back at the last interest rate hike cycle, after the Fed paused its interest rate hikes, BTC bottomed out and rose, surging from $3,300 in February to $13,000 in June. The market often anticipates the Fed's rate cut expectations, and by the time the rate cut is actually implemented, a significant rally may have already been largely completed. Although it may be too early to talk about a rate cut at the moment, we are very close to the last interest rate hike, and the future market outlook is worth looking forward to.

Figure: In 2019, after the Fed paused its interest rate hikes, BTC experienced a significant rally

Conclusion

Short-term BTC holders are selling their remaining chips around $26,000, while patient investors see extraordinary opportunities. We maintain a neutral optimistic attitude towards the current market, and we are optimistic about a major BTC rally next year. Stay patient and cherish the buying opportunities brought about by the decline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。