Today's headlines:

Court documents show FTX has about $7 billion in assets, with $3.4 billion in cryptocurrency

PayPal launches cryptocurrency-to-USD exchange service

Coinbase Prime launches Web3 wallet for institutional and corporate clients

Digital asset platform Fireblocks launches non-custodial wallet service

Bitget launches $100 million EmpowerX fund to support ecosystem development

Regulatory news

According to The Block, Securities and Exchange Commission (SEC) Chairman Gary Gensler will attend a hearing of the U.S. Senate Banking Committee on Tuesday morning. He still insists that cryptocurrencies must comply with the same laws as stocks and other securities, and many cryptocurrencies fall under the SEC's jurisdiction. In prepared testimony released on Monday, he stated, "Given the industry's widespread non-compliance with securities laws, it's not surprising that we see a lot of problems in the market. This is reminiscent of the situation before the implementation of the federal securities laws in the 1920s. Therefore, we have taken a series of enforcement actions, some of which have been settled, and some have been litigated."

NFT

Milady founder Charlotte Fang stated on X platform that a Milady developer misappropriated approximately $1 million from the official Milady project Bonkler treasury and also seized the codebase, demanding the team to hand over more funds and NFT reserves. Currently, the X accounts of miladymaker and remilionaire are under the control of this developer.

Charlotte Fang stated that relevant members have been identified and their responsibilities will be pursued to the fullest extent of the law. The minting of Bonkler NFTs has been temporarily suspended, and the community treasury, contracts, and NFTs of Bonkler are secure. Other series of NFTs under the parent company Remilia have not been affected for the time being.

Data shows that the floor price of Milady Maker series NFTs has dropped to 2.9 ETH, with a 12.68% decrease in the past 24 hours.

Project updates

Court documents show FTX has about $7 billion in assets, with $3.4 billion in cryptocurrency

Court documents show that the bankrupt FTX has approximately $7 billion in assets, including $1.16 billion in solana (SOL) tokens and $560 million in bitcoin (BTC). The documents state that in addition to the $11 billion held on November 11, the company also received $15 billion in cash and held cryptocurrencies valued at $34 billion as of August 31. In addition, there are over 1,300 lesser-known and potentially illiquid tokens worth hundreds of millions of dollars, such as MAPS and serum (SRM). The presentation also details the $2.2 billion in cash, cryptocurrencies, equities, and real estate received by other executives such as Bankman-Fried and Nishad Singh, Zixiao "Gary" Wang, and Caroline Ellison in the months leading up to the bankruptcy. The documents also report 38 apartments, penthouses, and other properties in the Bahamas, estimated to be worth about $200 million.

Regarding customer claims,: as of August 24, 36,075 customer claims have been submitted, totaling $16 billion.

Later in the day, FTX has been in contact with over 75 bidders since May to assess the possibility of restarting the exchange.

PayPal launches cryptocurrency-to-USD exchange service

According to The Block, PayPal has newly launched a cryptocurrency-to-USD exchange service, following its previous service allowing customers to purchase cryptocurrencies. In a statement, PayPal mentioned that U.S. cryptocurrency wallet users can directly convert their cryptocurrencies into USD and have it credited to their PayPal balance, which can then be used for shopping or transferred to a bank card. This service supports usage in wallets, dApps, NFT markets, and MetaMask.

Coinbase Cloud integrates staking platform Kiln for native ETH staking below 32ETH

Coinbase Cloud has integrated Kiln's on-chain staking protocol, providing native ETH staking for amounts below the 32 ETH limit. This integration will allow Coinbase wallet users to directly stake smaller amounts of ETH from their crypto wallets.

