Will the SEC Approve Bitwise HYPE ETF S-1 or Postpone Its Launch?

Bitwise asset management has taken another big step in bringing crypto to traditional finance. The company has filed with the U.S. Securities and Exchange Commission(SEC) to launch the Bitwise HYPE ETF, a spot exchange-traded fund (S-1) designed to track the value of Hyperliquid’s native token, HYPE.

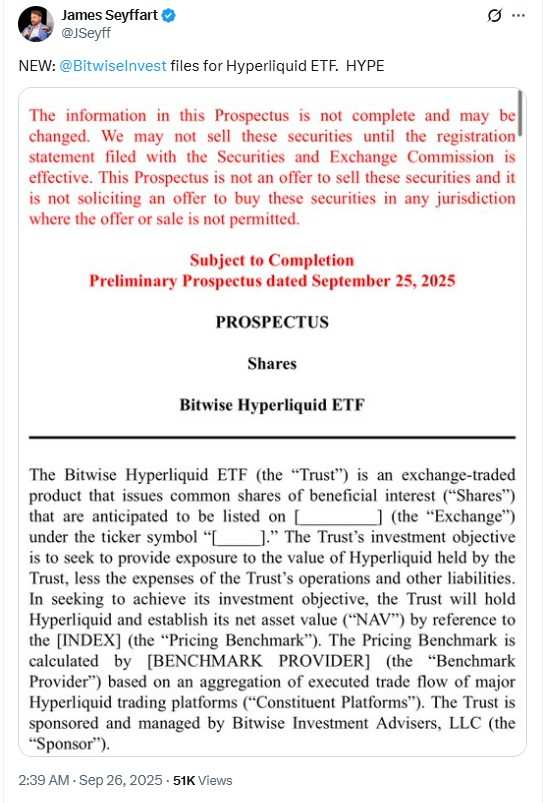

The news surfaced on social media platform X (formerly twitter), when James Seyffart, Finance analyst shared the S-1 filing details . This quick update sparked fresh interest among traders and retail investors looking for easier access to the token

Source: X

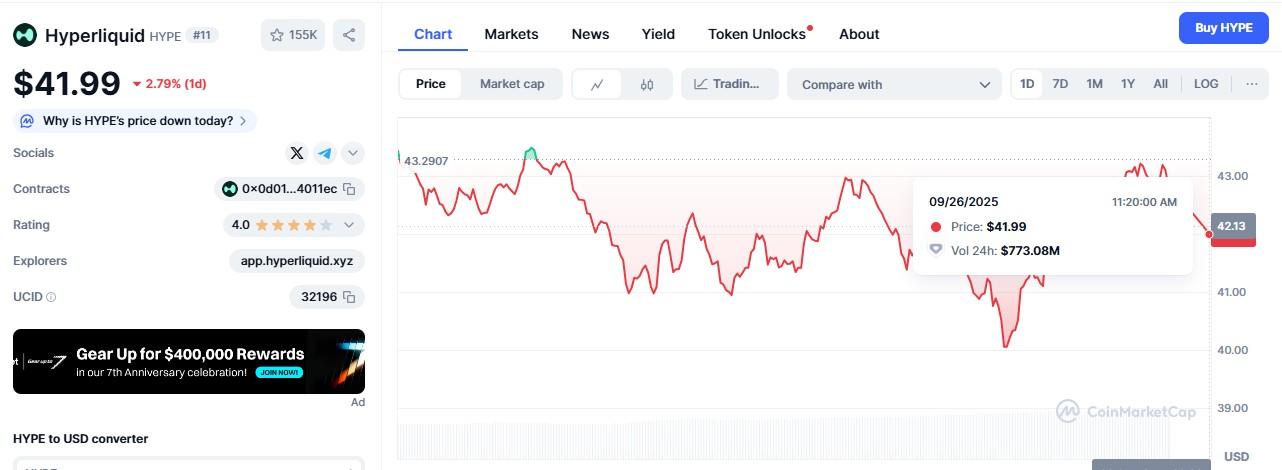

The Hype token is currently trading at $42.52 with a down of 1.35% recorded in a day. The token’s total market cap is $14.31B and volume in day recorded at $782.31 million which is 34.9% up today.

The token went to its all time high recently, on 18 September 2025 and on the other hand its all time low was recorded at $3.20, 10 months ago. The mentioned data is collected from CoinMarketCap.

Source: CMC

How the Bitwise HYPE ETF Works?

The filing shows that the fund will directly hold HYPE tokens. Unlike leveraged or derivative-based products, the trust is structured to be physically backed. Each share of the ETF will reflect the daily net asset value of the tokens it holds.

The eligible participants will be able to create and redeem ETF shares in large blocks, similar to the process used in spot Bitcoin and Ether ETFs. Notably, the Bitwise-HYPE ETF will also allow in-kind redemptions that means shares can be exchanged directly for HYPE-tokens instead of cash.

Coinbase Custody Trust Company is expected to act as custodian, while Bitwise-Investment Advisers will serve as the sponsor.

Why Hyperliquid and HYPE Matter

Hyperliquid is a Layer 1 blockchain designed for decentralized finance, with heavy emphasis on continuous futures trading. Its token, HYPE, plays an important role, with use in paying fees on the network and enabling discounts on Hyperliquid's decentralized exchange.

The Road Ahead for the Bitwise-HYPE ETF

The proposal was filed under a Form S-1, which registers the product under the Securities Act of 1933. Before it can launch, the ETF will also need a Form 19b-4 filing, kicking off a review process that could take up to 240 days.

Bitwise’s filing comes at a time when competition in perpetual futures DEXs is heating up. Competitor platforms, like Aster, have introduced their own tokens in recent times, threatening Hyperliquid's dominance in onchain futures volume.

Although the SEC recently authorized more comprehensive listing standards for crypto ETFs to expedite approvals, a roadblock still exists: there are no Hyperliquid futures contracts registered with the Commodity Futures Trading Commission (CFTC).

What This Means for Crypto Investors

If approved, the Bitwise HYPE-ETF would be the first U.S. product to provide regulated exposure to Hyperliquid’s token. It would lower barriers for traditional investors, offering a simple and familiar way to buy into one of the most talked-about projects in decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。