在量化交易风靡股市的今天,大多数人都认为这些冰冷的算法机器人是华尔街的无情收割机,不断以毫秒级的速度抽取散户因情绪误判或信息不对称而流出的血汗钱。

然而在过去的 48 小时内的一个新兴市场中,多个顶尖量化机器人近乎完美的收益曲线集体崩断,而一个名为 a4385 的神秘账户,却从中狂揽 28 万美元。

这个市场叫做预测市场,而一名叫 a4385 的交易者也是在这里向全世界展示了一次精心策划的、针对量化机器人的围猎。

金融版「猜大小」:量化模型的套利天堂

猜大小谁都明白,预测市场中也有类似的玩法。

比如,若你在「金价会在明天上涨或下跌」中押注「上涨」,且明天价格确实上涨,那么无论涨幅多少,你的「上涨」仓位都会根据下注时的赔率进行盈利结算,而赔率本身则对应事件发生的概率。反之,如果价格下跌,不论跌幅多大,你的仓位都会直接归零。

「XRP 15 分钟后上涨或下跌」便是预测市场中众多盘口的一个典型代表。每个 15 分钟盘口开启时都会产生一个起始价;15 分钟后,如果 XRP 的价格高于起始价,押注「上涨」的交易者获利,反之则押注「下跌」的一方获利。

如图,Price To Beat 对应起始价,Current Price 对应实时价格。右上角红色「12:29」对应距离结算剩余时间。若价格线在结算时处于图中「target」上方,则押注「上涨」获利,反之则押注「下跌」获利。

这个实时机制使得该盘口成了量化机器人的天堂:算法通过精密的统计模型,捕捉散户由于情绪、信息延迟、剩余时间等诸多原因导致的定价偏差,并通过自动化交易完美地蚕食稳定的利润。

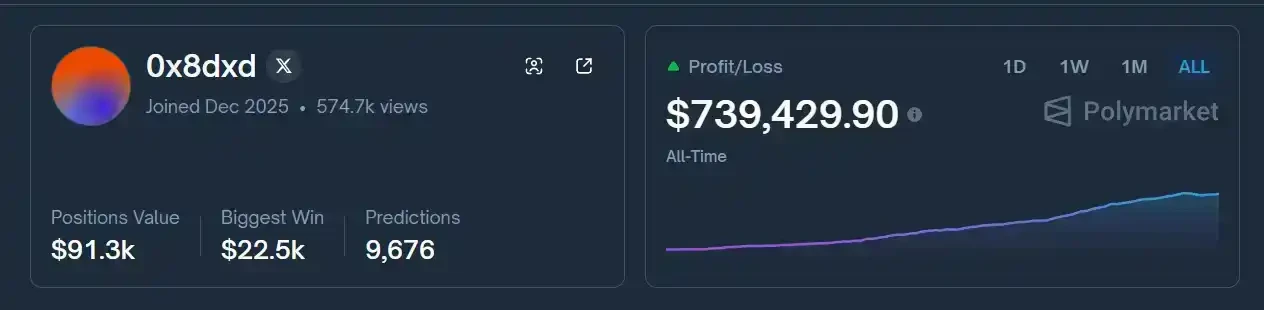

0x8dxd 就是众多量化机器人中的一个完美例子:自 2025 年 12 月 5 日上线以来,在过去的 44 天内累计收益 74 万美元,平均每天参与 219 个不同市场,其收益曲线非常平滑。

XRP 正好在结算时暴涨,「运气爆棚的傻大户」资金翻倍

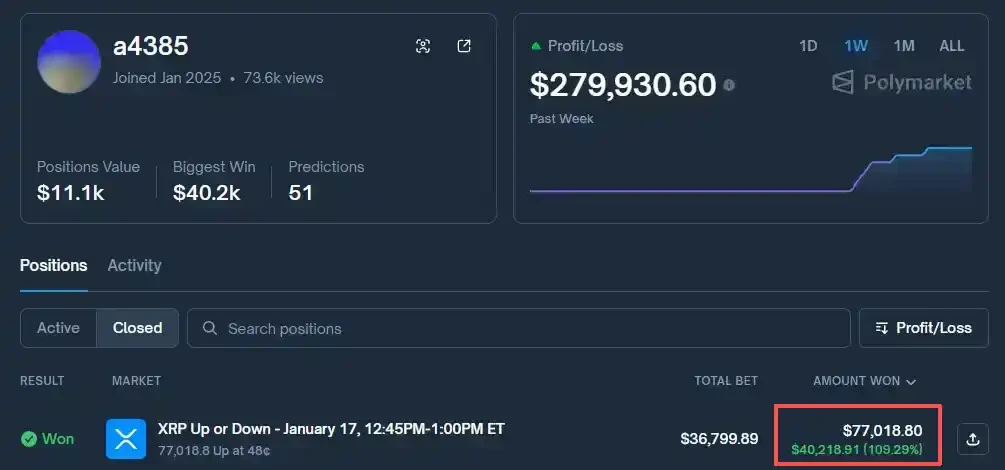

2026 年 1 月 17 日下午,a4385 在「XRP 15 分钟后上涨或下跌」中押注「上涨」。

该盘口的 XRP 起始价为 $2.0784,而直到 17:58:54(距离结算剩余 66 秒),XRP 的价格仍徘徊在$2.0737,对应的上涨概率也仅为 36%——市场共识认为,XRP 很难在仅剩的 1 分钟内上涨超过起始价。

