Tether 决定出手拯救加密 VC 行业。

9.24 日,由美国商务部长卢特尼克家族撮合,USDT 发行方 Tether 有意以 5000 亿估值出让 3% 左右股份,募资至少 150 亿美元。

在此之前,2025 年稳定币赛道初创企业融资不足 6 亿美元,根据 Rootdata 数据,加密行业整体融资仅 130 亿美元。

危中有机,2025 Q1 币安融资 20 亿美元,Q2 稍显沉寂,Q3 DAT 财库策略大行其道,Q4 预计围绕 Tether 展开争夺。

并未复苏,加密企业融资难,加密 VC 投资难的困境仍将持续。

2025 上半年融资额已经超越 2024 全年,这并不能说明 2025 情况更好,2024 年实在是太差了,根据 The Block 报道,2024 年,仅 20 家 VC 就占据了所有 LP 资本的 60%,而其余 488 家公司瓜分了剩余的 40%,集中化体现出内卷的无序和激烈。

资产创造体系的崩溃

2020 年 DeFi Summer 发轫于 2018 年,2025 年 Perp DEX War 起源于 2022 年。

美联储开启降息周期,在以往的叙事中,会是链上、DeFi 的利好因素,APR 跑赢美债收益率的压力更小,所以资金会涌向交易、借贷等高收益产品。

但是本轮周期,如果还有周期的话,情况可能不会如以往乐观。

一方面,加密产品已经和美债、美元深度绑定,比如一众 YBS(收益型稳定币)的底层收益并不是 ETH 对冲而来,而是美债利息+自身补贴;另一方面,链上资产的估值体系实则已经崩溃,高 FDV 击垮币安主站定价体系,现在只剩 Binance Alpha 苟延残喘。

沿着估值逻辑进一步思考,加密行业只有两种情况最赚钱:

1.绝对少的参与人数,相对高的资本流动性,比如 DeFi Summer 时期,链上人数 1000,CEX 买币者 10-100 万—>资产创造是最有利可图,发币的造富效应可以覆盖 VC 投资和项目方运营,头等仓 $Aave 1000 倍回报率并不极端,当时只道是寻常。

2.绝对多的参与人数,无限制的资本流动性,比如 USDT、公链($BTC/$ETH)和交易所(Binance/FTX/Hyperliquid),其网络效应依次降低,即使以 USDT 的 10 亿级使用人数来计算,仍旧无法比肩互联网超级应用。

目前来看,家办、养老基金、主权财富基金以及互联网巨头,基本不会再向资产创造领域投入重金,而会更考虑规模效应,这也意味着区块链作为生产力技术的想象触顶,只能当做大号的金融科技去估值。

