Original Title: "What is Frax’s plan for Real-World Asset Tokenization?"

Original Author: Kyrian Alex

Original Source: Medium

Compiled by: Lynn, MarsBit

The total TVL in the field of RWA tokenization is 23.85 billion US dollars, rapidly rising in the DeFi rankings from 22nd place to 8th place. What's next? What are the current choices?

Currently, only 0.06% of people on Earth use DeFi, highlighting the enormous potential for market development. The DeFi industry needs to enter the $16.1 trillion traditional asset market to effectively expand; this represents a 500% growth opportunity!

RWA tokenization stands out in this field, becoming the link between DeFi and TradFi. Why? Because tokenization makes a range of asset classes, including bonds, commodities, and real estate, more accessible to everyone.

Tokenized assets can be partially owned, providing investment opportunities to more people that were previously inaccessible to them. Citibank and industry leaders like Jeremy Allaire have been advocating for tokenization as the future.

Now, let's take a look at the connection between bonds-yield-RWA.

Now, let's take a look at the connection between bonds-yield-RWA.

After the UST-Terra collapse, DeFi users seem to be hesitating about the incredibly high yields. But is this a sign of DeFi's maturity or just PTSD?

Want to know the truth? In DeFi, there are many excellent opportunities to generate income using stablecoins while minimizing risk.

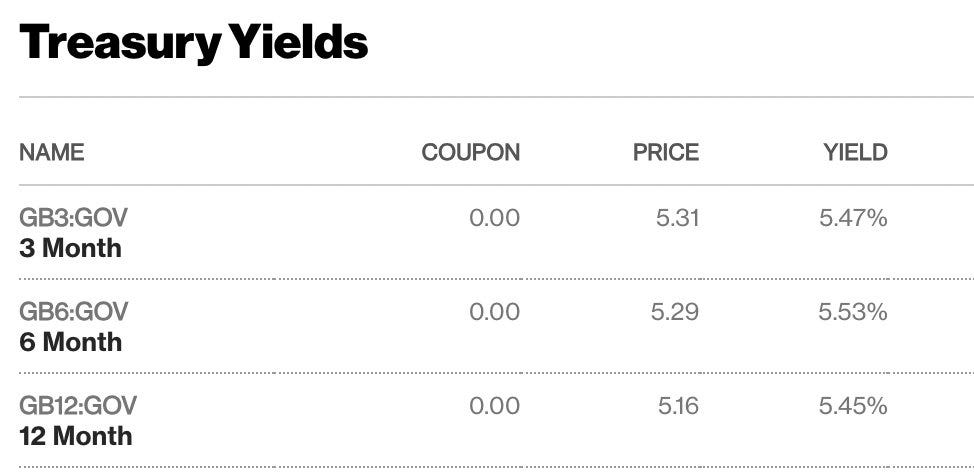

Looking at today's TardFi yields, the current three-month locked U.S. Treasury bond yield far exceeds 5%. This has a significant impact on the condition of all asset classes globally.

Investors are now eyeing each other:

Investors are now eyeing each other:

"If I can earn guaranteed income, why take risks in cryptocurrencies, real estate, or other asset classes?"

Considering the risks involved (exploits, decoupling, and private key issues), DeFi yields are severely underestimated.

