1、透明度:无形的门槛

在过去几个周期,加密行业的估值体系高度依赖叙事能力。一个清晰、有想象空间的叙事,往往足以支撑早期融资和市场关注度,乃至 TGE 后的 FDV 上涨空间。

DeFi、NFT、GameFi、AI + Crypto、Restaking、RWA……每一个赛道在爆发初期,都会伴随着大量概念输出与愿景承诺。但事实反复证明,叙事本身无法支撑长期价值,唯有产品进展与真实的市场采用才能做到。

随着整体投资回报率下降、失败项目层出不穷,这套估值体系已经几乎被证伪。在这样的背景下,投资者的关注焦点将从叙事本身,转移到项目本身的产品力、执行力与创新能力等,这几乎已经成为市场普通的共识。

然而,在项目关键信息与投资者之间,始终横亘着一道“透明度”的无形门槛,且缺乏可靠的信息呈现平台。只有项目方愿意主动披露动态信息,并且让用户可以便捷地查询,才能提高整个加密市场的信息效率与健康度。透明度,正在成为影响行业发展格局与未来空间的关键因素之一。

2、响应市场需求,将透明度指标量化

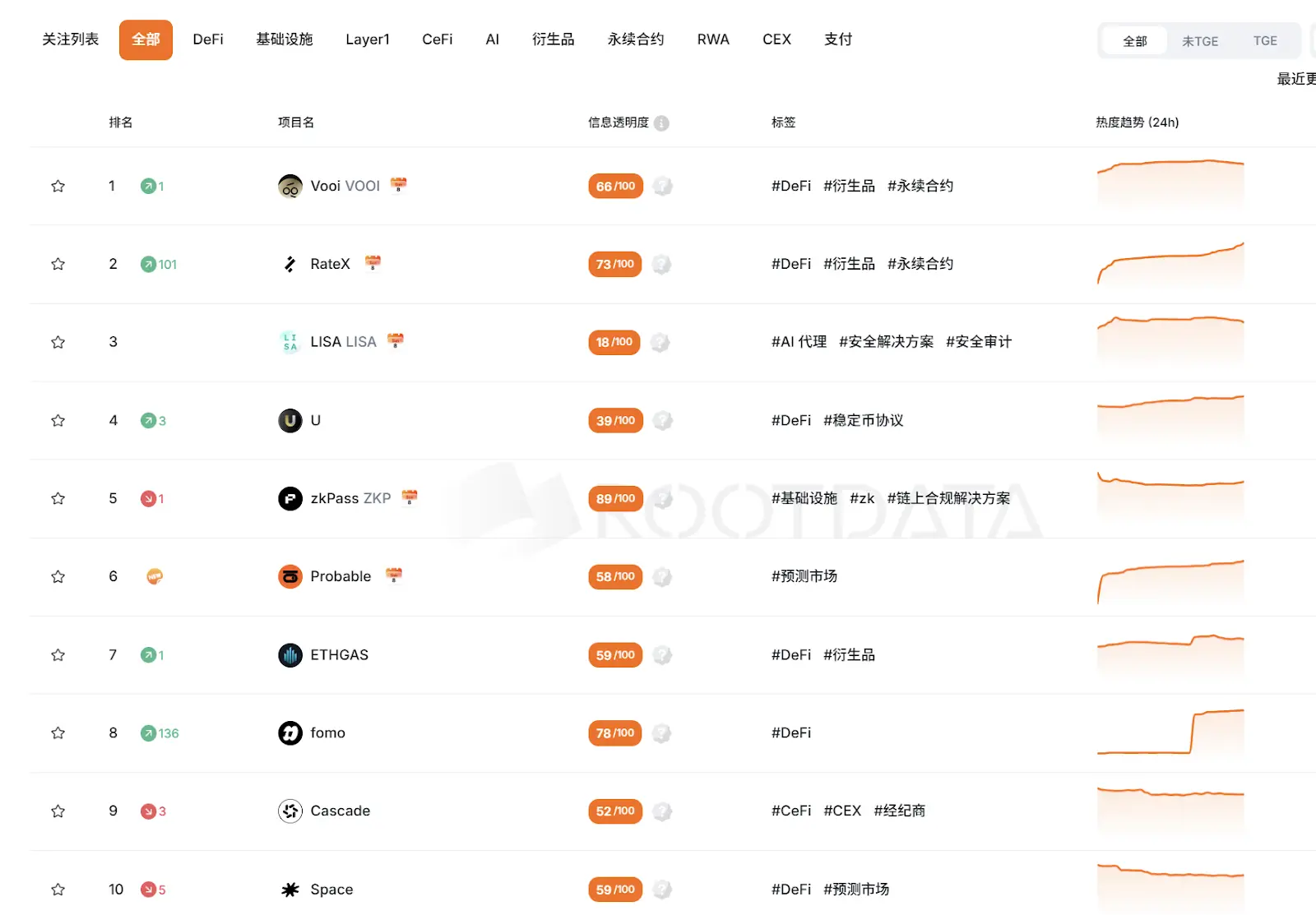

透明度长期以来是一个模糊、主观且难以比较的概念,用户只能凭经验、感觉来判断,难以通过量化的指标被市场评估。因此,RootData 基于长期以来在项目基本面信息上的积累,于近期正式推出项目的信息透明度评分,并在网站首页、项目详情页等诸多显眼位置提供曝光,使投资者与用户能够从更多维度来对项目进行了解与评估。