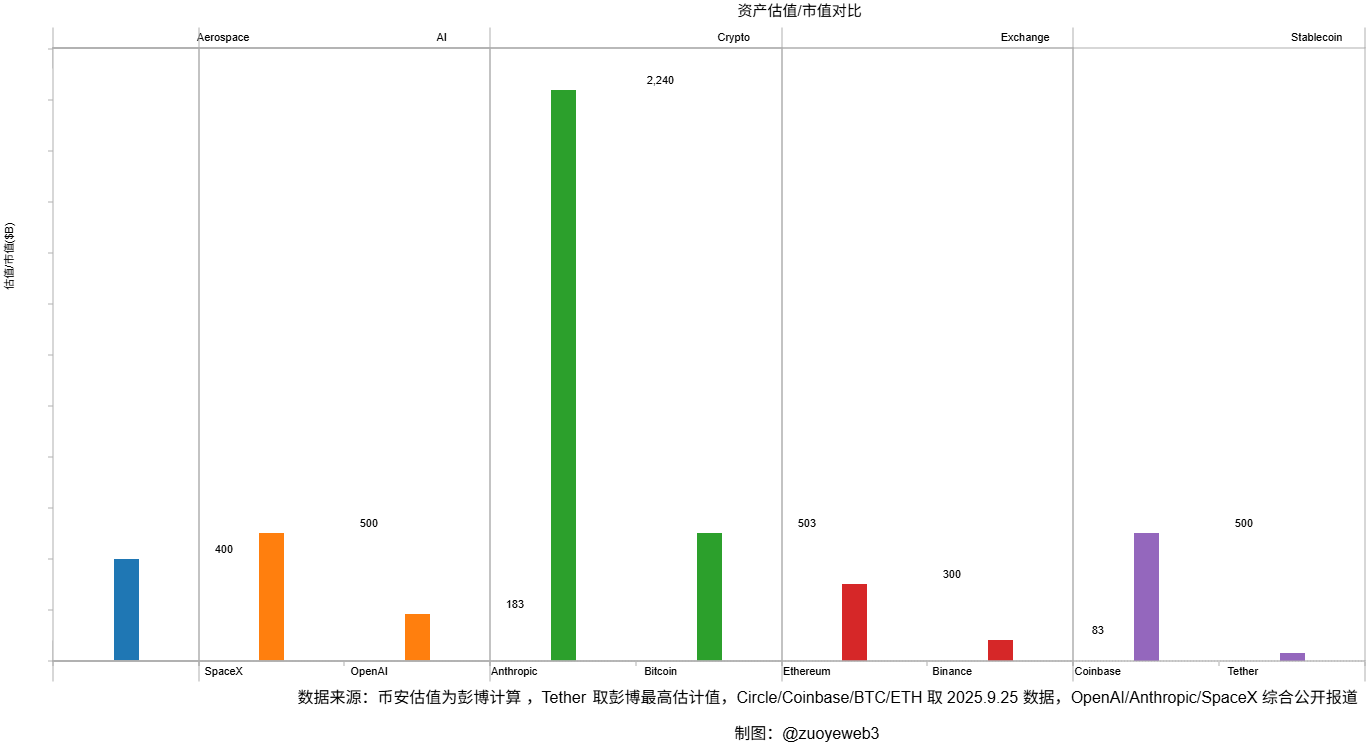

图片说明:资产估值市值对比

图片来源:@zuoyeweb3

与之对应,资本市场对航天(SpaceX)和 AI(OpenAI/Anthropic)仍旧心存幻想,而不是依靠运力和算力去定价。

一旦加密企业 IPO 上市,其估值也会坍缩至金融科技,市场对网络效应的验证方式在持续变化。

比如 Circle 的 USDC 发行量在 700 亿美元级别,Tether 的 1700 亿美元是其 1.7x,但是 Tether 估值 5000 亿美元是 Circle 当前市值 300 亿的 16x。

再比如,Coinbase 上市前融资 6 轮共计 5 亿美元左右,远远不如币安今年单笔 20 亿美元融资额。

如果计算 BTC/ETH 市值,那么更会得出一个结论,超强规模效应的加密项目无需上市,但这显然不符合当前的流行趋势,DAT、ETF 和 IPO,已经是当前加密 VC 和项目可望不可及的退出方式了。

继续细分,2017-2021年的资产创造的强周期,加密 VC 名利双收金丹期,但是 2021 年之后,情况迅速发生变化,交易所成为行业发展主轴,尤其是 FTX 和币安之间的争斗吸引所有人目光,包括监管行业。

资产创造迅速转向导向交易,一切竞争的核心,是上币效应,CeFi、山寨季的火热融资和上涨效应都是交易所优势地位的外溢,但是 FTX 2022 年中崩溃改变了一切,VC挺到 2024 年溃败已经是体面退场。

或许,导向交易恰恰是 2022 年 FTX 崩溃的副产物,Hyperliquid 抓住自己的机会,拒绝 VC 投资只是托辞,拥抱做市商和机构才是主轴,在 $USDH 拉票阶段,No Limit Holdings/Infinite Field/CMI 纷纷“自爆”参与 HL 做市。

在 2025Q3 DAT 彻底爆发前,Galaxy Research 统计过 Q2 的融资情况,揭示 2018 年成立的公司占据了筹集资金的大部分,而 2024 年成立的公司占据了交易数量最多的份额,即初创可以拿到小资金尝试下,但是大额资金流向被市场验证过的公司,更 Crypto 一点就是“穿越周期”。

钱最终流向不缺钱的牛,苦最终流向能吃苦的马。

不过在 Scroll “跑路”后,技术 Infra 创业季基本告终,ZK+ETH+L2 的概念堆叠都无法确保回报,想必也没什么能保证未来。

更雪上加霜的是,当前流向不等于明天还行,比如 Perp DEX 2025 年开打,但是 2022 年没投进现在就没有跟进的意义,导向交易的战争已经结束,这不会是之后的市场共识。

币安会和所有的散户发生直接联系,Hyperliquid 不介意外包前端给 Phantom,流动性才是自己护城河,网络效应也一直在嬗变。

至此,我们可以拼凑出行业发展和 VC 投资的失焦,加密行业相对于传统互联网行业周期性过强,2-3 个月便能跑完一个小周期,但是 VC 投资 Infra 往往需要 2-3 年才能见效,这意味着至少 10 个小周期后,VC 所投赛道要成为当期主流,VC 所投项目要成为该赛道主流,双重命中堪比过山车。

