Author | Baize Research Institute

It may be that the 20-year-long journey of designing IC chain is not favored by the current Crypto market (abandoning short-term speculation and insisting on the ultimate form of Web3). Since last year, the DFINITY Foundation has formulated a new short-term vision for Internet Computer (hereinafter referred to as IC), using Chain-key signature technology to directly integrate and release the ckTokens series, led by ckBTC and ckETH, with other public chains, becoming the "multi-chain asset center" of the Crypto industry. Users can use or exchange assets from different chains natively on the IC chain.

A brief review:

By directly integrating with other chains through Chain-key signature technology, assets from other chains can be directly introduced into the IC chain without the need for cross-chain actions.

However, due to the high transaction fees and slow speed on the Bitcoin and Ethereum chains, the IC ecosystem cannot be widely used directly. Therefore, the anchor tokens ckTokens series were issued, and only necessary transactions will be pushed to the corresponding chain.

ckTokens are issued based on smart contracts and NNS, the governance system of the IC chain. The minting and burning of ckTokens are managed by ICP holders through voting, making it completely decentralized.

In summary, the IC chain can introduce assets from other chains without the need for cross-chain bridges, and the issued ckTokens are also completely decentralized, leading to the emergence of the "multi-chain asset center."

Recently, the multi-chain DEX Helix Markets based on the IC chain has launched its public testnet, providing a preview of the "multi-chain asset center" scenario.

Currently, Helix Markets provides test coin trading for three chains: Bitcoin, Ethereum, and IC. Users need to deposit assets from a certain chain into Helix Markets in order to conduct transactions. It may sound similar to other similar products, all aiming to allow users to exchange A assets from chain X for B assets from chain Y. However, Helix Markets excels in one aspect: the trading process does not involve cross-chain actions or wrapped tokens (anchor tokens).

Helix also utilizes Chain-key signature technology to facilitate communication between two chains, enabling assets from other chains to be natively integrated into the IC chain.

In simple terms, most public chains rely on ECDSA as the underlying encryption signature scheme, such as Bitcoin, Ethereum, and Dogecoin. Chain-key signature technology allows innovative smart contracts on the IC chain to create public chain addresses that rely on ECDSA, thus holding real tokens. In addition, since Canisters can also make HTTP calls, this means that they can communicate directly with the outside world without the need for oracles. Based on this functionality, Helix Markets can propagate transactions to the corresponding chain, such as pushing Bitcoin transactions through Bitcoin nodes into blocks, sending Ethereum transactions to RPC providers, and then sending transactions to the Ethereum mempool for inclusion in blocks. Compared to the cross-chain bridges and wrapped tokens commonly used by mainstream Crypto users, Helix Markets is naturally more decentralized and native.

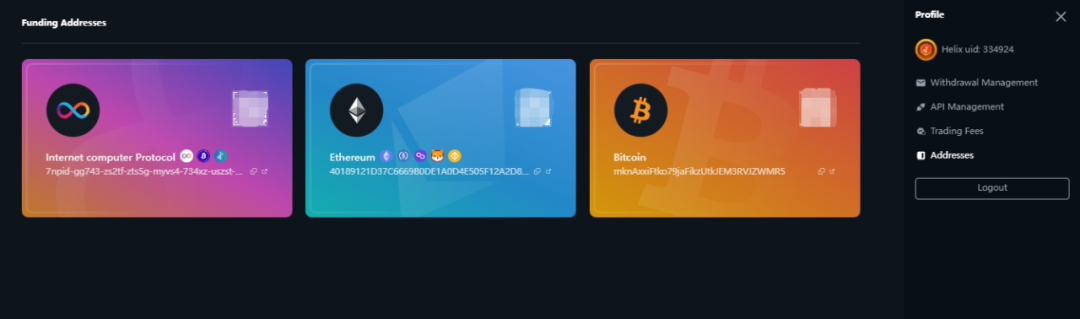

To completely isolate user funds, Helix Markets uses Canisters to automatically generate a set of addresses for each user's supported assets on the respective chains. For example, when a user deposits ETH into the Helix Markets wallet, they are actually depositing ETH into a new Ethereum chain address created by Canisters. Therefore, users have complete control over their funds. Alternatively, you can even use Helix Markets directly as your wallet and conduct multi-chain transactions at any time, which is quite convenient to think about.

