Article Author: LLAMARISK

Article Compilation: Block unicorn

Relationship with Curve

TrueUSD (TUSD) plays an important role in crvUSD as one of the Pegkeeper pools (crvUSD/TUSD), along with USDC, USDT, and USDP. Pegkeepers mint or burn crvUSD tokens based on market conditions to algorithmically control crvUSD to peg to 1 USD, essentially supporting outstanding crvUSD supply with a portion of its Pegkeeper pair.

Pegkeepers are enforced to maintain balance in each Pegkeeper pool, so if the pegged value of Pegkeeper assets falls below 1 USD, it leads to an excess of circulating crvUSD, causing crvUSD to become unpegged. Curve intends to launch an improved version of Pegkeeper that will check token prices against the composite of other tokens. This will provide better protection by preventing crvUSD deposits from entering unpegged Pegkeeper pools. Currently, the stability of crvUSD depends on strong confidence in the stability of its Pegkeeper pair and whether the stablecoin is low-risk.

In the context of being a Pegkeeper asset for crvUSD, there are some criticisms regarding the transparency policy of TUSD, which are worth emphasizing. In many aspects, including custody partners, reserve management, verification, on-chain operations, and ownership structure, there are transparency deficiencies with TUSD. This report will cover the most concerning issues surrounding the status of TUSD reserves, providing information for DAO voters to determine whether action is needed to limit the risk exposure of crvUSD to TUSD.

Introduction to TUSD

Issuer and Custodian

At a high level, TUSD is a custody stablecoin backed by fiat currency. TUSD is designed to maintain a 1:1 peg with the US dollar, providing stability in the volatile crypto market. The initial issuer of TUSD was TrueCoin, LLC (a subsidiary of Archblock, Inc.), but ownership was transferred to Techteryx on December 15, 2020.

According to TUSD representatives, Techteryx is referred to as an Asian conglomerate with operations in Hong Kong, Singapore, Guangzhou, Shenzhen, Beijing, and is involved in traditional real estate, entertainment, environmental, and information technology industries.

However, unlike its self-proclaimed status as an Asian conglomerate, Techteryx Ltd. appears on the registered list of the British Virgin Islands Financial Services Commission. Limited public information about Techteryx has led to speculation about its subsidiaries and the ultimate beneficial ownership of TUSD.

As of July 13, 2023, Techteryx has assumed full management of all offshore operations and services related to TUSD, including minting, redemption, customer registration, compliance, and supervision of banking and custodial relationships.

TUSD has three custodian partners, described in audit reports as Hong Kong custodian, Swiss custodian, and Bahamian custodian (audit reports can be downloaded from tusd.io).

Reserve Composition not specifically disclosed, but described as: US dollar cash, cash equivalents, and short-term, highly liquid investments of sufficient credit quality that can be easily converted into known amounts of cash. The Hong Kong custodian also invests in other instruments to generate returns, with the recorded cost of cash equivalents and other instruments in all cases.

The primary source of income for TUSD is interest earned on the fiat reserves held as collateral, which helps cover operational costs, compliance costs, and supports the growth and development of TUSD.

Minting/Redemption Process

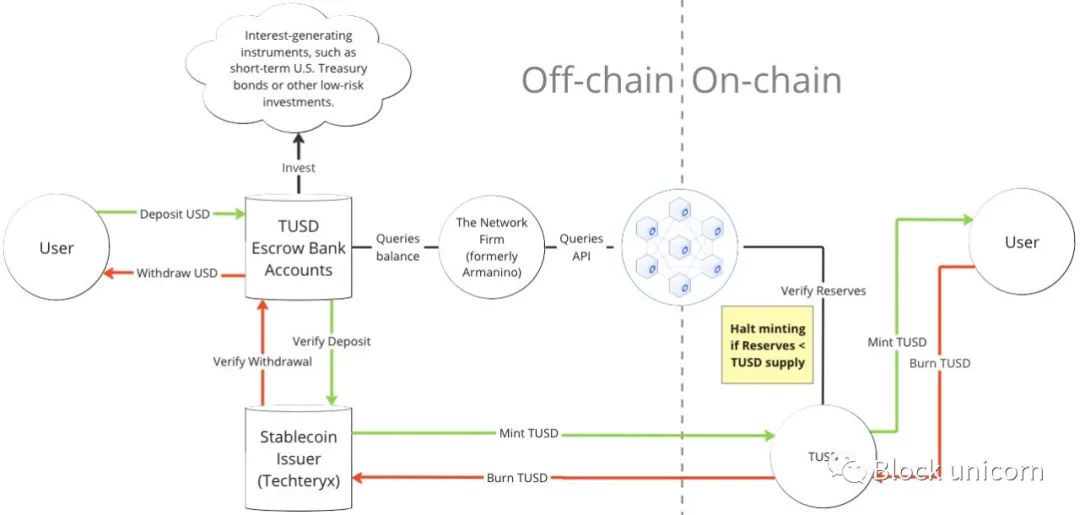

The system architecture of TUSD is as follows:

Users wishing to mint TUSD must have an account at https://tusd.io/ and undergo KYC/AML checks. Then, users wire US dollars to a designated bank account managed by the custodian partners. Techteryx emphasizes that fund management is entirely handled by its custodians, and the issuer never has the authority to handle user funds.

