Editor: Felix, PANews

Despite a 1.5-fold increase in annual trading volume and a slight revenue increase, Coinbase reported a net loss of $667 million in Q4 due to significant investment expenses, putting pressure on its stock price.

American cryptocurrency exchange Coinbase released its audited financial report for the fourth quarter (Q4) and the entire fiscal year 2025 on the evening of February 12. Q4 total revenue was $1.78 billion, lower than the expected $1.83 billion; adjusted earnings per share stood at $0.66, below the market expectation of $0.86; net loss was $667 million. After the report was released, the stock price fell 7.9% in after-hours trading.

Although short-term performance is under pressure, the trading volume for the entire year of 2025 surpassed $52 trillion, a year-on-year increase of 156%. The net profit for 2025 was approximately $1.26 billion. At the same time, Coinbase's share in the spot market doubled, rising from 3.2% at the end of 2024 to 6.4%.

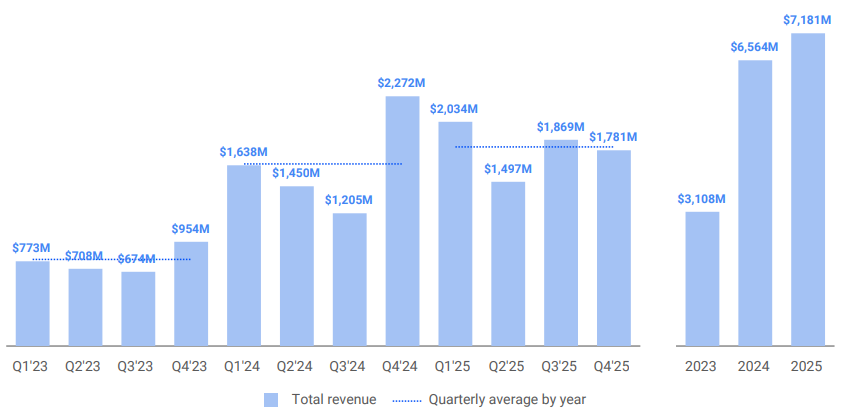

Quarterly revenue declined, annual revenue increased by 9.6%

Q4 total revenue recorded $1.78 billion, a quarter-on-quarter decrease of 5%, lower than the prior expectation of $1.83 billion; for the year, the revenue for 2025 was approximately $7.18 billion, an increase from $6.56 billion in 2024, reflecting a growth rate of about 9.6%.

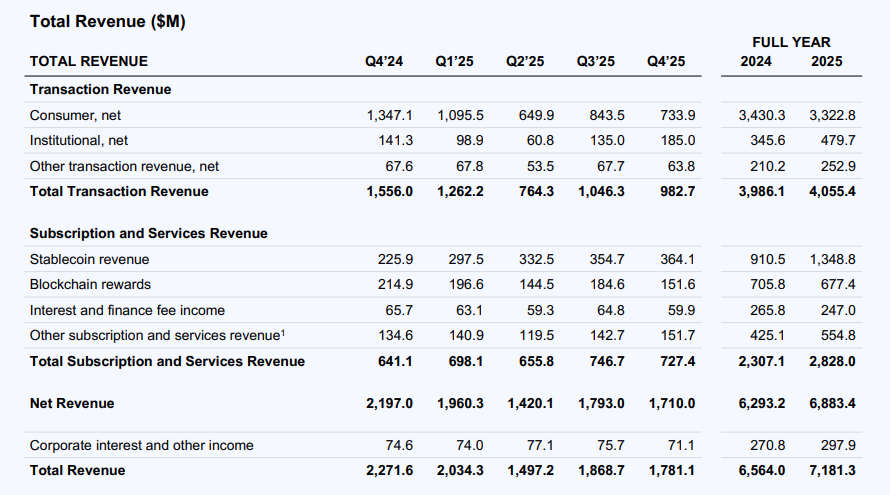

1. Trading revenue decreased by 6% quarter-on-quarter, both retail and institutional spot trading declined

Q4 total trading revenue was $983 million (a quarter-on-quarter decrease of about 6%), lower than the expected $1.02 billion, and also below Q3's $1.046 billion and Q4's previous year figure of $1.556 billion.

