Author: Daniel Li

After a long bear market, the market's demand for positive news is growing stronger. Relying solely on the emergence of innovative projects is no longer enough to boost overall market sentiment. The market urgently needs a new catalyst, just like the Grayscale Bitcoin Trust (GBTC) in 2020, which received approval from the U.S. Securities and Exchange Commission (SEC) and sparked a market frenzy at the time. Now, the highly anticipated Bitcoin spot ETF is most likely to play this role.

Although the U.S. SEC has always been cautious about Bitcoin spot ETFs and has once again postponed approval, the market remains optimistic about its eventual approval. According to current market forecasts, the probability of approval for a Bitcoin spot ETF within this year is 75%, and the probability of approval by the end of 2024 can reach 95%. The bear market has restrained the market for too long, and the approval of a Bitcoin spot ETF will be a potential significant positive development, potentially becoming the engine for the next round of the crypto bull market.

What is a Bitcoin Spot ETF and Why is it So Favored by Capital?

To understand the Bitcoin spot ETF, we first need to understand the concepts of ETF and Bitcoin futures ETF. ETFs (Exchange-Traded Funds) are investment tools designed to track the prices and performance of specific assets. They can be traded on stock exchanges, allowing investors to buy and sell ETFs just like stocks.

On the other hand, a Bitcoin futures ETF is a fund that holds futures contracts linked to the price of Bitcoin. In fact, Bitcoin futures ETFs do not directly hold any Bitcoin. Their investment strategy involves tracking the price movements of Bitcoin through holding futures contracts. Through Bitcoin futures ETFs, investors can buy, sell, and trade, thereby participating in the price fluctuations of Bitcoin.

A Bitcoin spot ETF, on the other hand, is a fund that allows investors to buy and sell actual Bitcoin at the current market price. In reality, this fund directly purchases, sells, and holds actual Bitcoin. This allows investors to hold Bitcoin without managing their own Bitcoin wallets. Through a Bitcoin spot ETF, investors can conveniently participate in the Bitcoin market and profit from the price fluctuations of Bitcoin.

Advantages of a Bitcoin Spot ETF:

A Bitcoin spot ETF possesses the advantages of a futures ETF, such as not requiring direct investment in Bitcoin through exchanges, lower trading costs, and a simplified process. Compared to futures ETFs, spot ETFs have lower risks. Spot ETFs invest based on the actual Bitcoin price, meaning that investors hold actual Bitcoin during the contract period. This characteristic of holding Bitcoin is also considered a more legitimate investment method.

Furthermore, as an exchange-traded fund, a Bitcoin spot ETF can be traded on stock exchanges. This means that investors can buy or sell Bitcoin spot ETFs just like trading stocks, providing more flexible investment and trading strategies. Investors can buy or sell shares of Bitcoin spot ETFs according to market changes at any time, enjoying the advantages brought by flexibility. This also makes Bitcoin spot ETFs a popular investment tool, attracting more investors to participate in the cryptocurrency market.

Additionally, a Bitcoin spot ETF also provides more investment opportunities related to cryptocurrencies for traditional financial institutions and capital markets. With the continuous development and maturation of the Bitcoin market, more institutional investors are hoping to participate. The launch of a Bitcoin spot ETF provides these institutions with a compliant investment tool, allowing them to participate in the Bitcoin market within an appropriate regulatory framework and gain returns. This further drives the development of the Bitcoin market and brings cryptocurrencies into the view of the traditional financial sector.

Reasons for Capital's Favor of Bitcoin Spot ETF:

Capital's favor of the Bitcoin spot ETF stems from its optimistic outlook on its broad future prospects. Here are some advantages explaining why the Bitcoin spot ETF is highly favored by capital:

Expanding market size and participation: As one of the main categories of exchange-traded products, ETFs have a huge market size, with a total value of $7 trillion. The introduction of a Bitcoin spot ETF will further expand the participation in the cryptocurrency industry, attracting more investors into the market, thereby enlarging the overall market size. For capital, a larger market size means more opportunities and potential profits.

Providing direct participation in the Bitcoin market: Compared to Bitcoin futures, a Bitcoin spot ETF is closer to the actual Bitcoin market. Spot Bitcoin involves direct trading of actual digital currency. This opportunity for direct participation in the Bitcoin market allows capital to more flexibly manage and allocate Bitcoin assets, further enhancing investment efficiency.

Meeting market demand and expanding investment channels: With the popularization of the cryptocurrency market, more and more traditional financial institutions hope to enter this field. However, due to regulatory restrictions and channel limitations, these funds cannot directly enter the crypto market. A Bitcoin spot ETF provides a more convenient and easy-to-operate investment method, offering traditional financial institutions and large capital a channel to enter the crypto market.

