一.前瞻

1. 宏观层面总结以及未来预测

上周,美国二季度 GDP 年化增速上修至 3.3%,显示经济在消费者支出与 AI 投资带动下反弹。与此同时,关税扩围与进口增加推高了通胀和成本压力,市场预期美联储 9 月降息概率快速升至 85%,并押注年内累计降息幅度可达 100 个基点。

美股在上周走势波动,前期受强劲 GDP 数据和科技投资热潮支撑,道指和标普500一度创下历史新高。但随着就业疲弱和信心下滑的信号释放,市场情绪趋于谨慎,部分交易日出现回调。整体而言,美股表现出对经济短期压力的担忧与对中长期增长动能的乐观并存。

2. 加密行业市场变动及预警

上周,在杰克逊霍尔会议上鲍威尔释放鸽派信号后,加密市场一度短线上扬。比特币快速突破至 11.7 万美元上方,以太坊也冲高至接近 4800 美元,市场普遍预期美联储 9 月降息,推动资金短期流入加密资产。整体情绪一度转暖,主流币价格出现阶段性上涨。

但很快市场出现抛压,大额比特币抛售引发连锁反应,比特币回落至 11 万美元附近,以太坊、XRP 等同步下行。分析人士提醒,尽管宽松预期提供支撑,但短期内加密市场仍面临回调风险,投资者应关注比特币关键支撑位以及流动性变化。

3. 行业以及赛道热点

由Google, 游戏巨头万代南宫梦&square enix参投,致力打造沉浸式电竞粉丝互动与数字藏品体验的平台STAN是一个专为电竞爱好者打造的粉丝互动平台;融资70万美元,开启AI驱动的跨链交易新时代的加密交互平台Kuvi.ai是一个基于 AI 的加密交互平台,其使命是通过“文本即交易”(Text-to-Trade)的方式,让区块链资产的买卖、交换、跨链等操作像发一条消息一样简单。

二.市场热点赛道及当周潜力项目

1.潜力项目概览

1.1. 浅析由Google, 游戏巨头万代南宫梦&square enix参投,致力打造沉浸式电竞粉丝互动与数字藏品体验的平台STAN

简介

STAN 是一个专为电竞爱好者打造的粉丝互动平台,在这里用户可以收集、游玩并与自己喜爱的电竞和游戏藏品互动。用户可以构建和升级自己的藏品库,与其他粉丝进行交易,还可以与电竞明星互动。通过这种沉浸式的电竞粉丝体验,用户有机会赢取福利和奖励,包括签名周边、主播训练营等专属待遇。

规则简述

1. 尊重行为准则

STAN 是一个建立在信任、尊重与合作基础上的社区。每一位用户与创作者都应在日常互动和俱乐部内秉持友善、体贴的态度相处。我们始终期望所有人展现出尊重的行为,以营造积极、互动的环境。

主要守则:

禁止骚扰或虐待行为: 严禁任何形式的骚扰、欺凌或攻击性行为,包括但不限于言语攻击、针对他人的种族、民族、性别、性取向、宗教、年龄或其他受保护特征的攻击。

禁止仇恨言论与攻击性内容: 任何宣扬仇恨、暴力或歧视个人或群体的内容或言论,均会被立即处理并受到严厉处罚。

尊重他人隐私: 严禁分享他人的私人、个人或机密信息(即“人肉”或“起底”)。威胁或试图恐吓、伤害他人的行为一律不被容忍。

俱乐部行为规范: STAN 中的俱乐部旨在打造有意义的交流与联系空间。任何在俱乐部内出现的骚扰、欺凌等不尊重行为,将被立刻处置。凡破坏俱乐部正向氛围的内容或行为,均会受到社区管理员处理。

2. 内容规范

STAN致力于为平台上的所有用户提供一个安全、可靠且愉快的使用体验。用户必须确保其行为不会损害 STAN 的平台完整性,也不得违反内容规范。

主要守则:

禁止发布 NSFW(不适宜公开场合)内容:

STAN 不允许任何形式的色情内容或不当材料。所有内容必须符合社区标准,适合所有用户群体观看。禁止赌博与激励类活动:

严禁涉及赌博、奖励机制或任何形式的激励式游戏行为(如付费获胜、作弊等)。任何用户或创作者一旦参与此类活动,将被永久封禁。禁止有害或暴力内容:

所有宣扬暴力、自残、饮食失调或其他危险行为的内容将被立即删除,违规者将受到处罚。隐私保护:

未经明确许可,禁止分享或传播他人的个人或机密信息。包括“人肉”(doxxing)、黑客行为或任何侵犯隐私的行为,都会受到严厉处理。俱乐部内容限制:

