In the wave of shifting from "speculation-driven" to "application-driven" in the cryptocurrency industry, stablecoins are rapidly evolving from trading mediums within the circle to globally accepted payment tools. This transformation is driven by the urgent need for efficient cross-border settlement in traditional finance and is an inevitable result of the Web3 ecosystem moving towards inclusivity.

Traditional public chains (such as ETH and Tron) expose pain points in stablecoin payment scenarios due to their general underlying design, including fee volatility, slow transaction speeds, and difficulties in compliance auditing. In contrast, stablecoin-specific chains focus on "optimizing stablecoin circulation," enabling them to promote stablecoins into the mainstream payment field with lower costs, higher efficiency, and stronger compliance.

The future competition in payments and settlements will center around key capabilities such as low-cost zero-fee transfers, instant settlement, compliance and auditability, and plug-and-play solutions for merchants and institutions.

This report selects five representative stablecoin-specific chains—Plasma, Stable, Codex, Noble, and 1Money—and conducts an in-depth analysis from five dimensions: positioning, market strategy, community engagement, development progress, and core data, revealing their differentiated advantages and potential challenges through horizontal comparison.

Plasma

Basic Introduction

Plasma is a high-performance Layer 1 blockchain specifically designed for stablecoins, supported by well-known institutions such as Bitfinex, Founders Fund, and Framework.

GTM Strategy

In mid-2025, Plasma opened a pre-TGE subscription window for XPL, attracting approximately $1 billion worth of stablecoins within 30 minutes under a "deposit first, apply later" process, with proportional refunds for oversubscriptions. The project is collaborating with Tether to introduce native USDT and working with liquidity partners such as Bitfinex, Flow Traders, and DRW.

Plasma's roadmap will start with a permissioned model (trusted validators), transition to a horizontal scaling phase, and ultimately move towards an open validator set;

The mainnet Beta is scheduled to launch on September 25, 2025.

Subsequently, Binance Earn launched the on-chain Plasma USDT Locked Product: the first batch of 250 million USDT was fully subscribed within an hour, and the limit was later expanded to 1 billion USDT, with daily USDT earnings distributed and XPL rewards allocated after TGE.

In September 2025, the team also launched Plasma One—a native neobank for stablecoins, with its debit card issued by Signify Holdings under Visa's license, supporting zero-fee USDT transfers, a "spend and earn" account model, and up to 4% cashback.

Community and Market Engagement

Benefiting from the strong background of its investors, Plasma has garnered significant market attention since its establishment in 2024. On the X platform, it has over 130,000 followers. Since the announcement of Plasma's public offering, it has sparked widespread community discussion, making it a hot topic in the stablecoin chain field.

Development and Testing Progress

Plasma's mainnet is currently in the Beta launch phase, technically achieving integration with Bitcoin sidechains and Ethereum EVM compatibility, connecting to node service tools like QuickNode and Tenderly; its core consensus mechanism is PlasmaBFT (based on the Fast HotStuff algorithm). The mainnet will progress through three phases: "trusted validator launch → scaling → full openness," with the zero-fee USDT transfer feature still under development in the testnet. By mid-2025, Plasma's testnet had already accommodated approximately $1 billion in stablecoins (including USDC, USDT, etc.) for cross-chain deposits, which were mapped onto the Plasma chain.

During the testing phase, Plasma also integrated with multiple wallets and exchanges, validating its zero-Gas stablecoin transfer capability and network stability. In terms of development activity, Plasma's official documentation and codebase are continuously updated to ensure developers can successfully deploy contracts on its EVM chain.

