Author: Andrew Kang, Partner at Mechanism Capital

Translation: Tim, PANews

PANews Editor's Note: Andrew Kang criticized Wall Street analyst Tom Lee's bullish views on Twitter, claiming they lack financial common sense and are "idiotic." However, some users in the comments disagreed with Andrew Kang's rebuttal, with one user pointing out that he had predicted in April this year that ETH would drop below $1,000. Therefore, this article has a certain subjectivity and readers should make their own judgments.

Tom Lee's Ethereum theory is the most foolish I've seen among well-known analysts recently, completely lacking financial common sense. Let's refute Tom's points one by one, which are mainly based on the following:

- Adoption of stablecoins and RWA

- Digital oil narrative

- Institutions will buy and stake ETH to provide security for their tokenized assets and as operating capital.

- The value of ETH equals the sum of all financial infrastructure companies

- Technical analysis

1) Adoption of stablecoins and RWA

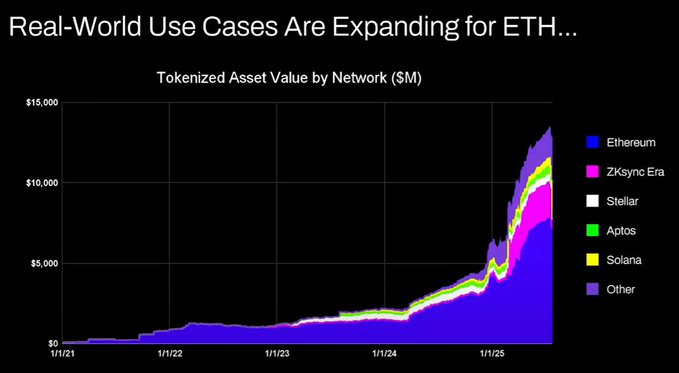

Tom's viewpoint is that the on-chain activity of stablecoins and tokenized assets is increasing, which should drive up trading volume and, in turn, increase ETH's transaction fees and revenue. On the surface, this seems logical, but if you spend a few minutes thinking and checking the data, you'll find that this is not the case.

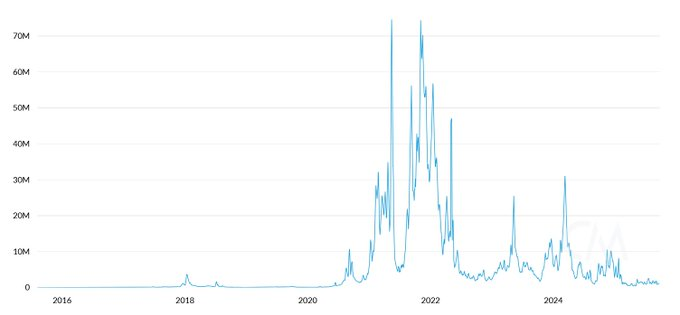

Daily ETH transaction fees

Since 2020, the total value of tokenized assets and the trading volume of stablecoins have increased by 100 to 1,000 times. Tom's argument fundamentally misunderstands the value accumulation mechanism, which may lead one to mistakenly believe that transaction fees will rise year-on-year, but in reality, they have remained roughly the same as in 2020.

The reasons are as follows:

- Ethereum network upgrades have made transactions more efficient.

- Activity in stablecoins and tokenized assets is shifting to other chains.

- The tokenization of low-liquidity assets generates almost no transaction fees. The value of tokenized assets is not directly proportional to Ethereum's revenue. One might tokenize a $100 million bond, but if it only trades once every two years, how much transaction fee can it generate for ETH? Perhaps only $0.1. In contrast, a single USDT transfer generates far more fees.

You can tokenize assets worth trillions of dollars, but if these assets are not actively traded, they may only add $100,000 in value to Ethereum.

Will blockchain transaction volume and fees increase? Yes, but most of the fees will be captured by other chains with stronger commercial viability. In the race to blockchain traditional financial transactions, all parties have seen opportunities and are actively seizing them. Solana, Arbitrum, and Tempo have currently captured most of the early fruits. Even Tether is supporting two new chains, Plasma and Stable, both aimed at transferring USDT trading volume to their own chains.

2) Digital oil narrative

Oil is a commodity. The inflation-adjusted real price of oil has fluctuated within the same range for over a century, with occasional price spikes that eventually fall back. I agree with Tom that ETH can be viewed as a commodity, but that is not a positive sign. I really don't know what Tom is trying to sell here!

3) Institutions will buy and stake ETH to provide security for their tokenized assets and as operating capital.

Have large banks and other financial institutions included ETH on their balance sheets? No.