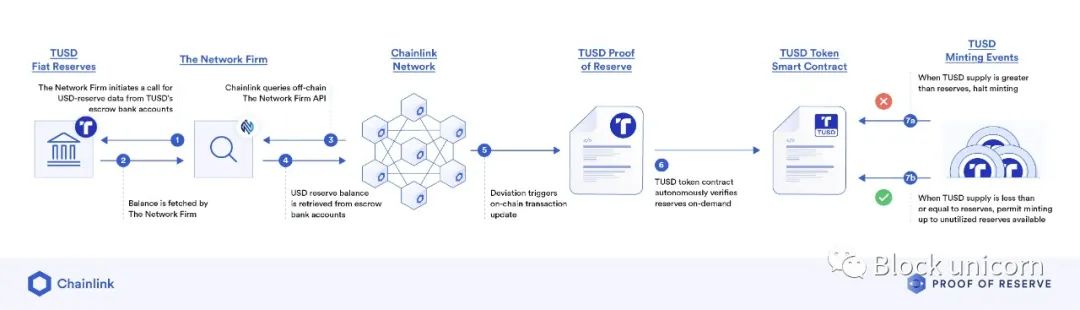

TUSD undergoes real-time admission through a collaboration with The Network Firm LLP and Chainlink Proof of Reserve (PoR). TUSD can only be minted when the total TUSD supply + newly minted TUSD is less than the reserves reported by Chainlink (provided by The Network Firm). Deposits confirmed through minting checks are subsequently tokenized, and the corresponding amount of TUSD is issued to the user's specified receiving wallet.

Conversely, when users wish to redeem their TUSD for US dollars, they undergo KYC/AML checks and specify their Ethereum and bank wire addresses to initiate the redemption process with the stablecoin issuer. TUSD tokens are sent to the TUSD smart contract for destruction, and the corresponding amount of US dollars is transferred back to the user's bank account.

Expansion of TUSD in March 2023

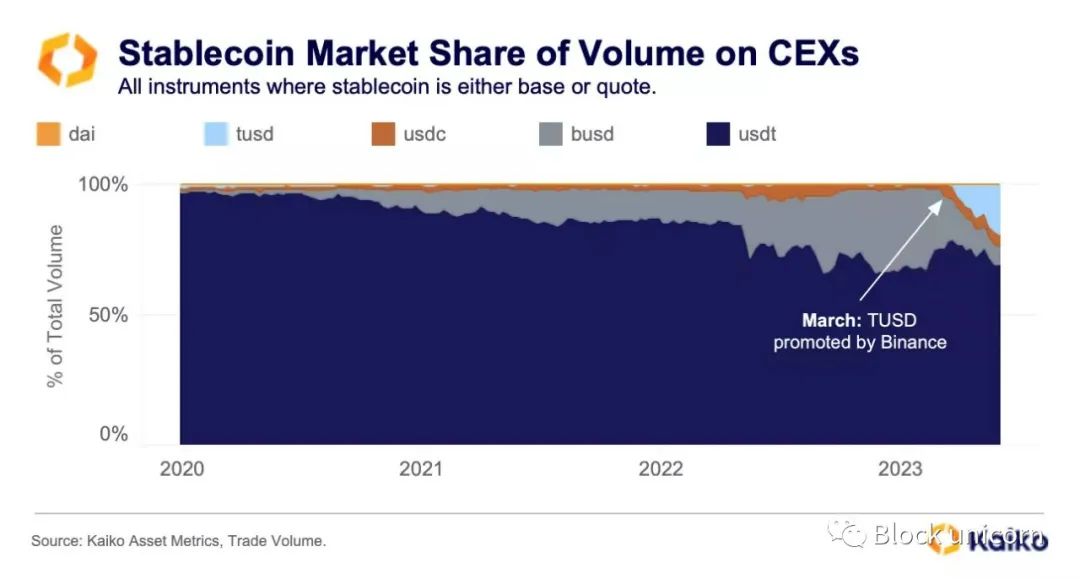

Until March 2023, TUSD was a small-scale stablecoin with limited trading activity, accounting for less than 1% of the overall stablecoin market share. However, Binance decided to promote TUSD as the successor to BUSD, subsequently expanding the BTC-TUSD trading pair and offering zero trading fees, significantly increasing its visibility and trading volume. Its market share rapidly expanded from less than 1% to 19% within a few months.

Two large transactions worth $1 billion each, originating from the same address, were suddenly sent directly to Binance on March 12 and June 16 (data date: June 27).

The rapid surge in TUSD may be related to Binance's zero trading fee promotion and widespread promotion of TUSD on the exchange, which was announced on June 21. Observers may also note that the abnormal growth trend of TUSD coincided with the period before the mid-June closure of its Prime Trust custodian partner.

After the New York Department of Financial Services (NYDFS) ordered the issuer of BUSD, Paxos, to stop issuing its BUSD stablecoin, Binance shifted support to TUSD stablecoin. This was due to unresolved regulatory issues with Paxos regarding the BUSD issued by Binance. This move appears to be aimed at maintaining market share in the stablecoin field and reducing reliance on a single stablecoin. The promotion of TUSD led to Binance becoming the largest holder of TUSD. It is worth noting that the majority of TUSD's trading volume is currently concentrated in Binance's BTC-TUSD trading pair.