In terms of performance, Plasma claims to support over 1000 TPS throughput, block generation speed per second, and second-level transaction finality, with most standard transaction fees below $0.01; particularly, it has designed a protocol-level paymaster mechanism for USDT, which can directly sponsor the gas fees for simple transfers, achieving zero-cost transactions (subject to frequency and qualification restrictions). This feature will significantly optimize the user experience for stablecoin payments. Based on official documentation and testnet data, its transaction speed characteristics (ordinary transfers block within 1 second, final confirmation within a few seconds, while zero-fee USDT transfers are slightly slower but still maintain second-level speed) primarily cover the needs of most mainstream scenarios—whether for retail daily transfer payments, mainstream DeFi lending and trading operations, or compliance settlements for small and medium-sized merchants, meeting the core demands for low cost and stability. However, in scenarios requiring extremely high real-time performance, such as high-frequency quantitative trading and institutional-level sub-second real-time settlement, or under extreme peak conditions with millions of concurrent transactions, the current second-level confirmation speed and channel design may seem insufficient. Overall, its performance accurately matches the popularization of stablecoin payment chains and the foundational needs of institutions, supporting the vast majority of daily and mainstream business scenarios.

Regarding USDC support: Plasma supports bridging and contract-level USDC, which is not native to Circle; the zero-fee policy clearly covers USDT but does not include USDC. This means that settling USDC on Plasma is feasible, but the cost experience differs from that of USDT.

Key Data Indicators

The following chart shows the main composition of stablecoin deposits in the Plasma network: the core is almost entirely composed of AETHUSDC and AETHUSDT, accounting for approximately 60% and 39%, respectively.

Composition of stablecoin deposits on the Plasma chain (data source: Arkham Intelligence)

Plasma has stated that when the mainnet goes live, it will aggregate over 15 stablecoins and has established partnerships with over 50 projects. These partners include wallets, payment companies, and DeFi protocols, bringing application scenarios to the Plasma ecosystem. For example, it is expected that Tether will directly participate in supporting USDT to become a native asset on Plasma, while exchanges like Bitfinex may provide deposit and withdrawal interfaces, and market-making institutions like Flow Traders and DRW will assist in providing liquidity.

Stable

Basic Introduction

Stable is a dedicated stablecoin public chain incubated by the Tether/Bitfinex team. Stable features a unique model of "USDT native Gas," meaning transaction fees are paid directly in USDT rather than requiring the holding of a native token. This significantly lowers the usage threshold for users, making the payment experience closer to fiat currency transfers.

GTM Strategy

In terms of market promotion, Stable fully leverages the influence of Tether/Bitfinex: in July 2025, it officially announced the completion of a $28 million seed financing round, with investors including Bitfinex, Hack VC, and numerous institutions such as Franklin Templeton (a well-known traditional asset manager), Bybit, and KuCoin.

Stable's roadmap is divided into three phases: Phase 1 (current) focuses on building network infrastructure and implementing the USDT Gas model; Phase 2 will introduce stablecoin trading aggregators and enterprise-level reserved block space services to attract institutional users with high payment volumes; Phase 3 plans to further optimize speed and provide developer tools to enrich the application ecosystem.

Community and Market Engagement

Since its exposure in mid-2025, Stable's popularity has surged. On the X platform, its official account quickly attracted over 160,000 followers (even slightly surpassing Plasma). The mainstream view is optimistic about Stable, believing it aligns with compliance trends and is likely to gain institutional favor. However, discussions in the community also remind that Stable needs to prove its performance advantages and security when competing for liquidity against rivals like Plasma, with users eager to see actual data from Stable's testnet.

Development and Testing Progress

The Stable project officially emerged from stealth mode in late July 2025 and is still in the early stages of development. As mentioned earlier, Phase 1 has already begun, including achieving sub-second block generation and finality, as well as the USDT native Gas mechanism. It is expected that by the end of 2025, Stable will open a public testnet and gradually launch the mainnet. As of now, Stable's internal testnet is operational, and selected partners have been invited to trial it.

Key Data Indicators

Since Stable's mainnet has not yet launched, there are currently no available data such as on-chain TVL.

Codex

Basic Introduction

Codex is a blockchain company dedicated to creating a "universal electronic cash system," with its core product being a stablecoin-specific Layer 2 network built on Ethereum.