Among them, retail spot trading volume was $56 billion, a quarter-on-quarter decrease of 6%. Q4 retail trading revenue was $734 million, a quarter-on-quarter decrease of 13%, partly due to the shift to low-fee advanced trading and an increase in Coinbase One subscription users (close to 1 million, more than threefold growth over three years).

Institutional spot trading volume was $215 billion, a quarter-on-quarter decrease of 13%. Institutional trading revenue was $185 million, a quarter-on-quarter increase of 37%. Compared to the weak performance in spot market trading volume, the derivatives business, particularly Deribit (Q4 revenue hitting a record high), continued to perform strongly.

Additionally, due to market weakness leading to reduced instant transfer activities, other trading revenue was $6.4 million, a quarter-on-quarter decrease of 6%.

From an annual perspective, revenue still saw growth. The total trading revenue for 2025 was approximately $405 million. Compared to 2024 ($3.98 billion), revenue remained stable due to doubling total trading volume.

2. Subscription and service revenue slightly decreased by 3%, stablecoin revenue remained strong

Outside of trading operations, subscription and service revenue was $727 million, down from the previous quarter's $746.7 million (a slight decrease of 3%), but higher than last year’s $641.1 million. The primary reason is the decline in cryptocurrency asset prices.

Stablecoin-related revenue remained impressive. Stablecoin revenue was $364 million, a quarter-on-quarter increase of 3%, mainly due to the growth in average USDC holdings, which rose by 18% to $17.8 billion, a record high. The average USDC balance outside the platform also increased by 11%, reaching $58.4 billion, though the increase was relatively small. Q4 average USDC market cap increased by about $8.4 billion to $76.2 billion.

Blockchain rewards revenue was $152 million, a quarter-on-quarter decrease of 18%. This decline was mainly influenced by the reduction in average cryptocurrency asset prices (particularly ETH and SOL, which fell by 13% and 16%, respectively) and a decrease in the reward rate for the Solana protocol (approximately 17%).

From an annual perspective, subscription and service revenue reached $2.8 billion, growing 5.5 times compared to the peak of the last bull market in 2021.

Q4 net loss of $667 million, increased $39 million in BTC

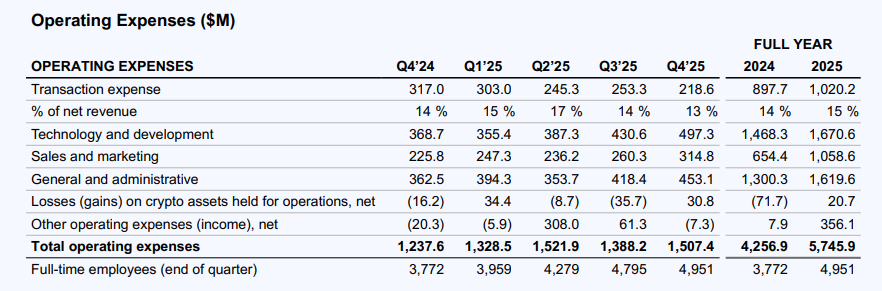

Total operating expenses for Q4 were $1.5 billion, a quarter-on-quarter increase of 9%. Expenses in technology and development, general and administrative, as well as sales and marketing increased by a total of $156 million, a quarter-on-quarter growth of 14%.

Among them, trading expenses were $219 million, a quarter-on-quarter decrease of 14%. The primary reason for the decline was due to falling asset prices leading to reduced blockchain rewards expenses, as well as decreased payment processing and account verification costs.

