The hidden concerns of the largest BTC-listed company MSTR.

On August 1, the Nasdaq-listed company MicroStrategy (MSTR) released its second quarter report for 2023, making a bold move to acquire 12,800 BTC. The market is generally concerned about the leveraged purchase of Bitcoin by the company, as it has spent $4.53 billion to purchase Bitcoin, with over $4 billion of the funds coming from issuing bonds or stock financing.

Usually, excessive leverage is not a good thing, but for MSTR, this has become a low-cost, low-risk play. However, due to the limited development of its software business, the company actually does not have excess cash flow. Currently, it seems difficult to finance through the bond market, and can only roll over debt through stock financing, effectively deeply tying the BTC price. If BTC cannot rise significantly before the 2025 maturity date, MSTR's game may not be sustainable.

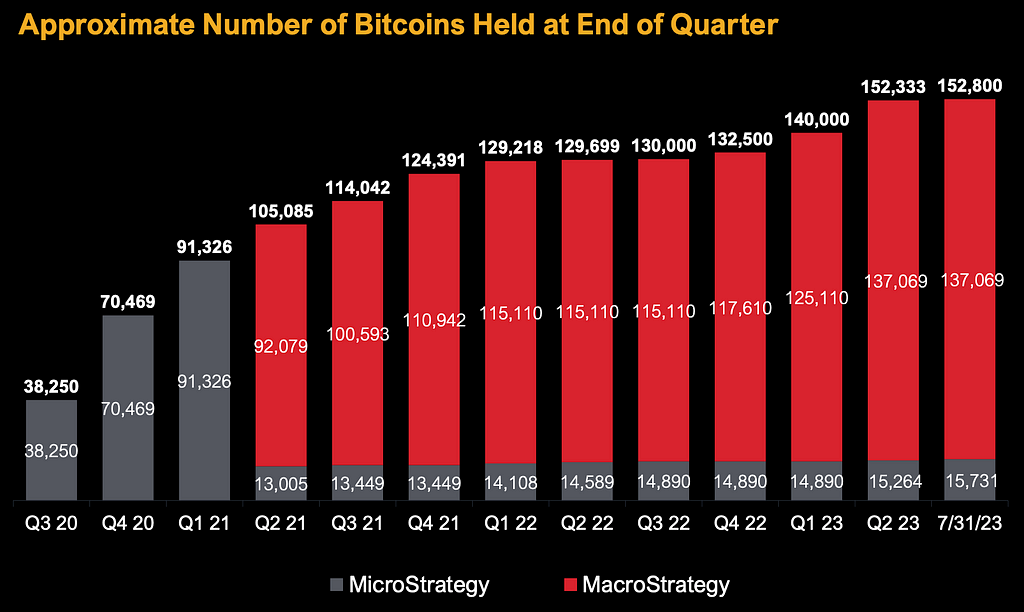

Bitcoin holdings:

As the largest holder of Bitcoin among listed companies, MicroStrategy initially acquired Bitcoin as a defensive strategy to protect its balance sheet, but it has now become their second core strategy.

MicroStrategy has two company strategies: acquiring and holding Bitcoin, and developing its enterprise analytics software business. They believe that these two strategies set them apart and provide long-term value.

The company initially stated that over $50 million in excess capital would be invested in Bitcoin, but subsequent statements indicated that they would continue to monitor market conditions to determine whether additional financing would be used to purchase more Bitcoin.

MicroStrategy began investing in Bitcoin in August 2020, shortly after the outbreak of the COVID-19 pandemic. As of July 31, 2023, the company holds 152,800 BTC, with a total cost of $4.53 billion, or $29,672 per BTC, almost on par with the current market price (29,218 USD on August 1). Of these, 90% of the Bitcoin is unsecured, meaning that these Bitcoins are not used as collateral for any loans or debts.