Token Distribution

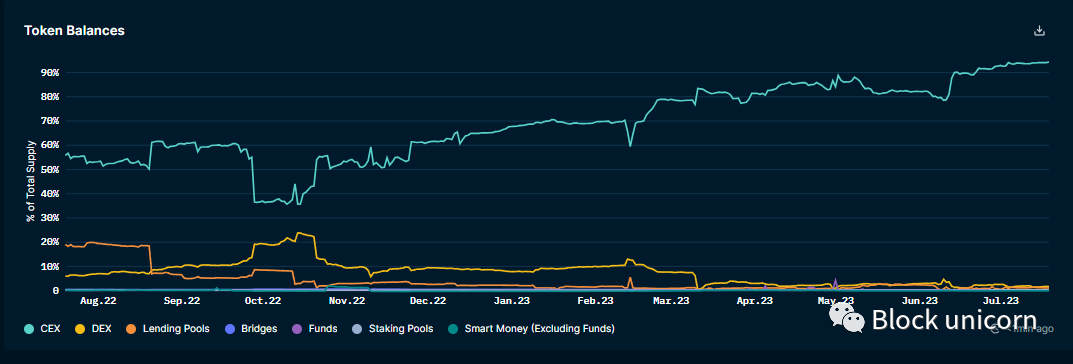

According to Nansen's data as of July 19, the vast majority of TUSD supply is held on centralized exchanges (CEX), with 94% of the token supply associated with CEX addresses. As shown below, the majority of TUSD is actually held on Binance.

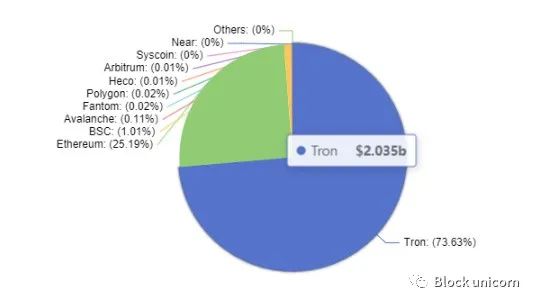

At the time of writing, the vast majority of TUSD token supply is held on TRON (73.56%), valued at approximately $2.035 billion. TUSD's official website promotes its usage on TRON, Ethereum, Avalanche, Binance BNB Beacon Chain (BNB), and Binance BNB Smart Chain (BSC), incorporating the token supply on these chains into its attestation report (the following data is from DeFiLlama as of July 19).

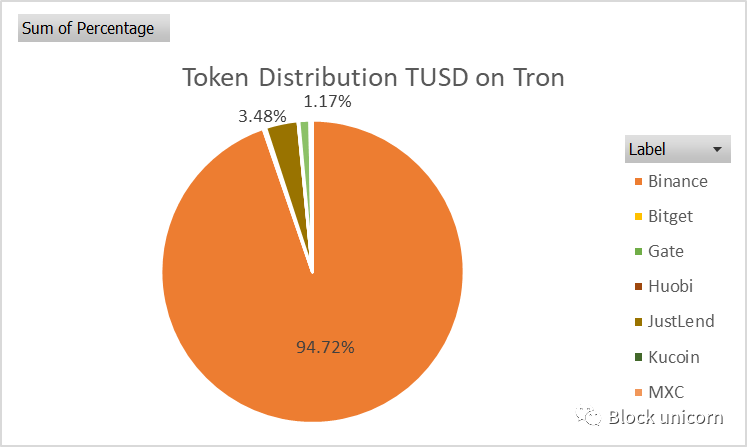

Distribution - TUSD on TRON

On TRON, the majority of TUSD is held by Binance (94.7%), with a small amount held on the DeFi lending platform JustLend (3.5%) and Gate.io (1.2%).

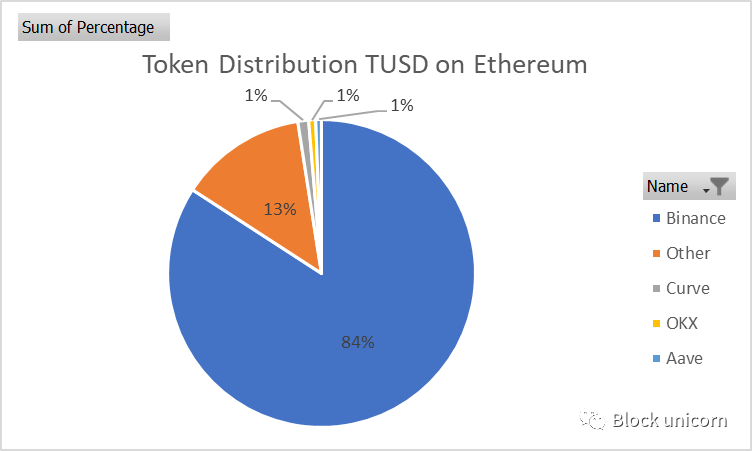

Distribution - TUSD on Ethereum

On Ethereum, TUSD token holders are heavily skewed towards Binance, holding 83.53% of the total token supply. Curve, OKX, and Aave hold smaller shares, at 1.12%, 0.73%, and 0.60% respectively. Curve's crvUSD/TUSD Pegkeeper pool contains the most TUSD tokens of any contract on Ethereum.

crvUSD Pegkeeper and Decoupling Risk

- TUSD/crvUSD pool contract

- TUSD Pegkeeper contract

- AggregatorStablePrice contract

Pegkeepers stabilize the peg of crvUSD by algorithmically supplying and withdrawing crvUSD to and from designated Pegkeeper pools. Currently, there are four pools: crvUSD/USDT, crvUSD/USDC, crvUSD/USDP, and crvUSD/TUSD. Each Pegkeeper is allocated a maximum debt that can be supplied to its respective pool. Currently, the maximum debt for each Pegkeeper is 25 million crvUSD, with a total maximum debt of 100 million crvUSD for all Pegkeepers combined.

The AggregatorStablePrice contract is crucial for Pegkeepers, as it aggregates the price of crvUSD from at least three price sources (currently the four Pegkeeper pools). Only when the crvUSD price referenced by the Aggregator is greater than 1 USD will Pegkeepers supply crvUSD.