所有在俱乐部中发布的内容也必须遵守以上规范。俱乐部并不是规则豁免区,任何违规或有害内容将导致用户被处罚或被移出俱乐部。

3. 平台诚信

STAN 提供多种工具和功能,旨在增强用户与创作者的使用体验。所有工具都必须被负责任地使用,以维护一个积极、尊重的社区环境。

主要守则:

禁止刷量与操控行为:

用户不得从事任何形式的互动操控行为,例如使用机器人、虚假账号或向他人发送垃圾信息等。这包括购买粉丝或使用自动化工具人为提升互动数据等行为。禁止干扰性行为:

严禁发布刷屏内容、大量重复发送消息或其他影响他人正常体验的行为。任何蓄意破坏平台功能或用户体验的行为均不被容忍。负责任地使用平台功能:

所有 STAN 提供的功能必须用于其设定的目的。若存在滥用行为(如利用功能进行破坏、欺诈或干扰平台正常运行),平台将对相关用户或创作者采取处理措施。俱乐部使用规范:

俱乐部应作为用户建立联系、协作与娱乐的空间。若被用于破坏性活动(如操控互动、发布垃圾信息等),将受到相应处罚,包括禁言、移除或封禁。

4. 创作者责任

创作者是 STAN 社区成功的关键组成部分,应以身作则,积极营造积极健康的社区氛围。所有创作者在平台上发布的内容必须严格遵守 STAN 的平台规范。

主要守则:

创作者责任制度:

创作者需对其在 STAN 上的所有内容与行为负责。任何与 NSFW(不适宜公开)、赌博、激励式奖励相关的内容,均将导致账号被暂停或永久封禁。违规处理机制:

STAN 拥有完善的内容审查与违规处理系统。一旦发现违反平台规范的行为,平台将视情节轻重采取包括删除内容、暂时封号或永久禁用在内的措施。俱乐部管理规范:

管理俱乐部的创作者必须确保俱乐部环境安全、尊重他人,并杜绝任何违反平台规定的行为。若俱乐部内发生不当行为,平台将进行干预,必要时会取消该创作者的俱乐部管理权限。

Tron点评

STAN 作为专注于电竞领域的粉丝互动平台,通过集收藏、交易与互动为一体的产品设计,有效提升了粉丝粘性和社区活跃度。平台提供数字藏品升级、名人互动、兑换实物奖励(如签名周边、主播训练营等)等功能,极具吸引力,尤其贴合 Z 世代和电竞核心用户的兴趣结构。此外,其“游戏化+社交化”的机制,有望打造出高频参与的粉丝经济闭环。

但STAN 的平台高度依赖电竞 IP 与KOL资源,若缺乏长期内容更新或热门赛事合作,用户留存可能受限。同时,NFT 交易及粉丝激励体系仍需面对合规风险和市场情绪波动问题。此外,从 Web3 入口用户体验来看,STAN 在降低链上交互门槛、跨平台运营能力及长期激励机制方面仍有优化空间。

1.2.解读融资70万美元,开启AI驱动的跨链交易新时代的加密交互平台Kuvi.ai

简介

Kuvi.ai 是一个基于 AI 的加密交互平台,其使命是通过“文本即交易”(Text-to-Trade)的方式,让区块链资产的买卖、交换、跨链等操作像发一条消息一样简单。

Kuvi 的口号是:“Don't trade, just Hoot!”(不用交易,只需喊话),通过 AI 理解用户的自然语言输入,自动完成复杂的跨链交易流程,彻底简化加密资产的操作门槛。

a. 核心价值主张

1. AI 驱动的简化体验

支持自然语言指令(如“买入200美元SOL”);

AI 自动识别最优路线,执行桥接、DEX 交易等多步骤操作。

2. 自主安全与双账户模型

Vault 账户:完全由用户自主管理,私钥自持;

Automated 账户:授予 Kuvi AI 权限,执行日常交易操作;

所有资产默认存在 Vault 中,仅在用户许可范围内转入 Automated。

3. 用户体验流

安装后创建 Vault 与 Automated 账户;

用户可设置 AI 的权限等级(如仅执行低风险交易、所有交易需确认等);

通过输入命令(如“交换ETH为SOL”),触发 Kuvi 的 AI 自动处理跨链、找最优路径、执行交易等流程。

b. 市场背景与机会

存在问题:

复杂的跨链与 DEX 操作;

UI 繁杂、容易出错;

缺乏统一入口,导致体验割裂。

Kuvi 的解决方案:

“一条消息,完成交易”;

自动选择最优桥接/交易路径;

降低新手门槛,同时为专业用户提供高效自动化通道。

c. 平台架构与技术细节

1. 核心模块

AI NLP 引擎:理解用户指令,规划最优交易路径;

交易编排层:实现跨链桥接、DEX 聚合、路径选择;

原子化交易打包:多步骤操作合并成一次性智能合约调用,确保成功或回滚;