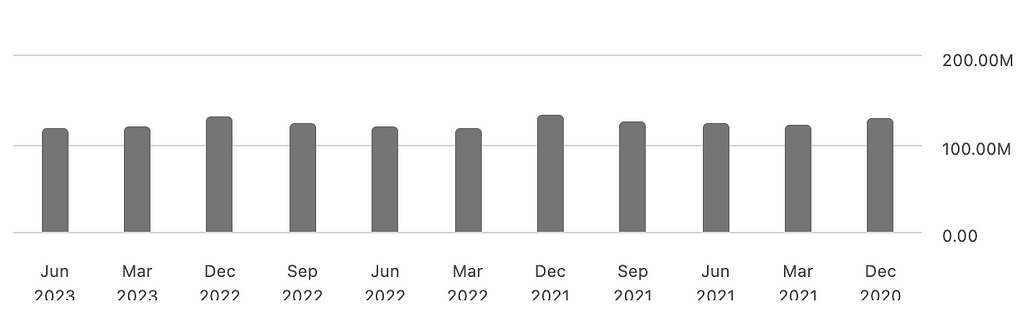

Chart of Microstrategy's BTC holdings change (MacroStrategy is a subsidiary of Microstrategy)

Source: MSTR, TrendResearch

It can be seen that MSTR purchased at a faster pace before the first quarter of 2022, and then almost stood still in the next three quarters as the market plummeted, and then accelerated its purchasing pace in 2023 with the market rebound.

Financing structure:

Their method of expanding the balance sheet mainly includes equity, debt, and convertible bond issuance.

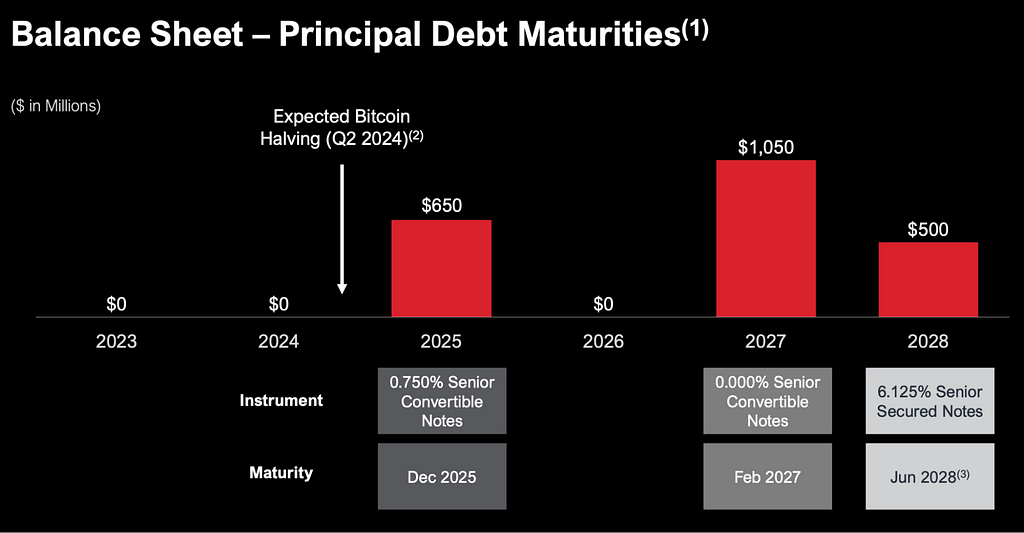

Bond issuance

Although MSTR has been increasing its Bitcoin holdings every quarter, and the price of Bitcoin has plummeted since the end of 2021, the company's debt structure is relatively stable, with approximately $2.2 billion in debt, an average fixed annual interest rate of 1.6%, and annual fixed interest expenses of approximately $36 million. This is mainly because the company used convertible notes to finance.

As of the latest second quarter report in 2023, the company's main debts include:

6.125% senior secured bonds due in 2028 (secured by 15,731 BTC), with an issue amount of $500 million and annual interest expenses of approximately $30.6 million. (Issued in June 2021)

0.75% convertible senior bonds due in December 2025, with an issue amount of $650 million and annual interest expenses of approximately $4.9 million. (Issued in December 2020)

0% convertible senior bonds due in February 2027, with an issue amount of $1.05 billion and no annual interest expenses. (Issued in February 2021)

MicroStrategy has no debt due from 2023 to 2024. Its debt maturity dates start from 2025, with the latest being in 2028. In other words, MicroStrategy can at least smoothly pass through the Bitcoin halving in 2024.