GTM Strategy

Codex's market strategy focuses on B2B scenarios and enterprise-level stablecoin settlements. Its chain is built on the Optimism tech stack, aiming to provide a platform for high-frequency stablecoin trading with predictable low fees and stable performance.

In market expansion, Codex places great emphasis on collaborating with stablecoin issuers and financial institutions: the project has received strategic investments from Coinbase, Circle, Foresight, and Cumberland (DRW). In addition to investing, Circle actively supports the native integration of USDC into the Codex chain. In July 2025, Circle deployed the USDC contract on Codex, making Codex one of the youngest networks to natively support USDC, with the launch of CCTP v2 for direct cross-chain channels; Circle's Circle Mint/API has been integrated, allowing enterprises to mint/redeem USDC directly on Codex, conduct cross-chain settlements, and manage on-chain FX/local fiat currency inflows and outflows, significantly reducing friction for enterprise access. This move has granted Codex authoritative recognition in the stablecoin issuance ecosystem and paved the way for attracting other fiat stablecoins (for example, the Turkish lira stablecoin BiLira has also been integrated into the Codex platform). Additionally, Codex is collaborating with various exchanges and over-the-counter brokers to create stablecoin off-ramps, enabling users to directly exchange on-chain stablecoins for fiat currency.

GTM strategy mainly includes: ① Anchoring the custody layer by collaborating with leading custodians like Fireblocks to build a compliant asset custody infrastructure, ensuring the secure deposit of institutional funds on-chain; ② Connecting the tool layer by integrating "Wallet-as-a-Service" (WaaS) solutions like Dfns to provide institutional users with convenient on-chain asset management access; ③ Bridging the application layer by focusing on connecting payment service providers (PSPs) and cross-border payment institutions, initially targeting high-frequency essential scenarios such as corporate settlements and cross-border B2B transactions to achieve practical verification of institutional-level payment settlements.

In summary, Codex's GTM strategy emphasizes compliance, institutions, and multi-assets: by collaborating with authoritative institutions like Circle to gain credibility, it primarily targets enterprise-level application scenarios such as cross-border payments and foreign exchange settlements, aiming to establish a foothold in this vertical field.

Community and Market Engagement

Compared to the more mainstream marketing approaches of Plasma and Stable, Codex's community engagement is relatively moderate. It has about 7,000 followers on the X platform. Codex's official communications on social media are cautious, focusing on product progress and industry insights. After announcing financing in April this year, mainstream media outlets like Cointelegraph and Fortune reported on it, sparking discussions in the industry about the "stablecoin-specific chain" model.

Development and Testing Progress

The Codex project was launched in 2024 and accelerated its network development after announcing financing in April this year. The Codex network adopts the Optimism Rollup architecture and has nearly completed the mainnet setup, achieving integration with the Ethereum mainnet and Circle's backend. In terms of technical progress, the Codex mainnet went live in mid-2023: Circle's official page also shows that the USDC contract address on the Codex chain has been deployed, and custodial/payment platforms like Fireblocks and Dfns have begun supporting Codex. This means that the Codex network has achieved the anchoring and circulation of USDC on the mainnet, as well as integration with leading institutional systems.

Currently, Codex's public testnet is also open, allowing developers to attempt cross-chain asset transfers to Codex and utilize its API for high-speed stablecoin transfers. Codex also emphasizes the development of compliance features, such as on-chain atomic swaps and compliance checks: through mechanisms like atomic withdrawal channels and on-chain foreign exchange trading, it ensures that KYC/AML reviews are completed during the transaction process, reducing the risk of fund bottlenecks and violations. Additionally, Codex is developing a cross-border FX instant settlement platform (Codex Avenue) to achieve second-level settlements for multi-currency stablecoins.

