Over the past month, Bitcoin has seen a slight increase, while Ethereum's price has been difficult to break through.

By Mary Liu, BitpushNews

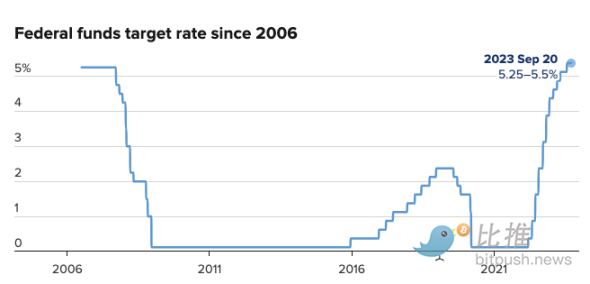

On the afternoon of September 20th, Eastern Time, the Federal Reserve announced that it would maintain interest rates at their current levels. This decision marks the second pause in rate hikes since the Fed began raising rates in March 2022, in line with market expectations.

In its statement, the Fed wrote that the labor market continues to slow, coupled with tightening credit conditions, leading to the committee's decision.

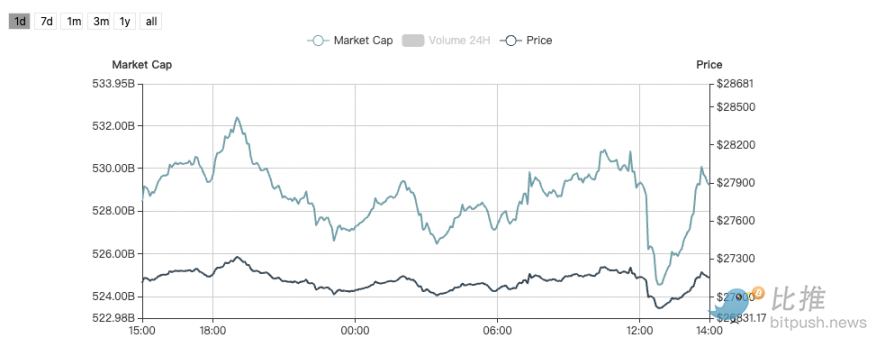

Following the announcement, the crypto market remained relatively stable. Within minutes of the central bank's announcement, the price of Bitcoin remained near $27,200, briefly falling about 1% to $26,900, before rebounding to above $27,000 at the time of writing. Ethereum's decline was slightly less than 1%.

Over the past month, Bitcoin has risen by about 3.5%, while Ethereum's price has been difficult to break through, falling by about 3% in the past month and about 6% over the past six months.

The S&P 500 and Nasdaq Composite indices closed lower on that day, with the Dow falling by about 76 points, the Nasdaq falling by 1.5%, and the S&P 500 falling by 0.94%.

Powell's Speech

As previously reported, the Fed has aggressively raised interest rates over the past 18 months, with 11 consecutive rate hikes from March to July last year, aiming to alleviate the country's highest inflation in over 40 years.

However, concerns about whether a soft landing can be achieved still exist. During a subsequent press conference, Fed Chairman Jerome Powell warned that there is still a long way to go for inflation to reach its target. He stated, "The U.S. banking system is sound and resilient, but tightening credit conditions for households and businesses could affect economic activity, employment, and inflation, and the extent of these effects remains uncertain."

Powell did not want to signal to investors that rate hikes had been completed. He reiterated that upcoming economic data would provide information for the central bank's decision and stated, "We never intended to signal a time for any rate cut, there will be a time for a rate cut when appropriate, there is still too much uncertainty, and as we enter 2024, the Fed will consider policy lags and data."

Rate Hike Predictions

The latest quarterly forecasts show that out of 19 committee members, 12 expect a further 25 basis point rate hike this year, while the remaining 7 believe no hike is necessary. This would raise the federal funds rate to around 5.625%, within a range of 5.5% to 5.75%.

Compared to June, there has been little change in the hawkish and dovish divide, with 12 out of 18 committee members expecting further hikes at the current level.

For 2024, the median year-end forecast for the Fed's key rate has jumped from 4.6% in June to 5.1%. Back in June, eight members had forecast the Fed's key rate to eventually reach 4.875% or higher; two members expected a rate of 4.625%; and eight dovish members expected the Fed's key rate to fall to 4.375% or lower.

In September, 10 members now believe the year-end rate will be at least 5.125%. Four other members forecast a rate of 4.875%; and 5 members expect the year-end rate not to exceed 4.625%.

Fed officials also expect rates to remain around 5.1% next year, a significant increase from the 4.3% forecast in June. They also anticipate stronger economic growth this year, with real GDP expected to grow by 2.1%, compared to the 1% forecast in June.

Impact on Risk Appetite

Ruslan Lienkha, market director at YouHodler, believes that the pause in rates is unlikely to spark bullish sentiment in risk assets.

In an interview with The Block, Lienkha stated, "Even if the same rates are maintained until the end of 2023, fixed income yields will continue to grow, which will exacerbate the situation for risk assets." He added that the current 5.5% target rate has not yet fully been reflected in the market, and the current rates will impact the market for at least a few months.

Analysts are optimistic that the Fed will maintain the key rate within the range of 5.25% to 5.50% by the end of the year.

James Butterfill, research director at CoinShares, commented that as the Fed becomes increasingly dovish, there could be a cut of about 75 basis points in 2024.

David Wells, CEO of Enclave Markets, stated that confirmation of the end of the rate hike cycle is a positive signal for the market. In a tweet, he said, "Bringing certainty to the market by pausing rates may be a positive signal for overall sentiment and may increase interest in risk assets in the short term."

Butterfill believes that the impact of high rates will increasingly pressure the economy in the coming months. He added that this will make it more difficult for the Fed to maintain a hawkish monetary policy stance. He stated, "Looking ahead, as the pressure of high rates on the economy grows, the prospect of further rate hikes will diminish, which could support Bitcoin."

Market research firm Asgard Markets expects some profit-taking after the Fed's decision. The company stated in a report, "Positions and sentiment are not as light or heavy as earlier this year, and there are not many new catalysts, which means 'in-the-money' participants will give up some chips and reassess."

The Federal Open Market Committee (FOMC) is scheduled to meet again on October 31 and announce the next rate decision on November 1. This means that the September consumer price data expected to be released on October 12 will be particularly important for determining the central bank's next steps. According to CME's FedWatch tool, investors currently estimate a 70% likelihood of rates remaining unchanged at the November meeting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。