Source: MSTR, TrendResearch

Among them, convertible bonds are a hybrid financial instrument that has both bond and stock characteristics. Taking the $1.05 billion convertible bond issued in 2021 as an example:

Issue amount: The issue amount is $900 million, including the initial purchasers' right to purchase an additional $150 million of notes within a 13-day period.

Nature of the notes: Unsecured senior debt with no regular interest, and the principal amount does not appreciate. They will mature on February 15, 2027.

Redemption: MicroStrategy can redeem the notes for cash on or after February 20, 2024, at a redemption price equal to 100% of the principal amount of the notes plus any accrued but unpaid special interest, subject to specific conditions.

Conversion: The notes can be converted into cash, MicroStrategy's Class A common stock, or a combination of both. The initial conversion rate is 0.6981 shares per $1,000 principal amount of notes, equivalent to an initial conversion price of approximately $1,432.46 per share. This represents a premium of approximately 50% over the last reported sale price of MicroStrategy Class A common stock on the Nasdaq on February 16, 2021, of $955.00 per share. Noteholders can also convert their notes before the maturity date, provided that the trading price of the stock must be 130% of the exercise price of 1400.

By issuing convertible bonds, MicroStrategy not only raised funds but also avoided directly bearing significant interest expenses. At the same time, it also controlled the immediate dilution effect on equity.

Why are investors willing to choose to invest in zero-coupon convertible bonds? The main reasons include:

Upside potential of stocks: Convertible bonds can be converted into the company's common stock under specific conditions. If the stock price of the company rises above the target price, investors can choose to convert the bonds into stocks, thus enjoying the benefits of the rising stock price. This is one of the main motivations for investors to choose zero-coupon convertible bonds.

Capital protection: Compared to directly purchasing stocks, convertible bonds provide better capital protection. Even if the company's stock price falls, investors can still redeem the face value of the bond, and the bond has a priority claim over stocks. This provides investors with a way to enjoy the upside potential of stocks while reducing investment risk.

Therefore, convertible bonds are equivalent to holding both bonds and call options on MicroStrategy stock. However, considering that MSTR's stock price is currently only $434, the stock price needs to rise more than 3.3 times by February 2027 for investors to profit. Therefore, once MSTR's stock, or strictly speaking, the price of Bitcoin, cannot rise more than 3 times from now, MSTR has effectively used this money for free for 6 years.

