文章编译:Block unicorn

布兰妮·斯皮尔斯(Britney Spears)的歌曲从每个电台传出,《黑客帝国》让我们质疑现实,世界各地的青少年忙着刻录 CD 来制作自己的混音带。互联网仍然笨拙,需要通过刺耳的拨号音才能接入,但它已经开始渗透到日常生活中。那是 20 世纪 90 年代末。

当时搜索引擎已经存在,但它们看起来和感觉上都很杂乱。雅虎的目录像是电话黄页的翻版,AltaVista 和 Lycos 会吐出长长的链接列表,速度很快但缺乏条理。找到你需要的信息往往是一项艰巨的任务。

然后出现了一个白色的屏幕,带有一个干净的搜索框和两个按钮——“Google 搜索”和“手气不错”。人们试了一次后就再也没有离开。

那是谷歌的第一个“魔法”。结果呢?拉里·佩奇(Larry Page)和谢尔盖·布林(Sergey Brin)的创造让“Google”这个词成为了搜索行为的代名词。当你忘了某些物理学理论时,你会说“谷歌一下吧!”。“想学怎么打一个完美的领带?为什么不谷歌一下怎么做?”

一夜之间,检索事实、寻找商家,甚至学习编程都变得自然而然。

这家公司随后在 Gmail、Android 和云服务上重复了这一策略。每次,它都将混乱的事物变得简单且可靠到近乎无聊。

在它如今主导的每个领域,谷歌都不是第一个进入者,但很快成为了该领域的领导者。Gmail 不是第一个电子邮件服务,但当竞争对手还在限制兆字节存储空间时,它提供了千兆字节的存储。Android 不是第一个移动操作系统,但它成为了全球预算智能手机的支柱。那些拒绝它的人反过来被世界遗忘。还记得诺基亚吗?

云服务也不是第一个托管解决方案,但它提供了让初创公司和银行愿意押注的可靠性。

在每个类别中,谷歌都将杂乱无章的原始技术变成了默认的基础设施。

那是过去三十年。如今,谷歌正在做一件矛盾的事情。

它正准备在一种曾经被设想用来取代这类科技巨头的创新——区块链——上进行构建。凭借其原生的一层区块链,这家科技巨头试图在价值领域复制它在信息领域几十年的成就。

通过 Google Cloud Universal Ledger,该公司希望为金融机构提供一个“高效、可信中立且支持基于 Python 的智能合约”的内部一层区块链。

像 CME Group 这样全球领先的衍生品市场已经开始利用这条链探索代币化和支付,谷歌 Web3 战略负责人里奇·威尔曼(Rich Widmann)表示。

为什么现在要构建内部区块链?

因为资金管道需要修复。

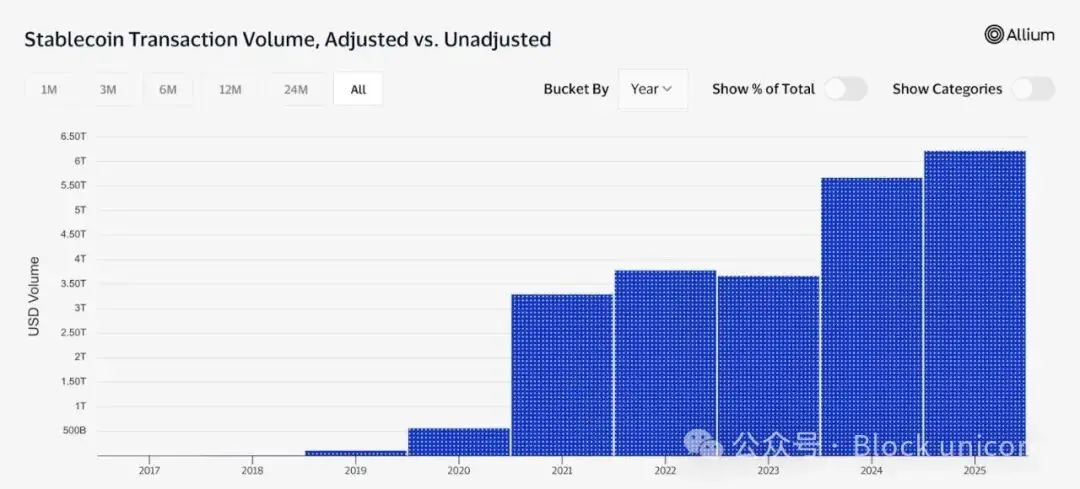

2024 年,稳定币的调整后交易量超过 5 万亿美元,超过了 PayPal 的 1.68 万亿美元年度交易量,仅次于 Visa 的年度支付量(13.2 万亿美元)。

