Imagine that the most powerful financial institution on Earth—the Federal Reserve—is about to completely change its course. This is not a simple policy tweak, but a reshaping of its core DNA. Today, we will delve into a potential watershed moment in American economic history: Kevin Allen Hassett possibly becoming the Chairman of the Federal Reserve. This is not just a personnel change; it concerns a fundamental restructuring of how the Federal Reserve operates in the future, profoundly affecting every aspect of our lives, from your mortgage rates to the prices of everyday goods.

For over a century, the Federal Reserve has been seen as the guardian of financial stability, often operating under a consensus that prioritizes price stability. But what if this consensus is about to be broken? What if the next Federal Reserve Chairman views the world from a radically different perspective, one that could fundamentally alter our economic landscape?

Challenging a Century of Consensus: The Rise of Hassett

We are experiencing an unprecedented period of economic transformation: a global pandemic, geopolitical tensions, and ongoing debates about the nature of inflation and economic growth. Kevin Hassett is emerging on this complex stage, and his trajectory as an economist signals a fundamental philosophical shift. Predictive markets have given him an 86% chance of being nominated as Chairman of the Federal Reserve, strongly indicating that his unique combination of academic credentials and ideology makes him a formidable candidate.

The rise of Kevin Hassett is not just a change in the Federal Reserve Chair; it is a challenge to a century of central bank consensus. He represents a new perspective that could fundamentally change the economic landscape.

Hassett's chairmanship is likely to challenge the post-Volcker consensus that views central bank independence as sacrosanct. While he publicly defends this independence, his writings suggest a functional shift towards a coordinated fiscal-monetary system. In simple terms, the central bank may act more as an accelerator of the executive branch's economic strategy rather than a counterbalancing force.

A Public Finance Perspective: Understanding the Foundations of Hassett's Economic Worldview

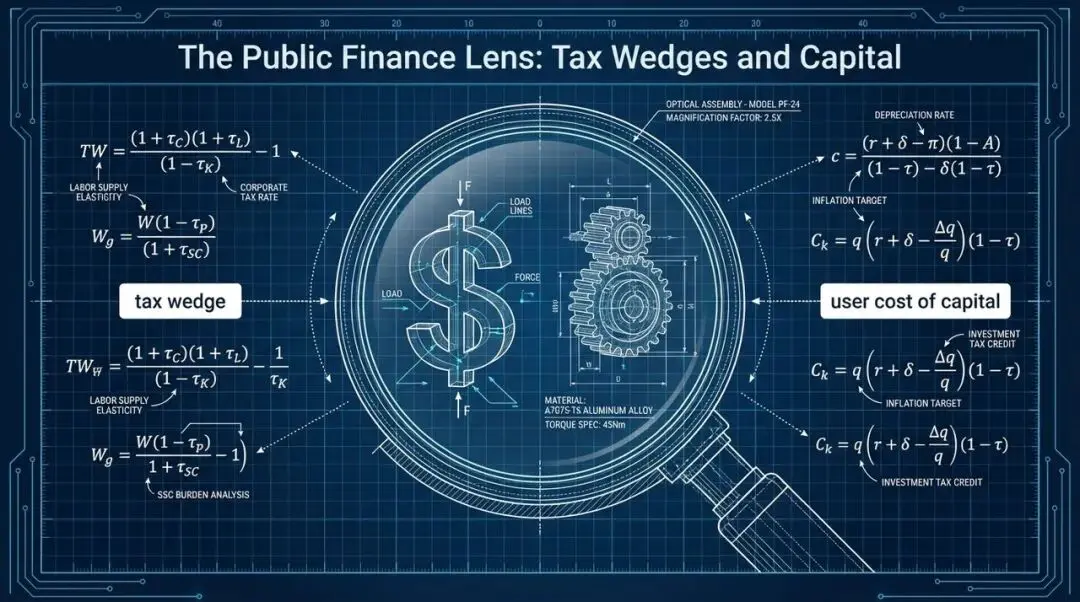

To understand Hassett's potential actions as Chairman of the Federal Reserve, we must first grasp his intellectual foundation. Unlike recent Federal Reserve Chairs like Bernanke or Yellen, whose careers are rooted in macro labor economics or monetary theory, Hassett is a product of the public finance tradition.

His primary perspective on the economy is not the interest rate transmission mechanism we often hear about, but rather tax wedges and the cost of capital usage. This distinction is crucial. His economic philosophy was shaped at the University of Pennsylvania, under the mentorship of public finance giant Alan J. Auerbach. The "Auerbachian" influence is vividly reflected in Hassett's obsession with the "cost of capital usage."