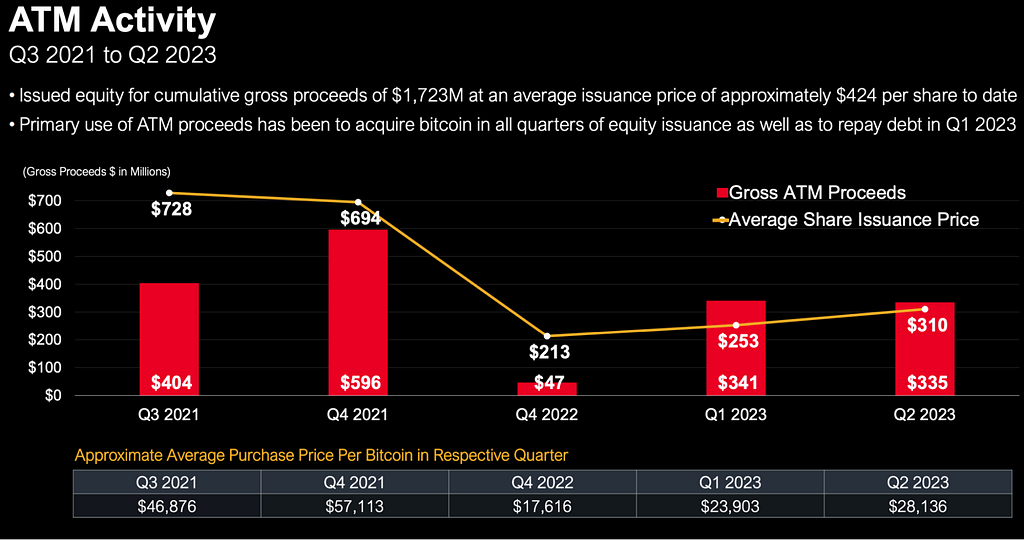

Stock issuance

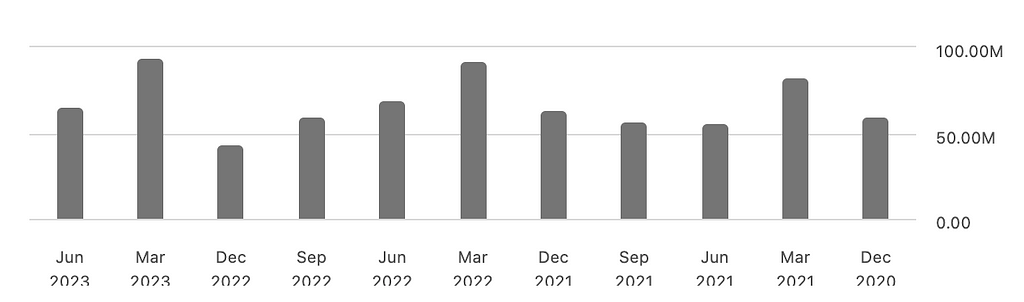

MicroStrategy issued a total of $1.723 billion in Class A common stock in 2021, 2022, and 2023, with an average selling price of $424 per share. The main purposes of these stock issuances were to purchase Bitcoin in all stock issuance quarters and to repay debt in the first quarter of 2023.

The issuance times of these stocks are as follows:

In the third quarter of 2021, financing of $404 million was raised through a rights offering at an average price of $728 per share.

In the third quarter of 2021, financing of $596 million was raised at an average price of $694 per share.

In the fourth quarter of 2022, financing of $47 million was raised at an average price of $213 per share.

In the first quarter of 2023, financing of $341 million was raised at an average price of $253 per share.

In the second quarter of 2023, financing of $335 million was raised at an average price of $310 per share.

Chart: MSTR's stock issuance prices and scale from 2021 to present

Source: MSTR, TrendResearch

On August 1, 2023, with the release of the second quarter report, MSTR announced the launch of a new $750 million rights offering, the largest in its history, with the purpose still to continue supporting the company's strategy of large-scale purchase and holding of Bitcoin.

Financial health analysis

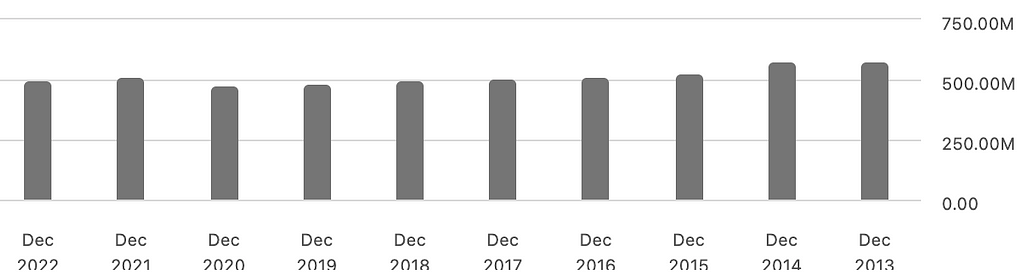

MicroStrategy's annual revenue has been relatively stable in recent years, reaching $499 million in 2022, but has remained at around $500 million since 2013, which is somewhat concerning for a software company that cannot expand its software sales revenue during the boom period of technology companies.