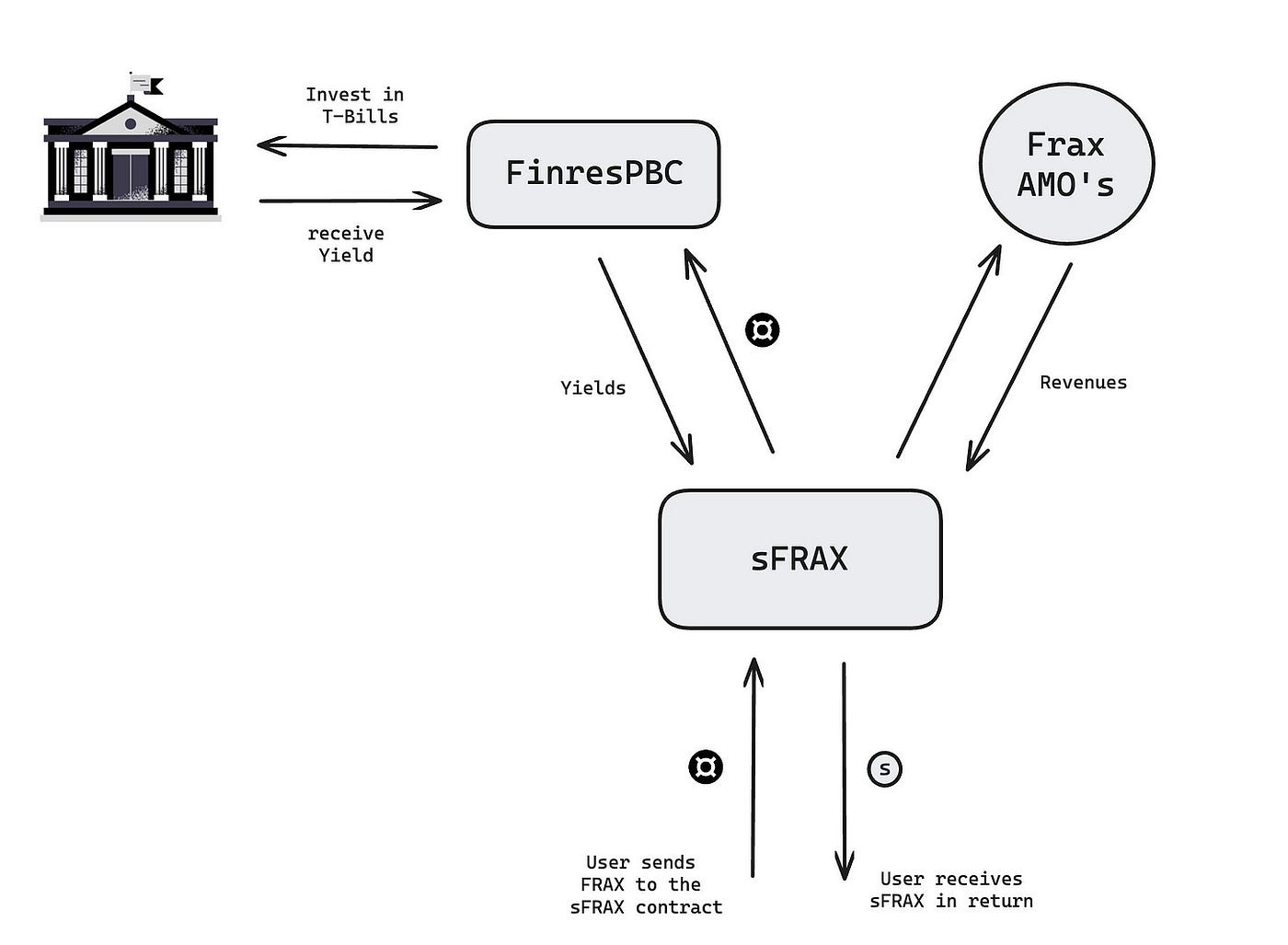

I believe that Frax Finance has considered all of this from the start of the FinresPBC journey. FinresPBC is Frax's RWA custodian, similar to how MakerDAO has entities holding its treasury bills and money market funds.

FinresPBC holds U.S. dollar deposits in FDIC-insured IntraFi savings accounts and earns interest from them. It does not seek profit or charge fees, but returns all its earnings to the Frax DAO.

But in order to access these earnings, Frax has introduced sFRAX and FXB.

Similar to DAI savings rates, sFRAX allows users to deposit Frax (pegged to 1 USD) and earn interest in the form of the FRAX stablecoin, providing users with low-term savings options.

The interest rate is variable and may come from multiple sources. One of the mentioned sources of income will come from the allocation of Frax Protocol revenue from the Frax algorithmic market operations controller (e.g., autonomous contracts owned by frax) and real-world asset strategies.

The annual interest rate will always "mildly target" the Federal Reserve's interest on reserve balances (IORB), which is currently at 5.4%. If this cannot be achieved, Frax will always prioritize keeping the collateralization ratio of $FRAX at 100% and then transfer any excess earnings to sFrax.

In summary, the introduction of sFRAX aims to enable developers to build on top of sFRAX, promoting the development of an enhanced stablecoin ecosystem and attracting greater liquidity while increasing FRAX supply.

On the other hand, according to Sam K, FraxBonds are "decentralized utility tokens, priced in FRAX stablecoin debt at a certain timestamp." FRAX holders will be able to purchase discounted FRAX in the form of Fraxbonds or FXB in the future.

All of this is part of Frax's RWA strategy and is very easy to understand.

- Users deposit their FRAX tokens into the treasury to receive sFRAX.

- The DAO selects the best option for earning income based on the current market conditions.

- If there are no good income sources on-chain, Frax's RWA partner (Finres) will convert the FRAX tokens deposited into sFRAX to USDC.

- The converted USDC is taken off-chain and invested in U.S. Treasury bonds.

- Then, the receipt of this conversion is converted back to FRAX and transferred to the Frax treasury.

- Users can then purchase FXB at a discounted price to earn returns upon redemption.

For example, you can purchase FRAX worth $1 at a price of $0.90 in 2 years. When you exchange FRAX for bonds, the protocol now has the collateral to perform its intended function to ensure enough income is earned within two years to repay the debt.

As Sam Kazemian said, "FXB does not grant the holder any rights to off-chain assets or the right to redeem for fiat currency or similar items, so they are just utility tokens in the Frax protocol. They only guarantee that each FXB will convert to 1 FRAX stablecoin at maturity. That's it."

FXB will automatically convert to FRAX on the specified maturity date of January 1st each year. Frax will offer FXB for 1-year, 2-year, 3-year, or 4-year terms. This will allow Frax to chain the yield curve (at least 4 years).

Conclusion:

Conclusion:

While this strategy offers attractive returns, it is important to understand the risks involved.

The main risk is protocol risk. If the protocol where you deposit stablecoins is exploited, you may run into trouble. Additionally, while stablecoin designs are intended to maintain a value of 1 USD, they are not immune to market fluctuations. We all have UST PTSD.

Furthermore, these RWA-backed stablecoins also face regulatory risks. The U.S. government harbors a serious hatred for cryptocurrencies and will find mediums to attack to slow down these protocols, potentially leading to their demise. While in the short term, we may rely on Treasury-backed yields, in the long term, these protocols may face some serious issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。