According to CoinDesk, Nick Taylor, Public Policy Manager at cryptocurrency exchange Luno, stated in a release that the company plans to prohibit some UK customers from investing in cryptocurrency. An email from a Luno customer indicates that they will be unable to purchase or trade cryptocurrency starting October 6. Taylor mentioned that the Financial Conduct Authority (FCA) has implemented new rules for cryptocurrency companies. Therefore, all compliant cryptocurrency companies with UK customers are making some adjustments to their platforms to comply with the new regulations. Affected Luno customers can still sell cryptocurrency and make withdrawals. Earlier reports stated that FCA will impose stricter regulations on cryptocurrency advertisers starting October 8, including banning investment incentives such as "refer a friend" or "new joiner bonuses," and prohibiting the combination of incentive measures such as airdrops with guiding users to invest. Luno is not the only company suspending some of its UK operations. PayPal previously announced the suspension of cryptocurrency purchase services in the UK starting October 1, with plans to resume in early next year.

Telegram Bot project Banana Gun stated on X platform that there is a vulnerability in the Banana Gun contract that cannot be resolved through hotfix. Despite two audits, a vulnerability still exists in the contract related to taxes, allowing people to sell their tokens while there are still remaining tax tokens in their wallets. The first step is to sell the treasury wallet to drain the LP (now locked), so that it can be reused for the new contract. Subsequently, the restart will be done as soon as possible, and an airdrop will be provided.

Banana Gun later stated in another announcement: "We are reviewing the new contract, but will not launch until everything is confirmed to be in order. Next steps: 1. A snapshot will be taken (18115275) before any action is taken, and all holders, LPs, and presale participants will receive an airdrop of their tokens, even if they sell later; 2. We will also restore the LP pool; 3. For all trades, we will analyze the profits and losses of all traders before 22:30 local time. If they bought more than they sold, they will be compensated in full with ETH."

Additionally, data shows that the Banana Gun token BANANA went to zero after being online for an hour and a half, with a short-lived peak above $8.5.

Coinbase Prime launches Web3 wallet for institutional and corporate clients

According to the official blog, Coinbase announced that its institutional brokerage platform Coinbase Prime has launched an institutional-grade Web3 wallet. Institutional and corporate clients can use this non-custodial wallet with MPC technology to store any tokens from supported networks (including assets not yet offered on Prime Custody), instantly access funds, interact directly with dApps and smart contracts, trade large amounts of assets using decentralized liquidity, vote on DAO governance, lend assets or equity, directly access DeFi, buy/sell/mint/manage NFT collections, and manage Web3 social accounts.

According to a screenshot shared by 23pds, Chief Information Security Officer of SlowMist, on X platform, Vitalik Buterin stated that he has regained control of his T-mobile account and confirmed that his previous account was compromised by a SIM card hijacking attack. Vitalik stated that phone numbers should be completely removed from X platform (Twitter), and mentioned that he may have used a phone number for registration when signing up for Twitter Blue. He had previously seen advice not to use phone numbers for verification due to their insecurity, but had not realized this before. Vitalik expressed his happiness at joining the decentralized social protocol Farcaster, where account recovery can be controlled through an Ethereum address.

Earlier reports stated that Vitalik's X account was compromised, leading to a theft of $691,000 after hackers posted phishing links.

Digital asset platform Fireblocks launches non-custodial wallet service

According to CoinDesk, digital asset platform Fireblocks has launched a non-custodial wallet service, allowing end consumers of companies like Revolut and Nubank to have full control over their assets. Fireblocks currently serves large companies such as BNY Mellon, BNP Paribas, Flipkart, eToro, Revolut, NuBank, and Wisdom Tree.

Michael Shaulov, CEO of Fireblocks, stated that this move essentially liberates fintech companies from acting as custodians for end users, making it easier for these end users to access crypto products such as decentralized finance (DeFi) and other Web3 applications.

Bitget launches $100 million EmpowerX fund to support ecosystem development

Gracy Chen, Managing Director of Bitget, announced at the Bitget EmpowerX summit in Singapore the launch of the $100 million EmpowerX fund. The fund will seek to invest in regional exchanges, data analytics companies, media organizations, and other entities. Chen stated, "With the impact of tightening regulations, rapid development of Layer 2 and DeFi technology, the CEX field is constantly evolving, and we expect to see more investments, mergers, and acquisitions in the coming months."