Traditional Monetary View

: Lowering interest rates makes borrowing cheaper, thereby stimulating demand.

Hassett's (Public Finance) View

: Investment is driven by tax incentives and regulatory certainty.

Within this framework, the role of monetary policy is essentially to clear the way for growth driven by fiscal incentives. This means that after Hassett becomes Chairman of the Federal Reserve, he may be less confident in his ability to "fine-tune" interest rates. He may focus more on creating a monetary environment that amplifies supply-side fiscal reforms.

From the Federal Reserve to AEI: The Formation of Policy Ideas

Hassett's career trajectory provides clues to understanding his policy ideas:

Early Years at the Federal Reserve (1992-1997)

: He served as an economist in the Research and Statistics Division of the Federal Reserve Board, witnessing firsthand Alan Greenspan's operations during the "soft landing" period. This experience allowed him to see the Federal Reserve's proactive interest rate hikes while also permitting the economy to grow at a pace that exceeded traditional model predictions, known as the "new economy" productivity boom.

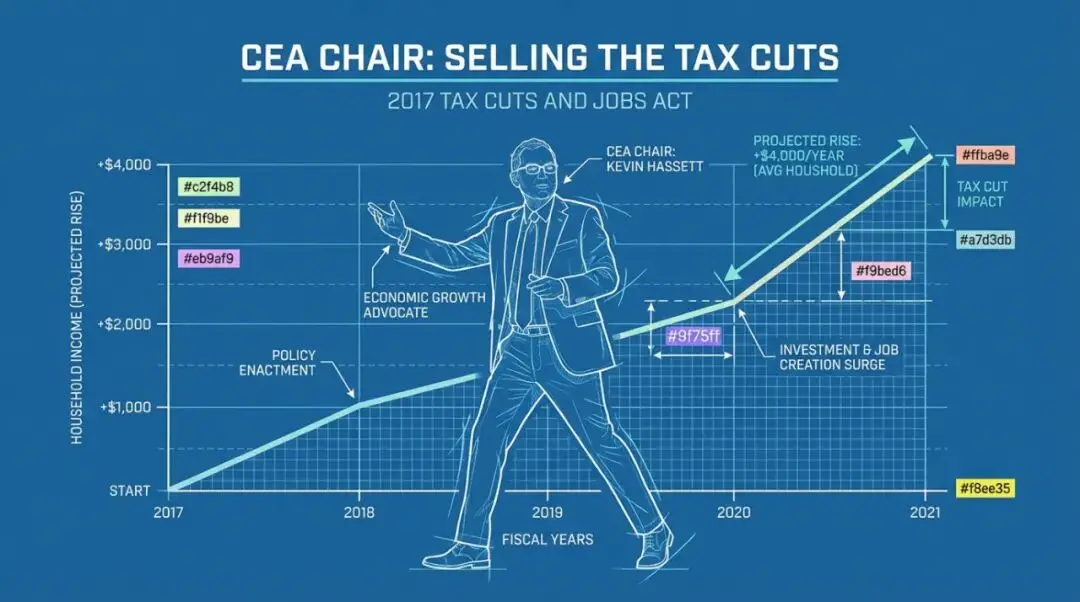

Years at AEI: Architect of Tax Cuts (1997-2017)

: At the American Enterprise Institute (AEI), he used this platform to refine the arguments that later supported the 2017 tax cuts. He argued that corporate tax cuts could raise wages because, in a globalized economy, capital is mobile while labor is not. High corporate taxes drive capital away, suppressing wages; conversely, tax cuts attract capital, enhance productivity, and ultimately raise wages.

Hassett believes that corporate tax cuts are not just beneficial for businesses, but through attracting capital and increasing productivity, they ultimately lead to wage growth for the working class. This is a core tenet of supply-side economics.