You might say that every DEX can create wallets for users on multiple chains, but don't overlook one thing: DEX controls your private keys. Helix Markets cannot control users' private keys because of Chain-key signature technology, which fragments the private keys and distributes them to nodes in the subnet where the Canister is located. If a Canister needs to use your address to initiate a transaction, it must obtain signatures from 2/3 of the subnet's nodes. Therefore, even if Helix Markets creates addresses for users, it cannot use your assets without authorization.

Without the need for cross-chain actions and with secure wallets, Helix Markets should be the safest multi-chain DEX now.

During the conceptual phase of Helix Markets, ICP enthusiasts expressed strong support for it, because it not only maximizes the advantages of direct integration between the IC chain and other public chains, but also introduces some interesting DeFi gameplay to the IC chain:

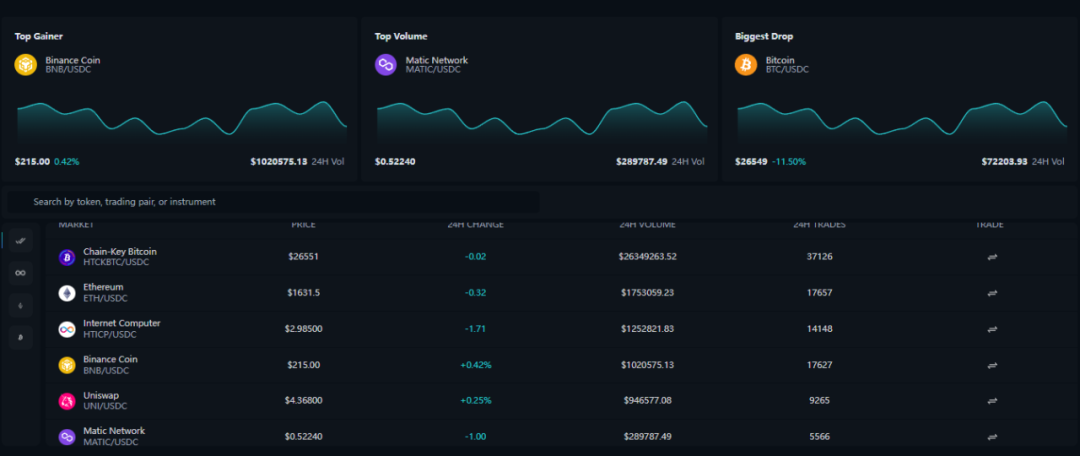

The IC chain does not have a native stablecoin. Helix Markets brings the stablecoin leaders USDT and USDC to the IC chain, allowing users to trade ICP/USDC and even ecosystem tokens paired with USDC, such as SNS1/USDC.

Trading other network tokens on the IC chain, such as BTC/USDC, ETH/USDC, MATIC/USDC, and even SHIB/DOGE, SHIB/SNS1.

New projects in the IC chain ecosystem can be listed on Helix Markets.

Benefiting from the IC chain's "reverse Gas" mechanism, users do not need to pay gas fees for interactions, allowing Helix Markets to provide users with a seamless, frictionless trading experience equivalent to CEX.

Helix Markets Public Testnet Interaction Tutorial

According to the development team members' responses on Discord, Helix Markets currently has no plans to issue tokens. However, regardless of whether there will be a test user airdrop in the future, as long as you are an ICP enthusiast, the public testnet of Helix Markets is worth a try because the experience is really smooth. It uses test coins, and the liquidity is very sufficient, with transactions completing in seconds.