Codex's mainnet gas fees typically start as low as $0.001, paid in ETH; it supports the native minting of USDC without requiring cross-chain bridges, focusing on payment chain characteristics and emphasizing asset liquidity rather than DeFi locking. Currently, it is primarily focused on applications like instant USDC transfers, maintaining high throughput. Codex's co-founder mentioned in an interview that they plan to support major stablecoins like USDT and EURC, but the specific timeline for USDT integration has not yet been announced.

In terms of development activity, the Codex team has a strong background from OP Labs and the Ethereum community, with robust technical capabilities, continuously updating network code and the TokenFactory module on GitHub to meet the needs of various issuers.

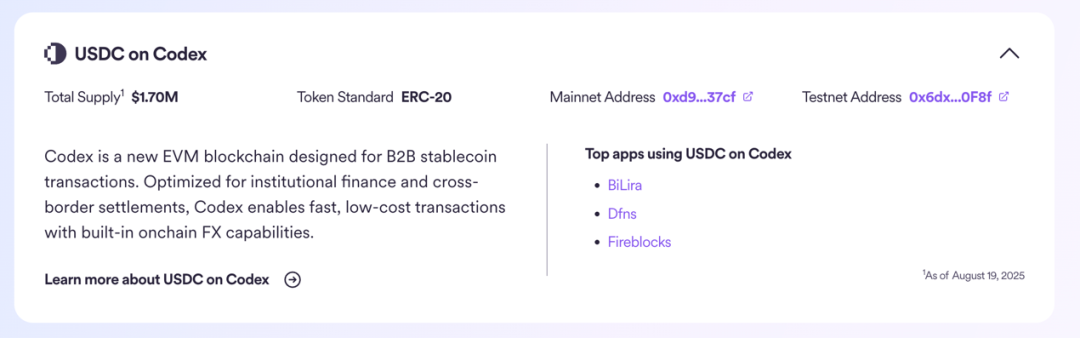

Key Data Indicators

The native USDC on the Codex chain has been launched and is supported by CCTP v2, with a current circulation of approximately $1.7 million. However, data aggregation websites like DefiLlama have not yet listed Codex as an independent chain, so there are currently no comparable "DeFi TVL" statistics, which aligns with Codex's focus on B2B settlements and compliance pathways rather than general DeFi liquidity.

USDC issuance on the Codex chain (data source: Circle)

Noble

Basic Introduction

Noble is the first application chain in the Cosmos ecosystem focused on on-chain asset issuance.

GTM Strategy

Noble's market strategy is based on the multi-chain ecosystem of Cosmos, aiming to become the "stablecoin issuance hub" to deeply bind the application needs of various public chains. Its entry point is the collaboration with Circle, which led to the native issuance of USDC on Noble in April 2023, addressing the previous lack of mainstream stablecoins in Cosmos.

Noble positions itself as the "native issuance chain for stablecoins and RWA": any stablecoin wishing to serve Cosmos users can choose to issue on Noble and then seamlessly circulate to nearly 50 chains in the entire ecosystem through the IBC protocol. This "one issuance, multiple circulations" model greatly facilitates the acquisition of trusted stablecoin liquidity for applications.

Additionally, Noble has partnered with decentralized stablecoin infrastructure provider M^0 to launch its own yield-bearing stablecoin, USDN (Noble Dollar), in January 2025, innovatively introducing U.S. Treasury yields. Through USDN, Noble aims to enhance the attractiveness of stablecoins in Cosmos, differentiating itself from traditional USDT/USDC.

Its GTM roadmap is also clear: ① Directly connect upstream to Circle Mint/API, allowing institutional/fiduciary funds to be minted directly into USDC@Noble, eliminating version conflicts and reducing reconciliation friction with an "official version"; ② Distribute USDC with low latency to application chains in the Cosmos ecosystem, prioritizing essential scenarios such as trading and settlement; ③ Extend the asset layer to launch the USDN yield-bearing stablecoin, forming a link where "interest-free USDC converts to interest-bearing USDN," applying it to margin accounts, trading settlements, and DeFi scenarios across various application chains.