Taking TUSD as an example, the following conditions must be met for Pegkeepers to supply crvUSD:

It has been at least 15 minutes since the last update.

The TUSD balance in the pool is greater than the crvUSD balance.

The crvUSD price referenced by the Aggregator is greater than 1 USD.

If the conditions are met, the supply equals one-fifth of the balance difference in crvUSD.

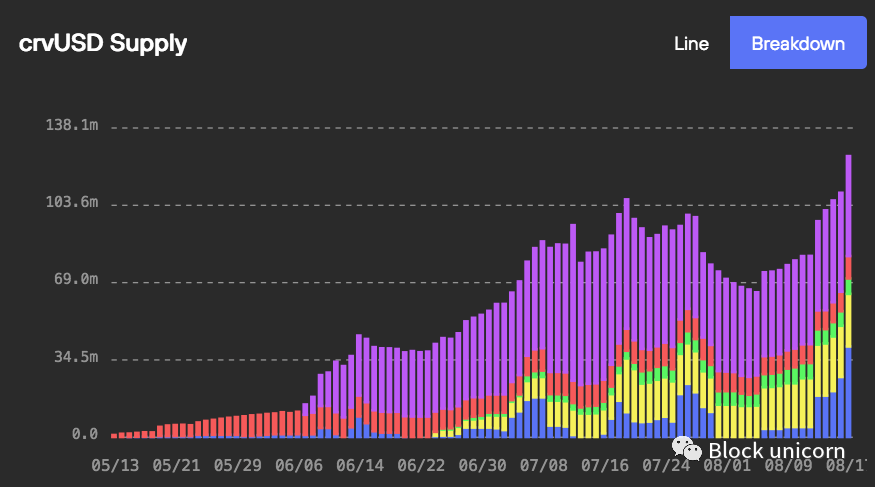

The chart below shows the supply of crvUSD over time, divided by source. The blue bars represent the crvUSD supplied by Pegkeepers, reaching a peak of 40.6 million crvUSD in mid-August (utilization rate of 40.6%). The recent increase in Pegkeeper utilization coincided with a sharp decline in the cryptocurrency market, driving up the demand for crvUSD. As of August 18, the total crvUSD supply was 125.5 million, with 85 million borrowed from collateral. This means that the crvUSD supplied by Pegkeepers accounts for 32.27%, and the borrowed amount accounts for 67.73%.

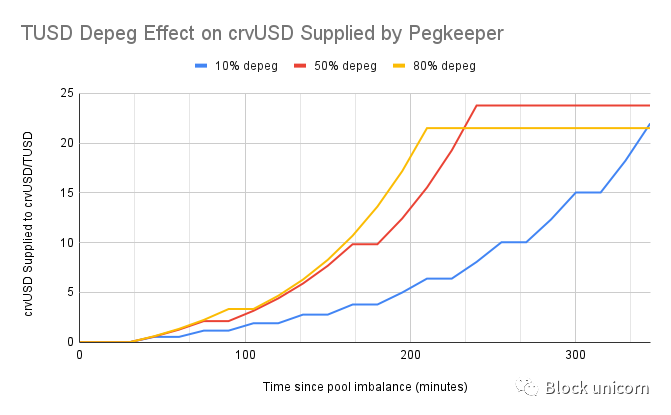

Any Pegkeeper asset (e.g., TUSD) losing its peg, whether permanently or for an extended period, would have adverse consequences. Because the Aggregator checks the pool balance to determine the price of crvUSD, when a Pegkeeper asset becomes unpegged, it may incorrectly set the crvUSD price to >1 USD. This would allow Pegkeepers to supply crvUSD to the pool until their maximum debt is reached. The chart below shows a simulation of how quickly Pegkeepers could supply crvUSD under different degrees of decoupling:

These data were collected in Brownie under the scenario of losing the peg on August 8. Regardless of the degree of decoupling, almost all available Pegkeeper debt would be introduced during a sustained 4-5 hour decoupling event.

It is important to note that these data are isolated and would result in a proportional decrease in crvUSD exposure for other liquidity providers in reality, leading to decoupling in proportion to the unsupported amount of crvUSD entering circulation. Decoupling would lower the price quoted by AggregatorStablePrice, restrict additional Pegkeeper crvUSD from entering circulation, and enable the DAO to take mitigating measures. The decoupled Pegkeeper pool's supplied crvUSD would become bad debt for the protocol (assuming the decoupling is permanent).

The stability of crvUSD not only depends on its Pegkeeper pools to maintain stability but also on them to ensure the continuous solvency of crvUSD. Therefore, it is crucial to assess the protocol's exposure to potential Pegkeeper debt (i.e., maximum debt), proportionate to the total crvUSD supply, and consider the confidence in the peg of each Pegkeeper asset.

Transparency Issues with TUSD:

- Opaque Reserve Management:

Ambiguous Handling of Reserve Accounts: TUSD's attestation documents do not specifically mention the names of its reserve accounts but generally describe its reserves being held at a Hong Kong reserve institution (previously disclosed as First Digital Trust), a Bahamian reserve institution (previously disclosed as Capital Union Bank), and a Swiss reserve institution.

With a significant portion of TUSD reserves transferred to offshore entities, the custodial account structure has become more ambiguous. TokenInsight reported on March 16, 2023, that the previous operator of TrueUSD, Archblock, had transferred $1 billion in reserves of the token to Capital Union Bank in the Bahamas, citing deteriorating banking conditions for U.S. crypto businesses. Capital Union Bank, located in Lyford Cay, Nassau, is an independent banking institution providing private banking services, regulated by the Central Bank of the Bahamas and the Securities Commission.