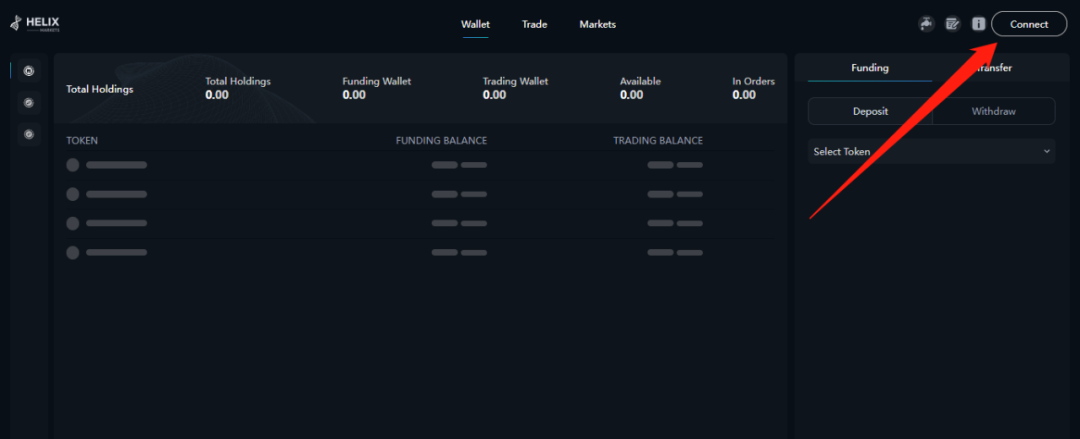

1. Open the official website and connect your wallet

First, open the official website https://www.helixmarkets.io/wallet

Click "Connect" in the upper right corner to connect your ICP wallet (NNS).

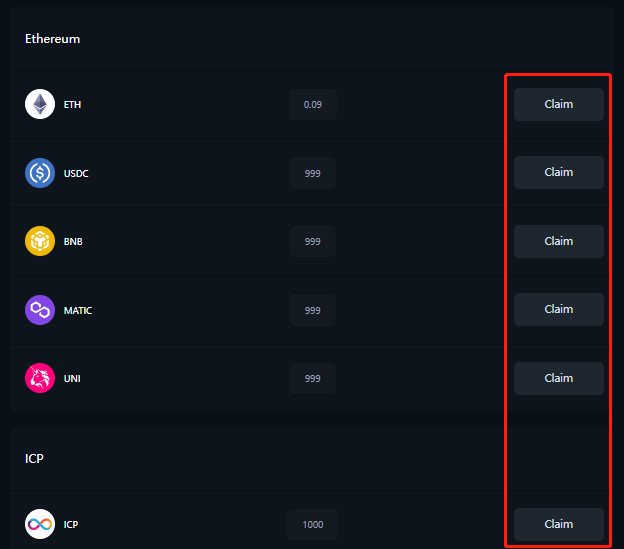

2. Claim test coins

Click the "Faucet" button.

On the new page, you will be prompted to connect your MetaMask wallet. After connecting, change the network of your MetaMask wallet to the Ethereum Goerli testnet. Before claiming test coins from the Ethereum series, your wallet needs to have a certain amount of ETH test coins to pay for gas fees. You can claim a small amount from the following platforms:

https://goerlifaucet.com/

https://faucet.paradigm.xyz/

https://goerli-faucet.pk910.de/

https://faucet.paradigm.xyz/

Then claim the test coins. Here, there are Ethereum series coins (ETH, USDC, BNB, MATIC, UNI), ICP series coins (ICP, htDNA, ckBTC), and Bitcoin (BTC). For convenience, only claim Ethereum series coins and ICP series coins here.

3. Deposit Ethereum series test coins into Helix Markets

In fact, after claiming ICP test coins, you can directly proceed to step 4. Here, we also demonstrate cross-chain deposits, depositing test coins from Ethereum Goerli into Helix Markets.

