Author: ZENECA

Translation: MetaCat

Layout: MetaCat

To be honest, the vast majority of NFT projects/communities are reimagined meme coins, shit coins, altcoins, or whatever you want to call them.

Please join me as we take a walk down memory lane, comparing NFTs and meme coins, examining their similarities, differences, and what we can learn from them.

Cobie (to some extent) is right

Cobie once said: "NFTs are just shitcoins with pictures." The NFT community had a fairly instinctive negative reaction to this statement at the time, but now more and more people are beginning to realize that what he said might be a fact.

When we compare what is happening in the meme coin space now with what happened in the NFT space at the end of 2021 and in 2022, it is easy to see the accuracy of his point.

Yes, I know there are exceptions.

I will talk about some exceptions later. We know that not all NFTs are garbage; on the contrary, NFTs have enormous potential, utility, and advantages. This is something that ERC-20 tokens cannot match. It's just that currently, in the NFT projects that have been released, it can be almost certain that over 99% are Ponzi air projects.

Think about those 10k PFP series, they all have a team, a dream, and a "community." Except for a few exceptions, these tokens are no different from $PEPE, $DOGE, $SHIBA, $TURBO, $BEN, or any other less successful ERC-20 tokens.

Oh, you don't believe me?

"Oh, but my project has a plan, a roadmap, a vision, and the team is working."

Do you think meme coins don't have a roadmap? Look at SafeMoon's roadmap, one of the most popular meme coins in early 2021:

Looks familiar, doesn't it?

Yes!

The roadmap for NFT projects is usually just a more polished version of the meme coin roadmap.

The internal structure of most meme coins and most NFT projects is basically the same:

- You have an idea

- You start promoting this idea everywhere

- During the bullish/hype phase, this usually comes with "presale" or "whitelist," creating a false sense of high demand and creating FOMO for those who didn't buy in

- There is usually a "roadmap"

- After selling, most buyers/holders immediately try to list at a price higher than the purchase price

- 97-99% of holders hope for a price increase and sell to the next fool

- 1-3% of holders stay because they actually believe in the idea/community/vision/project, or something else

The lifecycle looks basically the same:

- Start

- A lot of hype before minting/release

- Attempt to further hype after release; in a bull market, this can get pretty crazy

- An inevitable major incident

- Maybe a need for a second pump, but usually not

- Slowly bleed to death, with some die-hard fans trying to revive the project, but most people have already left

- Meanwhile, "holders" keep saying things like "Wow, look at how many holders we have," "Look who just bought in," "Why are people selling," "Buy the dip," "The team is working," and so on

- Looks familiar, right? If you've spent time in NFT Discord servers or meme coin Discord/Telegram, none of this should be surprising.

- The atmosphere is remarkably similar. Again, I know there are exceptions. I know this doesn't apply to all projects

Differences:

One strange phenomenon is that when it comes to NFT projects, people seem to expect the team to bear more responsibility than meme coin teams. Perhaps because for meme coins, people expect the team to dissolve and the token to go to zero, while for NFT projects, there is no such expectation.

It's not that people don't want the founders of meme coins to be held accountable, but in most cases, these expectations ultimately turn into a rug pull.

I think people actually know that meme coins are a gambling game, because that's essentially all meme coins are. The same mindset doesn't apply to NFT projects, perhaps because there are more exceptions to that rule.

This often means that the lifecycle of NFT projects is much longer than that of meme coins, and compared to the rapid death of most meme coins, we see more NFT projects as "slow rugs."

We also see many legitimate projects with longer lifespans, and they are more likely to establish a sustainable business model + ecosystem, breaking the Ponzi pattern and truly creating value.

A deeper study of the differences will reveal that NFTs are inherently irreplaceable.

This uniqueness makes potential innovation, products, and solutions possible, something that replaceable tokens simply cannot do.