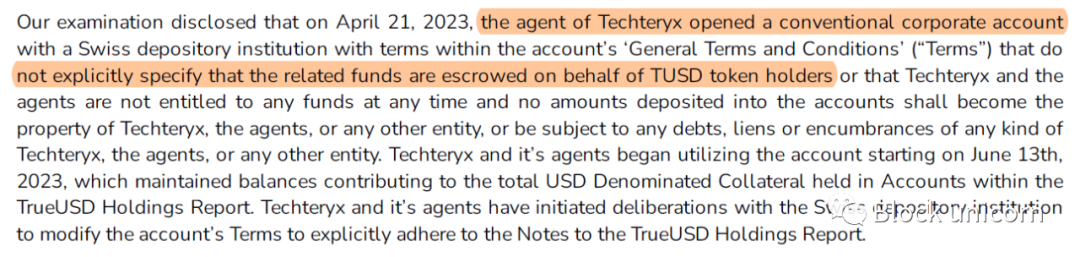

Additionally, a recent addition to the attestation document indicates that Techteryx opened a corporate account at a Swiss reserve institution on April 21. The terms of the account disclosed in the attestation do not explicitly provide significant protection for TUSD token holders, stating that:

The funds in the account are held in trust for TUSD token holders.

The agent has no authority to use the funds in the account at any time.

Any amount deposited into the account does not become the property of Techteryx, its agents, or any other entity.

Any amount deposited into the account is not subject to any debt, lien, or encumbrance of Techteryx, its agents, or any other entity.

Excerpt from the attestation:

The recent addition of this account further highlights the lack of clarity between the reserves held by Techeryx's partners and the lack of clarity between the issuer and user funds. Such a setup is highly susceptible to commingling of client deposits or misuse of corporate account funds.

- Opaque Verification:

- TUSD provides relatively fewer details in its attestation documents, raising questions about the effectiveness of its reserve proof system and potentially creating a false sense of security for users.

Criticism 1: Opaque Reserve Management

Fuzzy Handling of Reserve Accounts

The attestation documents of TUSD do not specifically mention the names of its reserve accounts but generally describe its reserves being held at a Hong Kong reserve institution (previously disclosed as First Digital Trust), a Bahamian reserve institution (previously disclosed as Capital Union Bank), and a Swiss reserve institution.

Regarding the composition of the investment portfolio held by the unnamed custodial institutions supporting TUSD, it is disclosed in general terms as including: US dollar cash, cash equivalents, and high liquidity, short-term, sufficiently credit-worthy investments that can be easily converted into known amounts of cash. The Hong Kong custodian also invests in other instruments to generate returns.

There is no further detailed explanation regarding the balance of investment portfolio assets or the amounts held by each custodian, apart from this general description. The phrase "other instruments" used in the Hong Kong account is vague. The riskiness of the assets in this account is not explicitly indicated, and because the accounting statements for the collateral are disclosed at "cost," these investments may have experienced significant depreciation, which is not reflected in the attestation.

Readers are advised to compare TUSD's attestation (available on TUSD's website) with the latest attestations of its main competitors USDC (June 2023), USDT (June 2023), and USDP (June 2023) regarding the disclosure of information about custodians and reserve asset compositions. In comparison, these issuers have disclosed more information about their custodians and reserve asset compositions.

June 2023 Market Panic: Prime Trust Closure

Prime Trust is a Nevada-chartered trust company providing B2B custody, custody, compliance, statutory processing, trading software, and other financial services. TUSD has maintained a continuous partnership with Prime Trust since August 2019, when the collaboration agreement was first announced. It utilizes Prime Trust for 24/7 fiat transfers for its stablecoin products, including TrueUSD (TUSD), TrueGBP (TGBP), TrueAUD (TAUD), and TrueCAD (TCAD).

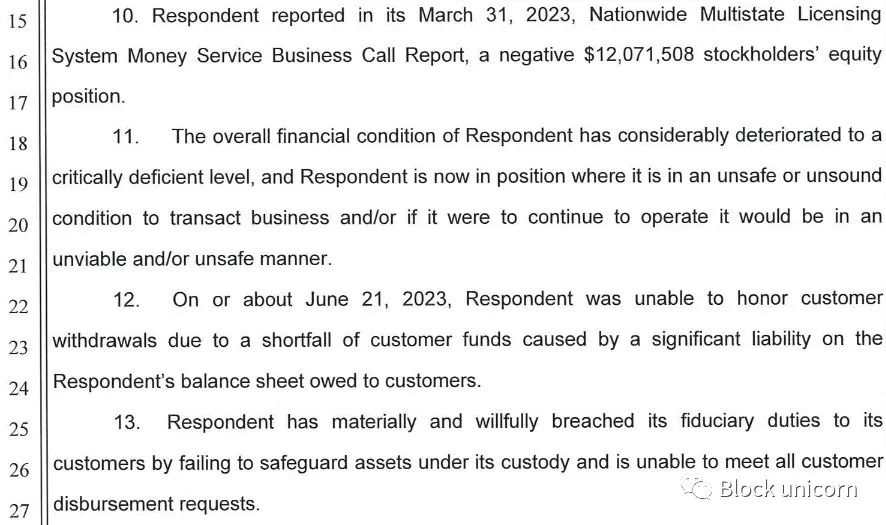

On June 21, 2023, the Nevada Department of Business and Industry Financial Institutions Division (FID) ordered Prime Trust to cease all operations after finding that it had violated state regulations. The company's financial condition was found to be extremely deficient, leading to an inability to fulfill customer withdrawals and protect its custodied assets.