First, add these tokens to your MetaMask wallet for easy transfer. Token contracts:

- USDC Coin (USDC): 0x7966Eb9c617062f396Bc798515134f30b701af44

- Uniswap (UNI): 0x209c8Aea894e72Ec6674d21C99E7CA7A8087060c

- Polygon (MATIC): 0x36543DF470a6b2724e9BaCC23969e117dCd8e325

- BNB (BNB): 0xac57201F29cf4611265066c013993C0a7beCfcc6

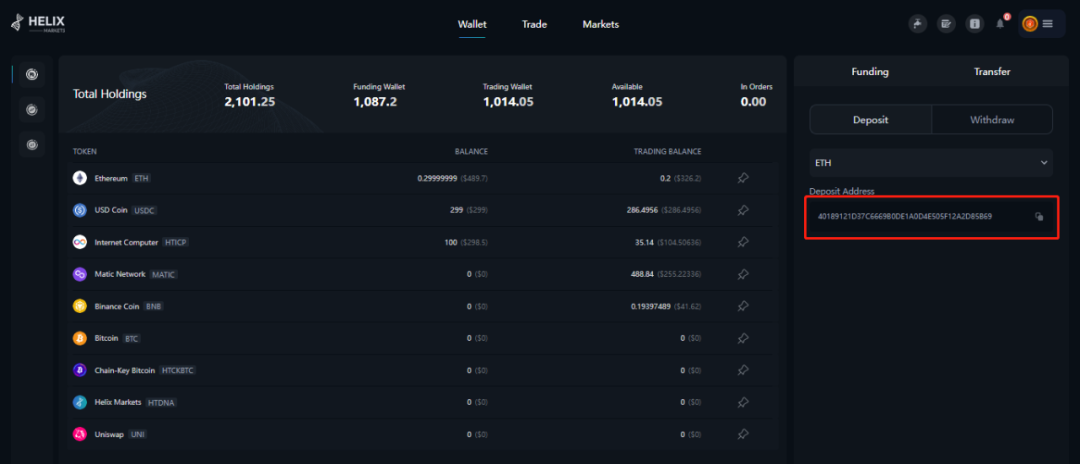

Return to the Wallet page, select the desired coin, copy the address on the right, and transfer the coins through MetaMask. They should arrive in about a minute.

4. Transfer assets

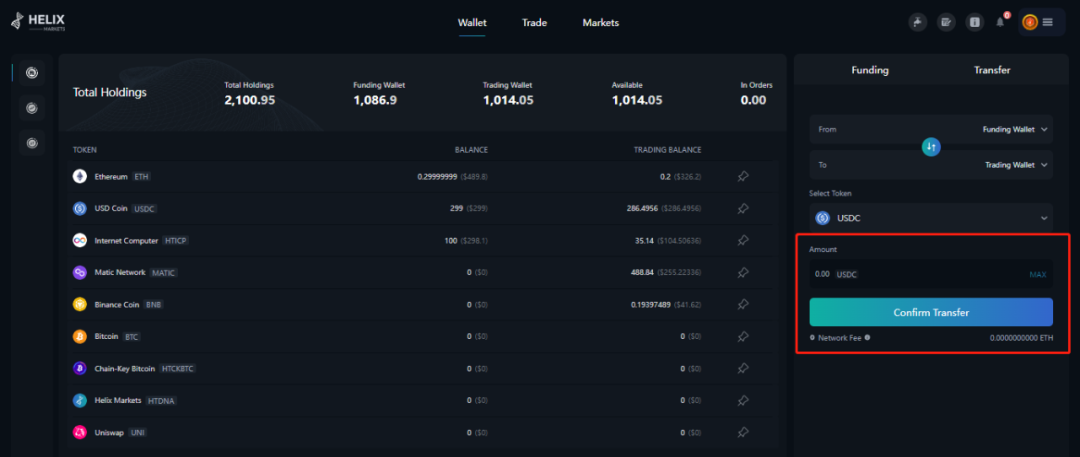

Similar to CEX, the deposited funds are in the "Asset Wallet" and need to be transferred to the "Trading Wallet" to be used for trading.