需要明确的是,RootData 的透明度分数并非传统意义上的项目评级。它并不试图回答“项目是否值得投资”这样高度主观的问题,而是聚焦于一个更基础、也更可验证的层面:项目是否持续、系统性地向市场披露自身关键信息。

在设计上,透明度分数强调客观与动态。它并非一次性生成,而是随着项目数据的补充、更新或停滞而持续变化。这意味着,透明度并不是一个可以通过一次集中披露“完成”的指标,而是一种需要长期维护的状态。

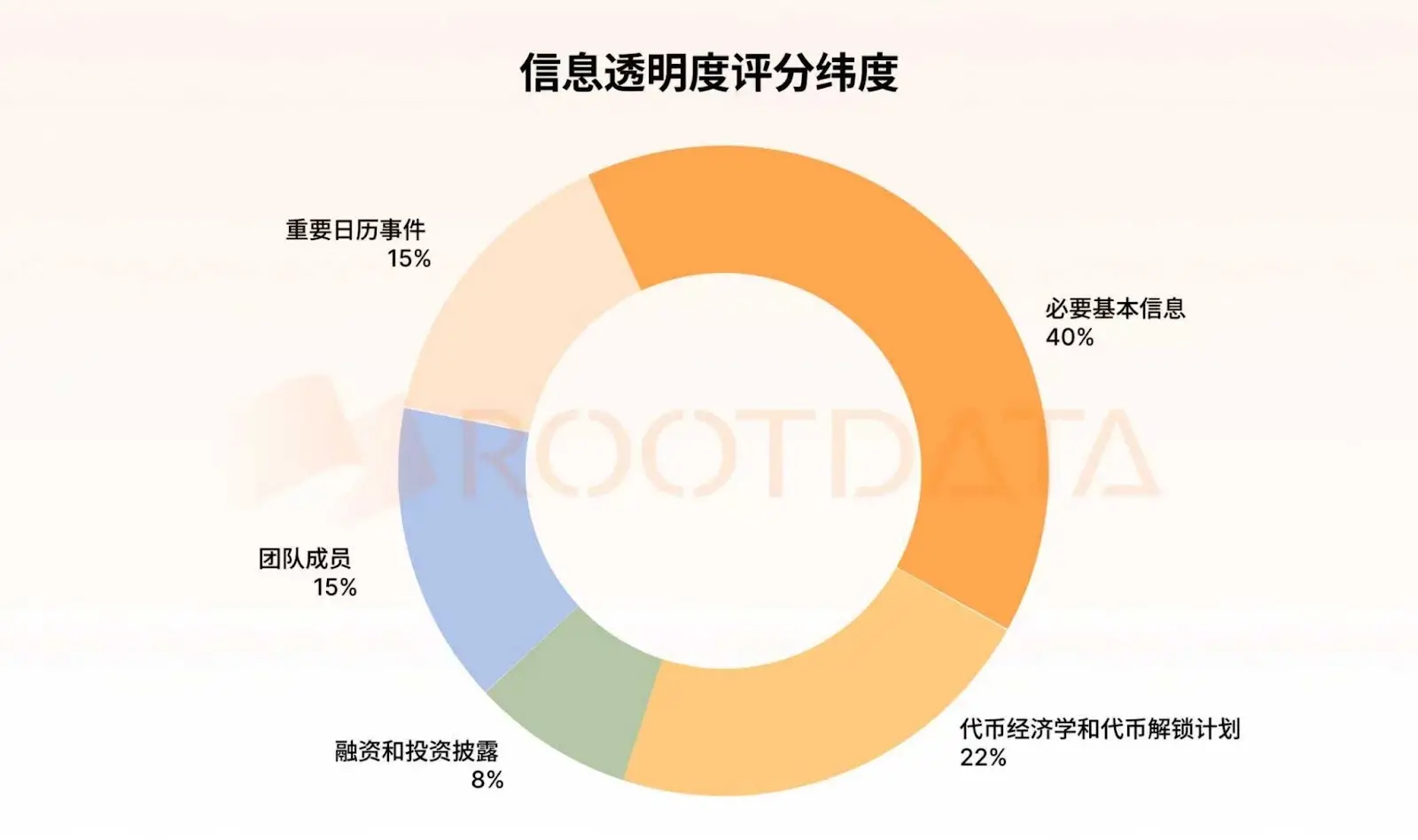

具体而言,透明度分数综合了多个维度的数据完整性与更新频率,涵盖项目基础信息、团队背景、融资背景与金额、代币分配与解锁情况以及项目进展动态等。每一个维度都对应项目是否在关键问题上向市场提供了足够信息,而非是否给出了“好看”的答案。