Technology and R&D expenses were $497 million, a quarter-on-quarter increase of 16%. The increase was mainly due to rising personnel costs, including a quarterly overall impact from the acquisitions of Deribit and Echo, as well as higher transaction-related amortization.

General and administrative expenses were $453 million, a quarter-on-quarter increase of 8%. Sales and marketing expenses were $315 million, a quarter-on-quarter increase of 21%. Equity incentive expenses were $230 million, a quarter-on-quarter increase of 4%.

Q4 net loss was $667 million, primarily due to a cryptocurrency asset portfolio loss of $718 million (most of which is unrealized) and a strategic investment loss of $395 million (including investments in CRCL). Adjusted net profit was $178 million, with adjusted EBITDA of $566 million.

As of the end of 2025, holding cash and cash equivalents of $11.3 billion, and continued share buybacks. As of February 10, approximately $1.7 billion worth of shares had been repurchased.

Additionally, the Q4 financial report also disclosed that in the fourth quarter of last year, it had increased its Bitcoin holdings by $39 million through regular weekly purchases. As of December 31, 2025, the fair market value of Coinbase's cryptocurrency assets for personal investments and as collateral was $2 billion and $823 million, respectively.

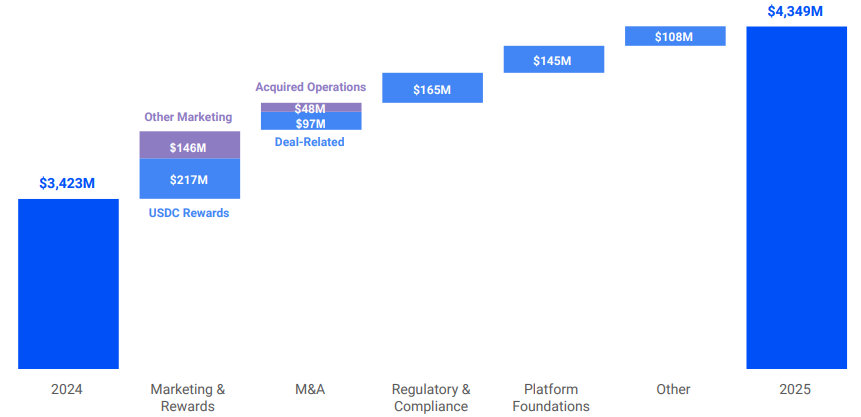

From an annual perspective, total operating expenses for 2025 reached $5.7 billion, a year-on-year increase of 35%. Technology and development, general and administrative, as well as sales and marketing expenses combined totaled $4.3 billion, a year-on-year increase of 27%. The number of full-time employees grew by 31% year-on-year to 4,951, with the customer support and product teams seeing the largest increase in staff.

CEO sold over $500 million in stock in nine months

Following the release of the financial report, Coinbase's stock plummeted.

It fell about 4% in after-hours trading to around $135, marking the lowest level in nearly two years. As investors digested the financial report's performance, the stock price rebounded in after-hours trading, briefly reaching about $141, but was still down 37.61% year-to-date.

However, the decline in stock price may not be solely attributed to disappointing financial results, as the continuous sale of shares by Coinbase's founder had earlier triggered market dissatisfaction.

According to VanEck, Coinbase CEO Brian Armstrong sold over 1.5 million shares of Coinbase stock in the past nine months (April 2025 to January 2026), cashing out approximately $550 million. The ongoing sale by executives not only undermined market confidence but also significantly pressured the stock price and potentially raised questions about the long-term interests of executives.

Yet, regarding the long-term development prospects of cryptocurrency, Coinbase stated it remains “optimistic” and continues to push for product expansion. “The cryptocurrency market is cyclical; experience tells us it will never be as good as it seems on the surface, nor as bad. While asset prices may fluctuate, beneath the surface, the currents of technological change and cryptocurrency product applications continue.”

Related reading: Robinhood vs Coinbase: Who Will Be the Next Tenfold Stock?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。