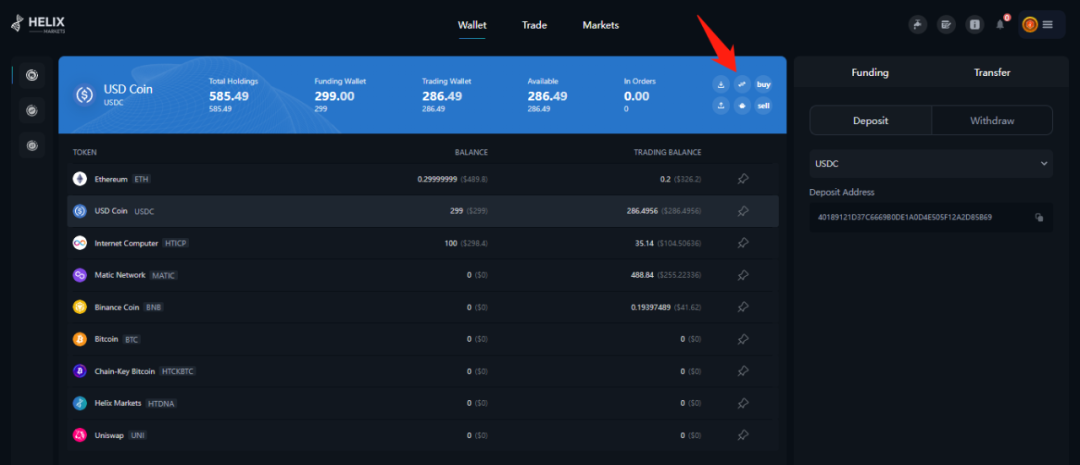

Taking USDC as an example, click on USDC and click the "Transfer" button in the top operation bar.

Continuing in the right-hand operation bar, enter the amount, click the button, and wait for the transfer to be successful. (Note that if the transfer is for Ethereum-based coins, you must have ETH for gas fees, otherwise the transfer will fail. As mentioned earlier, the wallet here is actually an Ethereum Goerli testnet address)

5. Enter the trading interface and start testing transactions

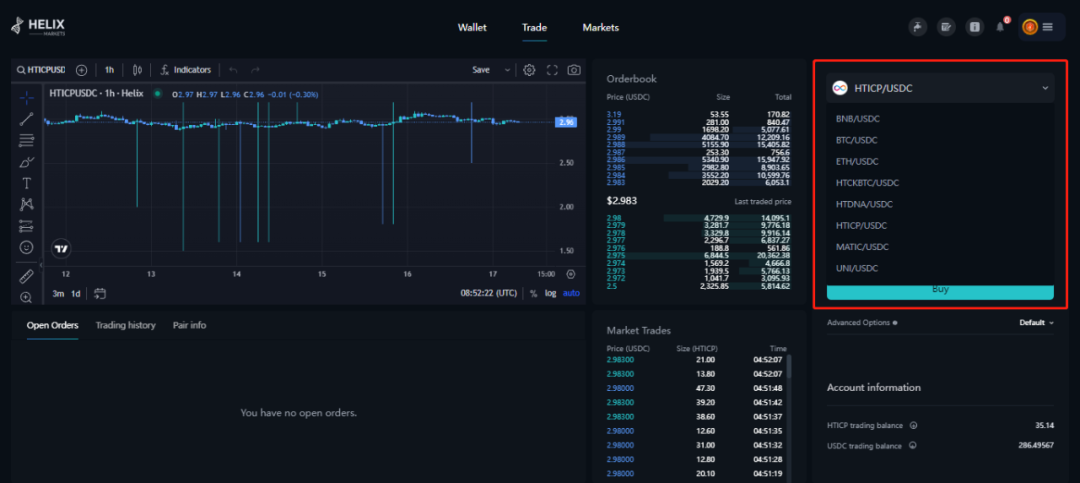

Click "Trade" at the top to access the trading page.