In 2020, there were issues with the upgrade of its wallet management system, which apparently led to a discovery in December 2021 that Prime Trust had made funds in its traditional wallets inaccessible. It was reported that Prime Trust began using deposits from other users to purchase cryptocurrencies to meet withdrawal requests. The Nevada Financial Institutions Division found that the custodian owed customers $85 million in fiat currency but only had $3 million on hand. It claimed that Prime Trust had negative shareholder equity of $12 million and had effectively become unable to repay its debts.

TUSD Exposure to Prime Trust Risk

Before the Nevada financial regulatory department issued the cease-and-desist order, rumors circulated in the market about TUSD being insolvent. On June 9, TUSD announced that it would suspend minting through Prime Trust until further notice (other minting/redemption services remain available). This news triggered a relatively brief market panic.

Subsequently, TUSD sharply deviated from its peg on Binance US, dropping to a low of $0.80. It is important to note that this was not an isolated decoupling event in the market. Binance US faced threats to its reliable deposits and withdrawals due to struggles with the U.S. Securities and Exchange Commission, difficulties in finding banking partners, and its own exposure to Prime Trust's risk.

After the issuance of the cease-and-desist order, TUSD initially announced on June 22 that they had no exposure to any risk with Prime Trust. However, in the TUSD funding report on June 28, there seemed to be a $26,000 TUSD risk exposure. Although this amount was insignificant, users reported at the time that they were unable to mint/redeem TUSD, continuing to trigger market panic as market participants remained wary of potential undisclosed additional risk exposure.

According to TUSD's representatives, this $26,000 came from random user funds at Prime Trust, which the auditors included in TUSD's balance sheet, emphasizing that this amount was actually unrelated to TUSD.

Reports of Redemption Failures

In mid-June, when Prime Trust encountered issues, reports began to surface claiming that multiple users seemed unable to redeem TUSD but instead had their TUSD returned to their wallets. This contradicted TUSD's announcement on June 9, which claimed that while minting through Prime Trust had been suspended, all other custodial partners were intact, and minting or redemption services were uninterrupted.

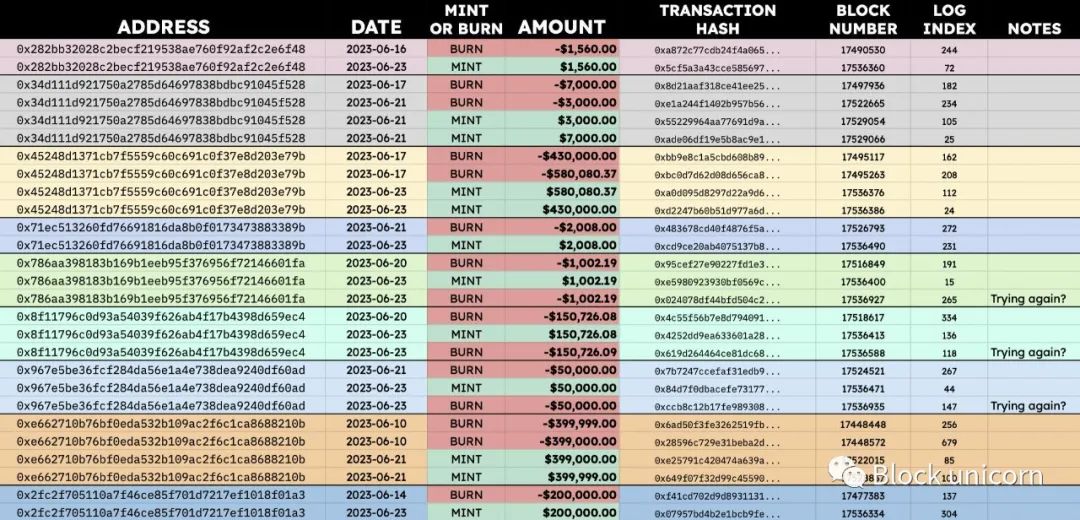

Prime Trust's closure on June 21 aligned with reports of redemption issues. Blockchain analytics company @Chainargos and @willmorriss4, who claimed to be a former TUSD employee, provided on-chain transaction records of redemption failure attempts between June 10 and June 23:

TUSD's representatives responded that these transactions were users attempting to send transactions to Prime Trust, despite their public announcement that minting/redeeming through Prime Trust had been suspended. They further emphasized that anyone could still redeem TUSD 24/7 without restrictions through other custodial partners.

Criticism 2: Opaque Verification

LedgerLens System

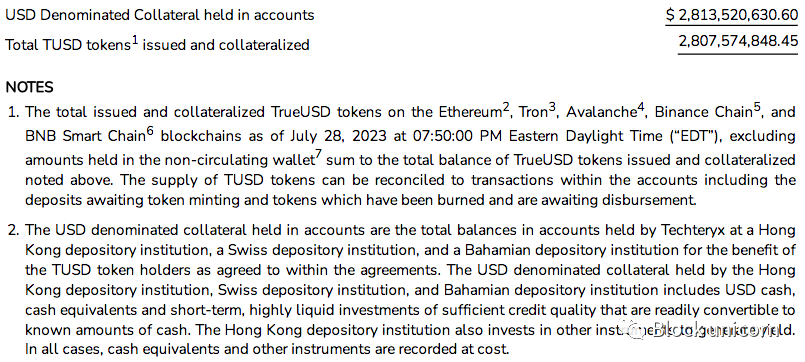

Real-time confirmations are provided by The Network Firm LLP through their LedgerLens system, offering real-time reserve data. The service queries the total supply of TUSD on all chains (ETH, AVAX, BNB, TRON, BSC) and the total account balance of Techteryx's custodial partners at multiple custody institutions daily, as shown in the confirmation report from July 28:

Ripcord is an embedded alert system in the verification service used to define blocking conditions for automatic confirmation updates. They are used to detect system issues, as external APIs used for confirmation may sometimes be unavailable due to maintenance, downtime, or inaccuracy.

