作者:1912212.eth,Foresight News

8 月 22 日,OKX 继续刷新历史新高,价值一度触及 258.6 美元,24 小时涨幅超 30%,实现日线图 3 连涨,从底部 50 美元,短短 10 日之内便涨幅超 5 倍,甚至一度 24 小时现货交易量超越 BTC 与 ETH。截止目前,OKB 市值 50.94 亿美元,排名第 27 位。

值得一提的是,昨日价格飙升后,OKB 在以太坊链上价格,较 OKX 平台一度存在 42% 正溢价。

销毁流通供应量的 52%,固定 2100 万枚上限

8 月 13 日的公告彻底改变了 OKB 的轨迹。OKX 宣布进行史上最大规模的代币烧毁:销毁 6525.67 万枚 OKB,相当于流通供应量的 52%,并将总供应量永久固定在 2100 万枚。这一举措直接将 OKB 的稀缺性推向极致,类似于比特币的 2100 万枚上限设计。

持有以太坊版本 OKB 的用户需将资产充值至 OKX 并通过「提现到 X Layer」完成换链。同时,OKTChain 将分阶段下线,自 2025 年 8 月 13 日 14:10(UTC+8)起在 OKX 停止交易,并按 2025 年 7 月 13 日至 8 月 12 日的平均收盘价定期将 OKT 兑换为等值 OKB,链上 OKT 兑换支持至 2026 年 1 月 1 日。

烧毁后,OKB 价格在 24 小时内暴涨 183%,从约 50 美元飙升至 140 美元以上。8 月 21 日,OKB 突破 200 美元关口,创下 239.91 美元的历史峰值;次日(8 月 22 日)继续上攻,市值逼近 40 亿美元。这一连串新高,不仅刷新了 OKB 自身的记录,也带动了其他交易所代币如 BNB 短期反弹。

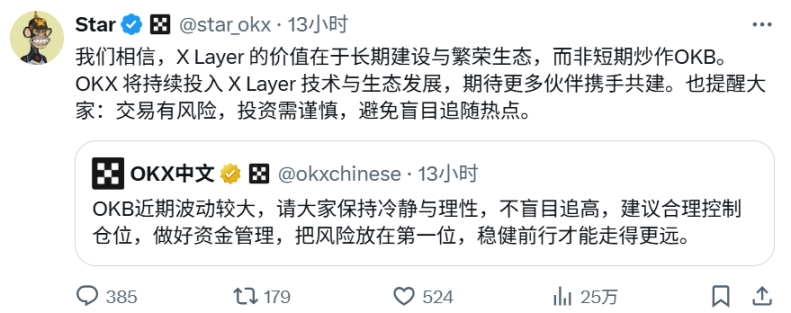

面对价格疯狂上涨,OKX CEO Star 甚至亲自下场发文提醒大家:交易有风险,投资需谨慎,避免盲目追随热点。

加密货币交易所 OKX 由 Star Xu 创立。目前 OKX 的生态系统包括 Web3 钱包、Layer 2 网络 X Layer,以及一系列 DeFi 和 GameFi 应用,这些都为其代币 OKB 提供了坚实的价值支撑。

OKB 最初作为 OKX 的平台代币,于 2018 年发行,总供应量最初为 3 亿枚。它不仅是交易所的手续费折扣工具,还用于生态治理、质押奖励和跨链桥接。2023 年 OKX 与 Polygon 合作推出 L2 网络后,OKB 则成了链上的的原生货币。

根据 OKX 历史数据,OKB 受限于早期市场波动和监管不确定性,2019 年 OKB 最低价仅为 0.57 美元。随着加密牛市的到来,OKB 在 2021 年一度攀升至 44 美元,但 2022 年的熊市将其拉低至 10 美元以下。进入 2025 年,OKB 在 50 美元附近上下反复徘徊震荡,直至销毁利好消息公布开始起飞之旅。

即将赴美上市

今年 6 月,OKX 被爆出计划明年在美国进行 IPO。

从财务角度看,IPO 将为 OKX 提供大量资本,用于技术升级、营销和全球扩张。成功上市后,OKX 可通过股权融资优化资产负债表,并提升其母公司估值,这对吸引机构投资者至关重要。此外,上市还将为其平台币 OKB 带来合法性,可能推动其价格进一步上涨。

然而,单纯将 IPO 视为财务操作可能低估了其战略意图。OKX 重返美国市场并考虑 IPO,更多是其进军美国市场的长期计划。美国是全球最大的加密货币市场,拥有庞大的用户基础和机构资本。通过上市,OKX 不仅能提升品牌知名度,还能与 Coinbase、Kraken 等竞争对手正面竞争。

而后两者均在其 L2 上加紧布局。Coinbase 推出的 L2 已成最活跃的二层网络之一,Kraken 也紧锣密鼓推出超级链 ink。

其背后的根源是,从中心化向去中心化的转型思考。

首先即是多元化收入与盈利模式。传统 CEX 依赖交易手续费,但 L2 提供新收入源。Coinbase 作为 Base 的唯一排序器,可捕获交易费显著提升收入。L2 帮助交易所从托管费、稳定币利息转向链上费用和 NFT 铸造(如 Coinbase 的 Onchain Summer 事件产生 5 亿美元资产),应对熊市波动。Coinbase 最新的财报显示,由于 DA 成本骤降以及用户数量激增,刨去 634 万美元的 DA 成本,Base 网络 3 月单月毛利达 Arbitrum 整个一季度毛利的 2 倍之多。

其次即是加强生态系统构建,将用户从中心化平台引导至自托管和 DeFi,扩大市场触达,吸引开发者构建 dApps,形成闭环生态。通过 L2 降低门槛(如零 gas 费体验),加速加密采用,尤其在美国监管环境下,提供合规路径避免 SEC 打击。

今年 8 月,OKX 对其 Layer 2 网络 X Layer 进行了重大升级,集成 Polygon 的 Chain Development Kit(CDK),将交易速度提升至 5000 TPS(每秒交易数),并实现近零 gas 费。这一升级使 X Layer 成为高效的 Web3 基础设施,吸引了更多 DeFi 项目和开发者入驻。OKB 作为网络的燃料代币,直接受益于生态扩张。

截止目前,据 X Layer 官方数据显示,目前其地址总数超 218 万个,24 小时新增 4.7 万个。持有 OKB 地址数超 78.6 万个,24 小时新增 3387 个。其生态包括发射台 DYORSWAP 等,其链上 meme 币 XDOG 的市值一度曾破千万美元。

总体而言,OKB 的暴涨体现了加密市场投资者对 X Layer 后续的期待以及 OKX 赴美上市的乐观情绪,在这个快速演变的市場,OKB 的故事或许只是更大浪潮的序曲。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。