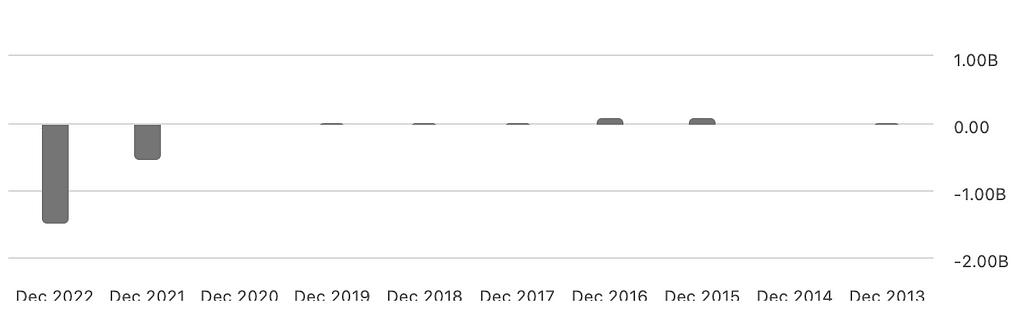

Chart: MSTR's annual total revenue (annual)

Source: TrendResearch, SeekingAlpha

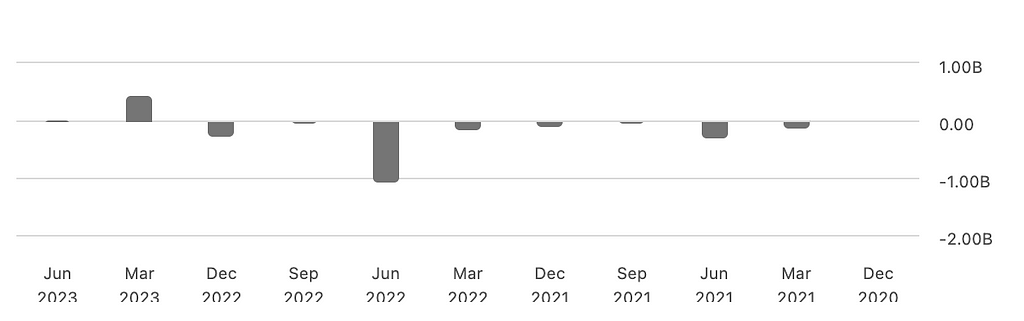

And since the beginning of this year, the revenue has remained almost unchanged, staying at the $120 million level.

Chart: MSTR Annual Total Revenue (Quarterly)

Chart: MSTR Net Profit (Annual)

Source: TrendResearch, SeekingAlpha

Although MicroStrategy recorded a net profit of $483 million in the first half of this year, its software business operations are still not profitable, with an operating loss of $30 million in the first half of the year. The appearance of net profit is mainly due to the recognition of $513.5 million in income tax benefits.

These benefits do not equate to actual cash received by the company, but rather represent various tax incentives and offsets that the company can deduct from total income when calculating pre-tax profits, mainly due to previous Bitcoin impairments. In accounting treatment, a company's asset impairments, business losses, etc., may generate income tax benefits because it can use these losses to offset future taxes.

Chart: MSTR Net Profit (Quarterly)

Source: TrendResearch, SeekingAlpha

In addition, despite the revenue reaching the $500 million level, the company actually does not have excess cash flow. Although the average cost of debt is only 1.6%, the annual interest expense of $36 million accounts for more than half of the company's cash reserves, forcing the company to continue issuing new bonds or stocks to raise interest. If the cash reserves bottom out, it could potentially jeopardize investment in the software business, further impacting operating income.

Chart: MSTR Cash and Cash Equivalents Reserves (Quarterly)

