Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Outflow of $642 Million

Last week, the U.S. Bitcoin spot ETF experienced a two-day net outflow, totaling $642 million, with a total net asset value of $14.648 billion.

Three ETFs were in a net inflow state last week, with inflows mainly from IBIT, HODL, and EZBC, which saw inflows of $355 million, $9.1 million, and $200,000, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $154 Million

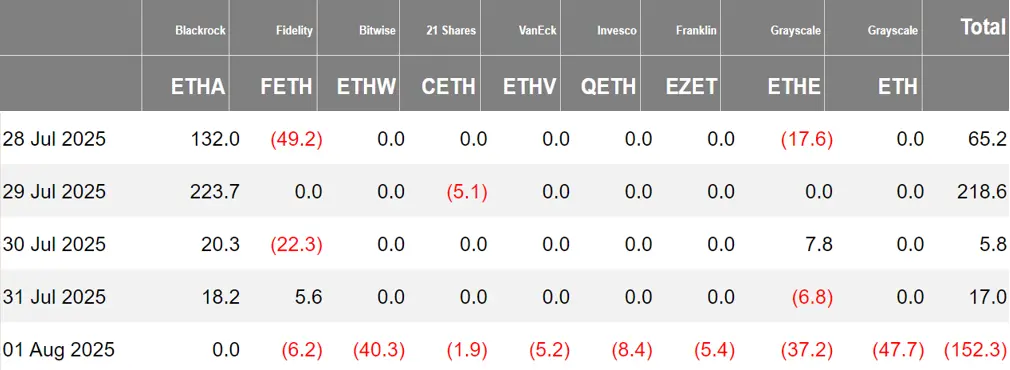

Last week, the U.S. Ethereum spot ETF saw a continuous net inflow for four days, totaling $154 million, with a total net asset value of $2.011 billion.

The inflow last week mainly came from BlackRock's ETHA, with a net inflow of $394 million. Only one Ethereum spot ETF was in a net inflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 1,499.9 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 1,499.9 Bitcoins, with a net asset value of $489 million. The issuer, Harvest Bitcoin, saw its holdings drop to 293.02 Bitcoins, while Huaxia's holdings reached 2,300 Bitcoins.

The Hong Kong Ethereum spot ETF had no capital inflow, with a net asset value of $8.645 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of August 1, the nominal total trading volume of U.S. Bitcoin spot ETF options was $2.79 billion, with a nominal total long-short ratio of 1.65.

As of July 31, the nominal total open interest of U.S. Bitcoin spot ETF options reached $25.55 billion, with a nominal total open interest long-short ratio of 1.89.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 41.33%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Multiple Asset Management Giants Submit Solana ETF S-1 Amendment to U.S. SEC

According to The Block, several asset management companies, including Franklin Templeton, Bitwise, Fidelity, Grayscale, and VanEck, have submitted amended S-1 registration statements for a spot Solana ETF to the U.S. Securities and Exchange Commission (SEC). Among them, Grayscale's filing disclosed that its fund plans to charge a 2.5% management fee and will be paid in SOL.

The SEC is considering several proposals for launching a SOL ETF and other crypto funds, including products tracking currencies like XRP and DOGE.

According to official documents, CoinShares' Solana Staking ETF has been registered in Delaware.

According to SolanaFloor, Jito Labs, Bitwise, Multicoin Capital, VanEck, and the Solana Policy Institute submitted an open letter to the U.S. SEC on July 31, suggesting the adoption of liquid staking tokens (LST) as a staking mechanism in exchange-traded products (ETP). This proposal specifically targets the eight Solana ETF applications submitted in June and an additional application submitted on June 25.

Cboe Proposes to Simplify Cryptocurrency ETF Listing Process

The Chicago Board Options Exchange (CBOE) submitted a new proposal to the U.S. SEC, suggesting the implementation of an "automatic listing" mechanism for cryptocurrency ETFs that meet specific criteria. According to the proposal, if a crypto asset has been traded on a regulated market for futures for more than six months, the related ETF can skip the SEC's case-by-case approval process and list directly.

The proposal also sets specific requirements for staking ETFs, stating that if more than 15% of the fund's assets cannot be redeemed immediately, a liquidity risk management plan must be established. This move could benefit assets that rely on staking mechanisms, such as Solana and Cardano.

U.S. SEC Delays Approval Decision for Truth Social Bitcoin ETF and Grayscale Solana ETF

According to Decrypt, the U.S. SEC announced on Monday in two separate documents that it would delay its approval decision for the Truth Social Bitcoin ETF and the Grayscale Solana Trust ETF. Under the latest schedule, the SEC will make a final ruling on the Truth Social Bitcoin ETF by September 18, while the approval deadline for the Grayscale Solana Trust ETF has been extended to October 10.

This delay continues the SEC's cautious regulatory approach toward cryptocurrency-related investment products. Despite a relatively open stance from the SEC toward the cryptocurrency sector recently, it has postponed approval decisions for multiple crypto ETF applications several times over the past few months. Grayscale is seeking to convert its existing Solana Trust into an exchange-traded fund, while the Truth Social Bitcoin ETF is a new Bitcoin investment product associated with Trump's social media platform.

Market analysts point out that the approval results for these two ETFs will provide important indicators for assessing the SEC's regulatory stance on innovative crypto investment products.

Cboe Submits Application for Canary Staked INJ ETF and Invesco Galaxy Solana ETF to SEC

According to official information from Cboe BZX Exchange, Cboe BZX has submitted an application to the U.S. SEC to launch an exchange-traded fund (ETF) tracking the native asset INJ of the Injective blockchain. This application was submitted by Canary Capital Group LLC, the initiator representing the trust. Canary first proposed the idea of the Canary Staked INJ ETF earlier this month.

On the same day, Cboe BZX also submitted the application form for the Invesco Galaxy Solana ETF, as more companies seek SEC approval for a spot SOL ETF.

These two documents are part of the "two-step process" required for submitting crypto ETF proposals to the SEC. Since President Trump took office in January, the U.S. regulatory environment has become more favorable, and the SEC is reviewing dozens of proposals for digital asset funds, covering a variety of tokens from DOGE, SOL to XRP. During Biden's administration, the SEC approved a spot Bitcoin ETF and subsequently approved a spot Ethereum ETF, a shift stemming from a key court ruling.

Among these proposed ETFs, some companies are attempting to incorporate staking mechanisms. The SEC's Division of Corporation Finance stated in May that certain blockchain staking activities do not fall under the category of securities issuance, leading many to believe that staking mechanisms may be allowed in crypto ETFs.

U.S. SEC Delays Decision on Truth Social's BTC Spot ETF

U.S. SEC Delays Approval of Grayscale's Spot Solana ETF Application

U.S. SEC Approves Physical Redemption Mechanism for Bitcoin and Ethereum ETFs

SEC Confirms Receipt of Application Allowing BlackRock's Ethereum Spot ETF to Stake

Views and Analysis on Crypto ETFs

Bloomberg ETF Analyst: 75% of Investors Buying IBIT are New BlackRock Clients

Bloomberg's senior ETF analyst Eric Balchunas stated on the X platform that 75% of investors purchasing BlackRock's spot Bitcoin ETF "IBIT" are new clients of BlackRock.

Moreover, 27% of them subsequently purchased other iShares ETFs. This is a significant success for BlackRock.

Pudgy Penguins CEO LucaNetz stated that the Pudgy Penguins team has officially participated as government advisors in U.S. cryptocurrency legislation with Abstract and has made multiple trips to Washington, D.C. to submit relevant proposals. The team has currently submitted an application for the PENGU ETF, which will cover the PENGU token and NFTs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。