而就在接下来的一分钟内,XRP 突然开始持续上涨,并在市场结算时的报价定格在$2.0817——刚好越过起始价。

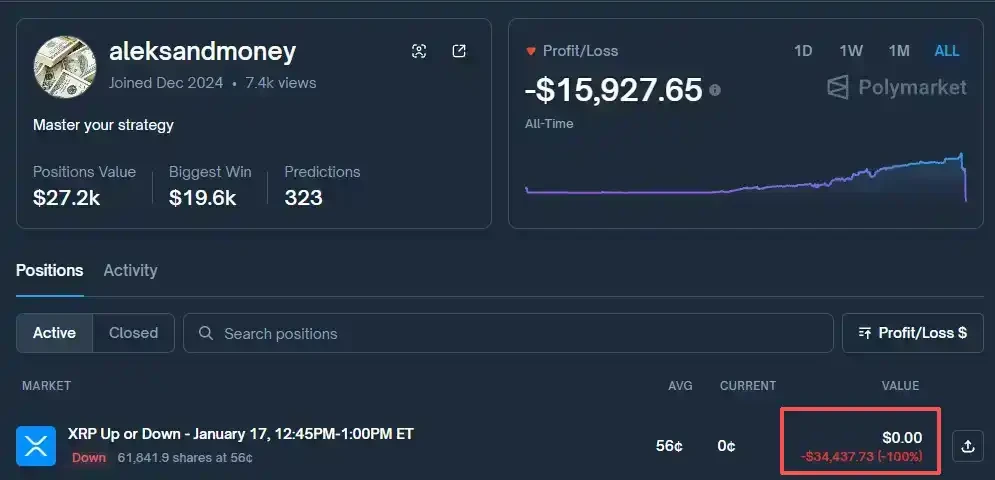

这意味着 a4385 从入场到结算的仓位实现了巨额盈利,而那些例如下图中的量化机器人,仅因这个单一市场,就吐出了所有历史利润,甚至还要承受额外亏损。

该量化机器人在过去 7 个月期间盈利超 4 万美元,而在本盘口亏损为 3.4 万美元。

屡次走运背后的精心操盘

该盘口结算后,人们发现 a4385 随后还复刻了好几次相似的「运气爆棚」操作:在多个市场结算前 1 分钟,XRP 价格突然暴涨,而结算后的下一秒又迅速回落。

这让人们开始怀疑,他的「运气」或许并非巧合,而是针对量化机器人的精准狙击。

理论上,a4385 可以先在 XRP 实时价格低于起始价时押注「上涨」,然后在结算前一分钟,通过市价大单买入 XRP,人为推高价格,确保结算时的价格高于起始价,从而锁定盈利。

此时,所有此前看似无关痛痒的细节便开始变得重要了起来:17 日为周末,代表着做市商为 XRP 提供的订单簿深度不足以缓冲短时的大额交易。

而选择 XRP 这个不同于比特币的冷门标的则进一步保证更浅的订单簿深度,从而保证操盘者可以用更少的成本在短时间撬动价格。

这就给了 a4385 一个完美的短暂操盘窗口:

先在预测市场中,在盘口结算前 10 分钟内多次大额押注「上涨」。由于这段时间内的实时价格均低于起始价,此时押注的赔率较高。

在对应的 XRP 价格图表上,一直到 17:59 前,其价格均徘徊在 2.074 左右。而最后一分钟内,多笔异常的大额交易量涌入,导致价格瞬间突破起始价(红色水平线)。

当该盘口成功结算后,立即将刚刚买入的 XRP 抛出,导致价格瞬间回落。

如果我们假设 17:59 的所有市价买单均来自 a4385,那么根据该分钟 K 线的成交量 56.9 万美元计算,在交易所手续费为 0.32% 的情况下,其买入与卖出的总成本约为 $6,200。

而他在本盘口押注「上涨」的收益为$40,218。通过不断复制该策略,他在 48 小时内已经赚了近 30 万美元。

在惊叹于 a4385 看似印钞机一般的印钱操作时,我们也需要给这个看似「散户反杀」的热血故事背后的成本。

买入拉盘除了需要承担上千美元的手续费磨损之外,还会在结算后抛售时承担币价回落导致的巨额亏损。

所以在拉盘的同时,他也需要持有一个等额的 1 倍空单。只有这样,无论手中的现货 XRP 价格如何剧烈波动,他的资产总价值才可以保持不变。

也就是说,在承担手续费磨损之外,他还需要超百万美元的流动资金来保证这个策略的可行性。

所以,这并非是一个赌徒的运气游戏,也不是普通散户的狂欢。

在一个个赌场暴利的传奇故事背后,也许笑到最后的从来不是幸运本身,而是资金、结构与规则被精确计算后的必然结果。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。