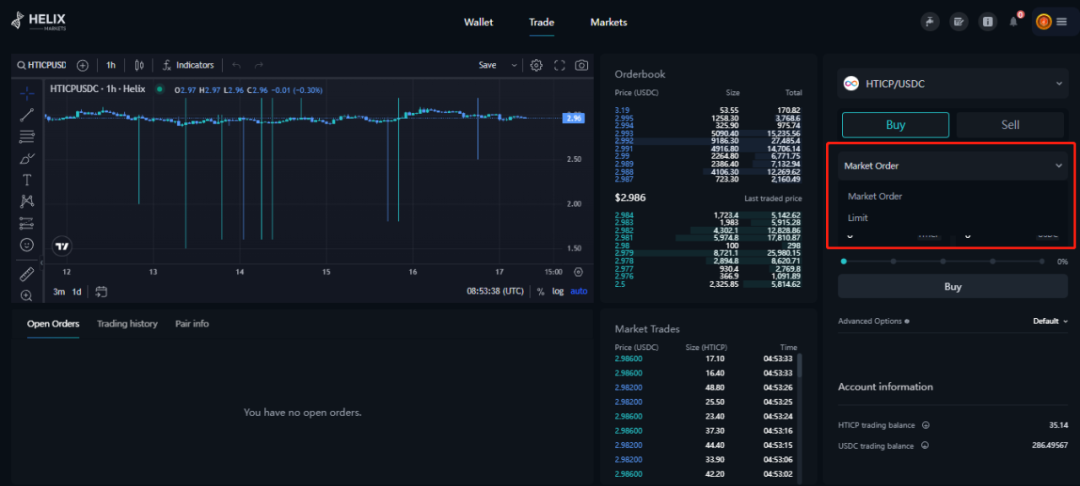

In the red box in the image below, you can switch trading pairs.

There are two types of trading modes, one is market order, and the other is limit order, similar to how it is used in CEX.

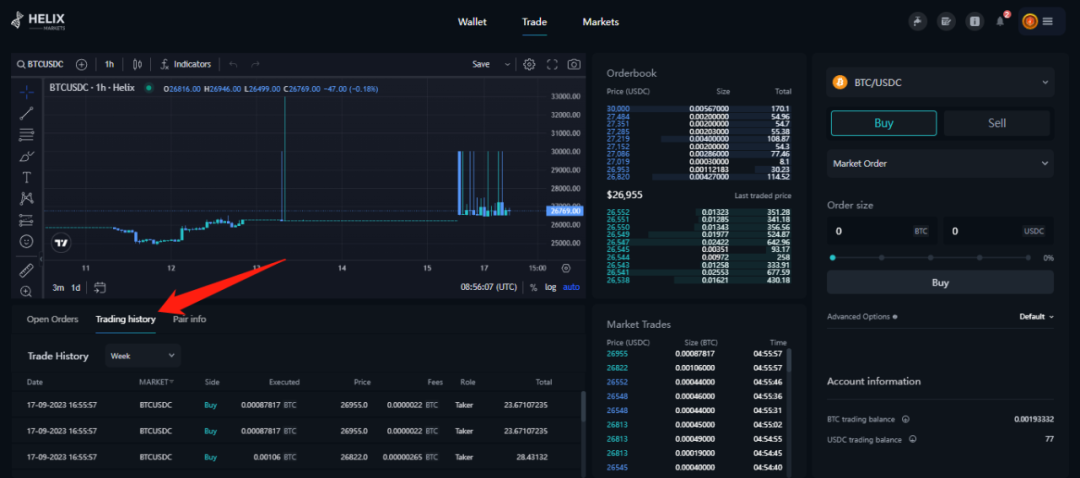

Here you can view the order history.

That's the end of the interaction tutorial.