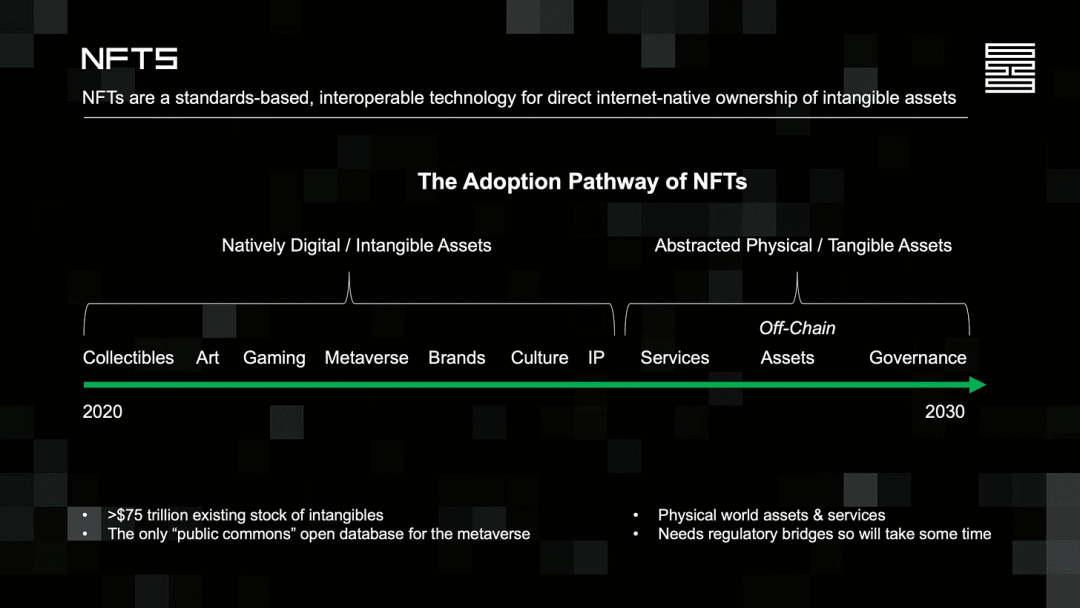

Whenever I talk about the potential and future of NFTs, I like to reference the image from @punk6529. We are in the early days of crypto. Most NFTs are still in the camp of art + collectibles, but there is also a place for games, metaverse, brands, culture, and intellectual property, and there are many exciting things happening in these areas.

Of course, there are already individuals and companies creating amazing NFT-related things: rewards/loyalty programs, tickets, POAP, memberships, and more.

Of course, crypto art is one of the best use cases for this technology. Digital artists around the world finally have a way to sell their work, and collectors finally have a way to collect digital art.

Another major difference between meme coins and NFT projects is the role played by the "team." For NFT projects, the team is largely doxxed and to some extent putting their reputation at risk, and if the project doesn't go well, the community will hold them accountable (I believe every NFT project founder feels this).

For meme coins, it's different. Completely anonymous projects still get trading volume and reach crazy market values. And more commonly, the project team will openly deceive you.

Clearly, the intentions of many NFT project founders are much purer than those of most meme coin founders. Many of them genuinely believe in their ideas and have put in tremendous effort to go from 0 to 1. This is also a big reason why I'm still here and why I'm still bullish on NFT technology.

Defending Meme

It seems like I'm completely downplaying meme coins, but in reality, I don't hate them. On the contrary, I think memes are very important.

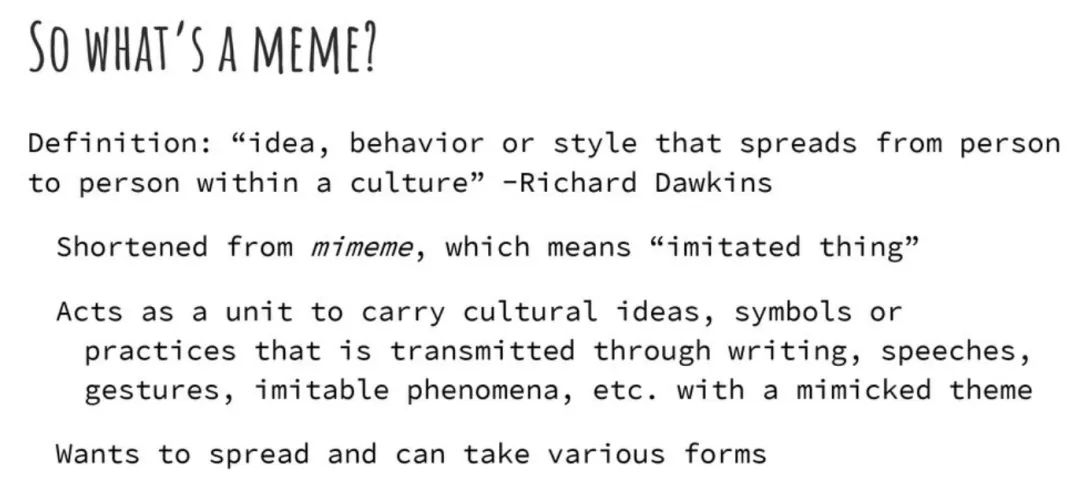

Memes are the most powerful thing in the world. Memes rule everything, everything is a meme. Memes are not just doge, pepe; religion is a meme, diet is a meme, all fashion is actually a meme.

Memes are culture.

Source: http://slideplayer.com/slide/14009958/

Source: http://slideplayer.com/slide/14009958/

Many meme coins have their own lives. Watching them evolve, mutate, and spread in the community is interesting. I think it's a mistake to immediately abandon them; there is a lot to be learned from meme coins.

