Original Title: The Axis of Illicit Finance: Iran’s Crypto Strategy Explained

Original Author: Jessica Davis, Insight

Original Translation: Peggy, BlockBeats

Editor's Note: Under more than forty years of intense sanctions pressure, Iran has gradually been squeezed out of the global financial network centered on the US dollar and traditional banking systems. This article outlines the evolution of Iran from oil embargoes and financial disconnections to the introduction of cryptocurrencies, presenting how sanctions have objectively driven a constrained country to build a parallel financial system.

In Iran, cryptocurrency is no longer just a technical choice but has been incorporated into the national-level toolbox for evading sanctions and geopolitical maneuvering. As this system intertwines with a broader alternative financial network, its impact has transcended Iran itself, pointing to profound changes occurring in the sanctions mechanism, global financial order, and security landscape.

The following is the original text:

This article marks the beginning of a series of eight articles aimed at examining how Iran increasingly relies on cryptocurrency to evade international sanctions. These changes occur against a backdrop of high volatility: Iran's confrontation with Israel in 2025, the ongoing activities of its regional proxy networks, and waves of protests triggered by corruption, economic hardship (exacerbated by sanctions), and political repression.

Understanding how and why Iran incorporates cryptocurrency into its sanctions evasion strategy is crucial for assessing how it will respond to countermeasures in the future and what impact this will have on global security.

Iran's cryptocurrency activities are also part of a larger narrative. I refer to it as the "Axis of Illicit Finance": an emerging alternative financial system involving other sanctioned or adversarial countries to the West, such as Russia, Venezuela, and North Korea (DPRK), with China playing a key supporting role.

In the upcoming series of articles, I will gradually dismantle how this system operates, who benefits from it, and why it is more noteworthy now than ever before.

Background of Sanctions on Iran

For a long time, Iran has adopted highly adaptive financial strategies to mitigate the impact of international sanctions and continue supporting its regional proxy organizations. These methods include shadow shipping fleets, money service providers, shell company networks, and cash couriers. As sanctions increasingly constrict its access to the formal financial system, Iran and its affiliates have increasingly relied on cryptocurrency to bypass regulations and funnel funds to the "Axis of Resistance," which includes Hezbollah, Hamas, Ansarallah, and militia groups in Iraq.

Although Iran's cryptocurrency-based financing infrastructure is still in development, its complexity and coverage are continuously improving, gradually integrating traditional financial systems with emerging digital mechanisms. At the same time, this system is becoming more embedded in an alternative financial system shaped by Russia and North Korea (DPRK) and supported by China, with other countries (including Venezuela) also utilizing this system. Thus, it is evident that cryptocurrency is likely to play an increasingly important role in Iran's efforts to withstand sanctions and its ability to fund proxy forces throughout the region.

A Nation Shaped by One of the Harshest Sanction Regimes Globally

Since the 1979 revolution, Iran's economy has repeatedly suffered from the impact of international sanctions. These measures aim to limit Iran's access to US dollars and its ability to enter US financial institutions, while also severing its ties with foreign banks that have correspondent relationships in the US, thereby weakening its capacity for trade and international transactions. At certain times, the economic impact of sanctions has compounded the shocks from global oil price fluctuations.

In other instances, US and international sanctions have prompted Iran to make concessions in negotiations aimed at limiting its nuclear capabilities and related developments. However, under the conditions of "maximum pressure," these sanctions have also stimulated the Iranian regime to intensify its sanctions evasion efforts—both to enhance its bargaining chips and to alleviate domestic economic pressures. In recent years, these evasion behaviors have increasingly incorporated cryptocurrency.