安全权限管理:

AI 仅可访问 Automated 账户;

用户可设置额度、黑/白名单、时间锁等防护措施;

Vault 资产只能通过用户签名转出。

2. 跨链与集成能力

支持多个桥接协议(LayerZero、Hop、Connext 等);

整合多个 DEX 聚合器(如 1inch、Matcha);

支持 Solana、EVM 系链(Arbitrum、Polygon)等,未来将拓展非 EVM 生态。

Tron点评

Kuvi.ai 通过“文本即交易”的 AI 驱动交互方式,解决了加密世界中用户体验分裂、跨链繁琐、安全机制薄弱等核心痛点。其独特的双账户设计既保证了用户资金主权,又支持高效的日常交易体验。凭借成熟的技术架构、明确的代币机制和清晰的市场路径,Kuvi 有潜力成为 AI 交易接口领域的领军者。

2. 当周重点项目详解

2.1. 详解头部交易所Bitfinex,Kucoin以及BYBIT参投,融资2800万美元的高并发、低延迟与极致可扩展性的融合的解决方案Stable

简介

Stable 提供强大、可靠且具成本效益的稳定币区块链解决方案,专为 USDT 优化。通过为机构、普通用户和开发者量身打造的全面功能,Stable 提升金融效率,推动卓越运营表现。

Stable 专为优化 USDT 交易而设计,为机构提供高效、安全且具成本效益的支付与结算解决方案。面向企业的功能包括:

企业专用区块空间(即将推出): 使用区块链基础设施的企业需要确保交易延迟的一致性。Stable 为企业提供区块空间的专属分配,即使在网络拥堵时也能保持交易性能的可靠性。

专为 USDT 交易打造: Stable 提升 USDT 的发行、结算和日常交易,能快速且安全地处理高频次的大规模 USDT 活动。

高交易吞吐量: Stable 支持快速交易处理,使机构能在快速结算大额交易,并通过 USDT 转账聚合功能实现大规模转账。

安全性与可靠性: Stable 拥有强大的安全机制,全面保护交易和资产。其安全架构为高价值结算和关键金融操作提供了可信基础。

隐私转账(即将推出): Stable 提供企业级的保密隐私转账能力,使机构在执行交易的同时保护隐私,并完全遵守监管要求。通过先进的加密技术,敏感交易数据不会公开展示,但可由授权方进行审计。这使企业在满足 AML/KYC 和财务审计等法规时,也能保障必要的隐私,从而在合规金融环境中建立信任与运营信心。