This series of initiatives indicates that Noble's GTM strategy is "dual-pronged": on one hand, it provides a bridge for existing mainstream stablecoins to enter Cosmos to meet DeFi and other demands; on the other hand, it launches innovative local stablecoin products to enhance user retention and value capture. At the same time, Noble places great emphasis on user experience and compliance: collaborating with Circle to use its cross-chain transfer protocol (CCTP) ensures that exchanging USDC from Ethereum to Cosmos is smooth and secure; it also supports features like blacklisting and address freezing to meet the compliance requirements of issuers.

For Noble's offerings, users can swap between USDC and USDN. There are two vaults to choose from to maximize USDN yields:

- Points Vault: Forego yields to earn points. Lock USDN here; the longer the lock-up period, the faster the points accumulate, with a multiplier bonus after 30 days.

- Enhanced Yield Vault: Can earn the base yield from U.S. Treasuries (currently 4.07%) and the additional yield forfeited by users of the Points Vault.

- Mechanism formula: Boosted APR ≈ r_tbill × (1 + Points pool balance / Boosted pool balance). When the two pools are of similar scale, the annualized yield is roughly double the base rate (~8%+). In the early stages of launch, an APR of ~16% was observed (including the base yield portion).

As of August 6, the Enhanced Yield Vault has been discontinued, and only the Points Vault remains. As of August 2025, the yield on USDN from U.S. Treasuries is approximately 4.08% annualized.

Its underlying interest comes from short-duration U.S. Treasuries, which are distributed to participants. Meanwhile, the average transfer fee on-chain is about $0.01, paid in USDC, with a 0.1% transaction fee for converting USDC to USDN (or vice versa).

Community and Market Engagement

As an important infrastructure in the Cosmos ecosystem, Noble enjoys a certain level of recognition in the industry. On the X platform, Noble's official account has about 30,000 followers. Compared to Tether-related projects, Noble's community size is moderate, but user stickiness is high—most fans are participants in the Cosmos ecosystem and developers in the cross-chain field.

Overall, market sentiment towards Noble is positive: first, the successful introduction of USDC is seen as a sign of maturity for Cosmos, which the community generally acknowledges; second, there has been considerable positive feedback on the USDN model launched by Noble, with many believing that it is a beneficial exploration of stablecoin innovation by bringing U.S. Treasury yields on-chain in a compliant manner. However, there are also some critical voices, such as concerns that USDN's use of centralized custodial assets to generate yields may lead to excessive ties with traditional financial institutions. Nevertheless, the Noble team (composed of former Polychain executives like Jelena) actively engages in community dialogue, explaining its security measures and decentralized approach to maintain community confidence. Overall, Noble has established an OG image in the Cosmos and cross-chain fields, being referred to as the "OG chain for stablecoin issuance on the Interchain," with steadily increasing market recognition and reputation.

Development and Testing Progress

Noble launched its mainnet in Q2 2023, becoming a dedicated asset issuance chain built on the Cosmos SDK. On the technical side, Noble has achieved full support for the IBC protocol, allowing assets issued on Noble to be instantly cross-chain to major chains like Osmosis, Cosmos Hub, and Kujira. After the first cross-chain issuance of USDC in collaboration with Circle in April 2023, Noble has undergone multiple network upgrades to support new asset types: in 2024, it supported the issuance of Ondo's OUSD (USDY) and Monerium's Euro (EURe); in January 2025, it successfully issued the USDN stablecoin.

The Noble network adopts a modular architecture based on the Cosmos SDK, introducing the TokenFactory module to empower issuers to mint/burn tokens independently and execute blacklisting operations. Over the past two years, Noble has significantly enhanced interoperability with Ethereum: by integrating Circle's cross-chain transfer protocol (CCTP) at the end of 2023, it has enabled rapid conversion of USDC from Ethereum directly to the Noble chain, followed by distribution through IBC, greatly improving user experience.

