Amid a global sell-off of risk assets, Bitcoin and the Nasdaq have fallen in resonance, with incremental funds being unstable, predicting that the market bets Bitcoin will drop below $65,000 within the year.

Written by: Yang Chen

Source: Wall Street Watch

Bitcoin has fallen below the $72,000 mark, bringing the "faith" issue of the crypto market to the forefront. Against the backdrop of a sharp decline in global risk appetite, investors are reassessing Bitcoin's positioning amid market turmoil, and the narrative of crypto assets as safe havens is being questioned.

According to Bloomberg, Bitcoin briefly fell to $71,739 in New York's late trading on Wednesday, marking the first time in about 15 months that it has dropped below $72,000. Compared to the peak in October last year, Bitcoin has retraced over 42%, with a year-to-date decline of about 17%, sliding to its lowest level since November 6, 2024.

This round of decline is no longer just a continuation of deleveraging within the crypto market, but rather a result of broader cross-asset pressures. On Wednesday, global markets experienced a synchronized sell-off, with the Nasdaq 100 index dropping over 2%, and sectors sensitive to interest rates, such as software and chips, facing widespread pressure, causing Bitcoin to weaken accordingly.

On the emotional front, a "crisis of faith" is forming. Shiliang Tang, managing partner at Monarq Asset Management, stated that the market is experiencing a "crisis of faith."

Andrew Tu, head of business development at Efficient Frontier, noted that the sentiment in the crypto market is currently at an "extreme fear" level, and if the $72,000 level is breached, Bitcoin could drop to $68,000, or even fall back to the low range before the initial rebound in early 2024.