There are four types of Ripcord (with a focus on "Balance" Ripcord):

Management: Unacknowledged statements, declarations, or terms of participation in the protocol by management during the previous reporting interval.

Integration: Smart contract calls returned errors during the previous reporting interval, and excluding this error would trigger the Balance Ripcord (see below).

Pricing: Confirmation of stablecoins is irrelevant. API errors or unresponsiveness occur when applying the value of USD (or other fiat-denominated) from pricing sources to collateral assets.

Balance: Third-party system or account responses, errors, or unresponsiveness during the previous reporting interval result in total liabilities exceeding total assets. This may be due to temporary imbalances caused by normal operations, such as clients opening bank accounts not yet integrated, or actual imbalances between liabilities and assets.

As the situation with Prime Trust gradually unfolded, the "Management" Ripcord was triggered on June 13, followed by the "Balance" Ripcord on June 20. TrueUSD clarified on June 22 that this trigger was due to API interface delays from a new banking partner (presumably the unnamed "Swiss custodial institution"), and at that time, confirmations had returned to normal. A representative of TUSD also mentioned that they were the only stablecoin with real-time confirmations, as the bank's API could not reflect amounts in real-time.

Previously in March 2023, concerns were raised about the outdated confirmations of other stablecoin products (including TrueAUD, TrueHKD, TrueCAD, and TrueGBP), sparking concerns about transparency. As of the time of writing, the confirmations for these stablecoins were last updated on June 22, and the "Management" Ripcord is currently triggered.

Chainlink PoR Integration Introduction

TrueUSD uses Chainlink's Proof of Reserve (PoR) technology to enhance the transparency and reliability of TUSD by regularly verifying the full collateralization of the stablecoin.

As shown in the above image, the minting and redemption processes depend on available reserves and involve the following steps:

The independent accounting firm The Network Firm requests reserve data for USD from TUSD's custodial bank accounts using its LedgerLens attestation service.

Obtain the USD reserve balance in the custodial bank accounts.

The decentralized oracle network Chainlink queries The Network Firm's API off-chain.

Chainlink retrieves the USD reserve balance reported by The Network Firm's API.

If there is a balance discrepancy, on-chain transactions are executed to update the TUSD Proof of Reserve contract.

The TUSD token contract autonomously verifies the reserves when needed.

The availability of TUSD minting depends on the comparison of reserves with TUSD supply:

- If TUSD supply exceeds available reserves, minting of new TUSD tokens will be halted to ensure the stablecoin remains fully collateralized.

- If TUSD supply is less than or equal to reserves, minting of TUSD tokens will be allowed, up to the maximum of the unused reserves, maintaining an appropriate collateralization ratio.

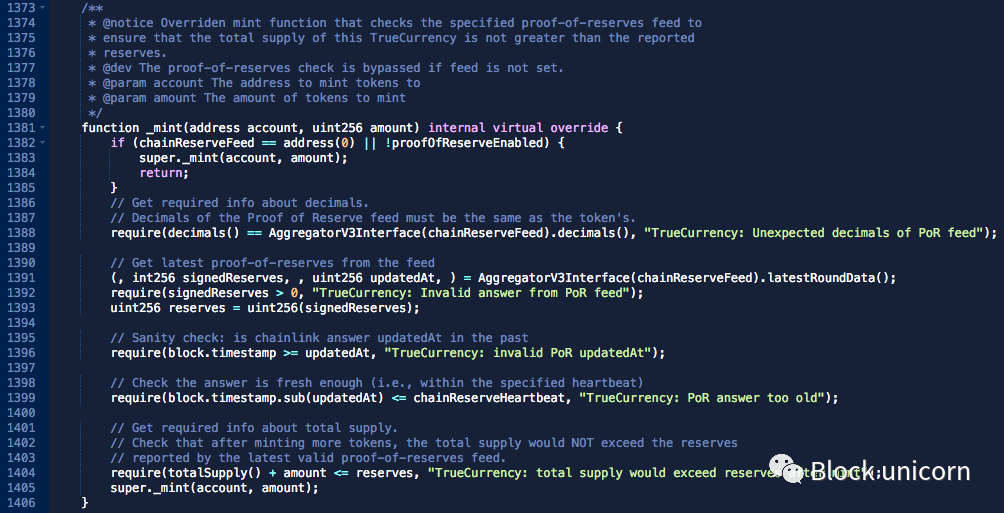

As shown in the image below, the _mint function of TUSD checks the reserve value passed from chainReserveFeed before allowing the minting of TUSD:

The integration with Chainlink claims to provide users with accurate and transparent information about the reserves supporting TUSD, making it a more reliable collateral and payment method in the DeFi space.

Stablecoin Verification: Lack of Comprehensive Information

The reserve report of The Network Firm for TUSD provided through Chainlink's PoR offers limited transparency, failing to disclose specific details such as:

- The full scope of company liabilities

- Banking relationships

- Composition of the asset portfolio

- Market value of reserves (calculated at "cost")

This makes it difficult for users to comprehensively assess the stability and legitimacy of the reserves.