For developers, Noble provides data services like the Range API to help the ecosystem query the flow of USDC across chains. Currently, Noble is testing support for the decentralized stablecoin Frax and the issuance of the Japanese Progmat stablecoin. It is evident that Noble's development progress is steady and its goals are clear: continuously introducing new assets while maintaining chain stability. With the integration of more RWAs like Treasury yield bonds, Noble is expected to continue leading stablecoin innovation in Cosmos.

Key Data Indicators

The issuance of stablecoins on the Noble chain has grown rapidly over the past year, with USDC being the most prominent: as the main dollar stablecoin in the Cosmos ecosystem, USDC's circulation on Noble once exceeded $500 million. So far, according to DeFiLlama data, the total market capitalization of stablecoins on the Noble chain is approximately $408 million, with USDC accounting for 82% and USDN for 16%. The following chart shows the specific supply situation of stablecoins on Noble:

Composition of Stablecoins on the Noble Chain (Data Source: DeFiLlama)

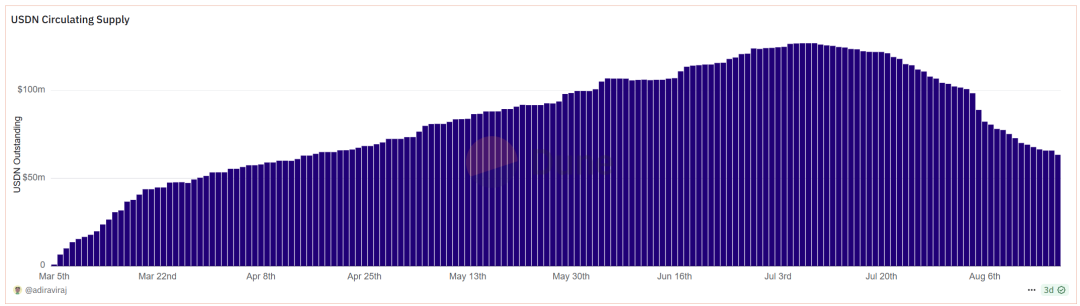

It is noteworthy that the circulation of USDN has reached approximately 64 million in just six months, showing rapid growth. In terms of ecosystem collaboration, Noble has established IBC connections with over 50 Cosmos chains, allowing its stablecoins to be freely used for transactions on these chains. Several leading Cosmos DeFi protocols (such as the Osmosis decentralized exchange and Kujira lending market) have incorporated USDC issued by Noble into their main trading pairs and stablecoin pools, significantly enhancing the liquidity depth of the Cosmos ecosystem.

Transaction Volume: The Noble mainnet processed over $5 billion in USDC transaction volume in its first year, indicating its high throughput capability. Fees are paid in USDC: it is officially stated that transaction fees on Noble are paid in USDC, with an average internal transfer fee of about $0.01. If there is a demand for USDT, it needs to be converted to USDC on the source side before being distributed to Cosmos via Noble/IBC.

Noble's daily USDN circulation is approximately $50 million to $100 million (Data Source: Dune)

Overall, Noble has significantly enhanced the dollar liquidity in the Cosmos ecosystem, with its growth curve closely related to the development of Cosmos DeFi, demonstrating strong momentum in both strategy and data.

1Money

Basic Introduction

1Money is a new blockchain project founded by Brian Shroder, the former CEO of Binance.US, aiming to create the world's first Layer 1 network optimized for stablecoin payments.

GTM Strategy

1Money's market strategy focuses on mainstream users in the payment sector, highlighting the selling points of "simplicity, compliance, and speed." Unlike traditional public chains, 1Money explicitly states that "no complex token economy is needed"—there are no native gas tokens, no staking, and no governance voting, making users feel as if they are not using blockchain at all. This design caters to the needs of businesses and ordinary users for simplicity. For example, when users transfer USDC on the 1Money network, the transaction fee is directly paid in USDC at a fixed low amount, without the need to hold any additional tokens.