Unfortunately, there are side effects. One of them is the cognitive problem they cause. People easily see the entire meme coin space as a huge scam. Although I know it's not, and you know it's not, we hope that everyone in the world will eventually know this.

Just because most meme coins are scams doesn't mean the ERC-20 standard is useless.

Just because most NFTs are scams doesn't mean the ERC-721 or ERC-1155 standard is useless.

Just because most L1s are scams doesn't mean BTC or ETH is useless.

Are meme coins the canaries in the mining event/market bull run? I think maybe!

Meme coins are a simple way for retail investors to enter the space and start consuming, especially when they are added to exchanges. Perhaps many people who have been watching decide to start with meme coins.

So, is it worth investing in meme coins?

You can make huge amounts of money by trading meme coins, just like you did with NFTs. There is no other market on earth where you can consistently see returns of 100x to 1000x. No risk, no return; no courage, no glory. The reason for such great returns is largely because the risk is so great.

The downside is that in 90-100% of cases, there is a huge negative return!

Meme coins are a microcosm of asymmetric bets. Think about the scenario of a 100x return. To break even on your 100x return investment strategy, you may have to bear the full expense of 99 projects.

One thing to remember is that the odds are always against you, and the house and the whales always have the advantage. This doesn't mean you can't win, but you're playing two different games.

Trading meme coins is gambling.

Gambling can make money; you can even have an edge and be a profitable gambler. Just be clear about the field you're entering, understand the risks, and only gamble with what you can afford to lose.

Most people shouldn't be doing this kind of trading.

Everyone overestimates their ability to be a profitable trader. In fact, everyone would be better off cost-averaging into BTC + ETH every month, without doing anything else.

How do you know if you should trade meme coins?

When I was a professional poker player, people always asked me, "Should I become a professional poker player?"

My answer was always the same: If you have to ask, the answer is no.

If you have to ask if you should trade meme coins, if you need others to validate it for you, then you shouldn't be trading meme coins. You need to know your edge, but the obvious fact is that most people don't have an edge.

The Happy Treadmill

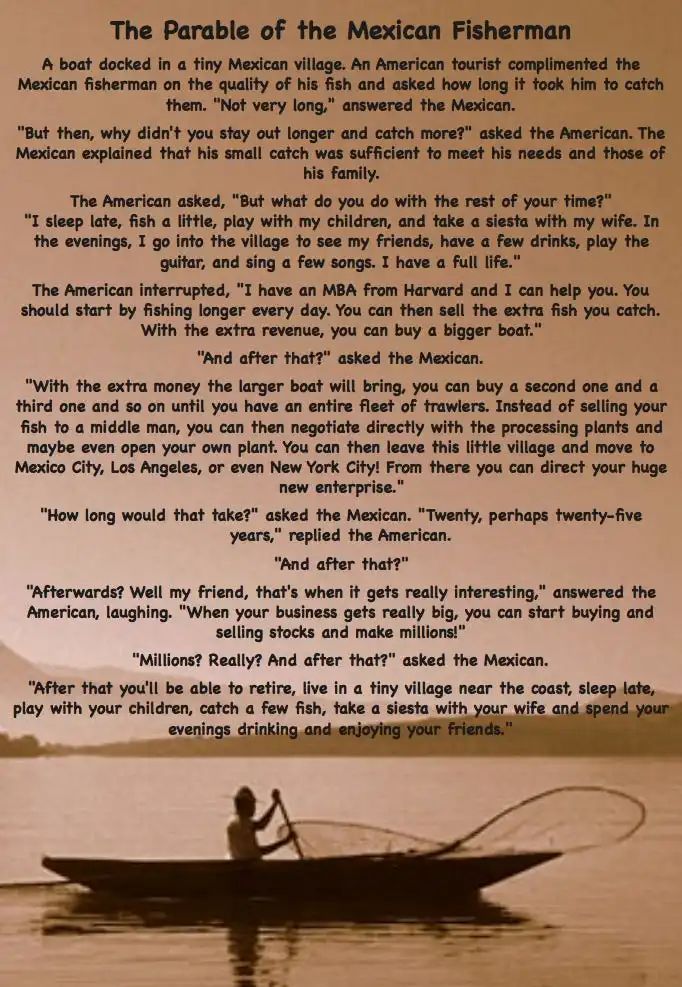

Step back and think about why you might want to trade meme coins, NFTs, or anything else. What is the ultimate goal? Is it to make more money? If so, for what purpose? Why are you in this? When is enough enough? What is the goal? What is the real goal?

Finally, here are two fables for you to ponder:

Source: https://cmcbp.co.uk/the-mexican-fisherman-what-can-we-learn-from-it/

Source: https://cmcbp.co.uk/the-mexican-fisherman-what-can-we-learn-from-it/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。