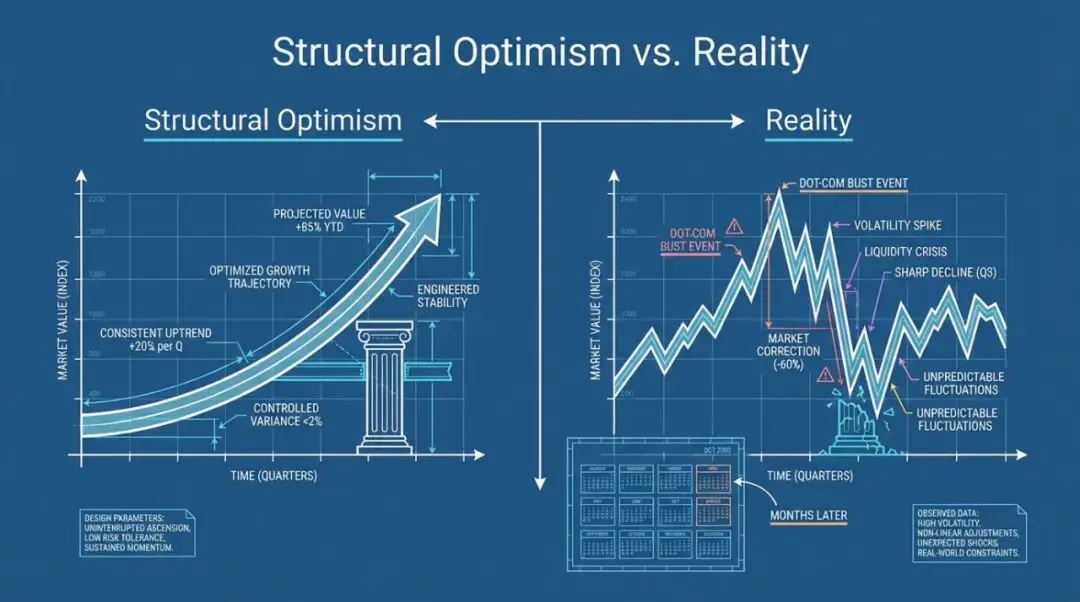

Controversial Predictions: "Dow 36,000" and Structural Optimism

Any analysis of Kevin Hassett cannot overlook his most famous, and perhaps most controversial, public work: his 1999 book "Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market." The core argument of this book is that "the equity risk premium is disappearing." He posited that, in the long run, stocks are not riskier than bonds, and investors are ultimately realizing this "truth." Once the risk premium falls to zero, stock price-to-earnings ratios will be significantly adjusted, and a Dow Jones index of 36,000 is not a "bubble," but a "rational" valuation.

However, fate intervened, and just months later, the internet bubble burst, leading the Dow Jones index into a "lost decade," only reaching 36,000 in November 2021—22 years late.

Why is this book so important for the future Federal Reserve Chairman? It reveals a cognitive tendency towards structural optimism. A Federal Reserve Chairman who believes that high valuations are justified by "structural changes," such as the disappearance of the risk premium, is less likely to use monetary policy to "swim against the tide" in response to financial excesses. Under a Hassett-led Federal Reserve, the "wealth effect" from rising stock markets is likely to be seen as a feature rather than a flaw, certainly not a reason for raising interest rates. This also indicates his willingness to adhere to a theoretical framework even when empirical realities contradict it. This trait could be dangerous in a crisis that requires a swift abandonment of previous beliefs.

Data Use in Crisis: Controversy Over COVID-19 Predictions

If "Dow 36,000" sparked questions about his market valuation theory, another event in May 2020 raised profound concerns about his use of data during a crisis. As a senior advisor returning to the White House during the COVID-19 pandemic response, Hassett's team developed an econometric model to predict the trajectory of the virus's spread. The model predicted that daily deaths would sharply decline to zero by mid-May 2020. In reality, the pandemic continued, claiming the lives of over a million Americans.

Critics labeled it "amateur hour," suggesting that the model was reverse-engineered to justify the government's desire to reopen the economy. This incident highlights a potential risk for the Federal Reserve: politicized analysis.

The Federal Reserve relies on robust forecasts to set interest rates. If a committee led by Hassett rejects staff forecasts to support a certain political narrative and adopts "optimistic" curve-fitting exercises, the credibility of the central bank could be severely compromised.

Hassettism: Transparency, Rules, and Monetary Doves

Although Hassett is not a career monetary economist, his public statements outline a unique "Hassettism":