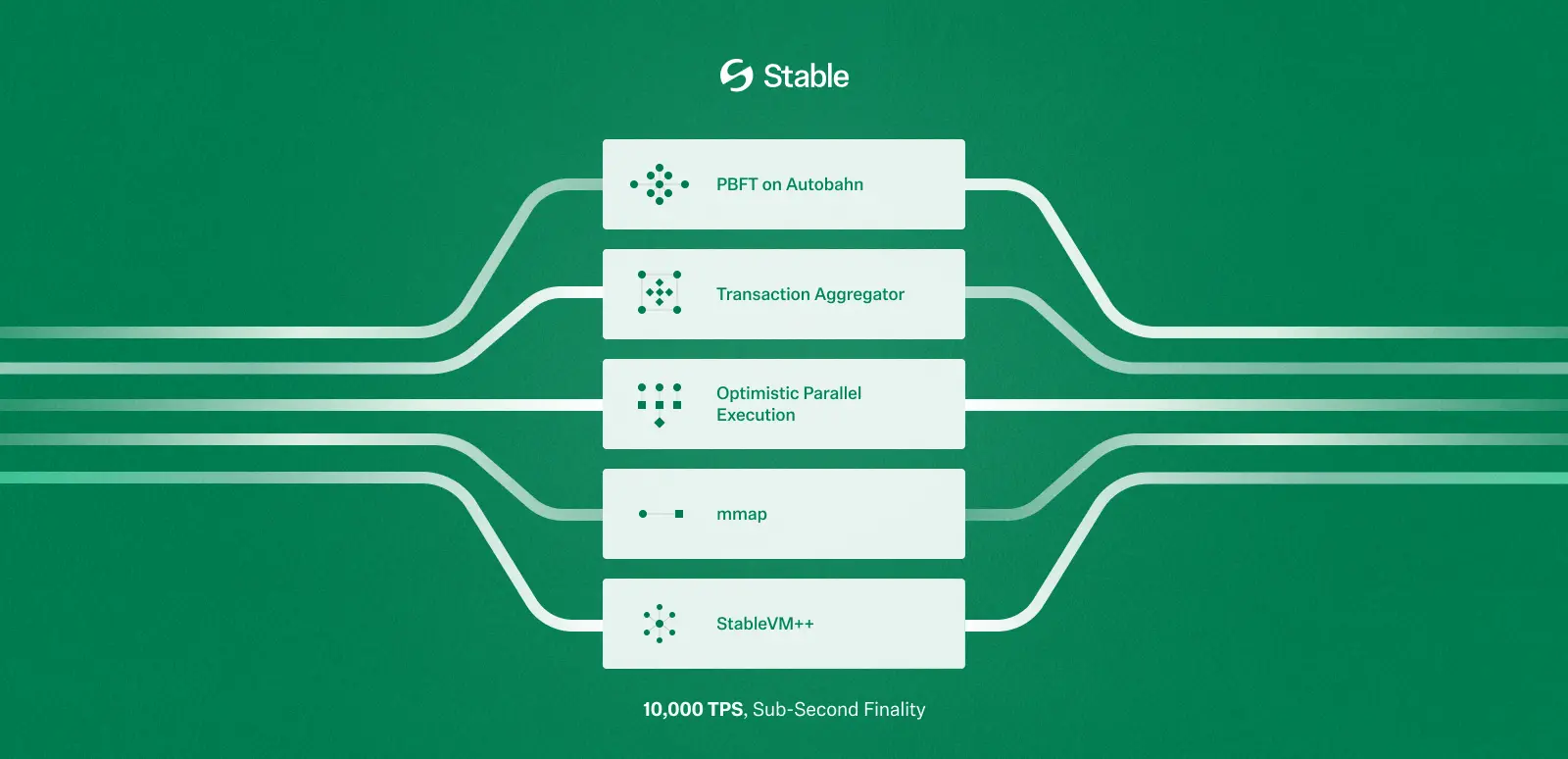

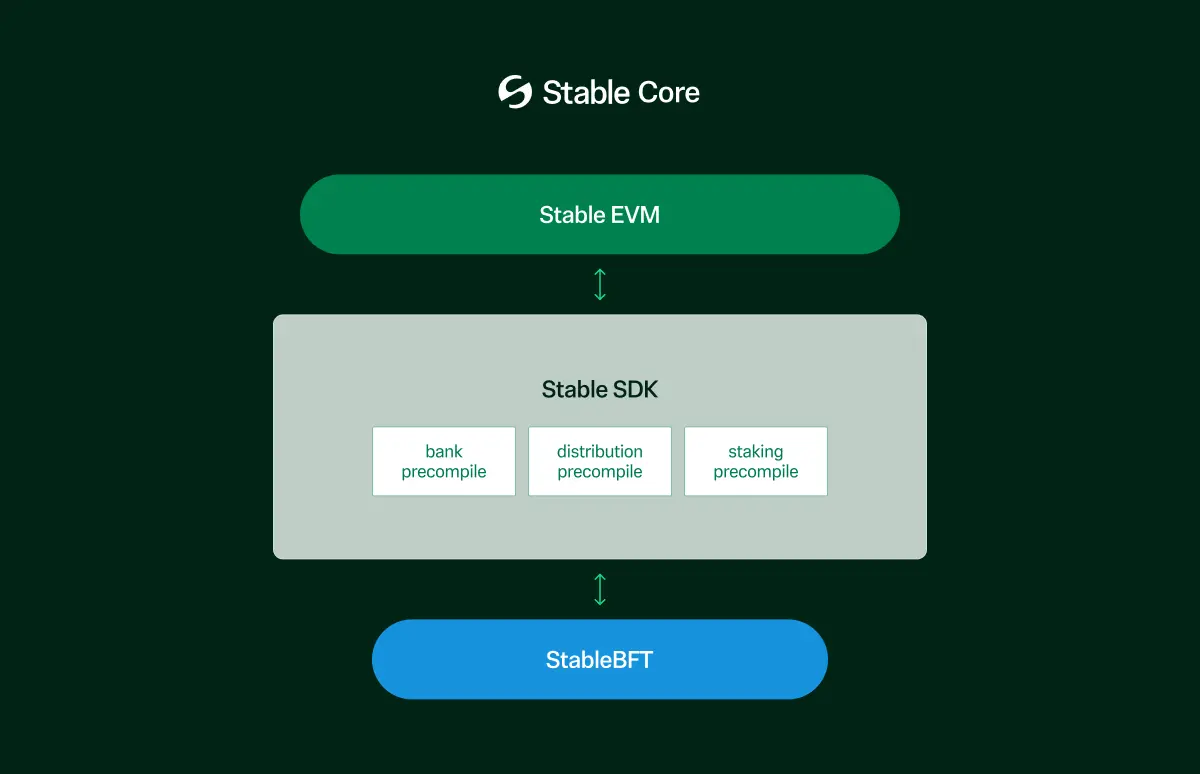

架构解析

从状态数据库、执行引擎、共识机制,到针对 USDT 的特定优化,Stable 的设计始终聚焦于性能、可扩展性与可靠性。技术栈中的每一层组件都经过专门优化,以支持高吞吐的工作负载和无缝的 USDT 原生操作。