The Bitget EmpowerX fund aims to expand Bitget's business scope, creating a comprehensive ecosystem encompassing trading, investment, research, DeFi, media, and other dimensions. Through more targeted and strategic investments, the fund will assist Bitget in expanding its ecosystem more comprehensively. A spokesperson for Bitget stated that the fund size may increase based on market conditions and future business strategies; this $100 million comes from Bitget's strategic reserves and is separate from the company's core budget, allocated specifically for this fund for investment purposes.

According to the FTX creditor @sunil_trades, the FTX 2.0 reboot plan, after the FTX 2.0 bidding deadline on September 24, will involve target selection on October 16. The plan collection will take place in the first or second quarter of 2024, with plan confirmation in the second quarter of 2024.

It is understood that the target selection after the FTX 2.0 bidding deadline refers to the initial public bidding action selected by the buyer designated by the company applying for bankruptcy protection. This action can attract more potential buyers to propose competitive acquisition prices.

According to CoinDesk Japan, Sony's wholly-owned subsidiary Sony Network Communications and the development company Startale Labs of Astar Network have signed an agreement to establish a joint subsidiary "Sony Network Communications Labs Pte. Ltd." in mid-September. The new company will focus on blockchain technology research and development.

Startale Labs CEO Soh Tanabe stated that the new joint subsidiary will advance the development of Sony Chain, which has the potential to surpass the Layer2 network Base previously released by Coinbase.

Arthur Hayes: If the Fed chooses to cut interest rates, Bitcoin will quickly rise to $70,000

BitMEX founder Arthur Hayes stated in a blog that if the Fed continues to raise interest rates, real interest rates will become even more negative and may remain so in the foreseeable future. The reason Bitcoin has not reached $70,000 is that people are more focused on nominal Fed interest rates and have not compared them to high nominal GDP growth in the US.

Hayes believes that the Fed's primary task is to protect banks and other financial institutions from bankruptcy, and that the rot of bonds could lead to the collapse of the entire financial sector. Therefore, the Fed's only choice is to cut interest rates to restore the health of the banking system and push Bitcoin quickly towards $70,000. The reason Bitcoin has such a convex relationship with Fed policy is that the debt-to-GDP ratio is too high, leading to the breakdown of traditional economic relationships. This is similar to raising the temperature of water to 100 degrees Celsius, it will remain liquid until suddenly boiling and turning into gas. In extreme cases, things become nonlinear and may bifurcate.

Although Hayes believes the Fed may be forced to cut rates close to zero and restart quantitative easing, he also believes that Bitcoin can rise significantly even if this is not the case.

The block production data for the zkSync Era block explorer has now been restored, with the latest block on the zkSync Era network being #208622.

The browser's data was previously stuck at block #208455 at 14:14, upon inspection, batch block #208456 was produced at 14:14, block #208457 was produced at 14:15, and the subsequent block production intervals were approximately 1 minute. Therefore, the lack of data updates may have been due to a browser data malfunction.

The Snapshot page shows that the Mantle community (formerly BitDAO) has passed the MIP-26 proposal to use the Mantle Treasury to promote network applications, with a final voting support rate of 100%. The proposal suggests providing up to $160 million in liquidity support for applications, up to $60 million in seed liquidity for RWA-backed stablecoins, and up to approximately $18 million in liquidity support for third-party cross-chain bridges. A total of $238 million will be allocated.

According to the official Ethereum blog, Go Ethereum has released the Ethereum client Geth v1.13 version. Go Ethereum stated that this version, developed over 6 years, provides a new database model for storing Ethereum state, which is faster than previous solutions and also has proper pruning implementation. This model supports correct and comprehensive dynamic pruning of historical states, meaning that nodes no longer need to be taken offline to resynchronize or manually prune.

Ankr and Tencent Cloud jointly launch Tencent Cloud Blockchain RPC service

LayerZero partners with Google Cloud, with Google Cloud becoming the default oracle for LayerZero

Technical issues encountered by Binance Futures platform, followed by resolution of issues with USDT-margin futures.