这种设计思路的核心在于,将透明度从价值判断中抽离出来,使其成为一种对外行为的客观记录。

3、强大的加速器与敲门砖

在实际应用中,透明度分数的价值,并不体现在短期价格预测上,而更多体现在长期信任度积累层面。对于普通用户而言,它提供了一种快速过滤机制,用于降低在信息严重不足或者慢性死亡项目中的暴露风险,结合RootData既有的热度指数、增长指数,将更多注意力引导至信息更加透明、发展潜力更大的项目。

对项目方而言,透明度分数代表了一种可逐步累积的外部信誉与评价体系。持续更新项目进展、如实披露调整与延误,虽然不会立即带来市场热度,但会在融资、合作、上币、营销或舆情波动等关键节点中,乃至用户的探索了解中,显著提升项目的可信度。

更具体而言,透明度分数可以从以下四个角度来理解:

1、融资加速器:在提高有效曝光量的同时,为投资人提供结构化、可验证的尽调材料,缩短决策周期。

2、上币增强器 :以全面、可验证的数据,满足交易所对项目信息“公开、可查、持续”的核心要求,从而加速上币审查进程。

3、合作敲门砖:以专业、可信的项目展示页面作为名片,向潜在合作伙伴(如钱包、Launchpad、生态基金或其他项目方)提供透明、结构化的信息,建立初步信任,便于开启业务合作沟通。

4、营销助推剂:通过平台的高流量曝光和背书,吸引更多社区用户、KOL关注,并为社交媒体传播、影响力营销提供可靠的第三方验证材料,放大整体推广效果。

换言之,维护高透明度评分是一项高ROI的战略行为。项目方往往只需通过简单的资料补充,即可有效提升分数。例如,在同赛道概念相似的项目中,透明度评分更高的项目在对接交易所和头部 VC 时,因为信任与沟通成本更低,往往能获得更快的响应和更深入的洽谈机会。

从反面来看,信息长期更新缓慢乃至停滞导致透明度评分低,则意味着项目在整个行业认知网络中的权重持续下降,系统性地失去市场可见度,而这一过程往往是缓慢但不可逆的。相比之下,能够持续披露真实进展的项目,即使节奏缓慢,也更容易在后续阶段重新进入市场视野,得到用户的信任。

事实上,RootData 项目数据已经成为 Binance 等多个交易所上币尽调的参考信源之一,其数据 API 也已经被 Binance 、OKX 等上百个知名行业客户采用,这意味项目在 RootData 上的信息完整度与更新频率形成的影响力不仅仅通过平台本身呈现,还会通过其广泛的合作伙伴网络多重放大,直接关联其市场推广效果,这会使得数据透明度在行业扮演越来越重要的作用。

为顺应此趋势,RootData已正式推出项目认领功能。经过审核的项目方账号可以针对性对项目数据进行维护,使项目方维护其透明度的门槛与周期大幅降低。与此同时,任何普通用户也可以通过项目页面的反馈按钮,对项目存在信息错误、更新不及时情况进行反馈,并获得积分奖励。

4、透明度不再只是附加项

随着加密行业逐步进入以产品与用户为核心的阶段,透明度的重要性正在被重新认识。它不再是附加项,而是决定项目是否具备长期参与资格的基础条件之一。

可以预计,接下来越来越多投资方和研究机构在内部评估中,将项目的信息披露以及透明度视为一个基础性指标。与此同时,交易所、做市商以及第三方合作方,也在筛选过程中越来越依赖结构化数据,而非零散信息。其逻辑并不复杂:如果一个项目连自身最基本的发展状态都无法持续对外说明,那么外部参与者几乎不可能对其长期治理能力抱有信心。透明度在这里并非道德评价,而是一种风险管理工具。

总结来说,RootData推出的项目透明度分数,并非用于预测未来,而是为市场与用户提供一个衡量当前信息状态的客观清晰刻度。在一个缺乏统一披露标准、信息壁垒较高的市场中,这种刻度本身,正在成为稀缺资源,并在行业价值体系重估中扮演不可估量的作用。

市场的透明度越高,对于维护普通用户与投资者的利益就更友好,反向将“垃圾”项目从市场淘汰出局,并奖励那些尊重用户、尊重Web3精神的项目,推动行业的健康化发展。

在此背景下,每个加密项目都应立即行动,将提升透明度纳入实质性的运营策略,注重其在用户群体中的形象,在新维度与新标尺的竞争中占据先机,赢得交易所、VC乃至用户的各方偏好。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。