Author: Chloe, ChainCatcher

Bitcoin failed to hold the critical psychological support level of $100,000, briefly dropping below $97,000, marking its lowest point since May of this year. As of the time of writing, it has returned to $97,612. Ethereum also saw a significant drop of 8% to $3,167, the lowest since July. This wave of cryptocurrency collapse is not an isolated event but rather the result of multiple structural pressures in the U.S. market erupting simultaneously.

Coinbase Premium Index Continues Deeply Negative, U.S. Market Dominates Sell-off

According to on-chain data from XWIN Research, U.S. retail investors are the main driving force behind the current decline. The Coinbase Premium Index has shown deep negative values for several weeks, with Bitcoin trading at lower prices on Coinbase compared to other global exchanges, indicating that the selling pressure in the U.S. investment market far exceeds the buying interest from Asia or Europe. This aligns with a recurring market pattern: Bitcoin tends to rebound during Asian daytime hours but sharply reverses during U.S. trading hours at night.

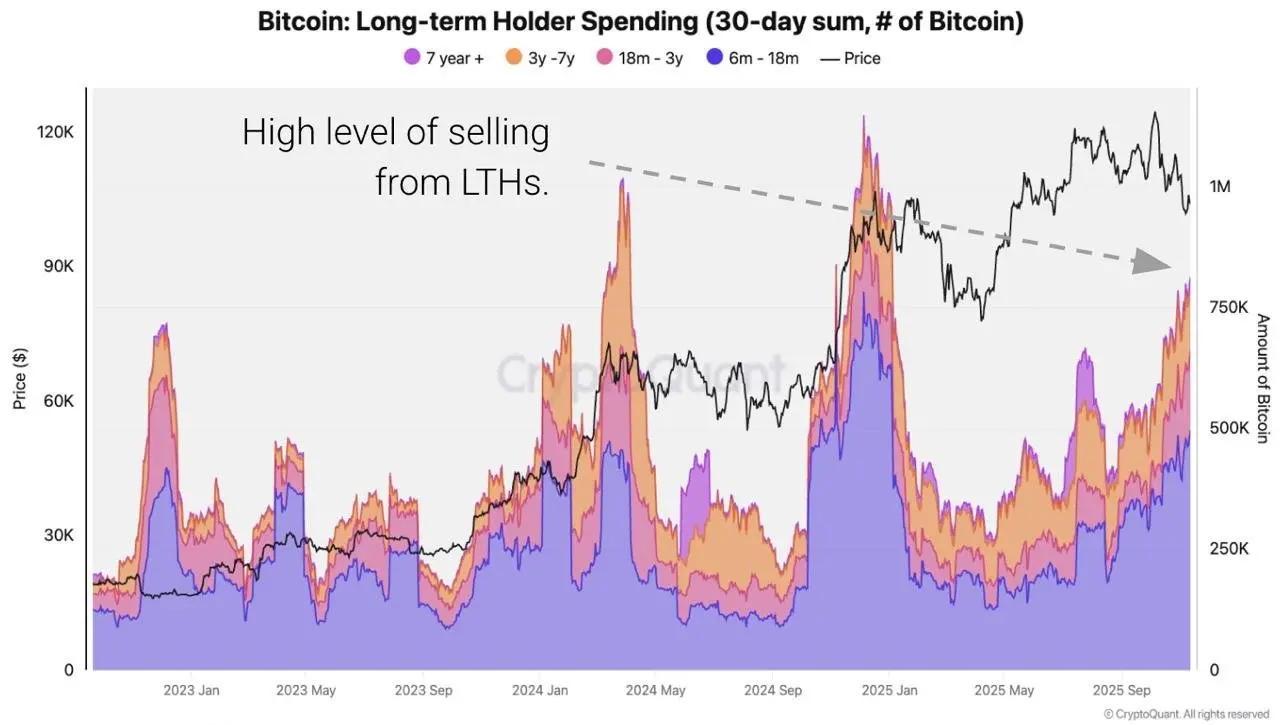

Moreover, long-term holders across all age groups are simultaneously selling Bitcoin. Analysts, including Will Clemente, co-founder of Reflexivity Research, have found that the selling pressure is not concentrated in a specific group but is widely distributed among holders of 6 months, 18 months, 3 years, and even 7 years. This phenomenon is extremely rare, and Fidelity has also confirmed that many long-term holders in the U.S. are taking profits before the end of the year to complete their investment allocation adjustments.

Government Shutdown Leads to Data Gaps, Fed Rate Cut Probability May Decrease

From a macro policy perspective, although the government shutdown that lasted nearly two months has ended, the market is concerned that the absence of key data due to the shutdown may strengthen the U.S. government's rationale for maintaining interest rates.

White House Press Secretary Karoline Leavitt revealed on Wednesday that some economic reports for October may not be published. National Economic Council representative Kevin Hassett also confirmed to Fox News that the government will not release the unemployment rate data for October because "there was no household survey conducted in October, so we will only get half of the employment report." According to the CME FedWatch, traders are currently pricing in a 51% probability of a Fed rate cut in December, down from 69% a week ago.

Additionally, during the government shutdown, market liquidity was severely impacted. With the federal government halting expenditures, a rare fiscal surplus emerged, effectively pulling billions of dollars out of the market. Under the dual pressure of tightening market liquidity and long-term holders taking profits, traders' expectations for a Fed rate cut in December have significantly cooled. According to CME FedWatch, the current pricing for a rate cut stands at 51%, down from 69% a week ago.

This wave of decline is primarily attributed to concerns over the Fed's next steps, tightening market liquidity, and long-term holders taking profits.

Furthermore, on Thursday, the tech-heavy Nasdaq index plummeted by 2.3%, with crypto-related stocks dropping by 10-20%. Palantir CEO Alex Karp expressed concerns about the profitability of AI during an interview at Yahoo Finance's Invest event, stating that not every AI application can "create enough value to justify the actual costs." This has further fueled market investors' worries that the U.S. economy may be entering a downturn, with stocks like Palantir (PLTR), Intel (INTC), and CoreWave (CRWV) all experiencing single-day declines of 6% or more.

Finally, Cointelegraph pointed out that this wave of selling pressure does not indicate that Bitcoin whales are cashing out. Crypto analyst PlanB also believes that the current long-term selling pressure mainly comes from holders who entered the market between 2017 and 2022. Market data shows that traders are not particularly bearish on Bitcoin itself, nor is there a specific major event triggering panic; this decline more reflects the uncertainty of the overall economic environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。