Funding News

Game startup Pahdo Labs completes $15 million Series A funding round, led by a16z

According to Decrypt, game startup Pahdo Labs has completed a $15 million Series A funding round, with Andreessen Horowitz (a16z) leading the investment. Pahdo has not formally announced other Series A investors, but Crunchbase mentions the participation of companies such as BoxGroup, Long Journey Ventures, PearVC, and 2 Punks Capital in this round of funding.

Pahdo Labs is a New York-based game development company founded in 2021. The company's core goal is to use generative artificial intelligence (AI) technology to create unique game experiences that deeply engage players and allow them to continuously influence the game world. Halcyon Zero is an animated action role-playing game developed by the company, and Pahdo Labs plans to use AI technology to introduce new game modes for Halcyon Zero. According to a tweet by a16z General Partner Jon Lai, Pahdo is "opening up creator tools for players to make their own animated games and enhancing game features through AI/programmatic generation."

Mountain Protocol launches interest-bearing stablecoin USDM and announces seed round funding

Mountain Protocol has announced the launch of a compliant, interest-bearing stablecoin called USDM. The token is fully backed by short-term US Treasury bonds and provides daily rewards to users in a staking format, with a current annual interest rate of 5%. Mountain Protocol obtained a license from the Bermuda Monetary Authority to become a digital asset issuer on July 27. However, USDM is not available to US customers, and the asset is not registered as a security in the US.

Mountain Protocol also announced a seed round funding led by Nic Carter of Castle Island Ventures, with participation from Coinbase Ventures, New Form Capital, Daedalus Angels, and others. Mountain Protocol's Co-founder and CEO Martin Carrica stated that the funding amount for this round is confidential due to regulatory requirements. It is worth noting that the CEO of Coinbase previously mentioned Mountain Protocol in the top 10 innovative tracks.

Web3 game studio GamePhilos completes $8 million seed round funding, led by Animoca Ventures

According to Businesswire, the development studio GamePhilos Studio for the Web3 strategy game Age of Dino has completed an $8 million seed round funding, with Xterio, Animoca Ventures, SevenX Ventures, and Chain Hill Capital leading the investment, and participation from Hashkey Capital, Sanctor Capital, Game7, Bas1s, GSR Markets, and GSG Ventures.

The funding will be used to develop the mobile/PC strategy game Age of Dino, which will be built on the Xterio platform and will be deployed on opBNB, integrating NFT and other content. The Xterio platform will provide technical support and a software development kit for Age of Dino. Age of Dino is planned to be released on mobile devices in selected countries/regions early next year.

Important Data

CoinShares: Net outflow of $59.3 million from digital asset investment products last week

According to CoinShares' weekly data, there was a net outflow of $59.3 million from digital asset investment products last week, marking the fourth consecutive week of net capital outflow, with a total outflow of $294 million over four weeks. Specifically, Bitcoin investment products saw a net outflow of $68.9 million, while Ethereum investment products saw a net outflow of $4.8 million. It is worth noting that investment products shorting Bitcoin saw a net inflow of $15.2 million, the largest weekly net inflow since March of this year.

On-chain data shows that on Monday, as market selling intensified, trading firms such as Jump Trading, Wintermute, and Abraxas Capital transferred large amounts of Bitcoin, Ethereum, and ARB to cryptocurrency exchanges. Blockchain analysis company Arkham Intelligence tweeted that asset management firm Abraxas Capital transferred 14,130 ETH worth approximately $22.5 million in two transactions to Bitfinex. Major market maker Jump Trading sent nearly 236 BTC worth $5.9 million in a single transaction to Binance. In addition, according to Lookonchain monitoring, another large market maker, Wintermute, deposited over $3.3 million worth of ARB into Binance in the past 8 hours.

According to Lookonchain monitoring, Vitalik Buterin's related address once again transferred 2,000 ETH to an address starting with 0x5567 in the early morning, worth approximately $3.12 million.

It is worth noting that over the past month, Vitalik's related address has transferred a total of 2,700 ETH worth approximately $4.77 million to an address starting with 0x5567.