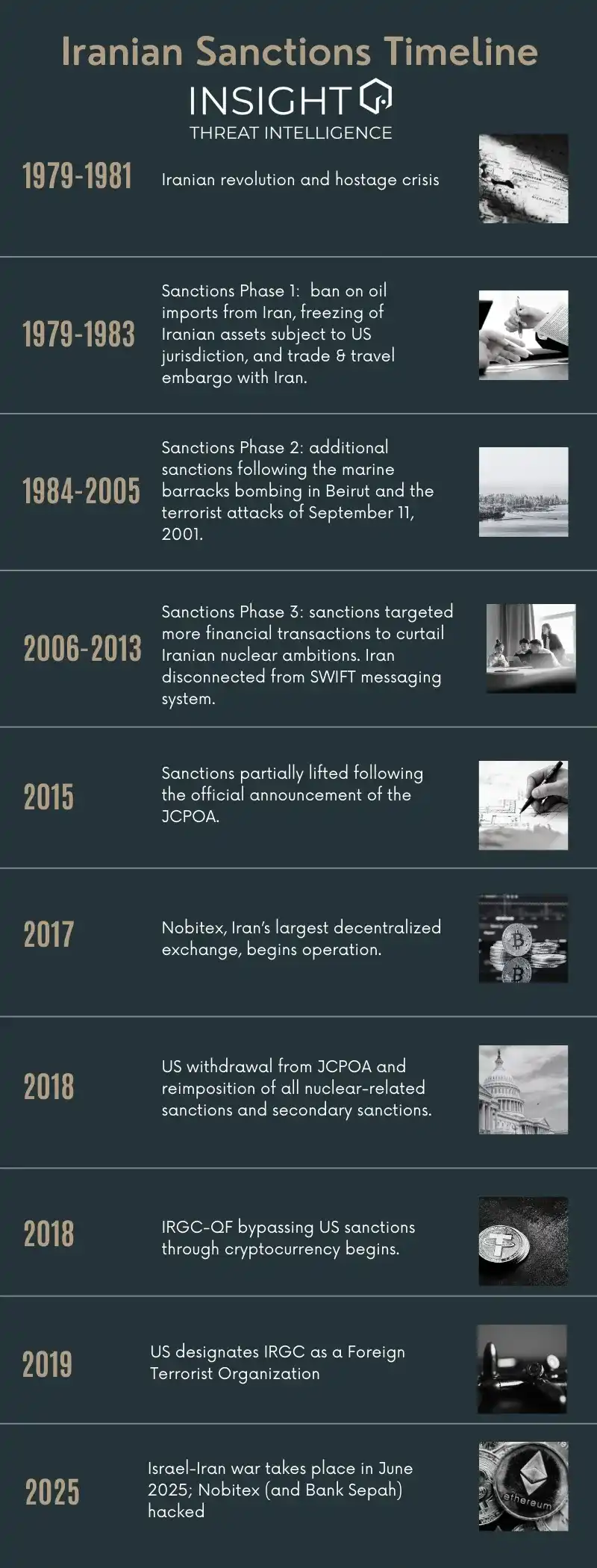

The timeline of sanctions on Iran shows that under decades of intense sanctions, Iran has gradually been "squeezed out" of the traditional financial system and ultimately incorporated cryptocurrency into its national-level toolbox for evading sanctions, financing, and geopolitical maneuvering. Specifically, since the 1979 Iranian Revolution and the hostage crisis, the US implemented the first round of sanctions against Iran, banning oil imports, freezing assets, and imposing trade and travel embargoes; from 1984 to 2005, sanctions were continuously intensified against the backdrop of multiple terrorism-related incidents; from 2006 to 2013, sanctions shifted focus to the financial sector to curb Iran's nuclear program, cutting Iran off from the SWIFT system. After the announcement of the 2015 Joint Comprehensive Plan of Action, sanctions were partially lifted, but in 2018, the US withdrew from the agreement and reimposed all nuclear-related and secondary sanctions. In the same year, Iran's largest decentralized exchange, Nobitex, began operations, and the Islamic Revolutionary Guard Corps' Quds Force also began using cryptocurrency to evade US sanctions. In 2019, the US designated the Islamic Revolutionary Guard Corps as a foreign terrorist organization. By June 2025, war broke out between Israel and Iran, and Nobitex and Sepah Bank were hacked, demonstrating that sanctions, the financial system, and cryptocurrency infrastructure are deeply intertwined in geopolitical conflicts.

To fund its proxy forces and evade sanctions, Iran operates a parallel financial infrastructure composed of informal remittance institutions, bank accounts, and shell company networks, aimed at laundering proceeds from oil sales and creating "deniability" regarding the sources of oil. When conditions allow, this network intersects with the Western financial system, facilitating Iran's financial activities globally. For example, media reports indicate that two fintech companies, Paysera and Wise, have unknowingly processed payments for this network. Over the past eight years, Iran has also integrated cryptocurrency capabilities into this shadow banking system.