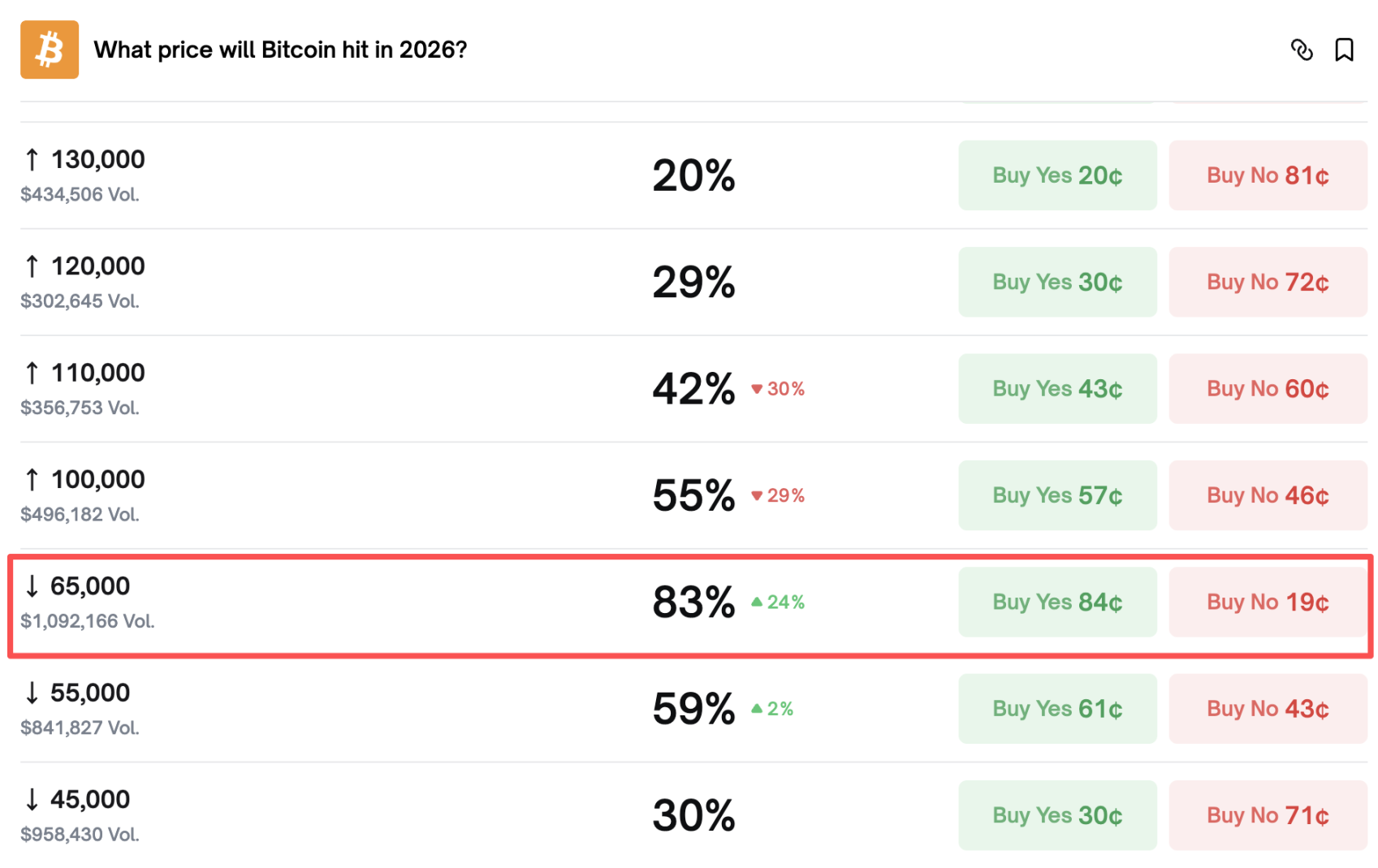

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of dropping below $55,000 has risen to about 59%.

Risk appetite turns sharply, Bitcoin treated as a "high-volatility risk asset"

According to Bloomberg, the selling pressure on Bitcoin on Wednesday was related to broader cross-asset tensions, rather than being driven solely by internal liquidations within crypto assets. This is significant for investors, as Bitcoin did not demonstrate resilience independent of risk assets during the synchronized sell-off phase; instead, it resembled a high-volatility long-tail risk asset.

The Nasdaq 100 index fell over 2% that day, dragging down sectors such as software and chips. Bitcoin's breach of a key integer level on the same trading day reinforced its market perception of resonating with risk appetite.

From a peak retracement of 42%, the crypto market has evaporated over $460 billion in just one week

Price retracement is rapidly transmitting through market capitalization contraction. According to CoinGecko data, the total market capitalization of crypto assets has shrunk by about $1.7 trillion since the peak in October last year. In just the past week, the market capitalization of crypto has decreased by over $460 billion.

As the largest cryptocurrency, Bitcoin's decline in magnitude and speed has a "anchoring effect" on market sentiment. When Bitcoin's year-to-date decline expands to about 17%, pressures from risk control, margin management, and fund redemptions often rise simultaneously, further exacerbating overall volatility.

How the "crisis of faith" emerges: from forced liquidation shocks to emotional dispersion

Statements from market participants indicate that changes in sentiment are becoming a core variable. The "crisis of faith" referred to by Shiliang Tang points to investors' simultaneous wavering of the mid-to-long-term narrative and short-term pricing mechanisms of crypto assets.

More critically, the changes driven by the decline are noteworthy. According to Bloomberg, previous phases of decline were more driven by unique liquidations within crypto assets, while the pressure on Wednesday stemmed from broader cross-market tensions.

This means that even if the internal leverage clearing in the crypto market comes to an end, as long as external risk assets continue to be under pressure, Bitcoin may still lack the catalyst for an independent rebound.

$72,000 becomes a short-term watershed, predicting the market bets it will fall to $65,000 within the year

Several trading professionals view $72,000 as a key short-term price level. Andrew Tu pointed out that if this level cannot be maintained, Bitcoin is "very likely" to drop to $68,000 and may return to the low range before the initial rebound in early 2024.

According to Polymarket, there is an 83% probability that Bitcoin will fall to $65,000 this year, while the probability of dropping below $55,000 has risen to about 59%.

The funding situation is also sending mixed signals. According to compiled data from Bloomberg, U.S.-listed Bitcoin spot ETFs recorded a net inflow of about $562 million on Monday, but immediately turned to a net outflow of $272 million on Tuesday, indicating that incremental funds are unstable.

Amid price declines and fluctuating fund flows, market skepticism regarding Bitcoin's role as a "safe haven asset during pressure periods" is rising.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。