Have any of them announced plans to do so? No.

Will banks stockpile large amounts of gasoline just to keep paying energy costs? No, because it doesn't matter; they only pay when needed.

Will banks buy shares of the custodians of the assets they use? No.

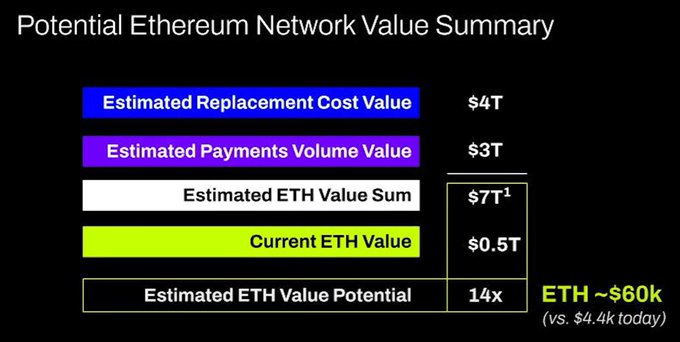

4) The value of ETH equals the sum of all financial infrastructure companies

I mean, come on. This is yet another fundamental misunderstanding of the value accumulation mechanism, pure delusion.

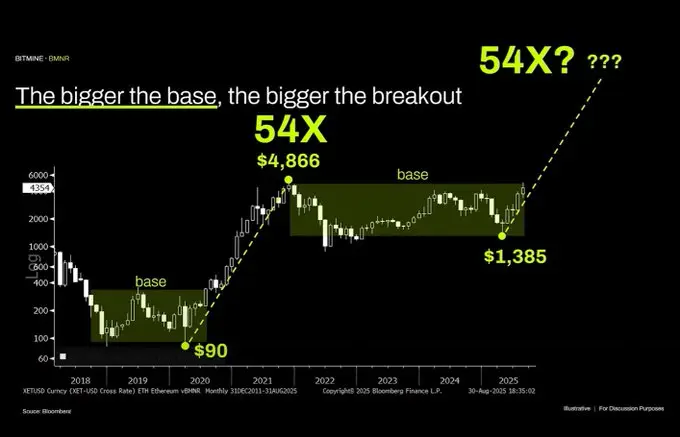

5) Technical analysis

I am actually a fan of technical analysis and believe it is very valuable when viewed objectively. Unfortunately, Tom seems to be using technical analysis to draw random lines to support his biases.

Looking at this chart, the most objective conclusion is that Ethereum has been in a multi-year range. This is quite similar to the price movements of crude oil, which has also fluctuated within a wide range over the past 30 years. Currently, Ethereum is not only in a range-bound phase but has also recently touched the top of the range without breaking through resistance. From a technical perspective, Ethereum's trend is actually bearish. The possibility of it oscillating between $1,000 and $4,800 long-term cannot be ruled out. Just because an asset has experienced parabolic growth does not mean that such growth will continue indefinitely.

Crude oil prices

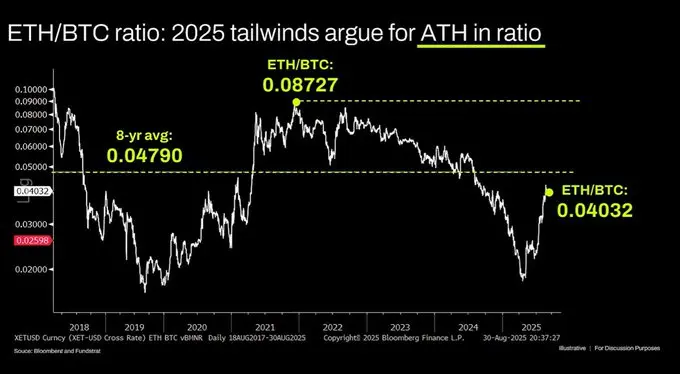

In the long run, there is also a misunderstanding regarding the ETH/BTC chart. While it is indeed in a multi-year consolidation range, it has been primarily dominated by a downward trend in recent years, only recently rebounding at a long-term support level. The driving factor behind this downward trend is that the narrative around Ethereum has become saturated, and its fundamentals cannot support valuation growth, which have not undergone substantial changes to date.

The valuation of Ethereum mainly stems from the market's lack of financial understanding. Objectively speaking, this cognitive gap can indeed create considerable market value, as seen with XRP. However, valuations supported by cognitive deficiencies have an upper limit; the loose macro liquidity environment temporarily maintains ETH's price level, but unless structural changes occur, it is likely to fall into a prolonged period of stagnation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。