然而,跨境支付仍然需要几天时间来结算,成本高达两位数的百分比,并且依赖于过时的系统。《经济学人》指出,如果不加以改变,到 2030 年,结算效率低下的问题预计每年将造成 2.8 万亿美元的损失。

谷歌希望从稳定币开始,但目标更远大。“稳定币只是起点。真正的机会在于将更广泛的现实世界资产代币化,并在开放的基础设施上构建可编程的金融应用,”谷歌在其博客文章中写道。

谁会使用它?

该账本是许可制的。所有参与者都必须通过 KYC 验证。智能合约以 Python 语言运行,这是金融工程师们已经熟悉的语言。访问只需通过一个 API,该 API 已集成到 Google Cloud 的现有服务中。

业界对其“中立基础设施”的标签持怀疑态度。当一家通过集中控制数据建立帝国的科技巨头如今宣称要提供“中立区块链”时,我对这种质疑并不感到惊讶。

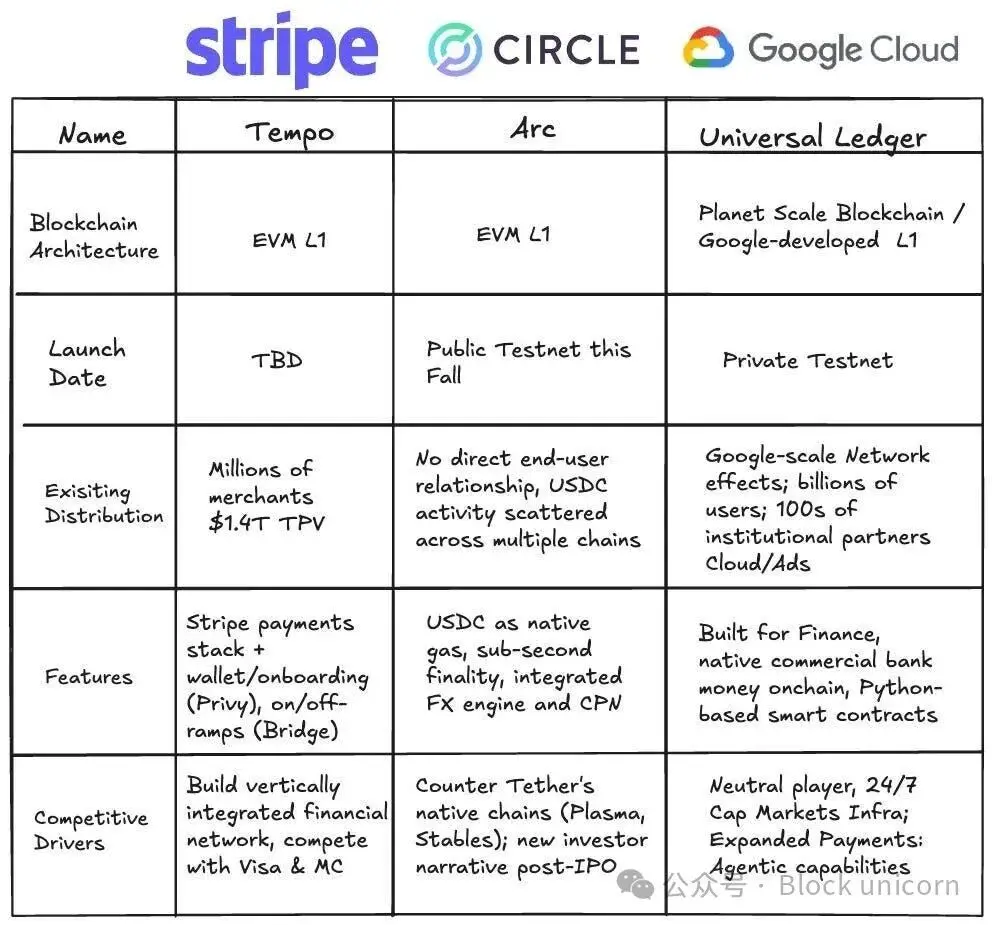

除了规模之外,谷歌还有什么与众不同之处?威尔曼认为,谷歌将成为其他金融公司赖以发展的平台。“Tether 不会使用 Circle 的区块链,Adyen 可能也不会使用 Stripe 的。但任何金融机构都可以与 GCUL 合作。”

