The blockchain industry has made progress, but its advancements are mostly "vertically deepening" rather than "horizontally expanding."

Written by: Liu Honglin

The Web3 industry experiences a narrative of "application explosion" every so often: NFTs change the art market, blockchain games disrupt game distribution models, DAOs rewrite corporate governance logic, and AI+Crypto aims to usher in a new era of "on-chain artificial intelligence agents"… However, after each wave of enthusiasm, we still face an increasingly clear question: the boundaries of the industry do not seem to have truly expanded.

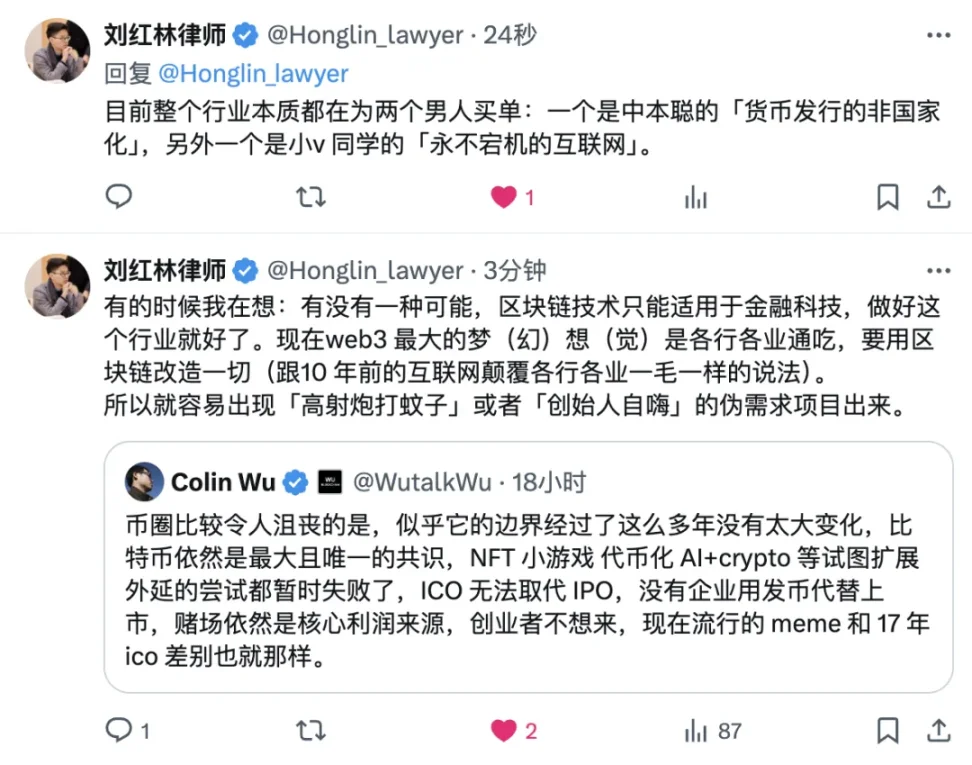

This sentiment is echoed in a tweet by Wu, which states: "What is frustrating about the crypto space is that its boundaries seem to have remained largely unchanged over the years. Bitcoin is still the largest and only consensus. Attempts to expand the perimeter, such as NFT mini-games, tokenized AI+crypto, etc., have temporarily failed. ICOs cannot replace IPOs, no company uses token issuance instead of going public, and casinos remain the core source of profit. Entrepreneurs are reluctant to come; the difference between the current memes and the ICOs of 2017 is minimal."

Indeed, from a market structure perspective, we have not seen a new "mainstream asset" challenge BTC's position, nor has a new business model emerged that allows Web3 to break out of the "fintech" category. NFTs, blockchain games, SocialFi, and AI narratives, although once very popular, have rarely seen projects successfully transition from "concept" to "sustainable application."

We seem to be experiencing a collective illusion—a technology field pushed forward by narratives, attempting to go further each time, only to find that it still cannot escape the initial path.

The boundaries of blockchain adaptation: Is it really suitable for "all industries"?

The "omnipotent fantasy" of Web3 has been repeatedly mentioned over the past few years: we want to create "on-chain social," "on-chain e-commerce," "on-chain education," "on-chain entertainment," as if there is room for "transformation" in any industry that has not yet connected to blockchain. However, upon closer examination, the technical characteristics of blockchain itself—immutability, verifiable ownership, and contract logic that does not require intermediaries—are indeed very suitable for financial scenarios, but may not be suitable for information flow-oriented or social-driven businesses.

The underlying logic of the internet is "zero-cost replication," while the logic of blockchain is precisely "limited replication + pay-per-write." Under this technical structure, attempting to recreate something like TikTok, Taobao, or Twitter using blockchain is mismatched from the start. The costs are high, the experience is poor, and the performance is unstable, while users do not have an urgent need for "decentralized social" or "traceable live streaming platforms."

More importantly, even if some industries do seem to have needs for "verification," "traceability," and "profit sharing," such as music copyright, art trading, or e-commerce supply chains, the addition of blockchain has not genuinely reduced costs or improved efficiency; rather, it has increased the understanding threshold and operational complexity. Ultimately, "chain reform" has become a selling point for project financing rather than a tool for enhancing commercial efficiency.