Data from makerburn.com shows that MakerDAO added another $100 million in RWA assets in the past 24 hours, with BlockTower Andromeda adding $50 million in RWA assets, primarily invested in short-term US Treasury bonds with an annualized interest rate of 4.5%. Monetalis Clydesdale added $50 million in RWA assets with an annualized interest rate of 4%. Additionally, the protocol's total RWA assets have now reached $2.613 billion.

PANews APP Points Mall Officially Launched

Free redemption of hardcore prizes: imKeyPro hardware wallet, First Class Cabin Research Report monthly subscription, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come, first served, experience now!

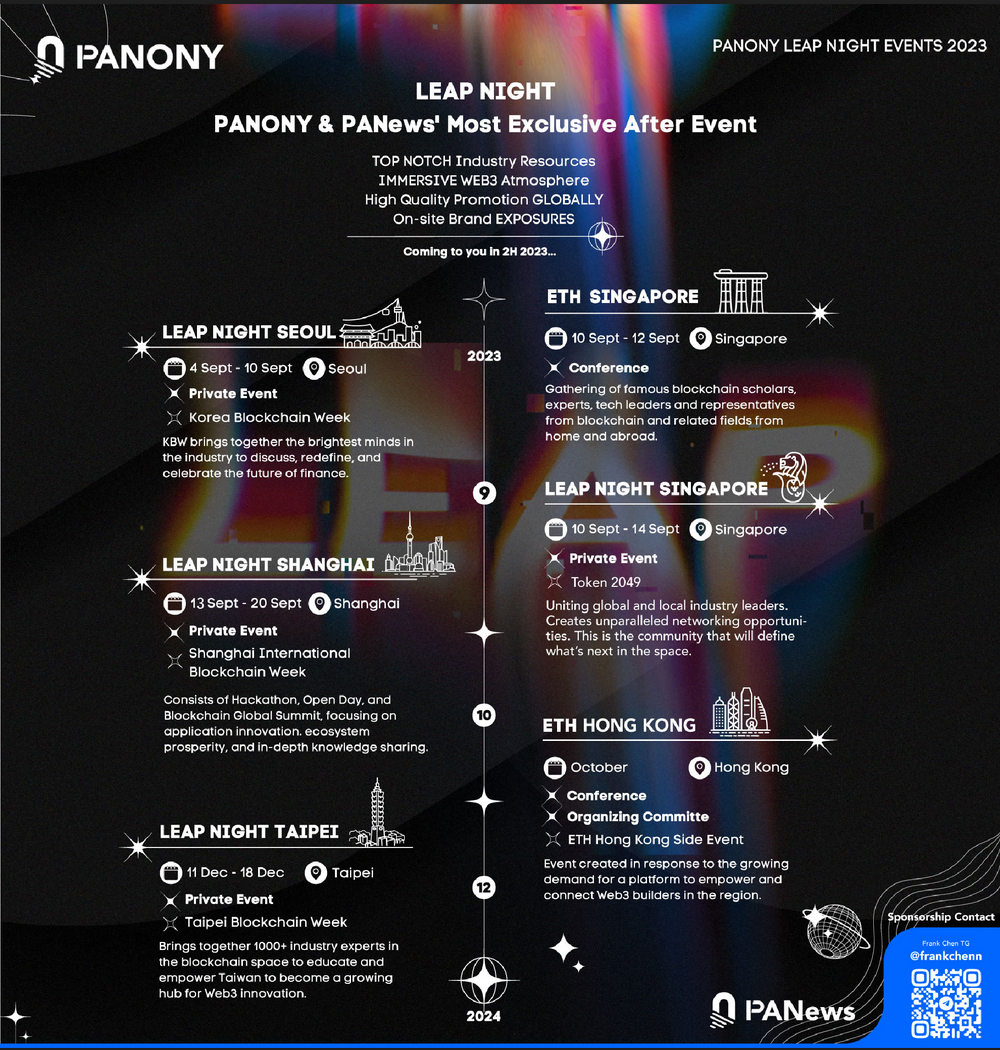

PANews Launches Global LEAP Tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations will come together from September to December to witness a new chapter in globalization!

?Co-building activities in multiple locations, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。