The purpose of stablecoin verification is to demonstrate the full redeemability of the entire stablecoin supply, and proof of solvency can be achieved by ensuring that both reserves and liabilities are fully accounted for.

Proof of Solvency = Proof of Reserves + Proof of Liabilities

While most of TUSD's liabilities can be found on-chain (i.e., issued TUSD), there may be a significant amount of off-chain liabilities. Audit providers of stablecoins, including The Network Firm (TNF), often provide reserve snapshots that do not capture the full scope of company liabilities. Hidden or undisclosed liabilities could affect the availability and support of stablecoins, making the determination of proof of solvency more complex.

As mentioned earlier, the custodial institutions controlling TUSD reserves are only described in the audit as Hong Kong custodial institution, Bahamian custodial institution, and Swiss custodial institution. The investment portfolio supporting TUSD is equally vague, only disclosing holdings including US dollar cash, cash equivalents, and short-term, highly liquid investments with sufficient credit quality that can be easily converted into known amounts of cash (the Hong Kong custodian also invests in other income-generating instruments).

Trust Assumption of The Network Firm LLP

According to the Chainlink PoR data source for TUSD, audit data relies entirely on The Network Firm LLP. The credibility and independence of the auditors have been questioned, especially considering The Network Firm's association with Armanino, which was scrutinized for its former business relationship with FTX US.

The Network Firm responded to the issues of its association with Armanino, calling it "an accidental or intentional misrepresentation," and emphasizing that The Network Firm is an independent accounting firm specializing in digital assets, distinct from Armanino. Many current team members are founding members of Armanino's digital asset industry practice. Following the failure and controversy with FTX, Armanino decided to reduce its audit services in the digital asset space. The Network Firm LLP was established in October 2022, without equity from Armanino, and only one founding member had worked on the 2021 financial statement audit of FTX US.

TUSD's representatives responded, stating that the premise of considering this association as spreading malicious rumors (FUD) is unfounded, as Armanino has a business relationship with FTX US, but the latter did not lose customer funds. Armanino is also the auditor for major crypto platforms like Kraken. Armanino holds confidence in the results of its collaboration with FTX US, and apart from unfavorable media reports related to this association, there is no evidence to suggest that Armanino or The Network Firm failed to fulfill their responsibilities or engaged in any misconduct.

Final Notes on PoR

While stablecoin verifications are far from perfect and require trust in auditors and responsible data provision from stablecoin issuers, they are positive steps towards promoting transparency and accountability. By voluntarily conducting and publishing verifications, TUSD demonstrates efforts to build trust between users and regulatory authorities, showcasing a commitment to financial transparency and responsible practices.

On the other hand, some key information has not been disclosed, involving custodial partners and their relative risk exposure with each institution, the asset portfolio supporting TUSD, and the company's liabilities, all of which could impact the backing of TUSD. When this information is not disclosed, users need to understand the trust assumptions involved, particularly being aware that reserve proof systems like Chainlink PoR have limited utility when many pieces of information remain undisclosed.

Risk Recommendations

TUSD has made significant efforts in building trust in solvency through real-time verifications and on-chain reserve proof implementation. It is distinctive as the first USD-backed stablecoin to program minting restrictions based on off-chain reserves.

However, there is valid criticism that Techteryx's transparency policy is lacking, as the issuer does not provide reasonable assurances regarding the stablecoin's solvency. Compared to its competitors, TUSD provides minimal information about its reserve status. It does not disclose the names of custodial institutions, balances for each custodian, or detailed contents of the investment portfolio. TUSD is currently the only Pegkeeper that does not disclose such information (in comparison to the latest verifications of USDC, USDT, and USDP).

The current Pegkeeper model may lead to crvUSD deviating from its peg or the protocol accumulating bad debt in the event of Pegkeeper asset deviation from the peg. Given the importance of Pegkeepers to the stability of crvUSD, these assets must undergo special scrutiny and minimum requirements must be set. In general, Pegkeeper candidates need to meet the following conditions:

- Strong confidence in anchoring at the technical, operational, and regulatory levels.

- Candidates should complement the Pegkeeper asset basket by introducing diversity in issuers, custodians, and geographical jurisdictions.

To achieve this goal, candidates should have convertible stablecoins with efficient arbitrage paths and should comply with regulations in their operating jurisdictions. Overall, the Pegkeeper asset basket should not be concentrated in any single jurisdiction or in white-label products with the same issuer and/or custodian (such as Paxos USDP and PYUSD).

We believe that TUSD should not be included in crvUSD Pegkeepers until upgrades are made to the Pegkeepers and preventive measures are taken to mitigate the negative impact of Pegkeeper asset deviation from the peg. Our reasoning is that, given Techteryx's current transparency policy, we cannot have confidence in TUSD's solvency or its peg. Lowering TUSD's maximum debt to zero would not have a significant impact on the overall situation (meaning that even if TUSD cannot continue to act as a Pegkeeper, there are other Pegkeepers that can continue to function, maintaining stability), as there are three other Pegkeepers with a total maximum debt of $75 million. Since May, the historical maximum debt utilization of crvUSD Pegkeepers has been $40.6 million (as of August 18).

An argument for lowering the maximum debt, rather than to zero, may be to ensure geographical diversity of Pegkeepers. Increasing the proportion of Pegkeeper assets established in the United States could increase risks related to US stablecoin regulation. If the DAO agrees with this reasoning, it is recommended to set the maximum debt of TUSD Pegkeeper to a conservative value, such as $5 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。