The future of payments is moving towards a hybrid model, and integrating existing payment systems with digital currencies is the next step towards achieving comprehensive decentralization in finance.

Written by: HERCULES | DEFI

Compiled by: Deep Tide TechFlow

We know that there is a global circulation of $170 billion every hour. However, cross-border payments face issues such as high costs and slow transfer speeds.

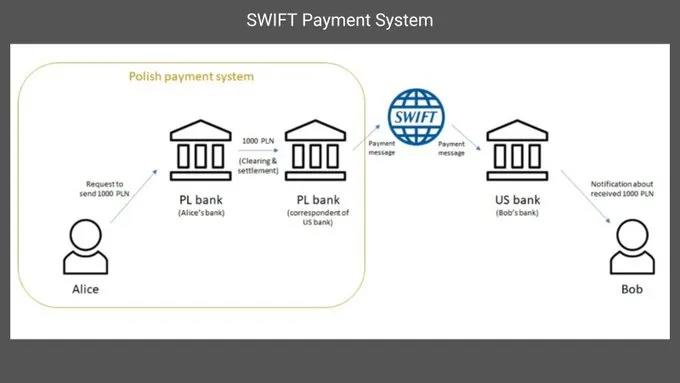

Globalization, market expansion, and technological innovation demonstrate the reliance on cross-border payments. But existing solutions like SWIFT have two main issues:

Additional costs are incurred if payments must be processed through intermediary banks.

Slow transaction speeds.

Both of these issues can be addressed by replacing reliance on intermediaries with direct transfers. Blockchain solutions such as Ripple, Stellar, and Chainlink can facilitate cross-border transfers.

Stellar

Stellar utilizes its blockchain network and IBM's World Wire platform to connect financial institutions for cross-border payments. Compared to SWIFT, Stellar's native cryptocurrency Lumens (XLM) is used for faster and cheaper transactions.

Stellar aims to replace SWIFT by facilitating cross-border payments for small and medium enterprises and individuals through a complex system involving deposit institutions, stablecoins, and trading functions. The platform uses blockchain technology and the Stellar Consensus Protocol to achieve efficient infrastructure. Users deposit funds at locally accredited deposit institutions, which are recognized by Stellar as "anchors."

Key features of Stellar:

Fast processing: 2000 transactions per second, cross-border payments confirmed within 5 seconds.

No intermediaries: Direct transactions through self-triggered smart contracts.

Decentralization: Efficient transfers without reliance on centralized institutions.

Ripple

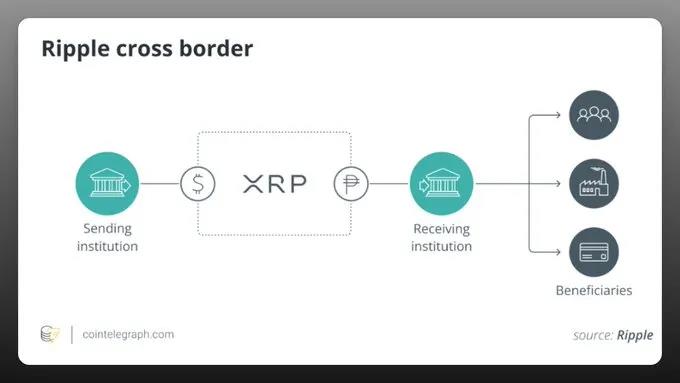

Ripple collaborates with global banks and financial institutions to drive technology adoption and enable wider cross-border payment usage through XRP. Key partners include Santander Bank, American Express, SBI Holdings, and PNC Bank.

Ripple's blockchain payment protocol using XRP allows real-time, low-cost cross-border transactions. It eliminates the need for multiple intermediary banks, resulting in faster settlements and lower costs.

Given the influence of SWIFT and the regulatory challenges faced by Ripple, there is uncertainty in replacing SWIFT with Ripple. However, Ripple is an ideal choice when favoring decentralized cross-border payments.

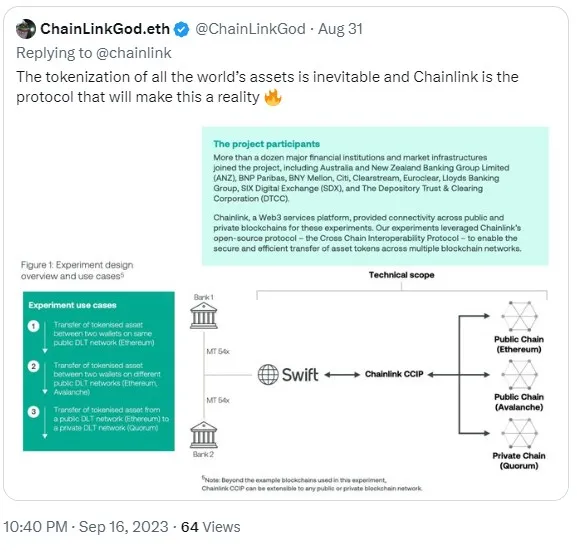

SWIFT is continuously evolving. It is actively conducting experiments to highlight the importance of tokenization. SWIFT's collaboration with financial institutions to facilitate token asset transfers across multiple pathways demonstrates the significance of its network.

Benefits of Tokenization

Tokenization is still in its early stages, with 97% of institutional investors believing it will change asset management. It will enhance efficiency, reduce costs, and provide more choices for investors through fractional ownership.

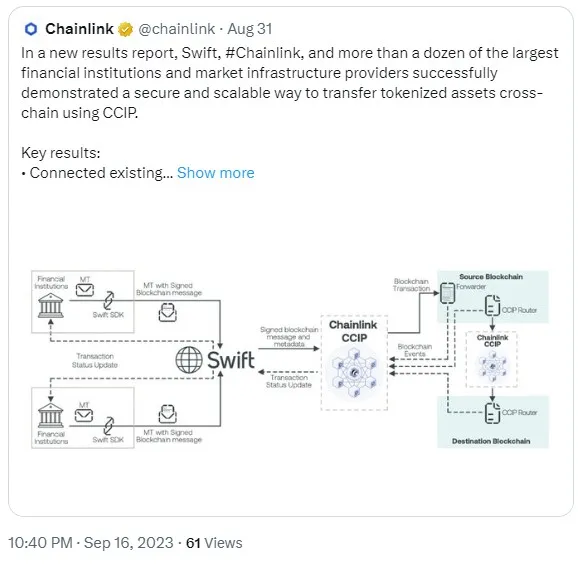

SWIFT has partnered with Chainlink to address blockchain fragmentation issues and improve tokenized asset trading.

Chainlink's Cross-Chain Interoperability Protocol (CCIP) has been launched on the mainnet. It provides plug-and-play options for inter-chain token transfers, supporting both burning and minting as well as locking and minting methods.

SWIFT aims to enhance interoperability and user experience through its collaboration with Chainlink. This collaboration streamlines the process of accessing multiple networks, reducing operational challenges and costs for tokenized assets.

Chainlink is leading the undeniable future of tokenizing all global assets.

Chainlink provides data transmission, token transfers, blockchain communication, and computing services. Key services for capital market tokenization include CCIP, proof of reserve audits, and functionality for synchronizing off-chain events or data.

Chainlink has brought over $8 trillion in transaction value to blockchain applications, providing security through a decentralized oracle network operated by major enterprises such as Deutsche Telekom, LexisNexis, and Swisscom. It maintains long operational uptime and tamper-resistant security even during market fluctuations.

Conclusion

The future of payments is moving towards a hybrid model. Integrating existing payment systems with digital currencies is the next step towards achieving comprehensive decentralization in finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。