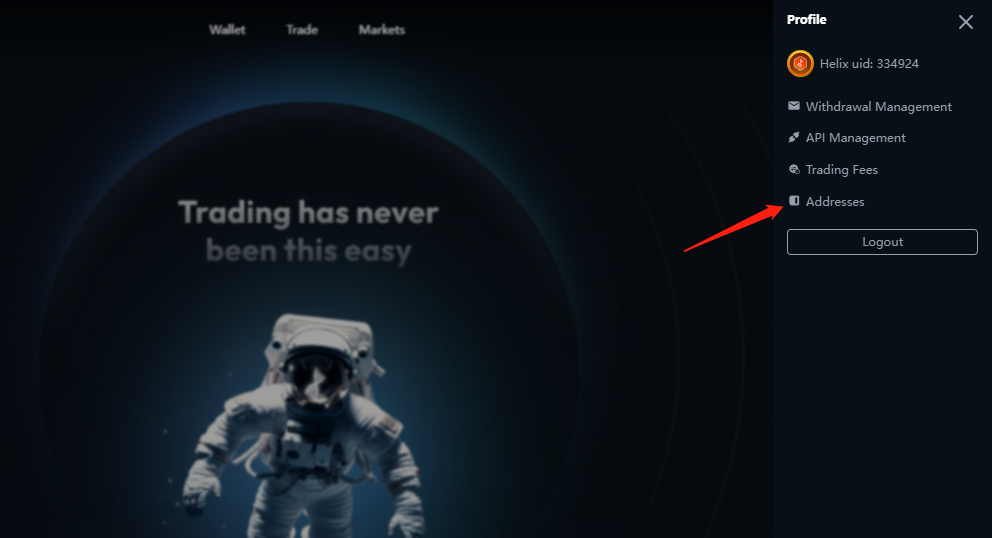

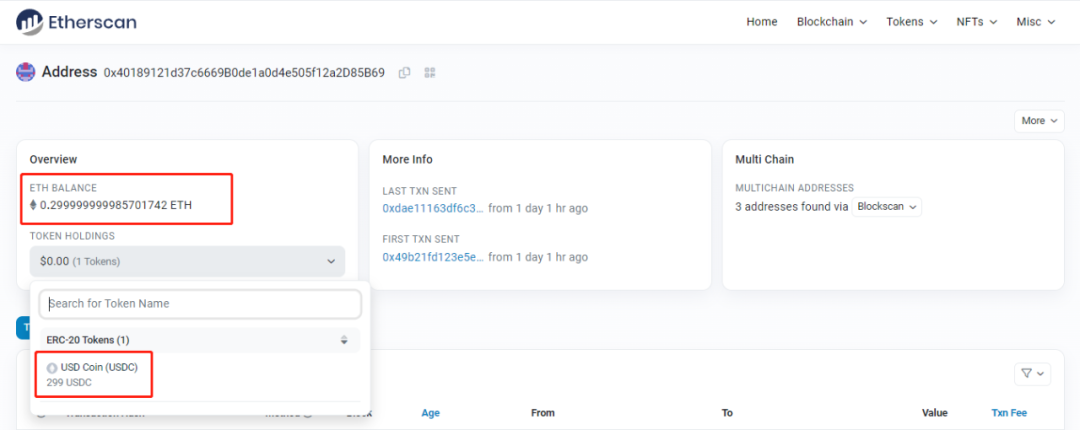

By the way, to verify whether the wallet in Helix Markets is a real independent address, you can click the three horizontal lines in the upper right corner, then click "Addresses" to view all the chain addresses generated for you by the smart contract.