导向交易体系的冲击

估值逻辑的崩溃,需要漫长时间的重塑。

或许人人都是 VC,或许并购也是退出。

货币具备时间成本,VC 是一二级信息差的垫资方,信息的流动性最终换回超额利润,经典的 IPO 或者币安主站都是流着钱与币的应许之地,但是现在要么帮项目 IPO,要么直接左转 Alpha,一念天堂一念地狱,ABCED 直接关门歇业。

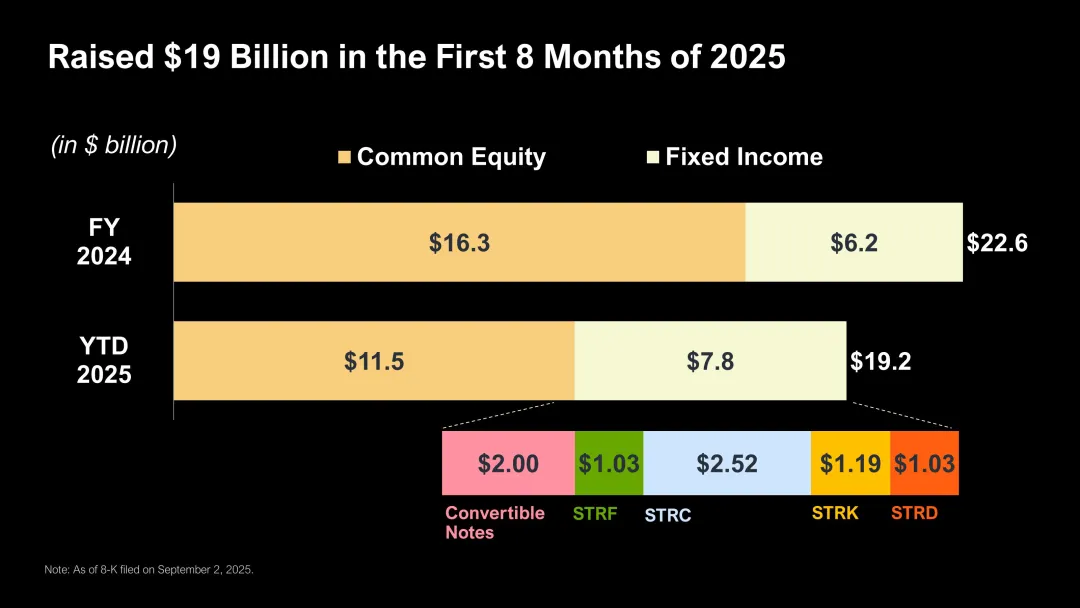

不论是 DAT、ETF 还是并购,VC 的角色不再是“造梦师”,而是更像配资方,比如今年度 DAT 总融资 200 亿美元(不计算 Strategy),但是彼得·蒂尔美股 ETH,华兴只能港股买 BNB,Summer Capital 只能做 $SOL DAT 主理人。

这其实并不正常,交易集中在 BTC/ETH,DAT 反而开始蔓延至小币种,也许山寨是一种刚性需求,在一级之外,还有更多玩法,唯一的问题是大部分 DAT 和 VC 配资方都无法人工打造 1000 倍回报率。

图片说明:Strategy 募资接近 190 亿美元

图片来源:@Strategy

更深刻的危机在于,融资并不一定需要 VC 参与,尤其是非美国 VC 参与,Polymarket 收购 CFTC 注册交易所 QCEX 重返美国市场,Tether 推出 Genius Act 合规稳定币 USAT 重返美国市场,ETF 和 DAT 也基本发生在美股,也是美国市场。