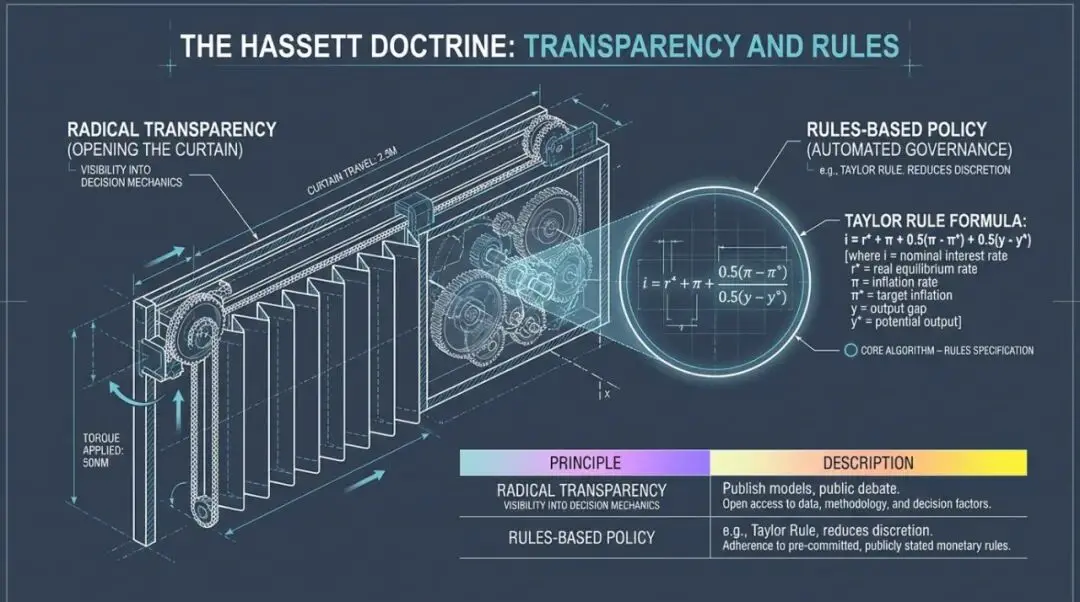

Complete Transparency

: He has been a strong critic of the Federal Reserve's opaque operations, advocating that the Federal Reserve should publish its specific economic models and submit them to public debate.

Rule-Based Monetary Policy

: He aligns himself with this school of thought, frequently citing the Taylor Rule as a superior alternative to Powell's "constrained discretion" at the Federal Reserve. He advocates for rules fundamentally to eliminate what he distrusts as "bureaucratic discretion."

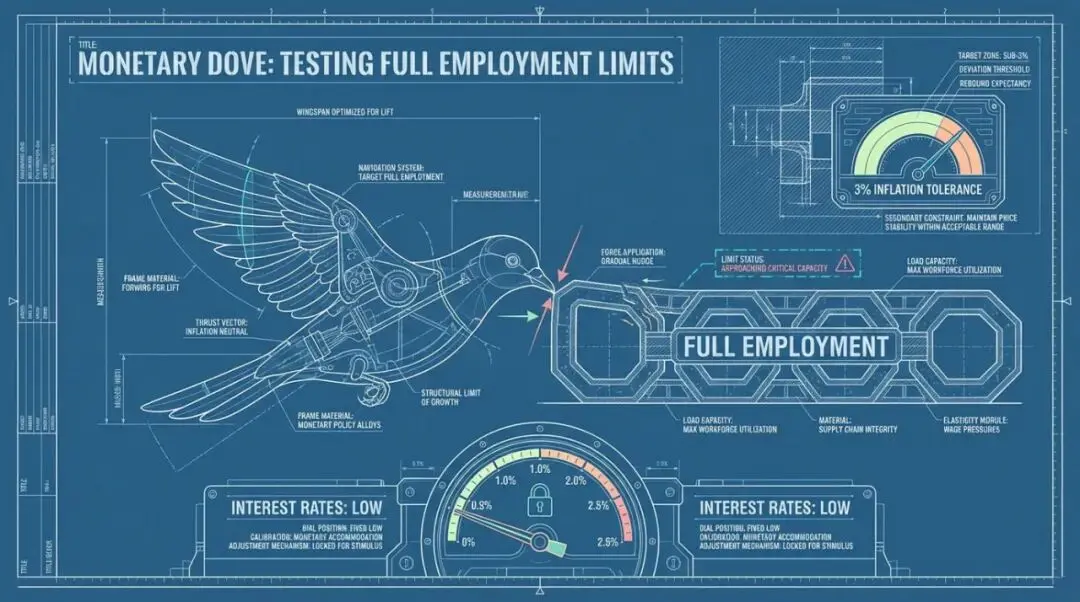

Functionally Monetary Doves

: He has consistently argued that Powell's Federal Reserve actions are too slow and that the "neutral interest rate" is lower than the Federal Reserve's expectations. He firmly believes that supply-side growth driven by deregulation and artificial intelligence is disinflationary. Therefore, the economy can sustain faster growth without overheating.

A Federal Reserve under Hassett may test the limits of full employment, resisting interest rate hikes until inflation is clearly visible and entrenched, rather than taking preemptive action.

Potential Impacts: Three Major Shifts and "Hassett Steepening"

If confirmed, how would Hassett's chairmanship change the economic landscape? We can anticipate three notable shifts:

"High-Pressure" Regime

: Hassett is likely to implement a "high-pressure economy" framework. The bias towards lower interest rates will become permanent. Even if the economy strengthens, Hassett may argue that "productivity improvements" allow for the continuation of low rates. While the official inflation target remains at 2%, the actual tolerance may rise to 3%, rationalized as a necessary lubricant for relative price adjustments in a heavily tariffed world.