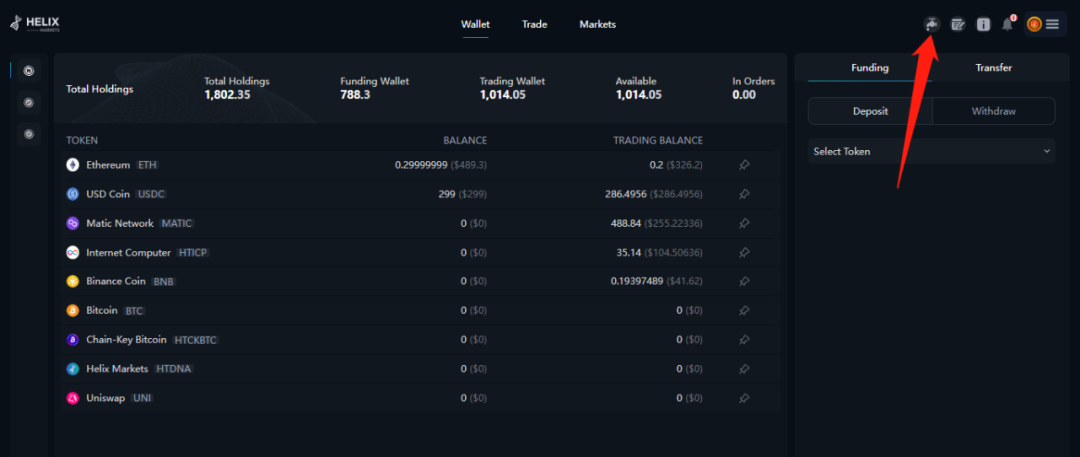

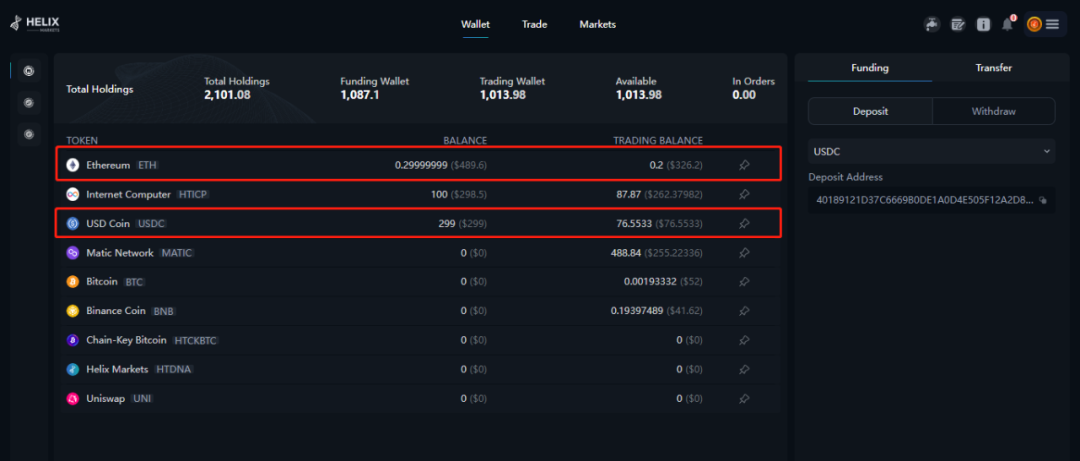

In the "Asset Wallet" of Helix Markets, it shows that my Ethereum-based coins are 0.29999 ETH and 299 USDC.

No problem, it's just that my assets in the "Trading Wallet" are not synchronized.

From here, you can see a current drawback of Helix Markets, which is that the "Asset Wallet" is on-chain, while the "Trading Wallet" is off-chain order book. Only when assets are transferred from the "Trading Wallet" back to the "Asset Wallet" will they be settled on-chain. The official plan is to move the order book on-chain by 2024, transitioning from a hybrid trading mode to a fully decentralized trading mode.

Overall, I am quite satisfied with my experience with Helix Markets. If you have assets on the IC chain, you don't need to deposit assets across chains, and you can directly trade supported tokens between chains. Remember, Helix Markets does not use cross-chain bridges or anchor tokens. As for whether Helix Markets can stand out and become the recognized safest multi-chain DEX due to this feature, and help improve the poor reputation of the IC chain, only time will tell. We can only wait and see.

However, from the perspective of the application of chain integration by Helix Markets, the path that the IC chain is taking towards a "multi-chain asset center" is correct. I hope to see dApps centered around chain integration flourishing in the IC ecosystem in my lifetime.

DYOR

Risk Warning:

According to the notice issued by the central bank and other departments on "Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Trading," the content of this article is for information sharing only and does not promote or endorse any business or investment activities. Readers are strictly advised to comply with local laws and regulations and not participate in any illegal financial activities.

Due to the revision of the public account, articles will no longer be published regularly.

If "Baize Research Institute" has been helpful to you,

click "Like" and "Share"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。