导向交易不再是更优质的撮合引擎之间的比拼,而是资本运作的成熟度,所谓的合规交易所,更像是制造新来者的准入门槛,小院高墙坐收高额手续费。

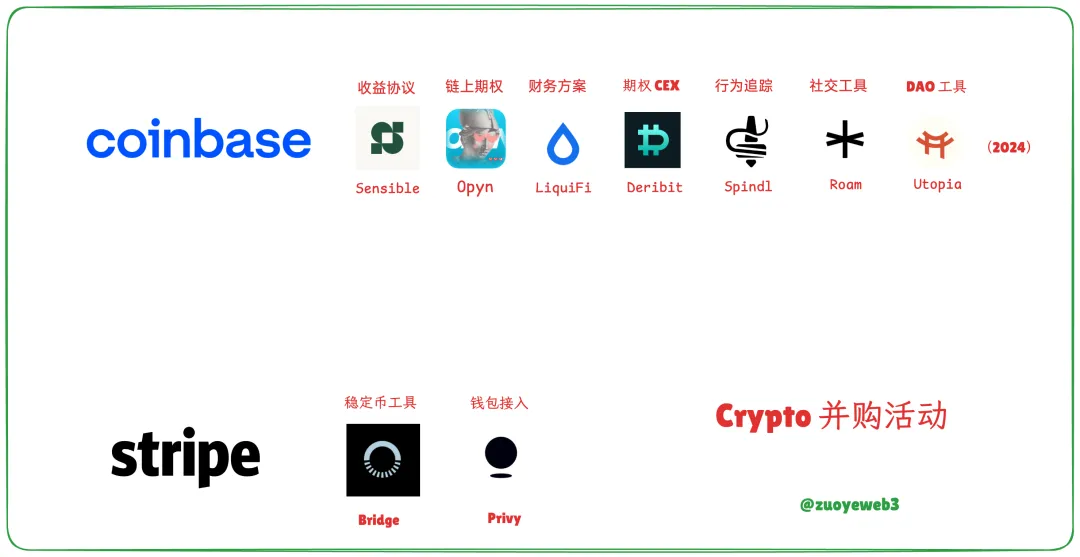

在融资之外,行业品牌自身也开始相互耦合,体现为 2024-2025 年并购周期,Coinbase 收购 Deribit 补齐期权市场,Phantom 收购钱包工具 Bitski,安全产品 Blowfish 和交易工具 SolSniper,甚至是 Stripe 也在收购钱包服务 Privy 和稳定币工具 Bridge。

图片说明:加密并购活动

图片来源:@zuoyeweb3

不论是 Coinbase 的 Everything Exchange 愿景,还是 Hyperliquid 的 House All Finance 口号,区分 CEX 和 DEX 意义已经不大,导向交易的重心也不再是和散户链接,而是提供更主流或长尾的交易选择,以及流动性!流动性还是流动性!

所以 Coinbase 会绑定 Circle 发行 USDC,Hyperliquid 要自行玩转 $USDH,看重的并非是稳定币的规模效应,而是稳定币的获客和留存能力,这是他们和 USDT 最大的不同。

VC 看待 USDT 的视角,投资 Tether 虽然昂贵,但是稳赚不赔;

USDT 本次开放募资:

1. 低利率时期开放募资,利用外部资金发展自身多元业务

2. 给川宝相关实体进入机会,参考币安完成融资使用 USD1

3. 预计应对更惨烈的稳定币竞争,尤其是 YBS 的分润机制,既需要阻击 Circle,也要应对 Ethena

导向交易成为 2025 年的资本流动共同特点,但是这不是未来,DAT、配资、LP、稳定币、RWA 都缺乏想象力,参投 Perp DEX 或者稳定币都是无功无过的打工人选择。

VC 说到底是手工作业,必须押注未来“感觉”和“趋势”,对底层技术、网络效应、当前热点的祛魅,寻求长周期内的 PMF。

千倍收益要看下一个“全球性应用”,稳定币、交易所和公链之外还有什么?

矿业已经到达临界点,矿业的未来是数据中心,或者更改比特币经济模型,简单来说就是收转账手续费,不同于交易手续费维护比特币网络,转账手续费维护使用者利益。

导向交易的各个环节已经被现有巨头圈中,挑战 Coinbase、Hyperliquid、币安几乎不可能,围绕其进行外围活动或者成为其生态一部分更为可行。

值得注意的是,交易所与做市商的强势是一种错觉,仅在币安生态有效,在更高维度的资金流动上,他们也变得弱势,ETF、DAT 和 M&A 等维度上,做市商并不强势,尤其是 BTC/ETH 的二级回报率,交易所和做市商并不比别人聪明。

如果对稳定币融资保持热情,那么唯一的问题就是,他们准备如何对抗 USDT 的先发优势和网络效应,这不是资金量的差异,而是消费行为的改变。

传统互联网可以烧钱换市场,打车、外卖、本地生活,但是怎么让人切换金融资产,目前还没想到好的解决办法,现在的尴尬局面,导向交易不会是未来创新重点,但我们还没想出交易之外的互动形式。

结语

加密行业正在经历裂变,必须超越 Fintech 估值框架,拥抱全球性应用才有未来,但是现在来到分岔路口,未来是更多、更频繁、更主流的交易,还是更广的用途(区块链,稳定币,RWA,Web3)?

对 2025 年 VC 行业的预先总结:

1. 周期破碎,交易主流化(BTC/ETH),投资集中化

2. 加密企业融资难,加密 VC 募资难,估值体系崩溃

3. 从投资到配资,中介属性增强,与二级市场互动减少

4. 主轴分散,Q1 币安,Q2 分散,Q3 DAT,Q4 稳定币

现在情况很像世纪初加密泡沫崩溃,人们需要重整旧山河,Facebook、谷歌和苹果都是泡沫之夏后的产物,逆周期投资也许看 Arthur Hayes?

总之一句话,我们需要加密时代的彼得·蒂尔,而不是互联网时代的 a16z。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。