After studying the web3 binary prediction market for a few days, the goal of the research was to make money. Based on the research from the past few days, today I will deeply analyze the ways to make money on Poly.

On Poly, the sum of yes and no for an event always equals 1u, meaning the probability is the price. The lifecycle of a binary prediction event token includes three processes: minting, trading, and redemption.

When the platform first releases a binary prediction event, there are no circulating tokens available for trading. Market makers can spend 100u to mint 100 yes and 100 no tokens on the platform, creating circulating tokens available for trading. Once the event result is announced, if the result is yes, then no will go to zero, and the smart contract will redeem the 100 yes tokens, each worth 1u, thus ending the lifecycle of the token.

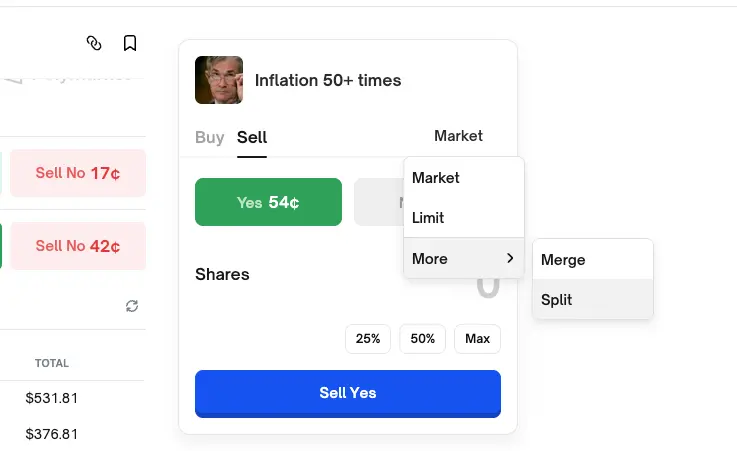

(Button to split 1u into 1 yes + 1 no on Poly)

The above is just a simplified process. In fact, as long as it is within the event cycle, anyone can mint one yes and one no for 1u at any time, allowing for buying and selling to profit from the price difference, and redemption can occur at any time.

Therefore, the first way to make money on Poly is as a market maker. They profit from buying and selling to earn the price difference + the platform's liquidity incentive program (after each binary event ends, Poly charges the winning side a 2% profit, most of which goes directly to the market makers providing liquidity, while the Poly platform takes less than 0.5% as operational settlement. Additionally, Poly has set up a liquidity incentive program).

The second way to make money on Poly: become a high-cognition player in a specific field. Users who are more specialized in a certain area can earn profits from users with lower cognition through a prediction success rate of over 50%, commonly known as profiting from high cognition + professional knowledge.

Another way to make money is through arbitrage. The essence of arbitrage is to correct erroneous markets. Because on Poly, probability is the price, yes + no always equals 1u. However, yes and no are completely independent markets. When one side of the market suddenly experiences significant volatility, causing 1 yes + 1 no to be less than or greater than 1, arbitrage opportunities arise.

If it is greater than 1 (for example, 1.1), one can mint 1 yes + 1 no for 1u and then sell it on the market to earn 0.1u. If it is less than 1, for example, yes equals 0.8 and no equals 0.1, one can spend 0.9u to buy one yes and one no, then combine 1 yes + 1 no into 1u, ultimately earning 0.1u.

Another form of arbitrage is through cross-platform probability deviation arbitrage, which involves operations between multiple platforms.

The last way to make money: neimu players. Especially in political prediction events, some individuals can know information in advance and profit from buying in, but this is for top players, and ordinary people do not have such resources. For the average person, they can monitor for significant changes in probability; if there is an intense change, it is very likely that someone has received information, and they can profit by following and buying.

After several days of research, I have a general understanding of the ways to make money in the prediction market and its basic mechanisms. However, I feel that to make money in this market, aside from the high-cognition player method, other methods require scripting, so in the coming days, I may study how to use its API for trading.

In summary, there are four ways to make money on Poly: market maker, high-cognition player, arbitrage player, and neimu player. Which one do you belong to?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。