Stripe 的 Tempo 自然会倾向于 Stripe 的商家。Circle 的 Arc 围绕 USDC 构建。谷歌的卖点是它没有竞争的支付或稳定币业务,因此可以可靠地提供其他公司可能会采用的方案。

谷歌在这一类别中同样不是第一个。其他企业巨头过去也构建了自己的区块链。

Meta(前身为 Facebook)的 Libra,后改名为 Diem,承诺推出全球稳定币,但从未推出。监管机构纷纷阻止,警告它可能破坏货币主权。到 2022 年 1 月,该项目的资产被出售。

R3 的 Corda 和 IBM 的 Hyperledger Fabric 建立了可靠的平台,但难以扩展到有限的联盟之外。它们都是许可链,对赞助商有价值,但未能将行业拉上共享的轨道,最终陷入了各自为政的境地。

教训是,如果每个人都认为一家公司控制了协议,网络就会失败。这也是笼罩在谷歌头上的阴影。

但 GCUL 的第一个合作伙伴——CME 集团,为我们提供了方向的线索。如果 Universal Ledger 能处理全球最大衍生品交易所的日常资金流,其规模的吸引力将为更广泛的采用提供理由。这也回应了去中心化的争论。

Google Cloud 的客户已包括银行、金融科技公司和交易所。对它们来说,通过 API 连接到 Universal Ledger 可能就像添加另一项服务,而不是切换平台。谷歌还有资源来维持那些因预算紧张而被小型联盟放弃的项目。因此,对于已经嵌入谷歌技术栈的机构来说,采用 GCUL 可能比从其他地方重新开始更顺畅。

对于散户来说,这种影响会更微妙。你不会登录 Universal Ledger 应用,但仍会感受到它的存在。

想想那些需要几天才能到账的退款、被卡住的国际转账,以及已经被正常化的延迟。如果 Universal Ledger 成功,这些问题可能会悄无声息地消失。

你还可以期待它扩展到日常产品。想象一下,只需支付几美分即可跳过 YouTube 广告,而无需每月订阅 YouTube Premium;只需支付几分钱即可获得额外的 Gemini 查询;或者实时流式支付云存储费用。广告补贴的互联网可能会悄然转向按次付费模式,让用户拥有更多选择,而不是只使用一种默认设置。

用户或许将首次有机会选择是用注意力换取服务还是花几美分。企业可以尝试一些过去无法实现的微交易方式,从云存储的流媒体支付到按需提供优质搜索结果。如果 GCUL 模式成功,谷歌的帝国可能从几乎完全依赖广告(占谷歌总收入的 75% 以上)转变为更灵活的、以交易为主导的模式。

去中心化与中心化的争论仍将持续。

我认为开发者不会选择在 GCUL 上构建无需许可的应用。没有人会在谷歌的平台上搭建收益农场或发行模因币。

已经使用 Google Cloud 和其他企业工具的机构很可能是采用 GCUL 的主体。目标明确而实际:在互联网上以更低摩擦移动价值,减少对账麻烦,并为银行和支付公司提供可信赖的支付轨道。

作为一个零售用户,我不记得自己何时切换到 Gmail。它只是成了电子邮件的代名词,就像谷歌成了网页搜索的代名词一样。我买第一部 Android 手机时甚至不知道谷歌拥有 Android。

如果 Universal Ledger 成为无缝的基础设施,你不会在意去中心化的问题。它只是那个好用的东西。

但这并不排除风险。

谷歌对反垄断审查并不陌生。美国法院过去曾裁定这家科技巨头在搜索和广告领域维持了垄断的地位。构建金融通道只会加剧监管关注。Libra 的崩溃证明,一旦中央银行觉得主权受到威胁,项目可能迅速瓦解。

目前,谷歌的 UCL 仍在测试网上。芝加哥商品交易所 (CME) 已经加入,其他合作伙伴也正在积极争取。谷歌计划在 2026 年进行更广泛的推广。但我认为,这种雄心壮志并非浪得虚名。

谷歌押注它能将资金流动变成像在搜索框中输入文字一样无聊、可靠且无形的基础设施。

故事始于一个空白页面和一个搜索框。它的下一章可能是一个无人看见却人人在用的账本。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。