Original Title: "A Little Bit About…"

Original Source: SAM ANDREW, substack

Compiled by: Kate, Marsbit

Former hedge fund analyst Sam Andrew was honored on the Artemis monthly analyst list. Sam has over 8 years of experience in financial analysis at Credit Suisse and hedge fund BlueMountain Capital. In this article, Sam shares his insights on four misconceptions of traditional investors transitioning to crypto investments, three key points on crypto fundamentals, his views on crypto investment themes, and offers his advice to newcomers interested in crypto investments. This heartfelt experience is worth reading. The following is the full translation:

I made it onto Artemis's analyst list this month. My conversation with Artemis founder Jon Ma covered personal, investment, and cryptocurrency topics. Our discussion provides more insight into my background, something that readers of Crypto Clarity have asked about.

I will explain my journey into crypto and share the framework I applied from my hedge fund experience to cryptocurrency. I outline the misconceptions most tradefi investors have about cryptocurrencies. I share more thoughts on the importance of cryptocurrency fundamentals. We conclude with interesting topics and general advice.

Below is my interview with Jon Ma, excerpted from "Artemis Monthly Analyst."

What is your story? How did you get into the investment and crypto field?

I grew up in Toronto, Canada. My grandfather introduced me to the financial markets and investing when I was in my teens. He was a World War II veteran who spent most of his life working in a factory and later taught himself about investing. I was fascinated! The idea that I could bet based on my own experiences and make money was exhilarating. At the same time, I realized I wouldn't become a professional hockey player, so I thought I'd better find something else!

My interest in investing and the financial markets led me to investment banking. I worked at Credit Suisse in London, UK. The banking industry served as a stepping stone for the buy side. After completing a two-year banking analyst program, I joined the hedge fund BlueMountain Capital. I spent over 8 years at BlueMountain. I worked in London for three years, primarily in credit investments. Then I was transferred to the company's headquarters in New York, where I spent over 5 years involved in the company's long-short equity strategy. I was fortunate to join a great company in its early days. The capital managed by the company grew from $3 billion to $22 billion.

I first dabbled in crypto in 2017. The seamless peer-to-peer currency exchange potential of Bitcoin and the programmability of Ethereum resonated with me. From my perspective, there are many potential financial market use cases. I bought my first BTC and ETH. I rode the bull market and the subsequent crash. I've been interested in cryptocurrencies for years to satisfy my curiosity. But it wasn't until a few years later that I fully immersed myself in the crypto space.

My belief in dedicating all my time to cryptocurrencies is driven by personal and professional motivations. Personally, being part of a rapidly evolving disruptive industry where I can take a leadership role and help develop a potentially revolutionary technology is too attractive to ignore. From a professional standpoint, cryptocurrencies are the most fertile ground for investment. It's the only market that is both inefficient and illiquid. It reminds me of the stock market decades ago when investing legends were just starting to emerge.

You spent over 8 years as a hedge fund analyst at BlueMountain. What framework and experience did you learn from the buy side when evaluating crypto assets?

I have summarized four experiences from my hedge fund experience that are applicable to cryptocurrency investments:

1. Time Management: The most important skill for an investor is effective time management. There is an endless amount of research to be done. Both timely feedback and capital returns are equally important. The ability to quickly discern what is interesting and why it's interesting is crucial. Careful research drives factors that move asset prices. Focus research efforts on this.

2. Source of Returns: Excess returns, often referred to as alpha, are a product of your divergence from and convergence with market expectations. Most investors get it wrong. Investors need to believe in one outcome while the market believes in another. If the market starts to believe in your outcome, it will drive asset prices and bring excess returns.

3. Paper-Driven Investing: Paper-driven investing is rooted in deep independent research that contains 3 to 5 principles unknown to the market that will change the market's view of the asset. The result of paper-driven investing is a differentiated viewpoint.

4. Risk Management: The correct probability of a very good investor is only slightly higher than their incorrect probability. The true driver of portfolio returns is position sizing. Those you get right, you size up. Manage position size accordingly. Investors need to find a balance between the courage of firm beliefs and the humility of making mistakes.

Where do you think most traditional financial investors researching cryptocurrencies go wrong?

When researching cryptocurrencies, traditional investors often fail to understand four things:

1. Business Models: Cryptographic protocols and applications sell products for a fee and generate revenue. This fundamental principle is no different from any other business. Non-crypto investors are interested in i) the term "cryptocurrency," ii) non-legal tender units, and iii) value appreciation. Most tokens are not currencies. It is unnecessary confusion to conflate tokens with currencies. Introducing a new unit of account is a paradigm shift. People find it hard to understand this. It weakens their existing viewpoint that fiat is the only yardstick of value. The appreciation of cryptocurrencies is not as straightforward as owning stocks. This difference is mainly due to regulation. I expect the appreciation of cryptocurrencies to become standardized.