Iran's meaningful cryptocurrency activities began in the mid-2010s when the country's first large cryptocurrency exchange, Nobitex, was established. As of 2023, Nobitex has become Iran's largest cryptocurrency exchange; additionally, Iran has four other larger exchanges: Wallex.ir, Excoino, Aban Tether, and Bit24.cash. Nobitex is deeply embedded in Iran's traditional payment ecosystem, supporting real-time fund deposits and account verification. It acts as a fully functional financial bridge, enabling users to bypass the international banking system, demonstrating "how to integrate cryptocurrency channels with local banking infrastructure within a sanctioned jurisdiction to build a resilient, borderless payment system."

Iranian citizens (sometimes even including members within the regime) utilize cryptocurrency to transfer capital abroad during geopolitical crises. Even if not for wealth transfer, many Iranians invest in cryptocurrency to hedge against the volatility of their local currency and the overall economy.

Iran's widespread adoption of cryptocurrency is not surprising: sanctions often drive adoption, especially in regions with high income inequality. In fact, cryptocurrency adoption is influenced by factors such as economic instability and infrastructure availability, and the adoption rate is typically higher in countries with limited access to traditional financial systems.

Since 2018, Iran has begun using cryptocurrency to evade US sanctions. The Islamic Revolutionary Guard Corps (IRGC) is one of the key users, utilizing cryptocurrency to fund intelligence activities and its proxy networks across the Middle East, while also supporting external intervention actions, such as sabotage, property destruction, and possibly even targeted assassinations.

At the national level, regime officials, and the IRGC are using cryptocurrency to evade sanctions and access international markets. According to a blockchain analytics company, Nobitex and other Iranian exchanges have adopted "advanced technologies" to transfer funds and deliberately obscure the sources and destinations of funds. For example, Iran uses cryptocurrency transactions to pay for imported goods that cannot be processed through traditional payment systems, compensating for fiscal revenue losses caused by sanctions. Additionally, Iran specifically uses cryptocurrency to legitimize import payments to bypass sanctions and avoid using US dollars.

In addition to directly using cryptocurrency for transactions, Iran also utilizes its surplus oil and energy resources to power Bitcoin mining, essentially converting energy into crypto assets. Given Iran's extensive use of cryptocurrency and its connections to international markets through multiple blockchains, this approach creates liquidity for Iran—usable for purchasing goods and services and for funneling funds to its proxy forces within the "Axis of Resistance." In fact, it is widely believed that the IRGC has engaged in large-scale Bitcoin mining activities.

Once Iran acquires cryptocurrency, it uses these funds to finance other illicit activities. This includes providing financial support to organizations within the "Axis of Resistance" that serve Iran's regional hegemonic goals, and possibly using virtual assets to fund overseas influence operations. To date, cryptocurrency transactions from the IRGC's Quds Force (QF) have flowed to Hezbollah, Hamas, and Ansarallah as part of its overall financing strategy. Cryptocurrency transactions may also benefit other organizations within the "Axis of Resistance."

Iran's turn to cryptocurrency marks the latest phase in its long-standing efforts to combat and evade one of the most comprehensive sanction regimes globally. Initially, this was merely a stopgap measure to maintain economic resilience; today, it has become a key tool supporting Iran's broader foreign policy objectives, particularly in sustaining its proxy networks across the Middle East. As Iran's cryptocurrency financing infrastructure matures and increasingly intertwines with an emerging alternative financial system involving Russia, Venezuela, North Korea, and China, its impact has far exceeded the borders of Tehran. Subsequent articles in this series will further explore how Iran's proxy forces utilize these financial innovations, the specific methods they employ to transfer and conceal funds, and the expanding roles of China and Russia in supporting and promoting Iran's alternative financial architecture.

Recommended Reading:

RootData 2025 Web3 Industry Annual Report

Xiao Hong: From Small Town Youth to Manus CEO, a Long-Termist Bitcoin Believer

The Power Shift of Binance: The Dilemma of a 300 Million User Empire

Has the Project Buyback Dividend Really Come to an End?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。