Providing higher transparency and regulatory compliance: A Bitcoin spot ETF is listed on stock exchanges, directly subject to review and supervision by regulatory authorities. Compared to some unregulated or lightly regulated cryptocurrency exchanges, a Bitcoin spot ETF offers higher transparency and regulatory compliance. This provides capital with a safer and more reliable investment environment.

The Spell of the Bitcoin Spot ETF May Be Broken

The idea of a Bitcoin spot ETF has been brewing for many years. Although numerous proposals have been submitted to regulatory agencies, as of now, no Bitcoin spot ETF has been approved for listing on major U.S. stock exchanges, seemingly becoming a spell in the U.S. crypto market. However, outside the U.S., a Bitcoin spot ETF has already been successfully approved. As early as February 18, 2021, the Canadian investment company Purpose successfully launched the world's first Bitcoin spot ETF—Purpose Bitcoin ETF, which began trading on the Toronto Stock Exchange with a trading volume of nearly $400 million on the first day.

As the global center of the crypto market, U.S. investment institutions clearly will not give up on this market. Since the Winklevoss brothers pioneered the application for a Bitcoin spot ETF in 2013, institutions in the U.S. have applied for a Bitcoin spot ETF every year, but without exception, all have been rejected. Due to the numerous past failures, previous applications for a Bitcoin spot ETF did not attract much attention in the market. People seemed to have little hope for whether a Bitcoin spot ETF could be approved in the U.S., until June of this year, when the world's largest asset management company, BlackRock, submitted an application for a Bitcoin spot ETF, once again igniting people's expectations for the approval of a Bitcoin spot ETF.

It is reported that BlackRock manages assets worth over $9 trillion. In this application, BlackRock also proposed Coinbase as the cryptocurrency custodian and spot market data provider, indicating that BlackRock was well-prepared for the application of a Bitcoin spot ETF. It is worth mentioning that out of 576 ETF applications in the past, BlackRock has been rejected only once.

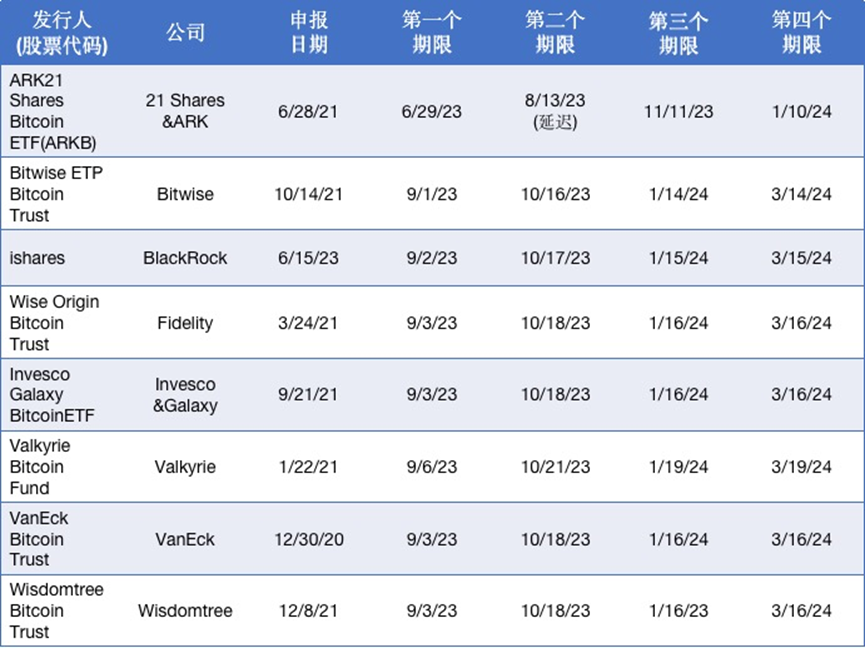

Due to the market's optimistic outlook on BlackRock's application for a Bitcoin spot ETF, some institutions that previously failed in their applications have once again joined the ranks of applying for a Bitcoin spot ETF. They believe that if BlackRock is approved, then other similar applications also have the potential for approval. According to data, as of August, 8 well-known institutions have applied for a Bitcoin spot ETF. The dense applications for a Bitcoin spot ETF by capital are clearly not groundless. The curse of the U.S. Bitcoin spot ETF not being approved may be on the verge of being broken after a long battle of 10 years in this wave of applications.

What Impact Will the Bitcoin Spot ETF Bring to the Crypto Industry?

Although Bitcoin spot ETFs have been approved in some countries, for the global crypto market, the approval of a Bitcoin spot ETF by the U.S. SEC still holds significant importance. According to Eric Balchunas, an ETF analyst at Bloomberg, if a Bitcoin spot ETF is approved, the U.S. may account for 99.5% of the global crypto ETF trading volume. Therefore, the importance of the U.S. market is self-evident. Once the U.S. approves a Bitcoin spot ETF, what impact will it have on the global crypto market?