1. Consensus

StableBFT 共识机制

在初始阶段,Stable 区块链采用 StableBFT,这是一个基于 CometBFT 定制的权益证明(PoS)共识协议,旨在确保网络具备高吞吐量、低延迟和高鲁棒性。其主要优势包括高确定的最终确定性以及强大的容错能力(即便有 1/3 验证者失效或作恶,网络仍可保持安全)。

为进一步提升共识性能,Stable 计划在不久的将来对共识相关的两层机制进行优化:

交易传播与共识传播拆解:通过将交易 gossip 层与共识 gossip 层分离,防止交易层的网络拥塞影响到共识通信,提升系统稳定性。

交易直接广播至区块提议者:当前模型中,交易在节点间通过点对点 gossip 传播,造成区块链网络中有大量的交易相关流量传输。Stable 计划引入直接广播机制优化这个机制,使交易可直接发送给区块提议者,从而提高交易传播效率。

未来规划:基于 DAG 的共识机制

为大幅提升共识效率,Stable 计划将其协议升级为基于 DAG(有向无环图)的设计,预期带来 5 倍的性能提升。

传统的基于视图的 BFT 协议(如 PBFT 和 HotStuff)在网络稳定时可实现低延迟,但在发生网络中断时性能急剧下降,恢复时间较长。

第一代 DAG 引擎如 Narwhal 和 Tusk 表明将数据传播与共识排序拆解可以消除单一提议者瓶颈,并在网络不稳定时提升鲁棒性。然而,这类架构与 CometBFT 系统不直接兼容,因为它们偏离了传统的基于区块高度的开发习惯和内存池(mempool)设计。

Autobahn 提供了一种 PBFT-on-DAG 架构,能更好与 Stable 的共识层集成,既能在正常网络条件下实现低延迟,也能在网络故障时快速恢复。Stable 团队与 Autobahn 论文作者保持紧密合作,并将利用 Autobahn 架构提升 StableBFT 的性能。

基于 Autobahn 架构构建的 StableBFT 将带来以下能力:

消除单一领导者限制,实现并行处理。

将数据传播与最终排序分离,实现更快的最终确定性。

借助强大的 BFT 机制,在网络异常条件下增强系统的处理弹性。

这一先进的共识设计已通过内部原型验证,在受控环境下实现超过 200,000 TPS(仅共识层) 的高吞吐表现。

2. 执行层

Stable EVM

1. Stable EVM 简介

Stable EVM 是 Stable 区块链的以太坊兼容执行层,允许用户通过以太坊常用工具(如 MetaMask)无缝交互。

它结合了 EVM 熟悉的开发体验与 Stable SDK 的模块化高性能基础设施。

引入了预编译合约,EVM 合约可安全、原子性地调用底层功能,如代币转账、质押、治理等操作。

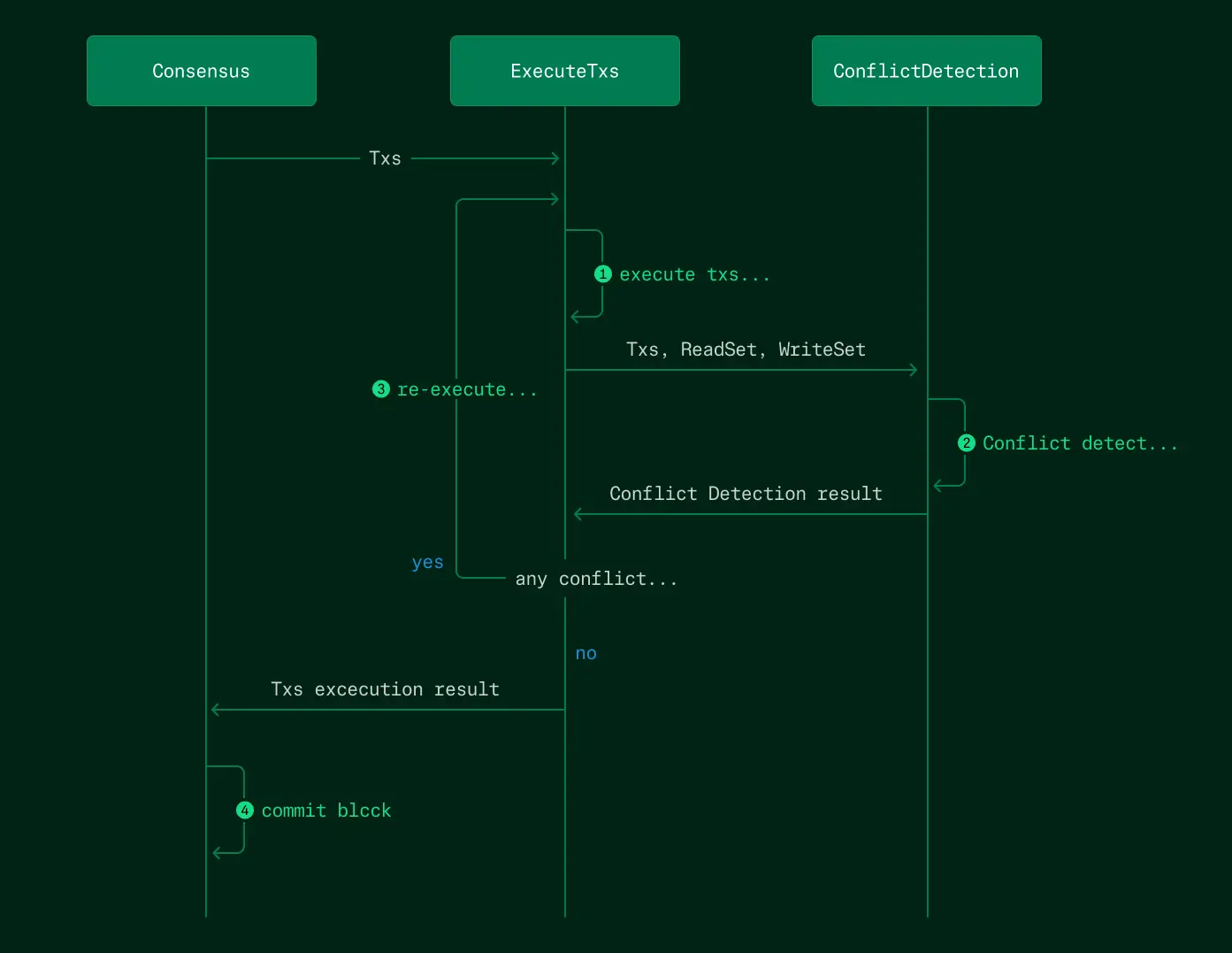

2. Optimistic 并行执行(OPE)概述

传统链使用顺序执行机制,虽然可保持一致性,但限制了吞吐量与扩展性。

OPE 提出用以解决上述瓶颈:在保持一致性的同时,实现多交易的并行处理。

Stable 将 OPE 作为核心性能提升策略,引入 Block-STM 并行执行引擎。

3. Block-STM 的核心原理

① 多版本内存结构(MVCC)

每个 memory key 支持多个版本,交易读取上一个已提交版本。

所有读写操作均打上版本标记,用于后续冲突验证。

② Read-Set / Write-Set 验证机制

执行阶段记录交易读取(Read-Set)和写入(Write-Set)内容。

验证阶段若发现 Read-Set 中键被其他交易写入视为冲突,需回滚重试。

③ ESTIMATE 标记机制

失败交易的 Write-Set 被标记为 ESTIMATE。

其他交易若读取到该标记会立即触发等待,避免无效执行。

④ 预设交易顺序

所有交易预设固定顺序,无论并行执行或验证都保持一致。

保证即使有重试,最终所有节点状态一致。

⑤ 协作调度器(Collaborative Scheduler)

线程安全地为执行/验证阶段分配任务。

优先调度索引更小(更早)的交易,降低重试率,提高吞吐。

4. Block-STM 的优势

无锁并行:基于 MVCC,无需加锁,提高多交易并发效率。

快速冲突检测:通过 ESTIMATE 提前中止依赖交易,节省资源。

高效调度:优先处理早期交易,减少延迟。

确定性强:即使有回滚重试,最终所有节点仍达成一致状态。

5. Stable 上的 OPE 与 OBP 的协同作用

OPE(Optimistic Parallel Execution)

并行执行交易,提升吞吐与执行效率。

OBP(Optimistic Block Processing)

非并行,但提前执行区块:

在 ProcessProposal 阶段,边 gossip 边执行。

执行结果缓存,FinalizeBlock 阶段复用,避免重复计算。

二者互补:

OPE 解决并发性能瓶颈,OBP 优化执行时机;

合作实现更高的交易处理能力和更低的延迟。

6. 性能预期

内部测试表明:

将 Block-STM(OPE)与 StableDB 结合,

Stable 的交易处理吞吐量可提升 至少 2 倍。

3. StableDB

Stable 的两大架构优化

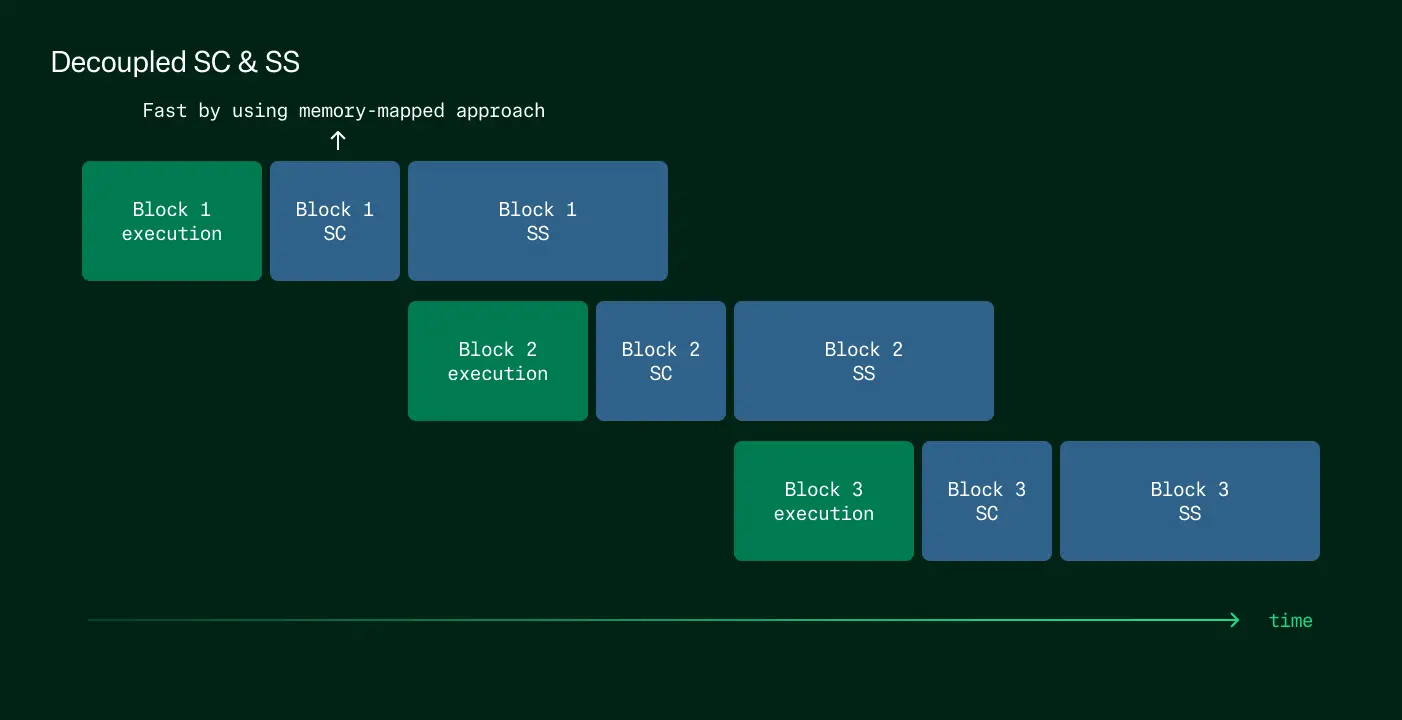

1. 状态提交与状态存储的解耦

执行完成后立即进行状态提交;

状态数据的磁盘持久化通过异步后台进程完成;

好处:

避免因磁盘写入阻塞下一区块执行;

显著提升交易处理速度和整体系统吞吐量。

2. 引入基于 mmap 的双数据库系统

通过内存映射文件(mmap)实现高效状态存储结构:

MemDB(活跃状态数据库):

驻留在内存,映射至固定地址;

存储当前热点状态,支持高速查找;

适合频繁读写、实时交易处理。

VersionDB(历史状态数据库):

持久化存储早期状态;

面向归档和审计查询,访问频率低;

用于历史回溯和验证,非关键路径操作。

4. 高性能 RPC

在构建高性能区块链的过程中,仅仅优化共识机制或出块速度是不够的。RPC 层 是区块链与用户之间的接口,是实现端到端用户体验的关键组成部分。Stable 提出一种高性能 RPC 架构,旨在突破传统 RPC 的性能瓶颈。

a. Stable 的 Split-Path RPC 架构总结

架构核心理念:路径分离(Split-Path)

Stable 的 RPC 系统采用路径分离的理念,将 读取操作 与 写入操作 完全拆分并分别优化,避免性能互相干扰。

功能拆分节点:

每种功能部署在不同的轻量节点(如读专用 / 写专用),使每类 RPC 请求拥有独立处理路径;边缘节点扩展机制:

利用轻量级、无状态的 RPC 边缘节点部署在多地区,提供近用户的低延迟接入点;基于功能的路径优化:

根据读/写请求特性分别优化底层数据访问路径及数据结构,提高响应效率。

b. 读取路径性能指标

Stable 内部测试显示其读取路径性能强劲:

性能指标 | 结果 |

吞吐能力 | 单节点支持超过 10,000 RPS |

请求延迟 | 端到端延迟 低于 100ms |

可扩展性 | 边缘节点支持线性扩展,无需同步 状态或参与共识 |

Tron点评

Stable 通过引入 Stable EVM、Block-STM 并行执行引擎、StableDB 存储优化 和 Split-Path RPC 架构,有效解决传统区块链在吞吐、I/O 和查询性能上的瓶颈。其特有的状态提交/存储解耦、内存映射数据库、多路径 RPC 架构,使其具备:

极高的执行并发性与确定性兼容;

极低的磁盘延迟与状态读写开销;

支持轻量级边缘节点快速扩展;

优化链上/链下资源配合,提升终端响应体验。

然而,Stable 的高度模块化设计也带来一些挑战,例如:

系统复杂度高,调度器、冲突重试等机制需精细调优;

mmap 与内存数据库在极大状态体积下仍面临内存压力;

异步状态持久化可能在极端条件下增加数据一致性管理成本;

对开发者而言,预编译合约和路径分离架构需要额外适配。

三. 行业数据解析

1. 市场整体表现

1.1. 现货BTC vs ETH 价格走势

BTC

解析

本周重点阻力:109600美元,113500美元,117500美元

本周重点支撑:107300美元,105200美元

ETH

解析

本周重点阻力:4500美元,4670美元,4960美元

本周重点支撑:4360美元,4260美元,4210美元,4070美元

2.公链数据

2.1. BTC Layer 2 Summary

2.2. EVM &non-EVM Layer 1 Summary

2.3. EVM Layer 2 Summary

四.宏观数据回顾与下周关键数据发布节点

美国第二季度 GDP 年化增长率上修至 3.3%,好于此前预期,较一季度的 –0.5% 大幅反弹。主要动力包括消费者支出强劲及 AI 基础设施投资增长,净出口也贡献显著,企业利润同比上升 1.7%,国民总收入(GDI)跳涨至 4.8%。

本周(9月1日-9月5日)重要宏观数据节点包括:

9月2日:美国8月ISM制造业PMI

9月4日:美国8月ADP就业人数

9月5日:美国8月失业率;美国8月季调后非农就业人口

五. 监管政策

美国

SEC 任命新执法负责人,监管风格转向制度性

美国证券交易委员会任命一名新的执法负责人,强化结构化监管。此外,商品期货交易委员会(CFTC)与财政部正在征求公众意见,拓展数字资产监管框架。特朗普家族启动价值约 64.2 亿美元的加密帝国

特朗普媒体集团联手 Crypto.com 与 Yorkville Acquisition,推出以 CRO 代币为主的新数字资产国库,包含约 10 亿美元 CRO 代币、2 亿美元现金与 50 亿美元股权额度。同时推动 Truth Social 平台采用 CRO 奖励系统,并谋划稳定币与比特币 ETF。Tether 聘前白宫加密顾问助力政策

前白宫数字资产顾问加盟稳定币龙头 Tether,推动其美国业务扩大,同时利用其立法经验应对加密政策格局。美元稳定币与数字资产逐渐融入美国社会

支付平台 Stripe 支持稳定币来维护美元的全球地位;美国也将加密资产纳入退休计划。与此同时,欧洲央行推动数字欧元建设以抗衡稳定币影响。美国政府建立战略比特币储备

特朗普行政命令设立“战略比特币储备”,将政府没收的比特币、以太坊、Solana 等纳入为国家储备。现估美国政府持有约 198,000 枚比特币。

欧洲与英国

英国稳定币监管迟滞,引发金融科技界焦虑

英国监管机构行动迟缓,金融科技企业(如 Coinbase、Noah)敦促政府制定国家级稳定币政策,否则恐损失创新优势。英格兰银行则担心稳定币可能替代传统银行货币。欧盟 MiCA 全面生效,构建统一监管框架

自 2024 年底以来,欧盟市场加密资产法规(MiCA)已全面实施,推动区内数字资产监管生态一体化,并加强投资者保护与市场透明。

亚洲

中国香港稳定币法规推进中

香港《稳定币条例》于 2025 年 5 月通过,预计最早将于 2026 年初发放首批稳定牌照,要求发行人满足反洗钱、风险管理与公司治理标准。巴林允许稳定币发行

巴林央行于 2025 年 7 月推出 SIO 模块,允许批准后以本币或美元为基础发行稳定币。巴基斯坦成立加密监管机构

巴基斯坦成立“加密委员会”并邀请币安联合创始人担任顾问,启动比特币储备试点,并分配电力资源发展矿业与 AI 数据中心。区域监管趋严,但创新土壤仍在

亚洲部分地区继续推动 KYC/AML 机制,监管明确,有望成为下一波加密创新的新引擎。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。