Its main pathways are: ① First, make gas-free stable payments the default experience and plan to provide gas-free paths through ecosystem partners; transaction fees are paid directly in the stablecoin being transferred, eliminating the need to hold a second gas token. ② The external narrative is "creating a dedicated payment network for stablecoins," suitable for entry points like e-commerce acquiring/small cross-border/P2P; its website and media repeatedly emphasize "no smart contracts, no congestion, and stable fees," making it easier to provide predictable service standards to merchants. ③ The team simultaneously operates the 1Money Global brand, providing stablecoin-driven debit cards and dollar account infrastructure, aiming to channel traffic from card organizations/banks into on-chain settlements.

In terms of market promotion, 1Money emphasizes its compliance advantages: its board has recently added senior political/regulatory figures such as former FinCEN Director Ken Blanco and former OFAC Acting Director Michael Mosier, endorsing the network's compliance framework.

On the financing front, 1Money announced in January 2025 that it secured over $20 million in seed investment, with investors including F-Prime (under Fidelity Investments), Galaxy, Kraken, KuCoin, BitGo, and other well-known institutions. These investors span traditional finance and the crypto space, bringing both capital and laying the groundwork for future connections with banks, exchanges, and other resources. 1Money also emphasizes that it will become a bridge connecting traditional finance and Web3, proposing the vision that "stablecoins will build the foundation of the modern financial system."

Overall, in its GTM strategy, 1Money aims to attract ordinary users to use stablecoins for payments through technological innovation (ultra-high TPS, extremely simple UX) while striving to get banks and payment companies to incorporate its network into their infrastructure through compliance and industry relationships. This dual-track strategy seeks to promote stablecoins from the crypto circle to mainstream payments.

Community and Market Engagement

As a newly launched project this year, 1Money's community size is currently relatively limited. Its official account on the X platform has about 7,000 followers, primarily consisting of crypto industry insiders and investors optimistic about the payment sector. At its launch, 1Money did not conduct large-scale airdrops or marketing aimed at retail investors, so it has not generated as much buzz in the retail crypto community compared to projects like Plasma.

Development and Testing Progress

The key words for 1Money's technical route are "speed + security + simplicity." Since its inception, the project has secretly developed an innovative consensus protocol called BCB (Byzantine Consensus Broadcast). On August 6, 2025, 1Money officially opened its public testnet and launched a developer portal. According to the official blog, the testnet demonstrates the network's "unprecedented speed" and verifies the feasibility of operating without a native token.

In terms of development progress, 1Money is currently optimizing the stability of the BCB protocol based on feedback from the testnet, ensuring consistent and efficient performance under various network conditions. The official plan is to launch the mainnet as early as Q4 2025 (slightly delayed from the originally scheduled Q2 launch), with at least one round of security audits and stress tests to be conducted before the mainnet launch.

1Money is also actively expanding its developer ecosystem. Although the network does not support smart contracts, it will provide easy-to-use APIs for wallet and payment application integration. Currently, developer documentation and SDKs have been launched on the portal, and some wallet service providers have begun testing integration.

Key Data Indicators

Since 1Money has not yet launched its mainnet, its on-chain metrics are primarily based on performance testing data.

In closed testing, the 1Money network achieved a processing capacity limit of 250,000 TPS, far exceeding the Ethereum mainnet and most existing public chains. The official statement indicates that this number can be linearly scaled, meaning it has the potential to handle global payment-level transaction volumes in the future. Transaction confirmation times during testing remained at 1 second, achieving an instantaneity in user experience similar to traditional electronic payments. In terms of fees, 1Money plans to set a very low fixed base fee and achieve zero fees for end users through partnerships (such as with merchant acquiring institutions).

Compliance metrics are also a significant feature of 1Money: it has a built-in network sanctions address interception mechanism to ensure that non-compliant wallets cannot complete transactions. Verification nodes undergo KYC, meaning that block production on the network is executed by vetted institutions, approaching the credibility level of consortium chains.