- Coinbase May Become the Biggest Winner Behind the Competition for Bitcoin Spot ETF

Once the ETF application is approved, the biggest beneficiary in the market will not be the ETF applicant institutions, although they will also benefit greatly. In comparison, Coinbase is the biggest winner behind the scenes.

The reason the SEC previously rejected Bitcoin spot ETFs was due to a lack of regulatory transparency. Therefore, the institutions in this wave of ETF applications have included surveillance-sharing agreements to meet regulatory requirements. In the surveillance-sharing agreement, the asset management company must choose a partner as the custodian of the Bitcoin fund, responsible for providing surveillance sharing services, allowing both parties to share information about trading, clearing activities, and customers to reduce market manipulation risks. In this regard, Coinbase, as the largest and compliant cryptocurrency exchange in the U.S., is undoubtedly the best choice.

At present, in the competition for Bitcoin spot ETF applications, besides BlackRock confirming its partnership with Coinbase, other participants such as Fidelity, VanEck, 21Shares under ArkInvest, Valkyrie, and Invesco have submitted revised applications, designating Coinbase as their partner. Once the SEC approves these asset management companies' applications, the vast assets under their names will be custodied on Coinbase. According to an analysis included in the ETF filing submitted by BlackRock, Nasdaq estimates that 56% of the $129 billion worth of Bitcoin trading in the U.S. is conducted on Coinbase. In the future, with the development of Bitcoin spot ETFs, this proportion is expected to further increase. Coinbase will gain huge benefits and become the biggest winner in this competition.

- Bitcoin Spot ETF May Become the "Engine" for the Crypto Market to Transition from Bear to Bull

Translated with www.DeepL.com/Translator (free version)

Once the Bitcoin spot ETF is approved, it will provide a safe and effective "pipeline" for the massive influx of traditional financial funds into the crypto world, which will have a more profound impact on the crypto market. Especially in the current market, which has been bearish for a long time, from 2022 to now, we have witnessed various crypto institutions collapsing and regulatory policies suppressing the market. Even industry leaders like Binance and Coinbase have faced multiple regulatory pressures. The price of Bitcoin has also dropped from its high of $45,000 in early 2022 to $25,000 now, causing market investors to lose confidence in the crypto market. At this time, a major positive development is urgently needed to stimulate the market from bearish to bullish and open a new bull market.

The Bitcoin spot ETF happens to have the ability to do just that. It's worth noting that the asset management company applying for a Bitcoin spot ETF, BlackRock alone, has assets under management of nearly $9 trillion. And BlackRock is not the only asset management company applying for a Bitcoin spot ETF. With more asset management companies entering this field, the traditional funds entering the crypto market will be a massive amount. The SEC's approval of the Bitcoin spot ETF will sound the horn for the crypto market to charge into a bull market.

- Accelerating the mainstreaming of crypto assets

The launch of the Bitcoin spot ETF provides institutional investors with a more convenient and standardized way to participate in the crypto market. Since ETFs are a more traditional investment tool, their introduction will allow more investors to participate in the crypto market in a more convenient way, thereby increasing awareness and popularity of cryptocurrencies. This will help further expand the scale and liquidity of the crypto market, attracting more institutional investors to enter the market.

In addition, the surveillance-sharing agreements implemented by the Bitcoin spot ETF will further increase the transparency of crypto market regulation, thereby enhancing market credibility and investor confidence. These agreements will also help align the regulatory approach of the crypto market with that of the U.S. market, leading to the implementation of more suitable regulatory policies and standards for the crypto market. This will help the crypto market move towards greater maturity and stability. Furthermore, the surveillance-sharing agreements will allow regulatory agencies to have a more comprehensive understanding of the operation and risks of the crypto market, thereby better protecting the legitimate rights and interests of investors.

Conclusion

Despite many reasons supporting the approval of the Bitcoin spot ETF, the outcome remains unpredictable until the U.S. SEC makes a final decision. However, logically speaking, since the SEC has allowed the high-risk Bitcoin futures ETF to be listed, there is no reason to reject the Bitcoin spot ETF. The previous reason for rejecting the Bitcoin spot ETF application due to a lack of regulatory transparency is no longer valid, as new applications have all included surveillance-sharing agreements. The SEC's delay in approval this time is different from past reasons for postponement. There are reports that Nasdaq is preparing a regulatory cooperation agreement with a U.S. Bitcoin trading platform. The SEC may be waiting for traditional financial institutions to complete infrastructure construction. Therefore, it seems that the listing of the Bitcoin spot ETF in the U.S. is only a matter of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。