2. Operating Leverage: Cryptographic protocols have already and have the potential to become highly profitable. They possess the operating leverage that tradfi investors talk about. Their costs do not increase in proportion to their income. Tradfi investors misunderstand the profit potential when income grows.

3. Durability: A company's durability, also known as competitive advantage or moat, comes from its intellectual property, brand, network effects, or regulatory capture. However, in cryptocurrencies, there is no ownership of intellectual property. Cryptocurrencies are open source. Code is copied and used to create new versions of existing protocols. Therefore, the durability that companies enjoy does not apply to cryptocurrencies. Tradfi investors avoid it due to the lack of a moat. They misunderstand that even without owning intellectual property, a moat can still exist. The moat lies in the network effects of the protocol.

4. Valuation: Valuing crypto assets is challenging. There is no universally accepted way to assess the value of tokens. Therefore, tradfi investors mistakenly believe that cryptocurrencies are primarily speculative. There are many methods to triangulate valuation. I believe most protocols will be seen as productive assets with token-equivalent cash flows. A small subset of tokens will also have properties of value storage assets.

We really like your research on Crypto Clarity. We enjoy hosting "Crypto Fundamental Investment" on Twitter and your article "Crypto Fundamentals Don't Matter… Do They?" So, are fundamentals important for cryptocurrencies? When do you think fundamentals will be more important?

The importance of fundamentals reflects an adoption curve. In the early days of cryptocurrencies, fundamentals were not important. They are more important now. They will become even more important in the future.

Fundamentals are becoming increasingly important because:

1. Indicators Exist: DeFi summer birthed many applications and generated metrics that need to be tracked, including developer activity, network usage, fees, and costs. These metrics did not exist before. Without metrics, there is no fundamental analysis.

2. Capital Formation: Cryptocurrencies are becoming increasingly important globally. The industry's development and adoption require capital. When investors can effectively assess the projects they invest in and predict their value, they are more willing to allocate capital.

3. Historical Analogy: The crypto market is similar to the stock market decades ago. Fundamental analysis of stocks has become increasingly popular over the past few decades. As the market matures, understanding and regulating fundamentals become more important. Stocks, credit, and commodities markets also follow similar patterns. Cryptocurrencies will too.

I believe regulation may be the watershed for cryptocurrency fundamentals. Increasing confidence and integrity in the crypto market will pave the way for more investors to apply what they do best, fundamental analysis.

What are the crypto themes you are currently researching or interested in?

In the low-volume market post-FTX, catalysts are crucial. Paper underwriting investments and catalyst-driven position sizing. I believe the two biggest catalysts next year, apart from macroeconomics, are EIP-4844 and the Bitcoin halving. I have spent a lot of time on these two aspects.

For new investors looking to enter the field of fundamental crypto investment in 2023, do you have any advice to share?

It is useful. This goes far beyond the scope of fundamental investment in 2023. Cryptocurrencies are not an expert's industry. In fact, it doesn't matter that you haven't been in the crypto industry for the past decade because no one has. Things change so fast that insights from two years ago are not as applicable today. So, you are not that far behind those who have been in the industry.

I had three goals when I started writing Crypto Clarity: i) to increase my knowledge, ii) to share that knowledge with others, and iii) to leverage my knowledge and value to provide crypto investment for others. If you provide value to others, you will also receive returns.

How do you use Artemis in your fundamental research?

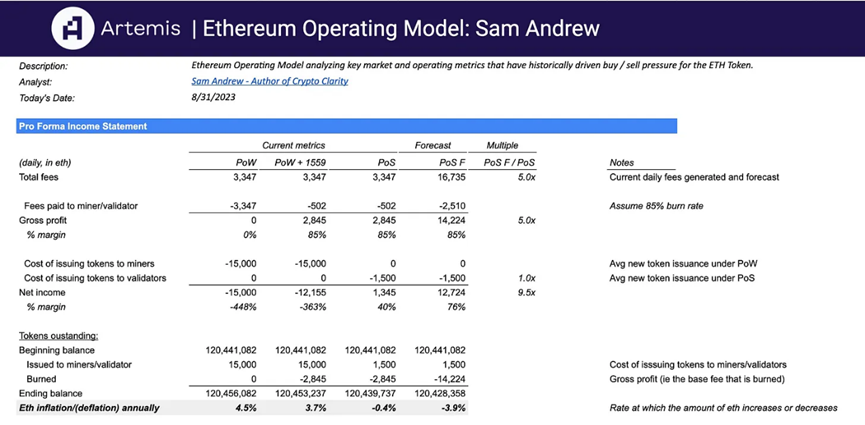

Artemis is my most used tool. Check out the 50+ articles I published last year. Artemis has the widest range of sources. Artemis is the tool I use to extract on-chain data and easily compare protocol metrics. I also use it to create dashboards and models in Excel and Google Sheets with just one click to update. Check out the Ethereum template I built on the Artemis sample template.

Stay curious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。