In terms of ecosystem data, 1Money has already formed a coalition of over 20 investment/partner institutions, covering exchanges (Kraken, KuCoin), payment companies (MoonPay, CoinFlip), custody security (BitGo), and traditional VCs (F-Prime). This will support the stablecoins after its launch—mainstream stablecoins like USDC and USDT are expected to be integrated into the 1Money network at the earliest, while new stablecoins (from multiple fiat currencies) issued in collaboration with partner institutions are also not ruled out.

In summary, 1Money's hard indicators currently focus on performance and compliance, and its success will be more reflected in its ability to attract active users to conduct a sufficient number of transactions in the future.

Conclusion

In conclusion, the five projects—Plasma, Stable, Codex, Noble, and 1Money—belong to the "stablecoin public chain" category, each with its own strengths in strategy, progress, and market acceptance:

Market Positioning and Strategy

Both Plasma and Stable have ties to Tether/Bitfinex, leaning towards building a payment network centered around USDT. In comparison, Plasma emphasizes breakthroughs in technical performance (zero fees, extremely high speed) and leverages Bitcoin's security for endorsement; Stable focuses on seizing the regulatory shift in the U.S., promoting compliance friendliness and the ease of using USDT as gas. In contrast, Codex and 1Money follow an enterprise-level/compliance route: Codex relies on Ethereum L2 to provide predictable fees and integration with existing infrastructure (like Circle and Coinbase); 1Money is designed from scratch with a compliance framework, even foregoing smart contracts to eliminate complexity, directly targeting cross-border payments and retail payment implementation. Noble's strategy differs from theirs; as part of the Cosmos ecosystem, Noble focuses on multi-chain issuance, acting as a partner for stablecoin issuers (helping USDC and others enter Cosmos) while also launching its own stablecoin innovation (USDN) to meet internal ecosystem demands.

Thus, strategically speaking: Plasma/Stable tend to compete for the existing USDT market, Codex/1Money aim to expand the incremental institutional payment market, while Noble delves into the internal stablecoin supply of the cross-chain ecosystem.

Development Progress and Technical Implementation

In terms of mainnet progress, Noble is the most advanced—having operated steadily for over a year, issuing multiple stablecoins and achieving hundreds of millions in cross-chain circulation. Plasma completed record testing deposits by mid-2025 and is now preparing for its mainnet launch, with technical details largely finalized. Stable is in the internal development testing phase, with its mainnet expected by the end of the year or later, and many of its design concepts (like USDT aggregators and dedicated block space for enterprises) still awaiting validation. Although Codex only secured funding in early 2025, it has quickly launched native USDC using the mature OP Stack solution, suggesting that core functionality development has been completed and is now in the optimization phase. 1Money, starting from scratch with an innovative consensus, has a slower progress but is also set to launch its public testnet in Q3 2025.

Application Scenarios

The five projects also reflect the diverse exploration within the stablecoin public chain track: some choose to embrace the existing largest stablecoin USDT to quickly scale; others focus on enhancing technology and compliance to gain recognition from traditional finance; and some are rooted in the internal public chain ecosystem to solve stablecoin liquidity issues. In the future, these projects may serve different niche markets or even form complementary relationships. For example, Plasma and Stable may dominate C-end small payment scenarios, while Codex and 1Money may handle B-end large settlements and cross-border remittances, with Noble continuing to focus on cross-chain asset issuance and interest rate products.

It is foreseeable that as the regulatory environment clarifies and market education deepens, stablecoin chains will enter a rapid development phase. At that time, the competition will not only be about technical performance but also about ecosystem building and compliance trust. Among the aforementioned projects, whoever can first achieve key application implementation and win user trust will emerge victorious in this "on-chain stablecoin infrastructure" competition, driving stablecoins toward mainstream payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。