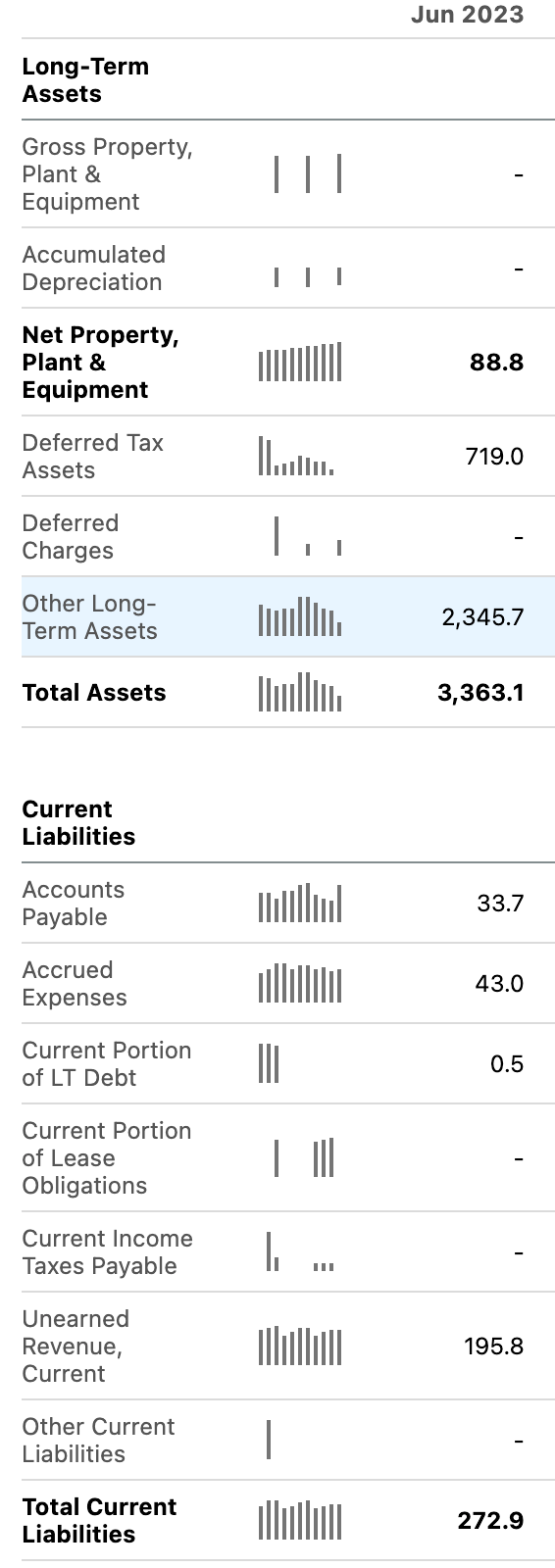

Based on the current balance sheet of MSTR, total assets of $3.363 billion ($2.346 billion in BTC) are actually undervalued, mainly due to the calculation of the value of BTC only considering impairments compared to cost, and even if the price subsequently rises, it will not be included in the statistics. This has resulted in a non-permanent impairment loss of $2.2 billion. In reality, at the current price of BTC approaching $30,000, MSTR's total assets should be $5.56 billion, corresponding to $2.73 billion in debt.

Chart: MSTR Balance Sheet (2nd Quarter 2023)

Source: TrendResearch, SeekingAlpha

Although MSTR has made every effort to reduce its debt pressure, overall, due to the poor performance of its traditional business, the company's overall business prospects are deeply tied to the price of Bitcoin. If the price of Bitcoin cannot sustain continuous growth at the current level, MSTR's continued fundraising may become difficult. For example, this quarter, MSTR announced the launch of the largest $750 million rights offering in its history. The landing situation is currently unclear, but the day after the announcement, the company's stock plummeted by 6.4%.

Looking at the specific situation of MicroStrategy, issuing new shares has a lower cost compared to conventional bond issuance, while issuing convertible bonds is slightly more difficult and requires carefully designed terms to attract investors, which is clearly not easy in the current bear market for digital currencies.

It can be seen that MSTR's three main bond issuances were all issued during the peak of the previous BTC bull market (December 2020 to June 2021), and after the third quarter of 2021, stock financing became the main method. This also reflects the difficulty MSTR may face in bond market financing, or the difficulty in bearing high interest rates, as the benchmark yield for junk bonds in the United States is 8%+. It is unsustainable to roll over existing debt at this cost, and the company can only bet on a significant rise in BTC before the 2025 maturity date.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。