The entire Web3 is paying for two men

To some extent, the entire Web3 industry is currently paying for two men.

One is Satoshi Nakamoto—the founder of Bitcoin—who proposed the idea that "currency issuance can be independent of state machinery." From Bitcoin to stablecoins, from CBDCs to anonymous coins, global monetary experiments can be seen as responses to this proposition left by Nakamoto. The rise of stablecoins is essentially an exploration of replacing state sovereign credit with private credit; while the regulatory suppression by various governments is a form of self-defense by state machinery.

The other is Vitalik Buterin, the co-founder of Ethereum. His proposition is: "Can we build a global internet system that never goes down?" From smart contracts and decentralized identity systems to trustless governance (DAOs), the entire Ethereum ecosystem is actually trying to construct a new system that does not rely on traditional trust mechanisms. However, the reality is that on-chain systems still face old problems such as governance failure, high gas fees, and performance bottlenecks; there remains a structural contradiction between "never going down" and "sustainable operation."

From this perspective, the development of Web3 is not without meaning, but its expansion path always revolves around the two aforementioned issues—restructuring the monetary system and internet infrastructure—rather than the fantasy of "pervasive penetration into all industries."

Market validation: Why are the most successful projects still "fintech"?

We can see the real situation from the most "stable" business forms currently in the industry: exchanges, stablecoin issuance, on-chain asset management, cross-border payments, custody services, and RWA (Real World Asset) asset tokenization, among others. These directions all have financial attributes and address specific market needs and regulatory adaptation issues.

Circle's USDC is gradually achieving a "quasi-bank" model in multiple countries, directly connecting with local payment systems; Hong Kong's licensed virtual asset exchanges are attracting traditional financial institutions to explore new paths of "tokenized financial products + exchange listings"; Singapore is rapidly advancing RWA pilots through financial regulatory sandboxes, allowing traditional assets like real estate and funds to circulate in token form. These are clear attempts to "move forward" within the existing regulatory framework, though far from disruptive, they have practical grounding.

In contrast, we rarely see "on-chain social" platforms survive beyond a full market cycle, and almost no blockchain games can escape the lifecycle of "short-term token issuance + short-lived ecosystems." As for on-chain content platforms and DAO city governance, most are still in experimental stages and cannot be said to have "exploded."

The repetition of "pseudo-applications": Are we wasting resources?

There is a prevalent risk in the industry: a large amount of capital, manpower, and resources are being invested in certain unsustainable application narratives. These projects often have a strong "financing logic" but lack reusable product logic or technical pathways, ultimately leading to the awkward situation of "completion of demonstration equals termination."

For example, some "AI+Crypto" projects are essentially just calling OpenAI interfaces on-chain and embedding token incentive mechanisms, with core functionalities no different from Web2 AI tools, and even worse experiences. Similarly, some NFT social projects rely entirely on "secondary market expectations" for user retention; once prices fall, the social value collapses as well.

The common characteristics of such projects are: narrative-driven, fictitious scenarios, lagging products, and a lack of stable user demand support. Meanwhile, investment institutions and entrepreneurial teams, driven by cycles, repeatedly tilt resources toward these directions, which not only inflate the industry bubble but also dilute potential continuous investments in infrastructure, payments, compliance, and other areas.

Is it an illusion, or are we unwilling to accept the "real boundaries"?

So the question returns to the starting point: Is the blockchain explosion merely an illusion?

Perhaps it is. But a more precise expression would be: it is not an illusion, but a misjudgment.

We misjudged the applicable boundaries of blockchain, treating it as a new generation of internet infrastructure, hoping it could "conquer all"; we misjudged the universality of user needs, believing everyone requires "decentralization"; we also misjudged the compliance thresholds and technical costs, overlooking the inertia of systems and considerations of efficiency in the real world.

However, we must also recognize that within the boundaries of fintech, Web3 still has very solid opportunities. The reconstruction of global payment networks, the enhancement of asset digitization transparency, the gradual maturity of compliant token issuance, and secondary market trading systems are forming the most stable foundation for Web3. It does not require excessive narratives, nor does it need to overturn everything; as long as it continues to provide real value in this field, it is sufficient to support a sustainably developing industry.

Conclusion: Returning to the core issues allows us to move forward

The blockchain industry has not made no progress; rather, its progress is mostly "vertically deepening" rather than "horizontally expanding." The industry is not without value; it is just that this value does not equate to all industries needing to connect to Web3; it is not without a future; it is just that this future may be more focused and narrower than we imagine, but also more real.

When we look back at the slogans of "chain reform everything" proposed in those years, we may realize that what is truly worth persisting in is not grand dreams, but the technological adaptation and institutional innovation that can transcend cycles. And these do not require much imagination but rather stronger execution and more rational industry awareness.

Where will Web3 ultimately head? We may not be able to predict all the answers, but at least one thing is clear: letting go of illusions allows us to see reality. And reality itself does not need embellishment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。