Institutional Deconstruction

: Hassett has vowed to carry out a "purge" at the Federal Reserve. The large team of PhD economists on the Federal Reserve Board, often viewed by conservatives as an ideologically captured group, may see their influence significantly diminished. Hassett may rely more on a small circle of appointed advisors rather than consensus forecasts from career staff. He may also support reforms to weaken the influence of regional Federal Reserve Banks, centralizing power to achieve democratic accountability, meaning accountability to the White House.

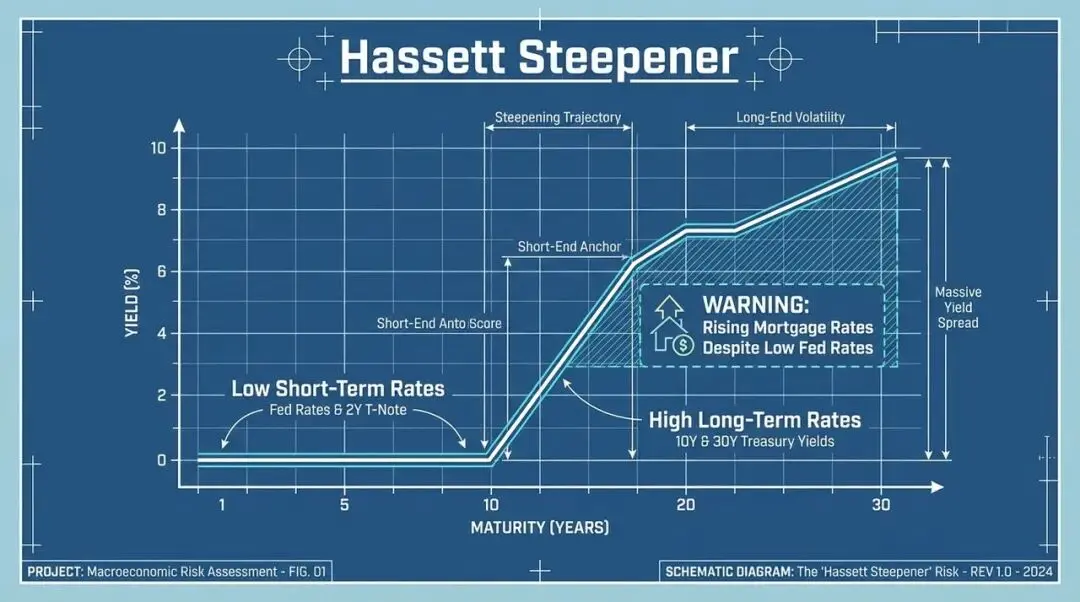

Confrontation with the Bond Market

: The biggest risk during Hassett's tenure is likely to be resistance from the bond market. Ironically, as a co-author of "Dow 36,000," he once believed that the risk premium was zero, but he may now face an era of soaring inflation risk premiums in the bond market. If investors believe that the Federal Reserve has abandoned its willingness to combat inflation for political growth objectives, long-term yields, such as the rates on ten-year and thirty-year U.S. Treasury bonds, could surge, significantly steepening the yield curve.

Traders are already pricing in what they call "Hassett Steepening"—low short-term rates controlled by the Federal Reserve, coupled with high long-term rates driven by inflation concerns. This could offset the stimulative effects of rate cuts by pushing up mortgage rates.

Kevin Hassett represents the antithesis of the technocratic central banker we are accustomed to. He is an outstanding communicator, a creative theorist, and a staunch supply-side economist who views the economy as a garden that needs to be fertilized with capital and incentives, rather than a machine that needs to be cooled down.

His nomination would mark the end of Jerome Powell's "data-dependent" era and the beginning of a "theory-driven" era. The "Hassett Gamble" hinges on the belief that the U.S. economy has undergone a structural transformation, driven by artificial intelligence, deregulation, and tax cuts, enabling it to challenge the traditional Phillips curve trade-off between unemployment and inflation. If he is correct, he may usher in a golden age of non-inflationary growth, validating his optimistic predictions in "Dow 36,000." If he is wrong—if supply-side constraints exist and his "three models" of growth fail to materialize—his tolerance for loose monetary policy may lead to runaway inflation expectations, a situation that could take a generation to rectify.

For the market, the most significant aspect of the Hassett era is one thing: the end of the "Federal Reserve Put" as a safety net against falling prices, replaced by a radical expansion driven by "Federal Reserve Push."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。